by Kevin Daum, Janice Brewster,

and Peter Economy

Building Your

Own Home

FOR

DUMmIES

‰

01_557092 ffirs.qxd 1/20/05 3:09 PM Page i

01_557092 ffirs.qxd 1/20/05 3:09 PM Page iv

by Kevin Daum, Janice Brewster,

and Peter Economy

Building Your

Own Home

FOR

DUMmIES

‰

01_557092 ffirs.qxd 1/20/05 3:09 PM Page i

Building Your Own Home For Dummies

®

Published by

Wiley Publishing, Inc.

111 River St.

Hoboken, NJ 07030-5774

www.wiley.com

Copyright © 2005 by Wiley Publishing, Inc., Indianapolis, Indiana

Published by Wiley Publishing, Inc., Indianapolis, Indiana

Published simultaneously in Canada

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or

by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permit-

ted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written

permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the

Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-646-8600.

Requests to the Publisher for permission should be addressed to the Legal Department, Wiley Publishing,

Inc., 10475 Crosspoint Blvd., Indianapolis, IN 46256, 317-572-3447, fax 317-572-4355, e-mail: brandreview@

wiley.com.

Trademarks: Wiley, the Wiley Publishing logo, For Dummies, the Dummies Man logo, A Reference for the

Rest of Us!, The Dummies Way, Dummies Daily, The Fun and Easy Way, Dummies.com and related trade

dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United

States and other countries, and may not be used without written permission. All other trademarks are the

property of their respective owners. Wiley Publishing, Inc., is not associated with any product or vendor

mentioned in this book.

LIMIT OF LIABILITY/DISCLAIMER OF WARRANTY: THE PUBLISHER AND THE AUTHOR MAKE NO REP-

RESENTATIONS OR WARRANTIES WITH RESPECT TO THE ACCURACY OR COMPLETENESS OF THE

CONTENTS OF THIS WORK AND SPECIFICALLY DISCLAIM ALL WARRANTIES, INCLUDING WITHOUT

LIMITATION WARRANTIES OF FITNESS FOR A PARTICULAR PURPOSE. NO WARRANTY MAY BE CRE-

ATED OR EXTENDED BY SALES OR PROMOTIONAL MATERIALS. THE ADVICE AND STRATEGIES CON-

TAINED HEREIN MAY NOT BE SUITABLE FOR EVERY SITUATION. THIS WORK IS SOLD WITH THE

UNDERSTANDING THAT THE PUBLISHER IS NOT ENGAGED IN RENDERING LEGAL, ACCOUNTING, OR

OTHER PROFESSIONAL SERVICES. IF PROFESSIONAL ASSISTANCE IS REQUIRED, THE SERVICES OF A

COMPETENT PROFESSIONAL PERSON SHOULD BE SOUGHT. NEITHER THE PUBLISHER NOR THE

AUTHOR SHALL BE LIABLE FOR DAMAGES ARISING HEREFROM. THE FACT THAT AN ORGANIZATION

OR WEBSITE IS REFERRED TO IN THIS WORK AS A CITATION AND/OR A POTENTIAL SOURCE OF FUR-

THER INFORMATION DOES NOT MEAN THAT THE AUTHOR OR THE PUBLISHER ENDORSES THE

INFORMATION THE ORGANIZATION OR WEBSITE MAY PROVIDE OR RECOMMENDATIONS IT MAY

MAKE. FURTHER, READERS SHOULD BE AWARE THAT INTERNET WEBSITES LISTED IN THIS WORK

MAY HAVE CHANGED OR DISAPPEARED BETWEEN WHEN THIS WORK WAS WRITTEN AND WHEN IT

IS READ.

For general information on our other products and services, please contact our Customer Care

Department within the U.S. at 800-762-2974, outside the U.S. at 317-572-3993, or fax 317-572-4002.

For technical support, please visit www.wiley.com/techsupport.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may

not be available in electronic books.

Library of Congress Control Number: 2004117535

ISBN: 0-7645-5709-2

Manufactured in the United States of America

10 9 8 7 6 5 4 3 2 1

1O/QY/QS/QV/IN

01_557092 ffirs.qxd 1/20/05 3:09 PM Page ii

About the Authors

Kevin Daum, from Alameda, Calif., is founder and CEO of Stratford Financial

Services, an INC 500 real estate finance company. Under Kevin’s guidance,

Stratford maintains a 100-percent approval rate on its custom home financing

projects. Kevin has provided financing education for more than 20 years. He

has underwritten loans for national institutions and managed real estate

financing for entrepreneurs and celebrity clients, including Pat Sajak, Pat

Boone, Dana Carvey, Phil Hartman, Jamie Farr, and Elvira, Mistress of the

Dark. He has facilitated more than 850 custom home projects and is a recog-

nized expert on the subjects of custom homes, real estate investment, and

real estate management.

Kevin speaks regularly on the subject of real estate finance. Kevin penned

and published the book What the Banks Won’t Tell You; How to Get the Most

Out of Your Mortgage (Grady Parsons) now in its second printing. He writes a

featured monthly column for Log Homes Illustrated magazine and writes regu-

larly for American City Business Journals. Kevin is actively involved with the

Young Entrepreneur’s Organization (YEO) and speaks on the subject of entre-

preneurship and the arts. In addition to his entrepreneurial ventures, Kevin

currently develops property and custom homes. He received his bachelor of

arts degree from Humboldt State University.

To schedule Kevin to present to your organization, association, or confer-

ence, call Stratford Financial Services at 800-727-6050. For more information

on the products and services provided by Stratford, visit its Web site at

www.stratfordfinancial.com or contact Kevin directly at kevin@

stratfordfnancial.com.

Janice Brewster is author of Log Cabins (Friedman/Fairfax) and Cabin Styles

(Publications International, LTD). She currently edits Timber Homes Illustrated

magazine and is former editor of Log Home Living. She has written articles for

The Washington Post, Cowboys & Indians, Catalina, Log Homes Illustrated,

Timber Frame Homes, and the National Association of Home Builders. Janice

received her bachelor’s degree from Mount Union College and her master’s

degree in magazine journalism from Syracuse University’s S.I. Newhouse

School of Public Communications.

Peter Economy, from La Jolla, Calif., is associate editor of Leader to Leader,

the award-winning magazine of the Leader to Leader Institute, and author of

numerous books, including Managing For Dummies (with Bob Nelson), Home-

Based Business For Dummies (with Paul and Sarah Edwards) (both published

by Wiley), and many others. He received his bachelor’s degree (with majors

in economics and human biology) from Stanford University and is currently

pursuing his MBA at the Edinburgh Business School. Visit Peter at his Web

site:

www.petereconomy.com.

01_557092 ffirs.qxd 1/20/05 3:09 PM Page iii

01_557092 ffirs.qxd 1/20/05 3:09 PM Page iv

Dedication

This book is dedicated to all those information hungry consumers pursuing

the American dream of home ownership.

Authors’ Acknowledgments

Just like a custom home project, it took many people to make this book

happen. We consulted experts in every area to make sure we included cur-

rent, accurate information.

Kevin relied heavily upon the help and resources of the excellent staff at

Stratford Financial Services, particularly Dawn Exline, vice president of client

services. In addition Kevin wants to thank all the clients, builders, and archi-

tects that shared their experiences.

The authors also want to thank the following people for giving time, energy,

and knowledge for the success of this book. Ahmad Mohazab and the expert

team at Tecta Architects in San Francisco shared their knowledge and draw-

ings for many chapters. Dan Ridings of Stonehenge Builders in Lafayette,

Calif., spent hours of time providing technical information. Thanks go to The

Original Lincoln Logs LTD., John Stetson, and Aaron Rosenbaum for their con-

tributions of photos and Lorin George of Lorelco appraisals for her appraisal

contribution. Thanks to Bud Davis of B. Davis construction for the special

“Writing Place.” Thanks to Scott Peloquin of BenefEx Benefit Consulting and

Troy Collins of McKinley Financial for their experience in the financial area.

Thank you to Charles Bevier, editor of Building Systems Magazine, for sharing

his expertise.

Kevin, Peter, and Janice are also appreciative of all the people at Wiley

Publishing, Inc. including Tracy Boggier, Joyce Pepple, Alissa Schwipps,

Chad Sievers, Melisa Duffy, and Holly Gastineau-Grimes.

On a personal note, Kevin wants to acknowledge Mark Levy for his coaching

as well as Tim Chrisman, Lisle Payne, and Dennis Erokan for their constant

support and encouragement. He also wants to thank his friends and Forum at

the Young Entrepreneur’s Organization (YEO), which made this opportunity

occur in the beginning. Finally Kevin acknowledges the love and support of

his wife Deanna, son Spencer, and his parents Hal and Nancy Daum who

showed him how to always put his clients’ needs first.

01_557092 ffirs.qxd 1/20/05 3:09 PM Page v

Publisher’s Acknowledgments

We’re proud of this book; please send us your comments through our Dummies online registration

form located at www.dummies.com/register/.

Some of the people who helped bring this book to market include the following:

Acquisitions, Editorial, and

Media Development

Senior Project Editor: Alissa Schwipps

Acquisitions Editor: Tracy Boggier

Copy Editor: Chad R. Sievers

Technical Editors: Bob Gammache, (Carteret

Mortgage

www.nva-mortgage.com) and

Dwayne Ganzel

Editorial Manager: Jennifer Ehrlich

Editorial Assistants: Nadine Bell, Hanna Scott

Cartoons: Rich Tennant,

www.the5thwave.com

Composition

Project Coordinator: Adrienne Martinez

Layout and Graphics: Jonelle Burns,

Carl Byers, Andrea Dahl, Joyce Haughey,

Stephanie D. Jumper, Jacque Roth,

Barry Offringa

Proofreaders: Laura Albert, Leeann Harney,

Jessica Kramer, Carl William Pierce,

TECHBOOKS Production Services

Indexer: TECHBOOKS Production Services

Publishing and Editorial for Consumer Dummies

Diane Graves Steele, Vice President and Publisher, Consumer Dummies

Joyce Pepple, Acquisitions Director, Consumer Dummies

Kristin A. Cocks, Product Development Director, Consumer Dummies

Michael Spring, Vice President and Publisher, Travel

Brice Gosnell, Associate Publisher, Travel

Kelly Regan, Editorial Director, Travel

Publishing for Technology Dummies

Andy Cummings, Vice President and Publisher, Dummies Technology/General User

Composition Services

Gerry Fahey, Vice President of Production Services

Debbie Stailey, Director of Composition Services

01_557092 ffirs.qxd 1/20/05 3:09 PM Page vi

Contents at a Glance

Introduction ................................................................1

Part I: Getting Started: The 411

on Custom Home Building ............................................7

Chapter 1: The Custom Home Process in a Nutshell ....................................................9

Chapter 2: Preparing for the Process ............................................................................23

Chapter 3: The Land Grab: Selecting the Perfect Site .................................................41

Chapter 4: Defining Your House Style ...........................................................................63

Chapter 5: Architects and Design: Time Spent Is Money Saved ................................83

Chapter 6: Engineering and Plan Approval:

Bureaucracy Made Somewhat Easy ..........................................................................109

Part II: All You Need Is Dough:

Financing Your Custom Home ...................................123

Chapter 7: Cash Is King: Using Debt to Your Advantage ..........................................125

Chapter 8: Knowledge Is Power: What You Don’t Know

About Construction Loans Can Hurt You ................................................................139

Chapter 9: Qualifying: It’s the Bank’s Way or the Highway ......................................161

Chapter 10: Show Me the Money .................................................................................185

Part III: Hammers and Nails:

The Construction Process ..........................................201

Chapter 11: All the King’s Men: The Contractor and His Cohorts ..........................203

Chapter 12: Excavation and Foundation: Getting a Solid Start ................................217

Chapter 13: Framing and Rough: So Much Goes Behind Those Walls! ...................231

Chapter 14: Heading for the Finish: So Much Detail .................................................251

Part IV: All the After Stuff .......................................275

Chapter 15: Home Sweet Nest Egg: Moving In and Managing

Your New Investment .................................................................................................277

Chapter 16: Refinancing: More Money, Cheaper Payments .....................................287

Chapter 17: Taking It Outside: The Art of Landscaping ...........................................301

Part V: The Part of Tens ...........................................317

Chapter 18: Ten Common Custom Home Mistakes and How to Avoid ’Em ...........319

Chapter 19: Ten Great Ways to Lower Construction Costs ......................................325

Chapter 20: Ten Common Stuck-in-the-Middle Problems and Their Fixes .............331

Chapter 21: Ten Helpful Custom Home Resources ...................................................337

Chapter 22: Ten Ways to Make Your Home Green .....................................................343

Index .......................................................................349

02_557092 ftoc.qxd 1/20/05 3:09 PM Page vii

02_557092 ftoc.qxd 1/20/05 3:09 PM Page viii

Table of Contents

Introduction .................................................................1

About This Book ..............................................................................................1

Conventions Used in This Book ....................................................................2

What You’re Not to Read ................................................................................2

Foolish Assumptions ......................................................................................3

How This Book Is Organized ..........................................................................4

Part I: Getting Started: The 411 on Custom Home Building .............4

Part II: All You Need Is Dough: Financing Your Custom Home ........4

Part III: Hammers and Nails: The Construction Process ..................4

Part IV: All the After Stuff .....................................................................4

Part V: The Part of Tens ........................................................................5

Icons Used in This Book .................................................................................5

Where to Go from Here ...................................................................................6

Part I: Getting Started: The 411

on Custom Home Building .............................................7

Chapter 1: The Custom Home Process in a Nutshell . . . . . . . . . . . . . . .9

Where Do You Start? Preparing to Build Your Home ................................10

Money Makes the World Go Round — Paying for Your Home ................11

Asking yourself about affordability ...................................................11

Them that has the gold makes the rules: If you finance,

the bank will dictate process .........................................................12

Introducing the Custom Home Life Cycle ..................................................13

It takes (more than) two to tango —

A quick guide to the players ...........................................................13

So many tasks, so little time — 50 steps to a custom home ..........16

Patience is a virtue — A true timeline for building your home .....18

Being an Owner-Builder: More Power to You! ...........................................19

Analyzing the truth about savings ....................................................20

Finding and managing subs ................................................................21

Financing implications ........................................................................21

Chapter 2: Preparing for the Process . . . . . . . . . . . . . . . . . . . . . . . . . . .23

Organizing and Documenting ......................................................................23

Building a workbook and portable file system ................................24

Calendar and communication — Your PDA is your friend .............25

Being the bean counter — Keeping track of your finances ...........26

Shopping and sharing — Collecting material information .............27

02_557092 ftoc.qxd 1/20/05 3:09 PM Page ix

Budgeting Your Project ................................................................................27

Looking at your finances and cash flow ...........................................27

Defining “dollars per square foot” .....................................................28

Using a budgeting template ...............................................................31

Hiring a Contractor .......................................................................................32

Understanding the contractor’s role ................................................32

Getting bids — Comparing apples to apples ...................................33

Evaluating a contractor’s 3 Cs — Cost, craftsmanship,

and compatibility .............................................................................34

Using expert interviewing techniques ..............................................35

Identifying Insurance Issues ........................................................................36

Liability policy .....................................................................................36

Workers’ compensation ......................................................................37

Course of construction policy ...........................................................37

Managing Your Expectations .......................................................................38

Planning a timeline — A custom home is forever

(So what’s the hurry?) .....................................................................38

Making hard choices — What you can (and can’t) afford .............38

Patience — Not everything must be perfect right away ................39

Making the process fun .......................................................................40

Chapter 3: The Land Grab: Selecting the Perfect Site . . . . . . . . . . . . .41

Knowing the Difference between “Land” and a “Lot” ...............................41

Location, Location, Location — Refining Your Lot-Buying Needs ..........42

Finding a Lot ..................................................................................................44

Surfing for turf .....................................................................................44

Engaging a real estate agent/lot specialist .......................................44

Doing the legwork on your own ........................................................45

Finding a lot when there isn’t one .....................................................45

Evaluating a Particular Lot — The True Value of Dirt ..............................46

Examining amenities and utilities .....................................................46

Zoning in on zoning’s limitations ......................................................47

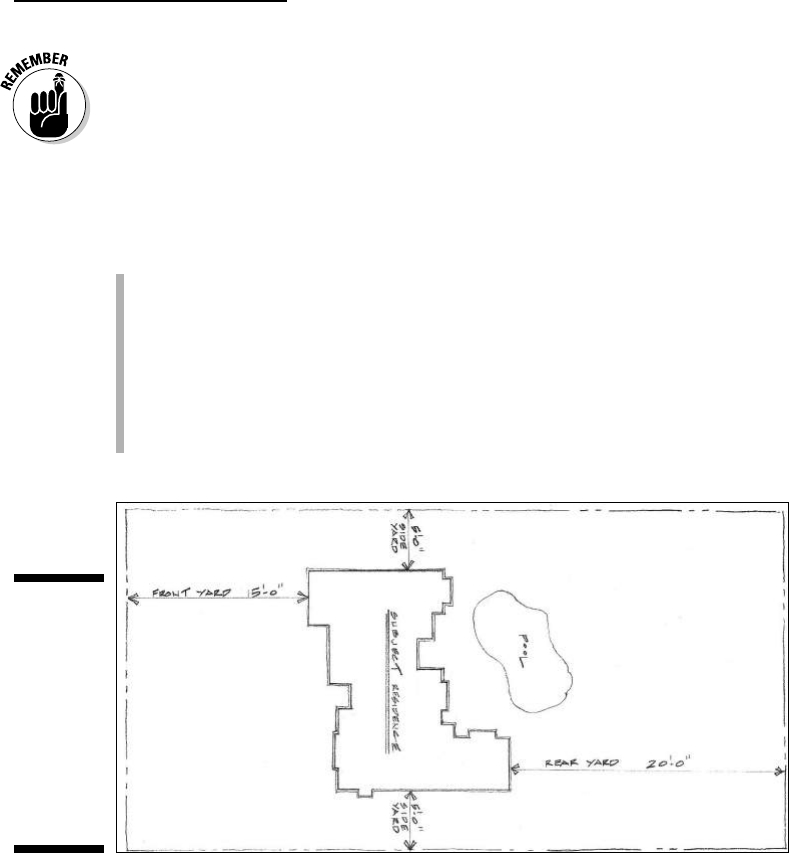

Understanding setbacks and footprints ...........................................48

Size matters — Assessing the land’s value with the house ...........50

A tale of two lot buyers — How square footage impacts value .....51

Dealing with a Tear-Down Property ............................................................52

Accounting for demolition costs .......................................................52

Assessing neighborhood tolerance ...................................................52

Financing pros and cons .....................................................................53

Buying Your Land ..........................................................................................54

Understanding the purchase process ...............................................54

Using the bank .....................................................................................56

Finding other land loan alternatives .................................................59

Making sure the loan period is long enough ....................................60

Stop! Don’t pay off your lot yet! .........................................................61

Building Your Own Home For Dummies

x

02_557092 ftoc.qxd 1/20/05 3:09 PM Page x

Chapter 4: Defining Your House Style . . . . . . . . . . . . . . . . . . . . . . . . . . .63

Getting to Know Your Style Preferences and Limitations ........................63

Educating your eye .............................................................................64

Discovering your local style ..............................................................64

Playing by community rules ..............................................................65

Tapping the wisdom of the pros ........................................................66

Considering Conventional Construction: Wood versus Steel ..................67

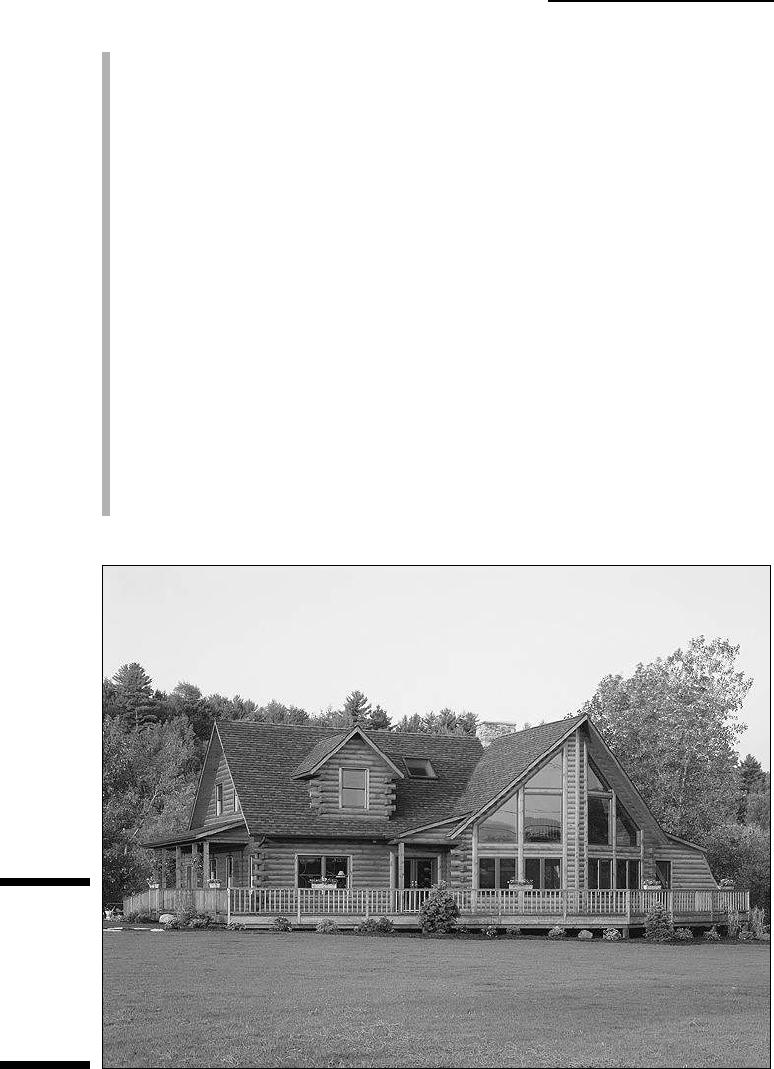

Enjoying the Warmth of a Log Home ..........................................................68

Two ways to skin a log ........................................................................69

Purchasing your log package .............................................................71

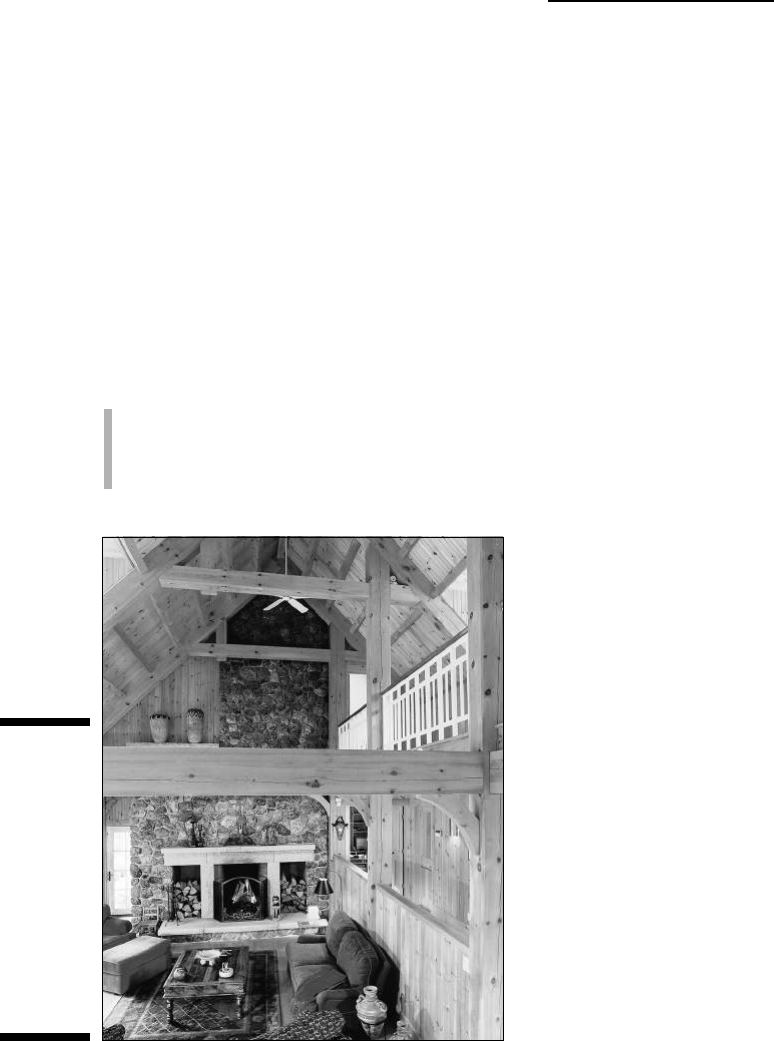

Highlighting Wood Inside — Timber Frame or Post-and-Beam ...............72

Considering a System Approach .................................................................75

Weighing your options ........................................................................75

Making a purchase ..............................................................................77

On the line ............................................................................................78

Unearthing Alternative Construction Methods .........................................79

Chapter 5: Architects and Design: Time Spent Is Money Saved . . . .83

Arming Yourself with an Architect ..............................................................84

Deciding whether you even need an architect ................................84

Finding the right architect ..................................................................85

Managing the architecture process ..................................................86

What does all this cost? ......................................................................87

Looking at Architect Alternatives ...............................................................89

Published floor plans — Picking a home from books or online ....89

Software programs — Designing your own plans ...........................90

Hiring a home designer .......................................................................90

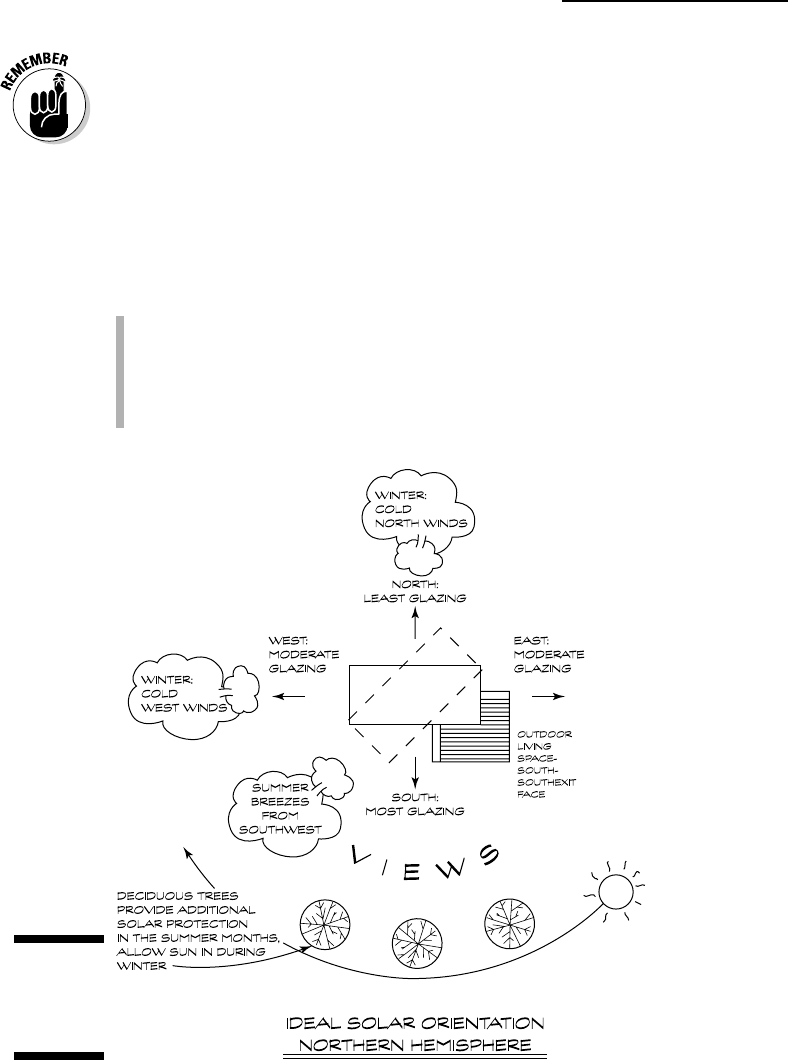

Placing the House on the Lot .......................................................................91

Foundation issues ...............................................................................91

Which orientation is best? North, south, east, or west ..................91

Taking advantage of natural elements ..............................................93

Planning the Size and Shape of Your Home ...............................................94

Size matters — Figuring the right square footage ...........................95

Designing for resale — Create a house everyone wants to buy ....96

Exterior styles — Considering architecture examples ...................96

Designing Your Home’s Interior ..................................................................97

Ten general floor-plan considerations ..............................................97

Special considerations room by room ..............................................99

The Devil Is in the Details ..........................................................................103

Materials, hardware, fixtures, and finishes ....................................104

Make all your decisions now — Allowance is a dirty word .........105

Energy efficiency — Saving the earth (and your money!) ............106

Considering technology options .....................................................107

xi

Table of Contents

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xi

Chapter 6: Engineering and Plan Approval:

Bureaucracy Made Somewhat Easy . . . . . . . . . . . . . . . . . . . . . . . . . . .109

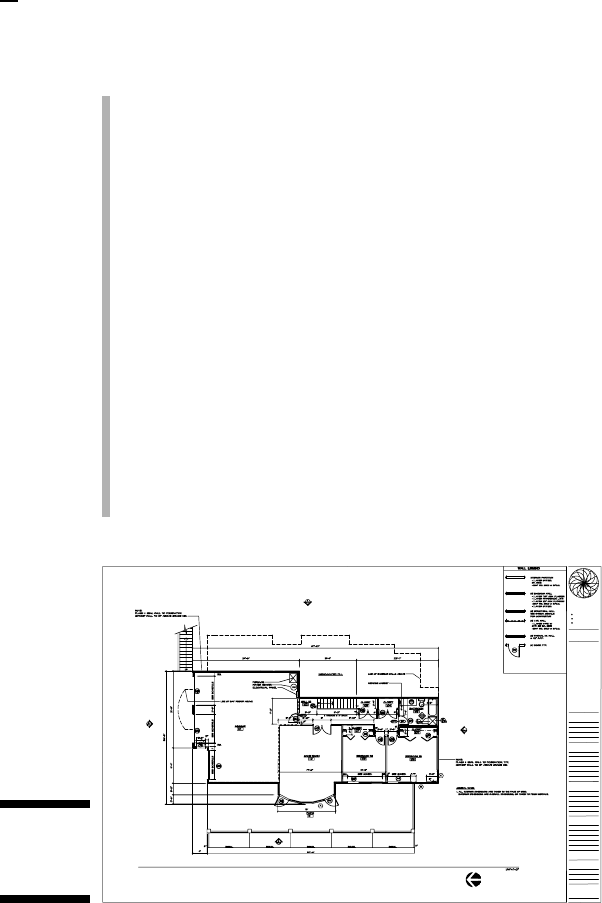

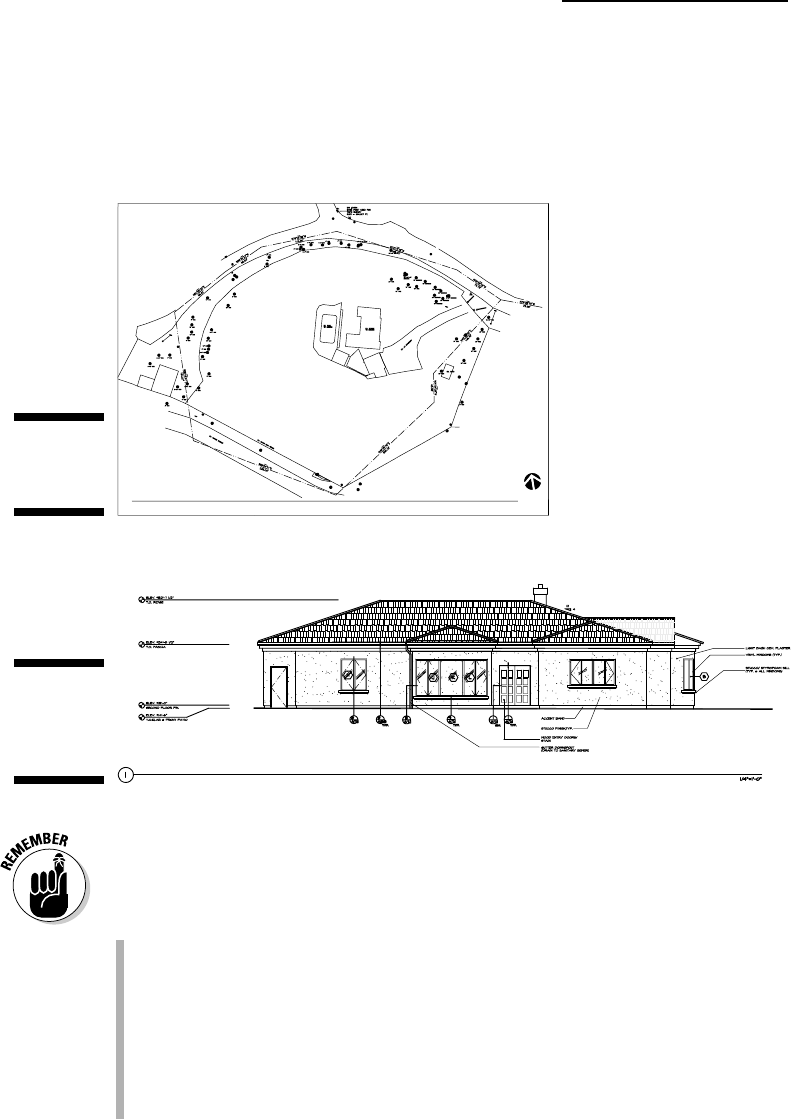

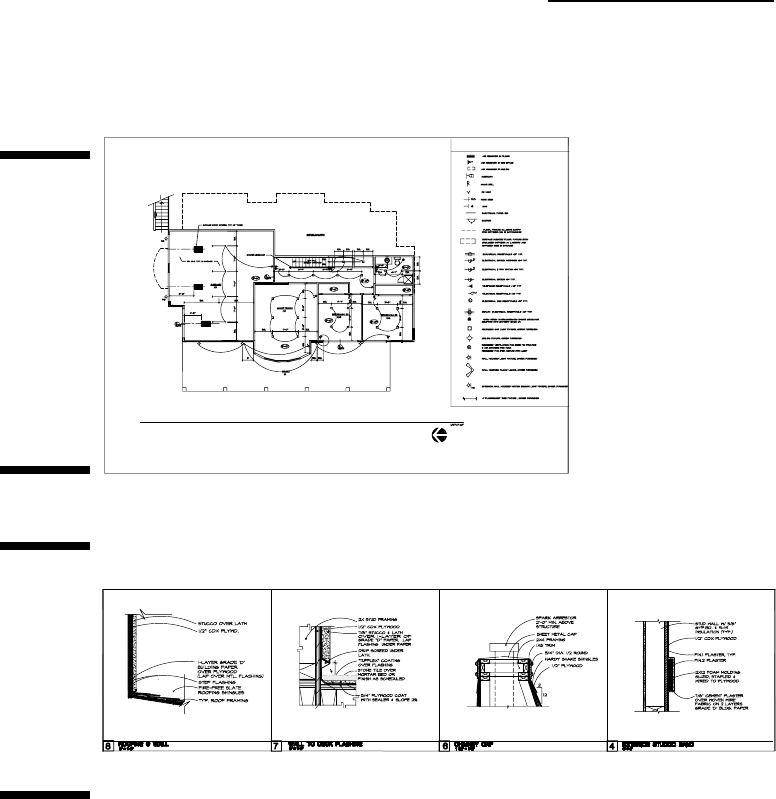

Understanding Plans and Blueprints ........................................................109

Prelims — Floor plans, site plans, and elevations ........................110

Working drawings: The how-to-build-it papers .............................111

Working with the Building and Planning Departments ..........................114

Submitting Your Prelims for Approval .....................................................116

Addressing grading, septic, and well issues ..................................116

Understanding design guidelines ....................................................117

Requesting variances and exceptions —

Don’t be Don Quixote ....................................................................118

Not so fast — Acquiring neighbor approval ..................................119

Gathering the Permits You Need ...............................................................120

Submitting and revising the working drawings .............................121

Picking up permits and paying the fees .........................................121

Part II: All You Need Is Dough:

Financing Your Custom Home ....................................123

Chapter 7: Cash Is King: Using Debt to Your Advantage . . . . . . . . . .125

Accepting the Need for Cash, Cash, and More Cash ..............................126

Breaking the Emotional Barriers — This Is Not

Your Father’s Depression .......................................................................127

Evaluating real estate within your net worth ................................128

Acquiring secured debt can be good ..............................................129

Getting on the same page — How banks evaluate risk ................129

Changing perspective — Home equity

isn’t a savings account ..................................................................130

Understanding the benefits of liquidity ..........................................131

Okay, So You Have All This Cash — Now Manage It ...............................131

Finding and working with a financial advisor ................................132

Diversifying your portfolio ...............................................................133

Exploring alternative investments ..................................................133

Turning Your House Into a Money-Making Machine ...............................134

More house for less cash — Benefiting

from leverage and appreciation ...................................................135

Protecting your investment by making it marketable ..................135

Understanding taxes — Many parts of a home project

are deductible ................................................................................136

Safely Deferring Financial Decisions Until the End

of the Construction Project ....................................................................137

Building Your Own Home For Dummies

xii

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xii

Chapter 8: Knowledge Is Power: What You Don’t Know

About Construction Loans Can Hurt You . . . . . . . . . . . . . . . . . . . . . . .139

Exploring Your Construction Loan Options ............................................140

Getting it done all in one — Benefiting from a single-close .........140

Construction-only loans — The double-close process .................141

Full documentation versus no-income-qualifier programs ..........142

Poor credit and odd-property options ...........................................142

Finding a Good Construction Lender .......................................................143

Choosing a broker or a bank ............................................................144

Testing a loan officer’s knowledge ..................................................145

Getting value added — Education and experience

are worth the money .....................................................................146

Private money — The last resort ....................................................147

The Loan Process from Start to Finish — When to Do What ................147

Deciding when to sell your existing house ....................................148

Applying on time ...............................................................................149

Getting the loan after construction starts .....................................149

Preparing the paperwork .................................................................150

Locking in an interest rate ................................................................151

Determining the length of your construction loan .......................152

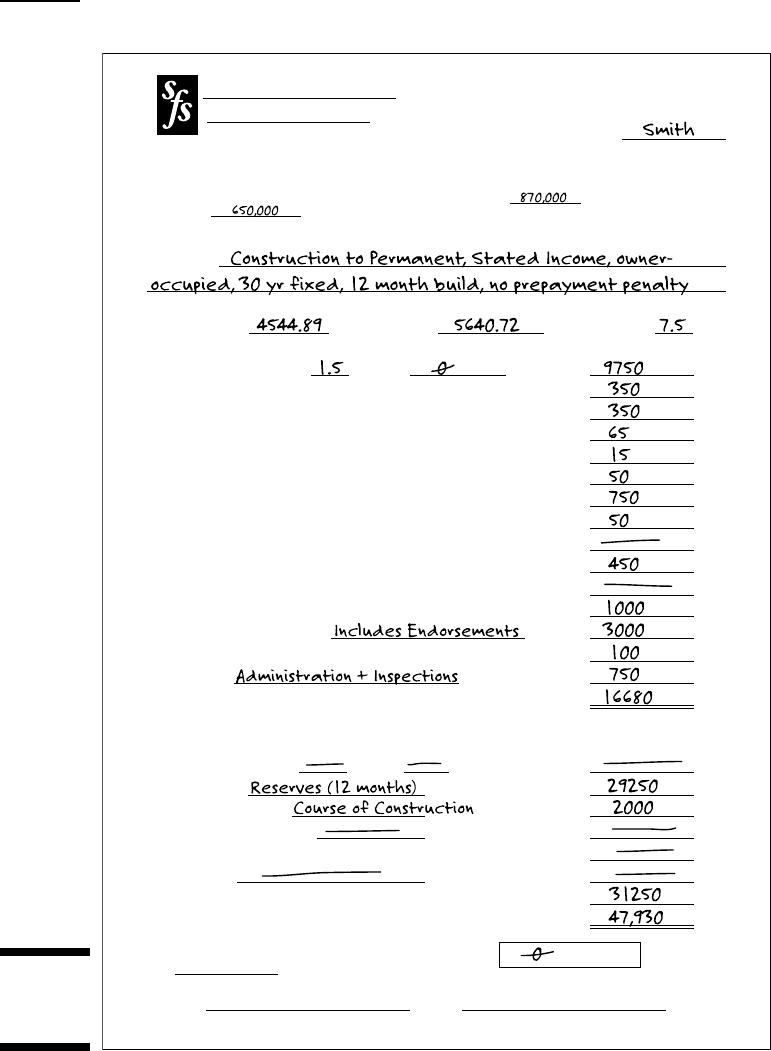

Understanding All the Fees ........................................................................152

Paying points .....................................................................................154

Escrow and title are more than other loans ...................................155

My goodness . . . so many appraisal fees .......................................156

Insurance costs ..................................................................................157

Figuring all the little stuff .................................................................157

Letting the Lender Carry Your Burden .....................................................158

If someone offers you money, take it ..............................................159

No payments — Taking an interest reserve ...................................159

Chapter 9: Qualifying: It’s the Bank’s Way or the Highway . . . . . . . .161

Stepping Behind the Desk — How a Construction Lender

Views Your Project ..................................................................................162

Why some lenders may seem uncaring ..........................................162

Understanding risk assessment ......................................................163

How banks view your property .......................................................163

How lenders view contractors .........................................................164

How lenders view occupancy ..........................................................164

How lenders view spec projects ......................................................165

Recognizing What a Construction Lender Really Wants to See ............166

On your credit report ........................................................................167

On your tax returns ...........................................................................169

In your bank accounts ......................................................................171

On the appraisal ................................................................................173

xiii

Table of Contents

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xiii

Building the Bank’s Construction Budget ................................................175

Figuring the land: Factor A ...............................................................175

Soft or indirect costs: Factor B ........................................................176

Hard costs (board and nail): Factor C ............................................176

The contingency: Factor D ...............................................................177

Calculating the interest reserve: Factor E ......................................177

Loan closing costs: Factor F .............................................................178

Totaling up the cost-to-build ............................................................178

Calculating the Loan Amount and Cash ...................................................179

Basing the loan on finished value — LTV .......................................179

Basing the loan on cost-to-build — LTC .........................................180

Calculating the cash needed for the project ..................................181

Solving Other Budget Problems ................................................................183

Landscaping and finish work can kill the project .........................183

Costing — What if I can build on the cheap? .................................184

What if I need more cash than is in my budget? ...........................184

Chapter 10: Show Me the Money . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .185

Managing a Self-Funded Project ................................................................185

Working with a Bank ...................................................................................186

Of course, you don’t get all the money upfront ............................186

Preparing for inspection ...................................................................187

Battling the bank ...............................................................................188

Understanding How the Voucher System Works ....................................189

Taking a Closer Look at the Draw Reimbursement System ...................190

Figuring which costs are which .......................................................191

Managing the flow of funds with percentages

and contingencies ..........................................................................194

Paying the subs ..................................................................................194

Dealing with deposits .......................................................................195

Using the draw system to pay for your log or

kit home deposits ..........................................................................195

Acing your finals — Final completion and final funds ..................196

Figuring Out Who Gets the Money — You or the Contractor ................196

Using Credit Cards Responsibly Can Buy You a Trip to Europe ...........198

Part III: Hammers and Nails:

The Construction Process ...........................................201

Chapter 11: All the King’s Men: The Contractor

and His Cohorts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .203

Working with Your Contractor ..................................................................203

Fostering good communication — A meeting a day

keeps the anger away ....................................................................204

Maintaining a productive work environment ................................205

Building Your Own Home For Dummies

xiv

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xiv

Change orders — Dealing with indecision .....................................205

Keeping a happy and healthy relationship with your

contractor .......................................................................................206

Managing Your Time and Money ...............................................................206

Executing contracts ..........................................................................207

Scheduling the project ......................................................................209

Controlling the funds — How to manage the checkbook .............209

Introducing Other Important Players .......................................................210

Dealing with suppliers ......................................................................210

Working with subs — Each one is an expert .................................211

Preparing for building and bank inspectors ..................................212

Managing Disputes ......................................................................................213

Avoiding mechanic’s liens — The contractor’s weapons ............213

Using legal remedies — Arbitration and attorneys .......................214

Chapter 12: Excavation and Foundation: Getting a Solid Start . . . .217

Surveying and Site Preparation .................................................................218

Using your survey .............................................................................218

Preparing your site before the first shovelful ................................220

Dealing with trees ..............................................................................220

Clearing and grading .........................................................................221

Constructing retaining walls ............................................................222

Providing drainage ............................................................................223

Marking the build site .......................................................................224

Spot-check — Surveying and site preparation ..............................224

Preparing for the Utilities ...........................................................................225

Connecting water ..............................................................................225

Hooking up to the sewer ..................................................................226

Installing septic systems ..................................................................226

Bringing in electricity .......................................................................226

Piping in gas .......................................................................................227

Spot-check — Utilities .......................................................................227

Pouring Your Foundation ...........................................................................227

Excavating the site ............................................................................228

Installing the foundation ..................................................................229

Spot-check — Foundations ..............................................................230

Chapter 13: Framing and Rough: So Much Goes Behind

Those Walls! . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .231

Things to Consider Before Framing and Rough Work Begin .................231

Questions to ask your contractor ...................................................232

Establishing a schedule ....................................................................232

Trusses and I-beams: Yes or no? .....................................................233

Looking at What’s Involved in Framing Your House ...............................234

Understanding the framing process ...............................................234

Spot-check — Framing ......................................................................238

xv

Table of Contents

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xv

Installing the Rough Systems with Ease ...................................................239

Rough plumbing ................................................................................239

Spot-check — Plumbing ....................................................................242

HVAC ...................................................................................................243

Spot-check — HVAC system .............................................................244

Rough electrical .................................................................................245

Spot-check — Rough electrical ........................................................247

Sheathing, Flashing, and Insulation ..........................................................247

Covering the framing — Sheathing and flashing with

your clothes on ..............................................................................248

Rolling out the insulation .................................................................249

Spot-check — Sheathing, flashing, and insulation ........................249

Chapter 14: Heading for the Finish: So Much Detail . . . . . . . . . . . . .251

The Icing on the Cake — Exterior Finishing ............................................251

Applying wall coverings ...................................................................252

Finishing an attached deck ..............................................................253

Up on the roof — Roofing and rain gutters ....................................254

Installing the driveway — Finish options .......................................257

Exterior lighting .................................................................................258

Spot-check — Exterior finishing ......................................................258

Moving Inside — Completing Fireplaces and Walls ................................259

Fireplaces and hearths .....................................................................259

Drywall and wall textures .................................................................260

Spot-check — Fireplaces and walls .................................................261

The Finish Carpenters — Doors, Windows, Molding, Cabinets,

and Countertops ......................................................................................262

Doors and windows ...........................................................................263

Baseboards and moldings ................................................................264

Cabinetry and countertops ..............................................................265

Spot-check — The finish carpenters ...............................................267

All the Pretty Stuff .......................................................................................268

Painting ...............................................................................................268

Hardware and fixtures ......................................................................269

Flooring materials .............................................................................270

Appliances ..........................................................................................273

Spot-check — Painting, fixtures, flooring, and appliances ...........273

Part IV: All the After Stuff ........................................275

Chapter 15: Home Sweet Nest Egg: Moving In and Managing

Your New Investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .277

Finishing Up the Custom Home Project ...................................................277

Getting your certificate of occupancy ............................................278

Obtaining the mechanic’s lien releases ..........................................278

Rolling the construction loan — Choosing a final loan

amount and program .....................................................................279

Building Your Own Home For Dummies

xvi

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xvi

Taking the Final Contractor Walk-Through ..............................................280

Selling the Old Home and Moving .............................................................281

Managing Maintenance and Repairs .........................................................282

The builder’s long-term responsibilities and warranties .............283

Dealing with construction defects ..................................................283

Should You Stay or Should You Go? ..........................................................284

Being aware of neighborhood trends ..............................................285

Two-year capital gains tax implications .........................................286

Chapter 16: Refinancing: More Money, Cheaper Payments . . . . . . .287

You Still May Want Another Loan ..............................................................287

Filling the need for more cash .........................................................288

Reconsidering how long you will stay ............................................288

Lowering your payments ..................................................................289

Three Things You Should Know About Refinancing ...............................289

You aren’t the bank’s customer .......................................................289

The banks view new custom homes differently than

existing homes ...............................................................................291

Rates and fees are only part of the big picture .............................291

Picking the Right Mortgage Program ........................................................292

A mediocre loan officer can cost you big time ..............................292

Home equity lines of credit (HELOCs) ............................................293

Adjustable rate mortgages (ARMs) .................................................293

Interest-only options .........................................................................296

Zero-cost loans can be expensive ...................................................296

Paying Off Your Home May Be Fiscally Irresponsible ............................298

The 15-year fixed myth .....................................................................298

The biweekly fallacy ..........................................................................299

Chapter 17: Taking It Outside: The Art of Landscaping . . . . . . . . . . .301

Designing Your Dream Landscape ............................................................302

Using a designer – yes or no? ..........................................................302

Revisiting your site plan ...................................................................304

Considering your wants and needs .................................................305

Dealing with your climate ................................................................307

Saving time and money by design ...................................................307

Getting your plan on paper ..............................................................308

Putting Your Plan in Action — Hardscaping ............................................309

Planning a patio, Daddy-o ................................................................310

Lounging on the deck ........................................................................310

The art of fencing ..............................................................................311

Building great walls ...........................................................................312

Adding water ......................................................................................313

Lighting the way ................................................................................313

Leafing Out — Softscaping with Plants ....................................................314

Planting trees after construction ....................................................314

Adding texture with shrubs .............................................................315

Bloom time — Annuals and perennials ..........................................315

xvii

Table of Contents

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xvii

Part V: The Part of Tens ............................................317

Chapter 18: Ten Common Custom Home Mistakes and How to

Avoid ’Em . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .319

Chapter 19: Ten Great Ways to Lower Construction Costs . . . . . . . .325

Chapter 20: Ten Common Stuck-in-the-Middle Problems

and Their Fixes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .331

Chapter 21: Ten Helpful Custom Home Resources . . . . . . . . . . . . . . .337

Chapter 22: Ten Ways to Make Your Home Green . . . . . . . . . . . . . . .343

Index........................................................................349

Building Your Own Home For Dummies

xviii

02_557092 ftoc.qxd 1/20/05 3:09 PM Page xviii

Introduction

A

s you read this book, you most likely have the seed of a dream taking

root in your mind. Your current home isn’t all it could be. You’ve been

daydreaming about a different place — one with more land, one by the water,

or one with a gourmet kitchen. You’ve trolled the open houses in your area,

but none of the homes really light your fire or seem to fit your lifestyle or

your family. You want something that feels more like you.

The only way to get a perfect house “fit” is to design it specifically for you. No

matter if your new home is a month away from completion or ten years down

the road, you need this book.

In our work, we’ve seen plenty of people like you tackle the process of build-

ing a custom home. For some, the process is challenging, but enjoyable. For

others, a custom home project becomes a nightmare that leaves them short

on cash and long on anxiety. We understand the process and what it takes to

move through it with as little stress as possible. In the pages that follow, we

provide you with the very best advice our many years of experience have to

offer.

No matter if your dream consists of a simple $150,000 house in the Midwest

or a multi-million-dollar mansion in California, Building Your Own Home For

Dummies is for you. This book can help you turn your dream of a custom

home into reality without losing your shirt or your sanity. With this book and

with some hard work and perseverance on your part, your dream of building,

owning, and living in your very own custom home can become a reality.

About This Book

Thousands of parts and hundreds of tasks go into a custom home project.

This book doesn’t tell you how to install a toilet or hang a door (other For

Dummies books cover those topics in detail), but it does tell you everything

you need to know about creating a custom home from scratch. Where do you

start? Who is responsible for what? How much will it all cost? These ques-

tions — and hundreds more — are what this book answers — and all in an

easy-to-use reference that you can take with you anywhere.

03_557092 intro.qxd 1/20/05 3:11 PM Page 1

We divide each chapter into sections, and each section contains information

about some part of understanding the process of building a custom home,

such as

A comprehensive approach to financing your home project, before,

during, and after construction

The types of custom homes that are available — from log to timber

frame to stick-built to modular

A view from the loan officer’s side of the desk

A complete look at the inspection process during construction and what

the inspector(s) will be looking for

Thorough and helpful tidbits on how to successfully build your home

and still have money left over

The great thing about this book is that you decide where to start and what to

read. It’s a reference you can jump into and out of at will. Just head to the

table of contents or the index to find the information you want.

Conventions Used in This Book

We use the following conventions throughout the text to make everything

consistent and easy to understand:

All Web addresses appear in monofont.

New terms appear in italics and are closely followed by an easy-to-

understand definition.

Bold text indicates keywords in bulleted lists or highlights the action

parts of numbered steps.

We also include spot-checks in the Part III chapters to guide you in conversa-

tions with your contractor and help you make sure the construction process

is going as planned.

What You’re Not to Read

We’ve written this book so that you can easily find and understand informa-

tion about building a custom home. Although you may be stuck on a deserted

island and have plenty of time to read every word in this book, chances are

you’re not. So, we simplify it so you can identify “skippable” material. This

2

Building Your Own Home For Dummies

03_557092 intro.qxd 1/20/05 3:11 PM Page 2

information is the stuff that, although interesting and related to the topic at

hand, isn’t essential for you to know:

Text in sidebars: The sidebars are the shaded boxes that appear here

and there. They share fun facts, but nothing that’s essential to the suc-

cess of your project.

Anything with a Technical Stuff icon attached: This information is

interesting, but if you skip it, your custom house won’t fall down.

The stuff on the copyright page: No kidding. You can find nothing here

of interest unless you’re inexplicably enamored by legal language and

Library of Congress numbers.

Foolish Assumptions

We wrote this book with some thoughts about you in mind. Here’s what we

assume about you, our reader:

You’ve been sketching custom homes on napkins or doodling floor plans

during business meetings. You’ve looked at your current home with a

critical eye and have, at least once, sighed and muttered the phrase,

“Someday. . . .”

You’re drawn to home-improvement stores, television shows, and books.

You’re desperately looking for a comprehensive guide that demystifies

the home-building process by focusing on the information important for

you the homeowner to know.

You’re willing to do some soul-searching in order to get your custom

home right. You (and any significant others you may have) have decided

that the only way to get the perfect home is to start from scratch.

You don’t live in a “money-is-no-object” world. You want to make edu-

cated financial decisions regarding the budget and long-term financing of

your custom home.

You want to be involved with the process but you’ll rely on professionals

to help you when you need it. Professional help may come in the form of

a financial advisor or loan officer, an architect or designer, a plumber, or

a landscaper. You’re willing to assess your strengths and weaknesses

and seek help when necessary.

We assume that you’ll hire a contractor in some capacity, as most

people do. (We do provide some small tidbits of information if you want

to be your own owner-builder, but the majority of this book focuses on

building a custom home with a contractor.)

You have the ability to keep an open mind and consider new approaches

and information, even when they seem at odds with what you’ve always

been told about the custom home and financing processes.

3

Introduction

03_557092 intro.qxd 1/20/05 3:11 PM Page 3

How This Book Is Organized

This book is divided into five parts. Jump in wherever you want! The follow-

ing sections explain what you’ll find where.

Part I: Getting Started: The 411

on Custom Home Building

Get up to speed on the basics of building a custom home. In this part, you

figure out how to get your project organized and how to find property to

build on. You start to envision your home and define its style. You get to

know the role of the architect or designer and obtain an overview of the plan-

approval process.

Part II: All You Need Is Dough:

Financing Your Custom Home

Your project won’t move from dream to reality without money. In this part,

you can find the lowdown on using debt to your advantage and the construc-

tion loan process, including inside information on qualifying for the money

you need to borrow. Read this part to understand why cash is king in getting

your new home built.

Part III: Hammers and Nails:

The Construction Process

No, we don’t expect you to build your own house with your own two hands.

But wouldn’t having some idea what those people are doing up on your roof

or in your laundry room be nice? Find out the roles of the general contractor

and the teams of subcontractors. Follow the construction process from exca-

vation to framing to mechanical system installations to finish carpentry and

beyond and use the provided spot-checks to make sure your contractor and

subs are doing what they’re supposed to do.

Part IV: All the After Stuff

Just because the house is finished, you’re not. Now it’s time to plant and

install your landscaping and, of course, move in. Also in this part, you see

4

Building Your Own Home For Dummies

03_557092 intro.qxd 1/20/05 3:11 PM Page 4

that money is still an issue — you need to consider how to manage the

investment you’ve made in your new home. Your construction loan is closed,

but it may not be too early to consider refinancing.

Part V: The Part of Tens

Like every For Dummies book, this part includes quick resources that provide

plenty of information in an easy-to-digest fashion. Above all, this part shows

that you aren’t alone. Gain wisdom from other homeowners’ trials and errors

in the list of most common custom home mistakes and problems. Discover

the best ways to lower construction costs. Use the list of best custom home

resources to answer lingering questions or help you uncover wellsprings of

useful information. We also provide an environmentally conscious list of ways

to make your project green.

Icons Used in This Book

To make this book easier to read and simpler to use, we include some icons

in the margins that can help you find and fathom key ideas and information.

These tidbits provide expert advice to help you save time and money in the

home-building process.

This icon highlights important information to store in your brain for quick

recall at a later time.

Avoid mistakes by following the sage words of advice that appear under this

icon.

Although this information may be fascinating, it’s not necessarily critical to

your understanding the topic at hand. Feel free to skip it if you must.

5

Introduction

03_557092 intro.qxd 1/20/05 3:11 PM Page 5

Where to Go from Here

The process of building a custom home isn’t linear. Not everyone starts with

the purchase of a piece of land, for instance. Some people go to an architect

first to help them create a floor plan. Others may jump right in with both feet,

and be halfway through construction before they realize they need to borrow

money in order to finish.

So, to reflect the nonlinear process of building a custom home, this book is

decidedly nonlinear as well. We organize it so that you can dip in wherever

you want and still find complete information. If you’ve already bought land

and met with an architect, but don’t know how you’re going to pay for the

project, for instance, go to Chapter 7 to read up on financing. Not clear who

does what on the job site? Flip to Chapter 11 for information on general con-

tractors and subcontractors.

If you’re not sure where to go first, you may want to start with Part I. It gives

you all the basic information you need to understand the process of building

a custom home. From there, you can skip to sections that cover the subjects

that seem most fuzzy to you now. Rest assured that when you’ve finished that

section, you’ll have a better grip on home-building reality.

6

Building Your Own Home For Dummies

03_557092 intro.qxd 1/20/05 3:11 PM Page 6

Part I

Getting Started:

The 411 on Custom

Home Building

04_557092 pt01.qxd 1/20/05 3:12 PM Page 7

In this part . . .

C

reating a custom home may be the biggest, most

exciting project you have ever been involved in

(yes, even more exciting than when you figured out static

electricity in third-grade science class). As excited as you

are though, you don’t want to rush into it. In this part, we

give you a general overview of what you’re getting into.

We also show you how to get organized and help you

acquire land. Lastly, we help you decide on the type of

home to build and walk you through the design and

permit process with architects and designers.

04_557092 pt01.qxd 1/20/05 3:12 PM Page 8

Chapter 1

The Custom Home Process

in a Nutshell

In This Chapter

Getting ready for the custom home process

Considering the finances

Figuring out who the players are

Understanding all the steps and time involved

M

ost people at some time in their lives desire owning a custom home.

Some people are attracted to the thought of designing and creating

something big from scratch. Others want to live in a new home that meets

their specific needs instead of a house that looks like every other home on

the block. Some people begin the custom home process by accident when

they find a piece of land that inspires them.

More than 35 percent of new homes in the United States are custom homes.

That means more than 300,000 custom homes are built every year. For each

person building a custom home, five people are in the process of designing

one. So you’re in excellent company with many people dreaming about moving

into a home designed and built just for them. Because custom homes are so

popular, tons of resources are available to help you through the process.

But, like Rome, your new home won’t be built in a day. The custom home

process is lengthy, emotional, and expensive, without much consistency to it.

Face it; custom homes require custom work and plenty of it! This work makes

building a custom home challenging, and yet that extra work is what makes

your project unique to you. You may feel overwhelmed at times, but by trust-

ing in the experience of the professionals you engage in your project and

keeping this invaluable book by your side, you can have a manageable pro-

ject that delivers the custom home you have been dreaming of.

05_557092 ch01.qxd 1/20/05 3:13 PM Page 9

Where Do You Start? Preparing

to Build Your Home

Believe it or not, the custom home process really has no standard starting

place. There are some logical entry points such as finding land, but most

often people start with a designed house they’ve had in mind for a long time.

Where you start isn’t important; what is important is for you to make sure

that you have taken all the necessary steps to give yourself the best chance

for success. The following list includes some questions you need to consider

before committing time and money to this project. We discuss some of these

issues extensively in other chapters (which we reference for you here).

Where do I want to live?

How long do I want to live in this house?

How will I find land? (See Chapter 3.)

How much money do I have to spend on this project? (See Chapters 7, 8,

and 9.)

How much extra time do I have to put into this project? (See Chapter 2.)

How do I find the right resources to design my house? (See Chapter 4.)

How do I find the right resources to build my house? (See Chapters 2

and 11.)

Is my marriage/relationship strong enough to survive this process?

(See your clergy or shrink.)

Don’t make the assumption that any one person can give you all the informa-

tion you need to prepare for this process. Contractors have one perspective

on the process, and architects may have a completely different perspective.

Do your homework and interview as many people as you can who are or who

have been involved in the process. By talking to professionals and consumers

and asking them to share their experiences, you can begin to get a clearer

picture of the process ahead.

Kevin recommends to all his clients that they get organized before beginning

the process. Sit down and assess how much time you can put aside each

week to focus on the project. Consider making a specific day each week your

day for working on custom home stuff. Also clear a space in your office or

den to be “Custom Home Central.” This way you always know where to find

what you need for your project. (You can find other organizing tips for your

project in Chapter 2.)

10

Part I: Getting Started: The 411 on Custom Home Building

05_557092 ch01.qxd 1/20/05 3:13 PM Page 10

11

Chapter 1: The Custom Home Process in a Nutshell

Money Makes the World Go Round —

Paying for Your Home

We talk a lot about money in this book and with good reason. Custom homes

require plenty of it. Your new home will probably be the most expensive item

you have ever purchased. In fact, it may be the most expensive item you’ll

ever buy in your entire life. Custom homes cost more than production or

tract homes because the materials aren’t bought in quantities and the labor

hired includes individual craftsmen. The results are worth it, however, and

will last lifetimes.

Many people find it a challenge to get past the large checks they’re writing. If

you decide to use an architect, even the first check to the architect will prob-

ably exceed the biggest check you’ve ever written. The key to success with

money in a custom home project is putting it in the right perspective. If your

project costs $500,000, then what each piece costs isn’t important as long as

it equals $500,000 or less.

When you buy a new car, you don’t argue over how much you spent for the

alternator or the exhaust system. You look for the car to meet the price of

your overall budget. Use the same logic when buying your custom home.

Look for the best price on each item, but look at it in perspective to the

entire budget. You’ll do better on some items and worse on others, but if it

fits your finances, then you’re in good shape.

Asking yourself about affordability

Of course you have heard horror stories about custom home projects that

have gone seriously over budget. The projects go over budget for many rea-

sons, but usually the main culprit is that the potential homeowners didn’t

spend enough time determining what they could afford. Obviously, if you’re

building well below your means, then going over budget is easily rectified by

using your own cash. But running out of money is the No. 1 cause of custom

home disasters. Before you start the custom home process, you seriously

need to consider the following:

What can you physically pay? Take stock of your cash on hand, equity

in real estate, and available cash from other resources. Make a firm deci-

sion how much money you’re willing to put toward the project. Chapter

7 can be a big help. You also need to get a rough idea of how much bor-

rowing power you have to help establish a limit for your budget when

added to your available cash. We provide tools and Kevin’s expert

financing assessments in Chapters 8 and 9.

05_557092 ch01.qxd 1/20/05 3:13 PM Page 11

What can you emotionally pay? Just because you have the money and

the borrowing power doesn’t mean you really want to spend it all. Think

carefully and discuss with your spouse what your limits are for making

payments and how much liquidity (or cash) you need in the bank to help

you sleep at night when all is said and done. Make sure you take into

account tax deductions and interest earned on investments when analyz-

ing your monthly cash flow. After you have found that emotional limit,

you can design your project to fit your comfort zone.

What is your cushion and tolerance for risk? Like we say again and

again throughout this book, building a custom home is a complex

process. You need to consider many variables beyond your control, and

then realize that the project can go over budget even if you do every-

thing right. You can certainly get good solid estimates, but ultimately

you won’t know what this home will cost until it’s finished and you total

up the receipts. Make sure you have addressed the “what if?” issues

thoroughly. Talk about how you’ll cover things financially if the market

turns sour — devaluing your property — or the cost of materials rise.

Decide what safety money (such as your 401(k) or retirement fund)

you’re willing or unwilling to tap into.

The more you talk about financial issues related to your custom home project,

the more likely you are to resolve problems before they happen. Optimism in

a custom home project can get you into trouble every time. The best approach

is to examine every possible risk and make contingency plans for every poten-

tial problem.

Them that has the gold makes the rules: If

you finance, the bank will dictate process

Most people don’t have all the money for a custom home sitting in their bank

account. Even if they did, putting it all into the project wouldn’t be a good

idea, as we explain in Chapter 7. Like it or not, you’ll probably have a finan-

cial partner in this project in the form of a construction lender or bank. The

good news is construction lenders have the same objectives you do.

They want to make loans for custom home projects. (That’s how they

make money.)

They want the house to be completed on time.

They want the house to be completed on budget.

They want the house to be completed in a workmanlike manner.

12

Part I: Getting Started: The 411 on Custom Home Building

05_557092 ch01.qxd 1/20/05 3:13 PM Page 12

Furthermore, the following tidbits can save you some arguments and frustra-

tions when working with construction lenders:

They don’t believe a house is worth exactly what it costs.

A larger loan makes you a riskier borrower, not a better customer.

You aren’t entitled to any loan.

They aren’t required by law to loan you any money.

They dictate how the money is handled throughout the process.

Accept the fact that if you want to use a lender’s money, you have to play by

its rules. Most of these rules weren’t made arbitrarily. They’re designed to

protect the financial viability of the project and protect the lender in the

unlikely event of a foreclosure, which is the act of taking back the home in

case you default on the payments or the construction contract. The guide-

lines and procedures are based upon statistical and anecdotal problems and

failures that occurred with the lender in the past. Unfortunately, sometimes

you pay for the sins of those before you.

Put yourself in the lender’s shoes. If you were loaning a friend 80 percent of

the money to build his home, you would want a few protections in place and

a little control over the money as well, right? If you get to know how lenders

see the project, which we explain in detail in Chapters 8 and 9, you can easily

navigate the approval process as well as the funding process (see Chapter 10).

This approach can make for a smoother, happier custom home project.

Introducing the Custom Home Life Cycle

The first step to beginning the process is looking at all the pieces and how

they go together. Your new home has a number of individual projects and

transactions necessary to complete it. Your new home also needs an army of

people with their expert work and services. This section breaks down in an

approximate order each person required to get through the process. Then we

outline each step necessary to go from land to landscaping.

It takes (more than) two to tango —

A quick guide to the players

The following list is a guide to all the individual players involved in the

custom home process. You may or may not use them all; their roles can vary

13

Chapter 1: The Custom Home Process in a Nutshell

05_557092 ch01.qxd 1/20/05 3:13 PM Page 13

14

Part I: Getting Started: The 411 on Custom Home Building

depending on your region and your project’s scope. The order of need may

also change depending upon where you start in your process.

Financial planner and/or certified public accountant (CPA): If possible,

start the custom home process by carefully assessing your finances; a

financial planner or CPA can help make sure you can afford this project.

Real estate agent: You may need a real estate agent to help you find and

purchase a lot, as we discuss in Chapter 3. She also plays a role when it’s

time to sell your existing home.

Loan officer: Your loan officer needs to be involved throughout the entire

process. You may need to start with a refinance or credit line to get liquid,

as we discuss in Chapter 7. You want to finance the land (see Chapter 3)

and do it consistent with the construction financing (see Chapters 8 and

9). Finally, you still may need another refinance after the project (see

Chapter 16). Your loan office can help you through these steps. Lucky

for you, Chapter 8 has good advice on picking the right loan officer.

Developer or landowner: The land you buy has to come from some-

where. If you’re buying in a subdivision from a developer, you may deal

with a sales office. Or you may end up buying from a landowner that has

had the property for generations.

Escrow officer or attorney: Your state determines who administers the

closing of your escrow, but either way, this person makes sure the title

papers and insurance are all ready for you to take ownership.

Architect and/or designer: Architects and designers design and draft

plans for the house. Architects are licensed; they’ll coordinate technical

specifications for the house that may be beyond the scope of a designer.

The architect can also guide you through the permitting process. (Chapter

5 can help you decide if you need an architect, and Chapter 6 provides

the ins and outs of the permitting process.)

Log or timber frame dealer: If you’re building a kit home (see Chapter 4),

you’ll work with your dealer for the design process as well as the pur-

chase of your materials package.

Contractor/builder: You need to decide whether you need this person

or if you’ll rely on yourself to drive the construction of your new home

(see the “Being an Owner-Builder: More Power to You!” section, later in

this chapter, if you may want to be your own owner-builder). We give

you tools for working with your contractor in Chapter 11.

Surveyor: This person makes sure you know where your land begins

and ends — a necessity for designing the house.

Soils engineer: In many states, such as California, your foundation

depends upon the report issued by this person.

Well/septic engineer: If you’re building in a rural area, you need this

person to design and certify your water and sewage systems.

05_557092 ch01.qxd 1/20/05 3:13 PM Page 14

15

Chapter 1: The Custom Home Process in a Nutshell

Planning department: Your house needs to meet your neighborhood’s

zoning requirements before you get permits. This department enforces

the zoning. (See Chapter 6 for details.)

Design review committee: You can’t always build what you want. This

committee dictates what it wants to see in your design. (Look in Chapter

6 for more information.)