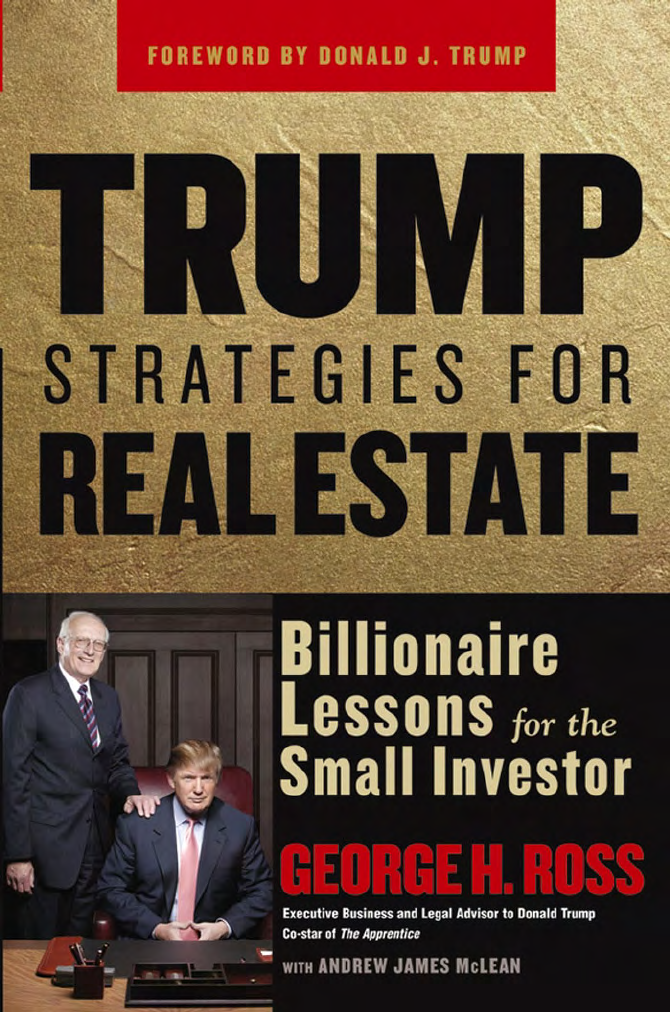

TRUMP Strategies For Real Estate

TRUMP

S

TRATEGIES

FOR

R

EAL

E

STATE

TRUMP

S

TRATEGIES

FOR

R

EAL

E

STATE

Billionaire Lessons for the Small Investor

GEORGE H. ROSS

with

Andrew James McLean

J

OHN

W

ILEY

& S

ONS

, I

NC

.

Copyright © 2005 by George H. Ross. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or

transmitted in any form or by any means, electronic, mechanical, photocopying,

recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the

1976 United States Copyright Act, without either the prior written permission of the

Publisher, or authorization through payment of the appropriate per-copy fee to the

Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923,

(978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. Requests to

the Publisher for permission should be addressed to the Permissions Department,

John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011,

fax (201) 748-6008.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used

their best efforts in preparing this book, they make no representations or warranties

with respect to the accuracy or completeness of the contents of this book and specifically

disclaim any implied warranties of merchantability or fitness for a particular purpose.

No warranty may be created or extended by sales representatives or written sales

materials. The advice and strategies contained herein may not be suitable for your

situation. The publisher is not engaged in rendering professional services, and you

should consult a professional where appropriate. Neither the publisher nor author shall

be liable for any loss of profit or any other commercial damages, including but not

limited to special, incidental, consequential, or other damages.

For general information on our other products and services please contact our Customer

Care Department within the United States at (800) 762-2974, outside the United States

at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that

appears in print may not be available in electronic books. For more information about

Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Ross, George H., 1928–

Tr ump strategies for real estate : billionaire lessons for the small

investor / George H. Ross with Andrew James McLean.

p. cm.

Includes bibliographical references and index.

ISBN 0-471-71835-1 (cloth)

1. Real estate investment. 2. Real estate development. 3. Real estate

investment—United States—Case studies. 4. Real estate

development—United States—Case studies. 5. Trump, Donald, 1946– I.

Title: Billionaire lessons for the small investor. II. McLean, Andrew

James. III. Title.

HD1382.5.R67 2005

332.63′24—dc22

2005000053

Printed in the United States of America.

10 987654321

This book is dedicated to my wonderful wife, Billie

the solid foundation on which the happiness and success

in my life was built.

C

ONTENTS

F

OREWORD BY

D

ONALD

T

RUMP

ix

P

REFACE

xi

C

HAPTER

1

S

ELL

Y

OURSELF

L

IKE

T

RUMP

:

F

IVE

P

ERSONAL

Q

UALITIES

Y

OU

N

EED TO

S

UCCEED IN

R

EAL

E

STATE

1

C

HAPTER

2

T

HINK

B

IG

: H

OW

T

RUMP

C

HOOSES

P

ROPERTIES TO

I

NVEST

I

N

21

C

HAPTER

3

P

RINCIPLES OF

N

EGOTIATION

:

H

OW

T

RUMP

U

SES

T

HEM

45

C

HAPTER

4

H

IGH

-P

OWERED

R

EAL

E

STATE

N

EGOTIATION

T

ECHNIQUES AND

T

ACTICS

69

vii

CONTENTS

C

HAPTER

5

T

HE

T

RUMP

T

OUCH

: C

REATE

“S

IZZLE

,” G

LAMOUR

,

AND

P

RESTIGE TO

G

ET

H

IGHER

-T

HAN

-M

ARKET

P

RICES FOR

Y

OUR

P

ROPERTIES

99

C

HAPTER

6

R

AISING

M

ONEY

: T

ACTICS FOR

A

TTRACTING

L

ENDERS AND

I

NVESTORS

125

C

HAPTER

7

G

ET

H

ELP FROM THE

B

EST

R

EAL

E

STATE

S

PECIALISTS

Y

OU

C

AN

F

IND

153

C

HAPTER

8

W

HY

T

RUMP

B

UILDING

P

ROJECTS

A

RE

A

LWAYS ON

T

IME AND

U

NDER

B

UDGET

165

C

HAPTER

9

T

RUMP

M

ARKETING

S

TRATEGIES

:

S

ELLING THE

“S

IZZLE

” S

ELLS THE

P

RODUCT

179

C

HAPTER

10

H

OW TO

M

ANAGE

P

ROPERTY

L

IKE

T

RUMP

:

T

REAT

I

TASA

C

USTOMER

S

ERVICE

B

USINESS

193

C

HAPTER

11

H

OLDING

S

TRATEGIES AND

E

XIT

S

TRATEGIES

207

I

NDEX

223

viii

F

OREWORD

by

Donald Trump

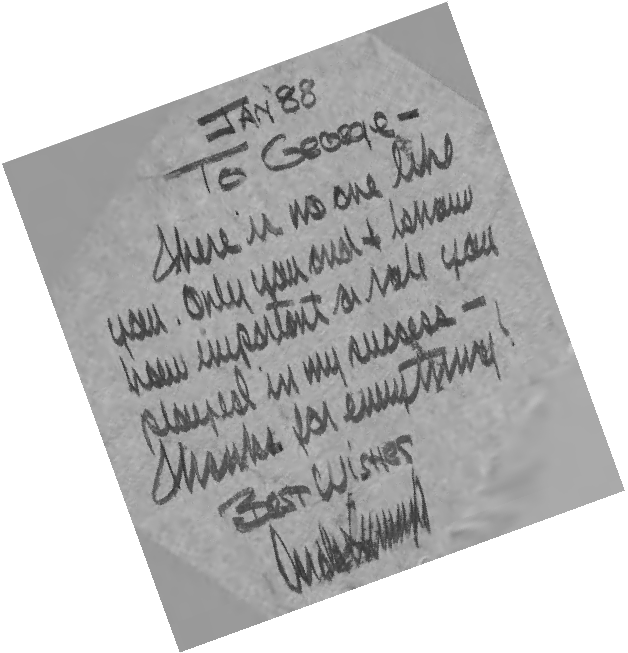

(In the author’s copy of The Art of the Deal)

T

o George—

There is no one like you. Only you and I know how important a

role you played in my success—Thanks for everything!

Best wishes,

Donald Trump

ix

xi

P

REFACE

I

’

VE SPENT

50

YEARS

as a lawyer, business advisor, and deal nego-

tiator for real estate tycoons at the top of the world’s toughest real

estate market—New York City. I’ve represented or negotiated with

great real estate minds like Harry Helmsley, Sam LeFrak, Bill Zeck-

endorf, and Donald Trump. It’s been my good fortune to spend many

of the best years of my career as Donald’s right-hand man.

These days most people know me best from the TV show, The

Apprentice, where Carolyn Kepcher and I help Donald make tough

decisions about whom to fire and whom to keep. The show has been

fun, but most of my work for Donald over the past 25 years has been

in the world of real estate. I have been an advisor, negotiator, and

lawyer on many of his biggest and most successful real estate invest-

ments, including the acquisition and renovation of the GM building,

Tr ump Tower on 5th Avenue, the Grand Hyatt Hotel, and my per-

sonal favorite, 40 Wall Street.

Throughout my career, I have had the opportunity to acquire a

great deal of knowledge and experience in real estate investing,

which I hope to pass on to you in this book. For example, during a

10-year period from 1956 to 1966 when Sol Goldman and Alex

DiLorenzo Jr. became two of the biggest property owners in New

York, I personally bought 702 individual properties on their behalf. I

have been intimately involved in many of New York City’s most

spectacular projects, such as the Chrysler Building and the St. Regis

PREFACE

xii

Hotel, which I helped one of my clients buy. I’ve also had the oppor-

tunity to watch Donald Trump in action as he made some of the

greatest real estate investments in history.

This book explains the strategies Donald Trump used to make

his real estate fortune, and how small investors can apply them to in-

vestments of any size, right down to a one-family rental property. I

describe how Trump implements some of his signature strategies

such as creating luxury, perceived value, exclusivity, and attention to

detail, which all come together to maximize the value of his invest-

ments. (This is why his properties earn far more money, square foot

for square foot, than his competitors’.)

A number of the chapters focus on a particular real estate invest-

ment that I was directly involved in negotiating or advising Trump

on. Using this example, I draw out the lessons and explain how the

same strategies that Trump used to make huge profits on his deals

can work for you—the small investor. Although Trump does things

on a grand scale and his target market is usually an elite, luxury cus-

tomer, Trump’s basic real estate strategies will be of interest to:

•Anyone who is interested in owning or developing real estate

•Anyone unsure of how to negotiate a real estate transaction

•

Anyone who isinrealestateonasmallscalebutwouldliketo

do more

•

Anyone interested in learning how Donald Trump does

hismagic

This is the first book on Trump’s strategies for the real estate

investor. Although it has a lot of nuts-and-bolts guidance and in-

vesting principles, the book alone will not make you a great in-

vestor. As I tell the students who take my negotiation course at New

York University, “There’s no way in 15 hours that I can make you

P

REFACE

xiii

an excellent negotiator. It is impossible! All I want to do is open

your mind to the possibilities and the power of negotiating, and

some basic techniques. Then, when you run into a specific situation

you can go back to your notes, and say, how did George handle this?

Or, what did he suggest?” You already have some ideas about real

estate, but I’ve learned many things in my 25 years working with

Tr u mp a nd 50 years in the real estate business, that I’d like to pass

along to you. If I am successful, this book will help you negotiate

far better deals, arrange better financing, make better investments,

and earn significantly more money in real estate.

I recall the day I first met Donald Trump in 1974. He entered my

office at the law firm of Dreyer and Traub beaming with enthusiasm

about a project he wanted to do with the old Commodore Hotel on

42d Street in New York City. He was just 27 years old at the time, and

I was a senior partner known for completing complex deals, but I

agreed to see him out of courtesy because I represented his father,

Fred Trump. Fred had spoken enthusiastically about Donald’s promise

as a future star in the real estate world.

Donald laid out his incredibly complex plan for buying the huge,

dumpy, rundown hotel next to Grand Central Station and turning it

into a first-class, state-of-the-art business hotel. I told him it was a

brilliant idea, but there was no way it would ever work, given the num-

ber of powerful people and governmental agencies he would have to

convince to grant him major concessions. Nevertheless, if he was will-

ing to pay the legal fees, I was willing to help him take a shot at it. We

spent the next two years negotiating with railroad executives, city and

state officials, lenders, and Hyatt executives making the deal happen.

During those tumultuous two years, Donald and I developed a great

working relationship and mutual respect. When he miraculously

pulled off the deal, I was so sure he would be a huge success in real es-

tate that I became his closest advisor and lawyer.

PREFACE

xiv

H

OW

M

Y

C

AREER

S

TARTED

When I was young, growing up in Brooklyn, New York, I planned to

go to MIT to be an engineer, but my father died suddenly when I was

16 and that plan died with him. At 17 I enlisted in the U.S. Army be-

cause they offered to send me to college. When I went on active duty,

I was trained as a cryptanalyst (a code breaker) and spent most of my

short army career in Washington, DC. The analytical skills, pa-

tience, and tenacity I learned as a code breaker helped me when I was

faced with seemingly unresolvable real estate problems.

With the help of the GI Bill, I obtained my BA degree at Brook-

lyn College and entered Brooklyn Law School. Working three jobs

concurrently and with the support of my working wife, I graduated

and was admitted to the New York Bar in 1953.

While looking for a job, I saw an ad in the Law Journal for a law

clerk. As luck would have it, the person who answered the phone was

Bill, a friend from law school. He was working for Dreyer and Traub, a

well-known real estate law firm. Bill said, “You don’t want this job.

Yo u’ll be nothing but a messenger and it only pays $25 a week.” But I

took it anyway! That was the inauspicious beginning of my legal career.

Although Dreyer and Traub was a law firm dealing primarily with

real estate matters, they handled litigation as a courtesy for their

clients, and Bill and I worked in the litigation department. Several

months later there was an opening upstairs in the real estate acquisi-

tion and leasing practice, the place where real money was made.

It was

an excellent opportunity for advancement and Bill was slotted for

the job. I was to take his spot in litigation. But before he could start,

he was drafted into the army and recommended me for the real es-

tate position. Once upstairs, I had the good fortune to apprentice to

Murray Felton, a very tough taskmaster. He was so demanding that

if I put a comma in the wrong place, I would hear about it for days.

But Felton was a superb technician and highly regarded in the

P

REFACE

xv

world of real estate attorneys. I knew that working with him was a

great opportunity to learn the intricacies of real estate law from a

perfectionist. So I soaked up every bit of helpful information I

could from him. I became adept at drafting leases, real estate docu-

ments, and participating in all types of transactions. My prior liti-

gation experience added to the perception that I was a competent,

though young, real estate attorney.

L

EARNING THE

R

EAL

E

STATE

B

USINESS

In 1955, one of my clients asked me to draft a commercial lease for

him even though he was to be the tenant. Usually, the landlord’s at-

torney drafts the lease, but in this case the landlord told my client to

have his lawyer prepare the lease. So I drew up the lease and inserted

a provision stating that the tenant didn’t have to pay any rent before

the landlord made a certain elevator operational. My client moved in

and, as it turned out, the elevator inspector for New York City re-

fused to accept the elevator repairs the landlord made, insisting that

only a brand new elevator would get his approval. The elevator stayed

out of operation for a very long time, but throughout that period my

client was still able to carry out his normal business operations.

Theowners, Sol Goldman and Alex DiLorenzo Jr. had a “tenant

in possession” utilizing the premises for its normal business opera-

tions, but because of that clause in the lease, the tenant was not paying

them any rent! Although the landlords were very unhappy they were

helpless.

In the mid-1950s, Goldman and DiLorenzo, who were both

mul

timillionaires, had decided to invest in real estate on a huge scale.

I had decided to leave Dreyer and Traub because I had been told that

there was no possibility for me to become a partner in the firm. I

happened to mention my impending departure to Sol Goldman and

PREFACE

xvi

he called me a few days later and said, “George, Alex and I would like

you to be our counsel.” I said, “Why me?” He said, “Well, we al-

ready paid $90,000 in the form of lost rent just for the privilege of

knowing you! We’ll make it worth your while if you say yes.” I ac-

cepted their offer.

E

VERY

P

ROBLEM

H

AS A

P

RICE

T

AG

Very quickly I learned something that every real estate investor

should understand: There is a huge difference between the legal as-

pects of real estate and the business of investing in real estate. I had

to restructure my whole way of thinking. Whenever I discovered a

legal problem with a real estate deal, Goldman would say, “Is it seri-

ous enough to blow the deal?” If I said, “No.” Then he would say,

“How much can I get off the price for the problem?” Most lawyers

simply advise their clients not to do a deal if they find legal problems;

lawyers cannot or will not make business recommendations for their

clients. Goldman forced me to think like a businessman, not just a

lawyer, and realize that almost every problem has a price tag. He

forced me to look at legal problems strictly as a way of improving the

deal. He’d say, “What can I get if I overlook this problem?” To find

that answer, I had to dig into the problem.

For example, Goldman and DiLorenzo contracted to buy Har-

borside Terminal in Jersey City, New Jersey, from the railroad that

owned it. The property consisted of a huge cold storage warehouse of

almost two million square feet abutting the Hudson River, right

across the river from downtown Manhattan. The purchase price

seemed reasonable even though it was to be an all-cash deal. How-

ever, the title report contained an exception for possible claims of the

State of New Jersey to a strip of land that the warehouse straddled. It

became clear to me why the railroad was having difficulty finding a

P

REFACE

xvii

buyer. No lawyer would let a client buy the property with such a de-

fect and certainly no bank would place a mortgage on it. The problem

related to land under water that was filled in sometime in the 1800s.

A law was passed stipulating that if the land under water was filled in

by the adjoining landowner before 1849, the landowner had good

title to it. If it was filled in after 1849, the State of New Jersey owned

it. I couldn’t prove when it was filled in and who filled it nor could

the State of New Jersey.

I told Sol we should get a price reduction and also convince the

railroad to take back a long-term purchase money mortgage at a low

interest rate since no lender would make any loan because of the title

defect. The railroad agreed to reduce the purchase price by $400,000

and to take a sizable mortgage, so we closed the deal. Several years

went by but the title impediment still stuck in my craw. I was certain

that the State of New Jersey must have encountered the same prob-

lem in the past since much of the land abutting the Hudson River was

filled-in land. I contacted the State and learned that they were aware

of the problem and rather than sit with a dubious claim they had

passed a statute giving the State the right to give up its claim in ex-

change for the value of their interest in the disputed land. Following

the procedure outlined in the statute, we paid a minimal amount and

received a quitclaim deed to the land in dispute from the State of

New Jersey. As a result, the property appreciated in value so much

that a bank made a first mortgage loan in an amount exceeding the

total purchase price paid by Goldman and DiLorenzo.

From 1956 to 1966 Goldman and DiLorenzo were New Yorkreal

estate. When I arrived at Goldman and DiLorenzo in 1956, they

owned18properties; when I left in 1966, they owned 720. I negoti-

ated and handled almost all of these purchasesby myselfwith very lit-

tle supervision from them. We were buying Manhattan ground leases

by thedozen, warehouses in New York harbor, and multimillion-

dol

lar office buildings. We were dealing in big num

bers, and much of

PREFACE

xviii

it was done with cash. Many times I walked into a closing on a prop-

erty with a certified check for millions of dollars inmywallet.Iwas

also given a standing million dollar deposit by Goldman and

DiLorenzo with which to negotiate. Goldman and DiLorenzo

would tell me what typeofdealtheywantedandmyjobwastomake

it happen. They were not anxious buyers, so if I didn’t think the

deal met their terms, I would kill it and goontothenextone.

That’s what enabled them to acquire so much real estate so quickly.

During that 10-year period, I bought the Chrysler Building, the St.

RegisHotel, the land under the Plaza Hotel, Harborside Terminal

in Jersey City, and numerous ground leases on their behalf. (A

ground lease isalong-term lease for land on which a building sits,

andgives the tenant all the rights and obligations of operation and

ownership except title to the land.)

Goldman and DiLorenzo’s appetite for real estate was voracious.

They had excellent financing connections which enabled me to close

transactions quickly. As their lone lawyer and business representa-

tive, I had almost unlimited authority to negotiate but not to in-

crease the purchase price. I negotiated with Harry Helmsley, Bill

Zeckendorf, and Morris Karp to name a few. These were all the big

names in New York real estate at that particular time—pretty heady

stuff for a 30-year-old lawyer.

For the first few years I worked for Goldman and DiLorenzo,

I was in way over my head. At Dreyer and Traub, I was handling

closings on single-family homes in New Jersey. I had never done a

contract and closing on any office building of any size. Now I was

thrust into an arena involving the purchase and operation of huge

office buildings. I really had no prior training or experience. Yet ev-

eryone thought, because I was so young and represented these mil-

lionaires in huge transactions, I must be brilliant so they treated me

as an equal. I knew how green I was, but I wasn’t going to dispute

their assessment of me! I learned as fast as I could from everyone I

P

REFACE

xix

came in contact with, including all the people on the other side—the

lawyers and other professionals and the real estate moguls them-

selves. I concentrated on what they did, how they did it, how they

acted and reacted in certain situations, and anything else that would

fill the void of my ineptitude. I was like a sponge absorbing every bit

of information I could. Before long my crash course in real estate

paid off and I began to give my clients well-reasoned opinions as to

which deals were good and which were not and what price to pay.

This gave me a unique combination of talents. Most lawyers don’t

know the business of real estate, and therefore, they are not

equipped to make business decisions. They are ready to render ad-

vice on any legal issue, but leave the business decisions to their

client.

R

ADIO

D

AYS

Any good lawyer will make lots of money while practicing law, but

since lawyering is a service business, the income stops when you step

down. I recognized the need to invest in some enterprise that would

be of value in my later years. In 1966, my brother-in-law, Martin

Beck, was leaving the Katz Agency, a big name in the business of sell-

ing radio time. He suggested that we look for investment opportuni-

t

ies together. He thought radio broadcasting on Long Island would be

profitable. I told him, “I don’t know anything about the radio busi-

ness.” He said, “I know all about radio but I don’t know how to raise

the capital necessary for a venture.” I told him, “You find and run the

stations and I’ll find the money to make it happen.” In 1966, we

formed Beck-Ross Communications Corporation and bought our first

radio station in Long Island, WGLI, for approximately $450,000.

Marty knew how to make money in radio broadcasting. Using the

profits from WGLI and by expanding our financial contacts, we

PREFACE

xx

em

barked on a plan of expansion. FM broadcasting was in its infancy

but the superiority of the sound made it an attractive prospect. We

purchased several other stations—both AM and FM—increased

their market share, and then sold them at huge profits. In 1986,

Marty and I bought out all of our investors for 25 times their origi-

nal investment. In 1987, we were faced with a decision that many in-

vestors confront at some time, to expand the business or sell out to

someone who would. We chose to take a substantial profit and leave

the expansion to the buyer.

But the radio business was only a sideline to my law career. In

1966, after 10 years with Goldman and DiLorenzo, my reputation

had grown to the point where I could have received a partnership

with any quality law firm with a real estate department. I opted to re-

turn as a partner to my old firm, Dreyer and Traub, where I was

being accepted as a senior partner. I realized that since only two

young attorneys had become new partners in the past 10 years and

the old partners were reaching retirement, it would be my firm

within a few years. That’s exactly what happened. By the early

1970s, I became one of four senior partners running one of the best

real estate law firms in New York with as many as 120 lawyers. I led

that firm for more than 20 years.

Eventually, I got tired of dealing with partnership politics, gave

up the active practice of law, got a severance package, and joined the

Edward S. Gordon Company where my role for the next 10 years was

to supply real estate expertise to major clients like United Technolo-

gies, IBM, the New York Times, and AT&T.

H

OW

I C

AME TO

W

ORK FOR

D

ONALD

T

RUMP

Although I left the active practice of law in 1987, I remained friendly

with Donald Trump, and though I had worked with him on many of

P

REFACE

xxi

his most successful projects, I was no longer his lawyer. When the

New York City real estate market tanked in 1990, Trump hit the

rocks. It was not due to a lack of business acumen; rather, his phe-

nomenal success had created an air of invincibility. Because he had

been so incredibly successful, he began to think that any business he

touched would turn to gold.

The banks would throw money at him. If he asked to borrow $60

million for a building, they gave him $80 million. When the bottom

fell out of the New York City real estate market, he was vastly

overextended and was over $990 million in debt. He owed so much

money that the lenders knew if they forced him into bankruptcy it

would have a disastrous effect on the real estate market. They had

many bad loans that they didn’t want to write off. So they came up

with a plan that would enable him to work his way back by agreeing

to accept a substantial reduction if the loans were repaid by a certain

future date.

Even though I was no longer a member of a law firm, I

wanted to help. I told Donald that if he ever needed legal advice or

counsel while he was in trouble, I would be happy to do it for him

without charge. He was impressed and asked me why I would do

that. I said, “Donald, I think a lawyer has a responsibility to repre-

sent a client when he’s down, not only when he’s on top. I’m here if

you need me.” Trump never accepted my offer because it’s not his

style to get something for nothing. But I’m sure he appreciated the

gesture. My philosophy has since paid off in spades—with Donald

Tr u mp, loya lty goes a long way.

In the mid-1990s, Donald had two deals going, the new Nike

Building adjoining Trump Tower and 40 Wall Street. Both were

plagued with problems because of the lawyers involved, and very lit-

tle was getting accomplished. Donald knows when to use delay tac-

tics, but he also hates deals that drag on and on. So he hired me to

eliminate the roadblocks and get those deals done. While I was

PREFACE

xxii

working on them, I told Donald that I was bored with my life at

Gordon and was planning to retire. He asked me to join the Trump

Organization on a full-time basis. He said, “I’ve got a lot of great

things going and you’ll have fun.” We quickly agreed on terms (I

only work four days a week) and 10 years later, I’m still an important

part of the Tr u mp team.

My title is Senior Executive Vice President and Senior Counsel for

the Trump Organization and my primary function is to give Donald

Tr ump business and legal advice. I offer my opinion as to the feasibil-

ity of his proposed projects, which he is free to accept or reject. He

likes to bounce things off me before reaching his own decision. He

knows that I will call it like I see it and give him an unbiased opinion.

I’m currently responsible for developing many foreign investments for

Donald and supervising the leasing and operation of 40 Wall Street

and Trump Tower.

Additionally, I teach a course at New York University on negoti-

ation. Negotiation is a subject that I have made a study of throughout

my career, because it is such a critical part of real estate success. I

could easily fill a book on this subject. For a discussion of some of

the principles and techniques, used by Trump, that I think are most

valuable, see Chapters 3 and 4.

Tr ump has been a great man to work for. In 10 years, he has

never once asked me where I’m going or what I’m doing. That’s the

kind of trust we have. When he gave me responsibility for 40 Wall

Street, I took the building from where it was—a one-million-square-

foot nearly vacant structure he purchased for $1 million—to where

it is now—a thriving office building worth in excess of $350 million.

After 40 Wall Street had been rented and had become extremely

profitable for Trump, I said to him, “I think I’m entitled to a bonus

for 40 Wall Street.” Trump’s reply was, “How much do you think

you’re entitled to?” I gave him a figure. He said, “You’ve got it.” It’s

this kind of recognition that makes it a pleasure to work for him.

P

REFACE

xxiii

Fred Trump once said to Donald when he needed a lawyer, “You

would be hard-pressed to find a wiser, more loyal, or a better advisor

and lawyer than George Ross.” I’m delighted Donald took that ad-

vice and gave me the opportunity to work with a true real estate

genius. Now I hope to pass on to you some of the powerful investing

strategies I’ve learned from some of the greatest real estate minds in

the business.

A

CKNOWLEDGMENTS

My gratitude to Donald J. Trump for becoming such an important

part of my life as a friend and for giving me the unique opportunity

throughout my career to help turn his visions of spectacular projects

into realities.

1

1

S

ELL

Y

OURSELF

L

IKE

T

RUMP

Five Personal Qualities You Need to

Succeed in Real Estate

K

EY

P

OINTS

•Use your enthusiasm for the project to inspire others.

• Build relationships with everyone involved in a deal.

•Showmanship is a real estate strategy.

•Be better prepared than anyone else.

•Be tenacious.

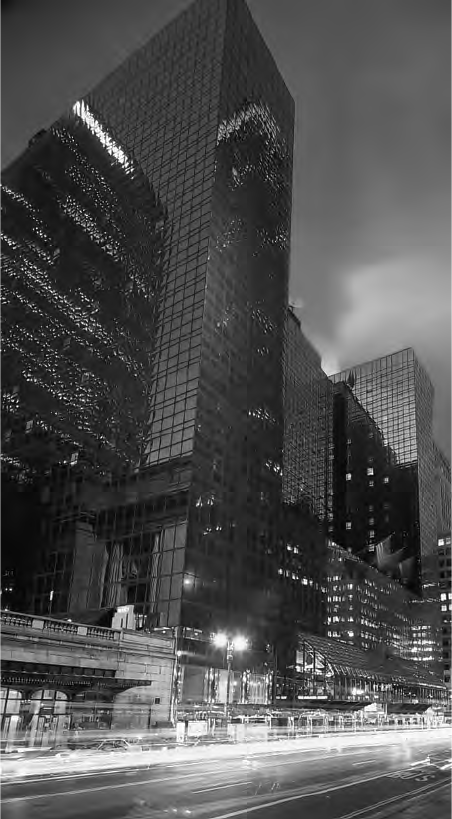

Grand Hyatt

3

D

ONALD

T

RUMP BECAME

a billionaire in real estate by making a

series of incredibly creative and successful investments in New

York City properties. He is now the largest real estate developer in

New York and is widely acknowledged to be one of the most brilliant

real estate investing minds anywhere. For example, in the early

1980s, with the building of Trump Tower on 5th Avenue, he single-

handedly created the market for high-end luxury residences in New

York City. He continued with a string of successes and in 2003, 9 of

the 10 highest selling apartments were in Trump buildings—apart-

ments that sold for millions of dollars each.

What can the small real estate investor learn from a billionaire

developer like Trump? After advising Trump on many of his biggest

investments over 25 years, I’m convinced that small investors can

successfully use many of the same principles that earn him millions.

It’s not the scale of your real estate investment project that counts.

Whether you are investing in a single-family rental, a four-unit

rental, or a multimillion-dollar office building makes no difference to

the financial success of your particular project, what’s important are

the real estate investing strategies used to acquire and develop the

property, and how you design and market the property to buyers or

tenants. Many of the same basic principles that work for one of

Tr ump’s $300-million skyscrapers work just as well for smaller prop-

erties. Anyone interested in investing in real estate can benefit from a

study of Trump’s real estate investor strategies.

For example, you can’t make big real estate investments—or re-

ally profitable small investments—without projecting certain per-

sonal qualities that inspire confidence in others, and make them want

TRUMP STRATEGIES FOR REAL ESTATE

4

to help you or to see things your way. The key personal qualities you

need are enthusiasm, relationship-building skills, showmanship,

preparation, and tenacity. Donald Trump has these qualities in

spades as he demonstrated on his first big real estate deal, the trans-

formation of the dilapidated Commodore Hotel on 42nd Street in

New York City into the magnificent Grand Hyatt. Remarkably,

Tr u mp u sed very little of his own money in this transaction, yet later

sold his half interest to Hyatt for $85 million.

This chapter will describe how these five key personal qualities

helped Trump make the Commodore-Hyatt deal work, and how

small investors can use these same qualities in their own real estate

investments to negotiate better deals, sell properties for more money,

and dramatically improve real estate profits.

INVESTING CASE STUDY

T

RUMP

’

S

C

OMMODORE

-H

YATT

P

ROJECT

This real estate investment was a monster as far as complexity was

concerned. It was 1974, New York City was struggling to survive,

and Trump decided that this was a great time to buy a huge, dilapi-

dated, nearly empty building on 42nd Street next to Grand Central

Station. Like many of the best real estate investors, he looks at prob-

lem properties and sees opportunities. Trump’s plan was to convert

this old building, the Commodore Hotel, into a 1,400-room first-

class convention hotel—the largest since the New York Hilton was

built 25 years earlier.

When 27-year-old Donald Trump explained his grandiose idea to

me during our first meeting, I told him that based on existing condi-

tions he was chasing an impossible dream that would never happen.

I thought the idea was brilliant, but it was totally unrealistic given the

S

ELL

Y

OURSELF

L

IKE

T

RUMP

5

economic environment and the huge cast of characters who would

have to embrace a set of entirely new concepts for the idea to work.

Tr ump would have to win major financial concessions from:

1. Penn Central, a bankrupt railroad that owned the land on which

the Commodore Hotel was built;

2. New York City, which was facing bankruptcy;

3. The State of New York, which had no money to contribute to any

venture;

4. A lender who was holding many defaulted loans on New York real

estate;

5. A major hotel chain that was not pursuing new facilities in New

Yo rk City since tourism and occupancy rates were extremely low;

and

6. Existing tenants occupying the building.

The deal involved successful negotiation of several treacherous in-

terconnected transactions. If Trump failed to conclude any one of

these transactions, it would sink the entire project. Using the five

personal qualities outlined in this chapter he had to:

1. Obtain an option to buy the Commodore Hotel from the Penn

Central Railroad for $12 million dollars;

2. Convince the representatives of Penn Central Railroad to turn

over the $12 million purchase price to New York City, which was

owed $15 million in back taxes from the Penn Central;

3. Convince New York City to accept the $12 million to cover $15

million in back taxes and agree to the creation of a long-term

lease that would give the city a share of profits in lieu of future

real estate taxes;

4. Convince the Urban Development Corporation, a New York State

Agency, to accept title to the property, then grant a long-term

TRUMP STRATEGIES FOR REAL ESTATE

6

lease of the property to Trump and to use its right of eminent do-

main to obtain possession from existing tenants;

5. Find a major hotel operator willing to participate in the owner-

ship and operation of the new hotel to give credibility to the cre-

ation of profits in which New York City would share; and

6. Find a bank willing to lend $80 million to cover all of the costs in-

volved in purchasing and developing the property.

This was as complex as it sounds. Something like this had never

been done before.

To jump ahead to the end of the story, Trump pulled it off,

convincing all these parties to work with him, using his enthusiasm,

relationship-building skills, showmanship, preparation, and tenacity.

In September of 1980, the Grand Hyatt opened—and it was a great

success from day one. The renovated Hyatt helped revitalize the

whole Grand Central Station neighborhood in New York City, which

in turn played a major role in reversing the failing, bankrupt image of

the city in the 1970s. By 1987, gross operating profits at the Hyatt

exceeded $30 million annually. Years later, after recouping his mod-

est cash investment in the property, Trump sold his half interest to

Hyatt for $85 million.

Here’s how Donald Trump used critical personal qualities to clinch

that monumental real estate deal. You can use the same qualities in

your own dealings regardless of their size or complexity.

U

SE

Y

OUR

E

NTHUSIASM FOR THE

P

ROJECT TO

I

NSPIRE

O

THERS

Enthusiasm is a crucial element of the investment game because your

success depends largely on capturing the imagination and securing

S

ELL

Y

OURSELF

L

IKE

T

RUMP

7

the cooperation of key players—buyers, sellers, lenders, tenants, con-

tractors, and others. If you’re not enthusiastic about your real estate

investment idea, there’s no way you can get someone else to sign on.

Remember that people will initially be skeptical of whatever you say.

So be like Trump, sell hard. If you can maintain your level of com-

mitment and enthusiasm in the face of initial doubts, you’ve taken

the first step toward getting the support you will need to succeed.

Tr u mp k nows that enthusiasm is contagious.

For example, Trump’s enthusiasm for the Commodore-Hyatt

project and the way he envisioned it benefiting the entire city of New

York were boundless. He communicated his vision over and over to all

of the people who were involved in the various governmental agen-

cies, including the mayor’s office and the railroad. He argued that

this one project could help turn around the entire blighted midtown

Manhattan area. They all agreed that it was important to do some-

thing about this eyesore, the Commodore, because of its critical loca-

tion next to Grand Central Station. Trump’s enthusiasm convinced

them that he was the only person capable of putting all the pieces to-

gether. For example, he told the city, “Forget real estate taxes and

concentrate on the money you’ll earn from room taxes, income taxes

paid to the city on the salaries earned by the employees working in

the new hotel, and the profits from the hotel operation.” (Trump of-

fered to make New York City a partner in the profits.) “Think about

how the new construction will bring desperately needed jobs to New

York and reestablish New York City as the capital of the world.”

Tr ump’s enthusiasm was the catalyst for getting key people,

whose support he needed to achieve success, interested in the deal

and to getting the city to embrace the idea. He prepared charts and

graphics showing the dreary existing conditions of the area, the like-

lihood of an extended recession in property values leading to further

erosion of the city’s tax base. He explained, “This is what you’ve

got

now but here’s what I can do for you.” He would then display a

TRUMP STRATEGIES FOR REAL ESTATE

8

dramatic color rendering of the building as it would appear when ren-

ovated and sell this as the linchpin of revitalizing the Grand Central

area—which in turn was the cornerstone of the reconstruction of the

image of New York City. All he initially sought was the city’s ac-

knowledgment that this was a great idea coupled with a loose com-

mitment to cooperate in bringing it to fruition, if they got

everything they wanted. He never talked numbers with the key play-

ers in this deal until after he got an initial expression of interest and

support for his plan. He knew that talking numbers too soon would

give people a reason to say no to his plan. It’s a valuable lesson for

you to remember in any real estate investment of yours: Enthusiasm

(and focusing initially on the large outlines of a deal rather than the

financial details) can overcome many obstacles.

How Small Real Estate Investors Can Use Enthusiasm

The Hotel Commodore conversion was a huge project that took over

two years and 23 drafts of a complicated and intensely negotiated

ground lease to finish. But no matter what the size or complexity of

your real estate project, at various stages of the transaction you’ll

need to convince other people to help you, and do what you want

them to do. This takes enthusiasm and perseverance. Share with the

seller, your lenders, contractors, and others what you envision for the

property you want to buy or renovate. Tell a great story about how

you found it, what your inspiration was, and the difficulties you have

already overcome. Play up what you see as its best or most unique

features. Trump knows that people like to be excited. You just have

to find creative ways to excite them.

If you’re not enthusiastic, the people you’re trying to convince to

lend you money, sell you a property, or invest in your partnership are

not going to stick their necks out. But if you can tell a great story

S

ELL

Y

OURSELF

L

IKE

T

RUMP

9

about your investment idea, if you are articulate and enthusiastic

about the opportunity you are offering others, you are on your way

to developing the requisite rapport with buyers, sellers, lenders, or

other decision makers.

B

UILD

R

ELATIONSHIPS WITH

E

VERYONE

I

NVOLVED IN A

D

EAL

The success of any real estate investment or any business deal, for

that matter, is not strictly a matter of dollars-and-cents. A lot of it

comes down to personal relationships—your ability to forge strong

cooperative relationships with all parties, whether they are directly

or even tangentially involved. Trump does this by taking the time

necessary to gain insight into the people he is dealing with—who

they are, what they do, how they do business, who are their family

members or friends, and if appropriate, what their hobbies are. If you

can establish a rapport and a feeling of mutual trust it invariably

makes for an easier negotiation and a faster, more amicable conclu-

sion to any problems that arise. The principle here is, “No one in-

tends to buy a bucket of trust but they will pay for it if it’s delivered.”

Give people reasons to trust you by building a relationship with

them, and you will be laying the foundation for long-term real estate

investing success.

The reason you have to build relationships, especially at the be-

ginning of a real estate transaction, is that people are naturally sus-

picious of others. Until you have built up a level of trust, it is likely

that what you say will be somewhat discounted.

One way to build a good relationship is to assume that the pres-

ent transaction you’re working on is only the beginning of negoti-

ating many deals with your counterparts. Work hard to create the

TRUMP STRATEGIES FOR REAL ESTATE

10

impres

sion of being “a nice person to deal with.” Some of Trump’s

best deals were the result of recommendations from adversaries with

whom he had past dealings. Leaving pleasant memories is the best

personal advertisement in any real estate transaction.

Here’s a great example of Trump’s relationship-building skill in

action from the Commodore-Hyatt deal. Trump had never met Vic-

tor Palmieri, an executive with Penn Central Railroad, which owned

the Commodore Hotel, but Trump knew Palmieri would have to play

a key role if Trump’s idea were to become reality. With full confi-

dence in his project and his salesmanship, Donald Trump called

Palmieri, introduced himself, and said, “Give me 15 minutes of your

time and we can reverse the decline of the City of New York and in-

crease the value of your Penn Central holdings.” In the meeting,

Tr u mp got Palmieri’s attention and a solid working relationship was

created. Without Trump building a strong cooperative relationship

with Victor Palmieri, the decision maker for Penn Central, he would

have never had the opportunity to purchase the Commodore from

Penn Central, let alone get Palmieri’s help in pressuring the city for

its cooperation, which became critical later on.

Small investors tend to think that they have no basis for building

a personal relationship, and therefore no negotiating power. Nega-

tive thoughts create their own problems. You may be dealing with

someone who’s much more successful, or who works for a large, im-

personal bank. You may think they can’t (or won’t) relate to you, but

that’s not true. You can relate to each other as human beings. Look

for anything at all you may have in common.

If you’re going into a meeting with someone, learn as much about

them beforehand as you can. Ask someone else about them, find out

what they know. If you’re going to meet with an owner of a rental

property, speak to one of his tenants beforehand. Ask questions, such

as, Is it a good property? What do you think about the landlord?

S

ELL

Y

OURSELF

L

IKE

T

RUMP

11

Now you have information that may help you establish rapport

with the owner, and probably some ammunition that will be useful

when you enter into negotiations.

S

HOWMANSHIP

I

SA

R

EAL

E

STATE

S

TRATEGY

Once you have conviction about how your real estate investment

can benefit not just you but the other people whose help you need,

and you’ve started to build relationships, the next step is to find

concrete ways to communicate your vision to your potential real es-

tate partners. Anyone who is involved with a real estate transaction,

especially a fixer-upper project or new construction, has undoubt-

edly spent a lot of time and effort thinking about the details of it:

how it will work, why it will be good for everyone involved, how it

will be successful, and what the end reward will be. The challenge

now is to condense everything that you’ve done and thought into

something that you can show or tell other people so that they get

the same degree of enthusiasm. It’s difficult, but that’s your chal-

lenge. Keep in mind that other people whose help you need are

starting off cold. They haven’t spent the weeks or the months living

with this project that you have. To get them to share in your

dream, you have to come up with a way of making it interesting to

them. This is called showmanship—and it is one of Trump’s signa-

ture traits.

One great example of Trump’s showmanship was his hiring of

Henry Pearce, a dignified, New York City banker with decades of

experience, to assist him in obtaining the financing for the Com-

modore. Trump was only 27 and he knew bankers would be skepti-

cal of lending so much money to someone so young. Showmanship,

in this case, meant conveying a powerful symbol of reliability and

TRUMP STRATEGIES FOR REAL ESTATE

12

safety to the conservative bankers, and this is exactly what Trump

did when he sat down at the table with Pearce at his side. Instead of

seeing a 27-year-old asking for millions of dollars, the bankers

saw Trump with someone they had been dealing with for years—

even though the reality was that he was just a temporary hired gun

for Trump.

An even better example of Trump’s showmanship is the way

he used flashy architecture to get people excited about the

Commodore-Hyatt deal. Using eye-catching, conversation-starting

architecture is one of Trump’s signature tactics, and it’s something

every real estate investor, no matter how small, should consider

doing. A good design and some flashy ideas from an architect can

easily add far more value to a project than the cost of the architect’s

fee. If you can create something impressive and distinctive, you will

be able to get premium rents or a premium selling price for your

property.

Tr u mp felt that the Commodore was going down hill because it

looked so dark and dingy. His plan was to build a new façade directly

over the building’s old skeletal structure in glass, or bronze if that

was feasible, otherwise he would demolish the existing building and

build a new one. It had to embody “showmanship”—a building with

sparkle and excitement that would make people stop and notice. He

hired a young, talented architect named Der Scutt, to help him real-

ize this vision.

Next, Trump used showmanship to get New York City to agree

to a massive 40-year tax abatement in order to make this deal work,

and instead, take a share of the profits. This was a critical piece of

his plan. But Trump knew that convincing the politicians and bu-

reaucrats in New York City government to go along with this plan

would be extremely difficult. To imagine that the run-down Com-

modore Hotel, mostly vacant and mired in unpaid property taxes,

could evolve into one of the busiest and most luxurious hotels in

S

ELL

Y

OURSELF

L

IKE

T

RUMP

13

Manhattan was a tough proposition for anyone to believe. He had to

give the Board of Estimate something physical to look at, to touch,

in order to make his vision real.

Tr u mp h ad t he architect come up with sketches and renderings

that he could use in his presentations to the city and the lenders. He

told Der to make it appear that he had spent a huge sum of money on

the drawings. A beautiful presentation can be very impressive. It

worked. People began to believe in the idea.

How Small Investors Can Use Showmanship

There are plenty of inexpensive ways to use showmanship in small

real estate investments. For example, instead of showing prospective

buyers a vacant piece of land, show them a rendering of what the

project will look like after it is built. Hire an artist if necessary. It

may be worth investing in a scale model of your property so that buy-

ers can visualize the final product.

Also, how you dress, your appearance, says something to the peo-

ple you’re trying to influence. Donald Trump always dresses in a way

that will make a good impression on the people whose help he needs.

To spearhead a luxury hotel deal in the heart of Manhattan, a pin-

stripe suit and silk tie are the safest bet. But because appearance

communicates adaptability as well as respectability, Trump knows

that khakis and a polo shirt are appropriate for golf course negotia-

tions, or a hard hat for on-site construction projects. Your dress

should be chosen to give people confidence that you can do what you

say you’re going to do.

Think about the people whose help you need to make your in-

vestment successful. When meeting withabankyoumaywantto

wear a suit—but very high heels or excessive makeup might com-

promise the impression you want to make. If you’re meeting with a

contractor, trytokeep it casual, don’t overdress, but try to wear a

TRUMP STRATEGIES FOR REAL ESTATE

14

casual outfit that still looks impressive. First impressions make a

powerful statement.

B

E

B

ETTER

P

REPARED

T

HAN

A

NYONE

E

LSE

Most people don’t realize that there’s a lot of preparation involved in

getting people to respond in the way you want them to respond. The

key is anticipating problems and questions that other people will ask

about your proposal and having answers ready. Donald Trump

spends significant amounts of time preparing for important meet-

ings in which he needs to persuade a key person or group.

Here’s an example for small investors: You want to sell a home to

a potential buyer. The buyer says that he wants to buy the house, but

his purchase will be subject to getting a mortgage. Here is where

your planning pays off. If you have already done your homework and

contacted a bank, which has agreed to make a mortgage on the house

for x amount of dollars, you anticipated this potential problem. Now

you can tell the buyer, “I already have the ideal bank for you to go

to.” I have now directed you to one source, instead of you going to

ten sources and getting confused.

You could be selling a house with a very old refrigerator, and you

don’t want to buy a new one. You anticipate a buyer’s objection by say-

ing (if the objection comes up), “I’ll guarantee that if the refrigerator

doesn’t last a year, I’ll buy you a new one.” You have anticipated a po-

tential problem. So instead of the buyer asking for a discount because

he wants a new refrigerator, you simply give him a one-year warranty.

Whatever the situation, whether you are buying or selling, try to an-

ticipate any likely potential problem.

You do this by taking an objective look at what it is you’re try-

ing to accomplish. You say, “If I were the buyer, what would I find

objectionable?” Put yourself in the shoes of the other party and

S

ELL

Y

OURSELF

L

IKE

T

RUMP

15

raise the questions they would raise, then find the answers to the

questions. There’s always some wrinkle in the transaction, some-

thing that you will need to address so that you can quickly move

on so the other party doesn’t dwell on it. Keep your goal in mind

and think through any potential obstacles and have possible solu-

tions ready.

If you are preparing for a meeting, you need to think about how

you can use the meeting to build rapport, but also focus on what

your objective is. Perhaps you want others to invest; maybe you want

them to accept your capabilities, whatever the case you must prepare

for that meeting: What you’re going to say; what you’re going to do;

and who the audience is; who you’ll be playing to. This way you can

have the maximum effect. If you don’t prepare, you’ll fall flat.

There was a researcher named Ziff who made a study of negotia-

tion. He expanded a concept called Ziff ’s principle of least effort,

which proved that most people will put the least amount of effort in

a transaction that they can in order to proceed. When I read about

the theory, I immediately realized it was true in real estate. Most

people are not willing to put in a lot of time to prepare before mak-

ing big real estate decisions, and you can make this work to your ad-

vantage if you are willing to do what most other people won’t.

Knowing that others want to put in very little effort, successful peo-

ple like Trump take the role of filling the gap and doing all of the ef-

fort that’s required in a transaction. They do it on behalf of the

other people involved in the transaction who don’t want to do it.

Tr u mp a lway s does more preparation than other people are willing to

because it gives him greater control in a fluid situation.

For example, if Trump is creating a plan to attract investors in a

property, knowing what he does about human nature, he’s not going

to expect you to spend a lot of time and effort reading the details.

He’ll do all the mathematics for you in the plan and at the bottom

he’ll write, in big type, “Return on your money: 20% a year.” Most

TRUMP STRATEGIES FOR REAL ESTATE

16

people are going to go right to that “20% a year.” They’re not going

to delve into the details. They’re enamored with the 20%.

When Trump has a person interested in a transaction, he will do

everything he can to make his involvement in that transaction easy.

For example, “I’ll do this so you don’t have to; I’ll send you this; I’ll

take care of that phone call.” You want to keep other people, as much

as possible, out of the nitty gritty of the actual transaction, so you

can control the details. Take advantage of the fact that most people

are not willing to spend time on preparation.

Tr ump spent huge amounts of time preparing for the New York

City Board of Estimate, which first met to approve his entire Com-

modore transaction in late December 1975. One of the things he did

a week beforehand, was to go to Victor Palmieri, the executive from

Penn Central Railroad who owned the Commodore Hotel and ex-

plain to him that if he wanted the city to take our abatement case se-

riously, we needed to get out the message that the Commodore was

going downhill fast and that it was not going to survive much longer.

Palmieri agreed with him. On December 12, Palmieri made a public

announcement to the media that the Commodore Hotel had lost an-

other $1.2 million during 1975, was anticipating worse losses in

1976, and as a result intended to shut down the hotel permanently no

later then June 30, 1976. This announcement by itself didn’t change

the Board of Estimate’s mind, but they agreed to hold several more

meetings with Trump. However, from the beginning of negotiations,

the single event that nobody in city government wanted to see was the

Commodore closed down and boarded up. So the news release prior

to the December meeting helped get the Board of Estimates worried

about a closing of the Commodore. Then, next spring, on May 12,

1976, one week before the Board of Estimate, for the fourth time, was

to vote on Trump’s tax abatement, Trump got Palmieri to announce

that Penn Central would permanently close the Commodore in six

days. Palmieri explained to the media that the occupancy had de-

S

ELL

Y

OURSELF

L

IKE

T

RUMP

17

creased from 46 percent the previous year to 33 percent, and that op-

erational losses for 1976 were projected at $4.6 million.

Adding fuel to the fire, on May 19, was the front-page news in

allthe local newspapers about the remaining tenants being forced

out of the Commodore. The news featured stories about the hun-

dreds of employees who were now looking for work, and the dismay

thelocal retailers were feeling in anticipation of a boarded-up Com-

modore Hotel.

On May 20, thanks in part to Trump’s strategic preparations for

his four meetings with the Board of Estimate, the Board finally

voted unanimously to give Trump the full tax abatement deal he had

sought. Over the 40-year term, the tax abatement saved him tens of

millions of dollars. This is typical of how Trump thinks strategically

about preparing for critical meetings. He will go to great lengths to

create conditions that will work to his favor during the meeting.

How Small Investors Can Use Preparation to Their Advantage

Suppose, for example, you need a temporary construction loan for a

fixer-upper. Before you ever ask for a loan, talk to other people who

have received constructionloans.Whatdidtheyhavetodotoqual-

ify? What kind of fees and ratesdidthelendercharge?Werethey

happy with the lender? Do as much networking as you can to find peo-

ple who have direct experience and are knowledgeable about the kind

of loan you want, and who can give you the inside story on what it

takes togetthatkindofaloanwithfavorableterms.Gettinginforma-

tion from insiders or people who know more than you is the best kind

of preparation you can do for an important meeting or negotiation.

Preparation is important in all phases of a real estate investment.

It shows up in how well conceived your plan for fixing up and selling

a property is, and how many contingencies you have prepared for;

it’s in how you present yourself to a lender and if you have properly

S

ELL

Y

OURSELF

L

IKE

T

RUMP

19

profitable projects have been those such as 40 Wall Street (to be dis-

cussed later in the book) where he picked up a property for very little

because a string of earlier investors had failed with the property—

and only he had the tenacity and vision to make it work. Everything

that is really successful was the result of hard work that nobody else

wanted to do. The only thing that held the whole Commodore-Hyatt

deal together was Trump’s tenacity—he was like a hungry pit bull.

For example, during early negotiations with New York City over

theCommodore Hotel, one of the city’s key concerns was who would

runthisnew hotel. They said, “You say you’re going to pay us rent,

and that you’re going to give usashareoftheprofits,butwhatdo

you, Donald Trump, know about running a first-class hotel?” And at

first, he didn’t have an answer. But he said, “All right, I’ll go out and

get a major player to run it.” And the city responded with, “Okay, if

you bring in a major hotel operator, we’ll go along with it.” That ten-

tative commitment from the city gave him a strong position from

which to negotiate with a hotel company, and he ended up bringing in

Hyatt as a partner. Once again his tenacity helped him turn a road-

block into anadditional benefit for this investment.

One ofthebiggest roadblocks the small investor will encounter is

themortgage lender. Tenacity can help a lot here. If the first lender

you approach denies you a loan, keep trying with other lenders. Make

inquiries with friends and neighbors about who is making mortgage

loansinyour neighborhood. If you look hard enough, you will find a

lender, though you may have to pay a premium for the loan.

Another potential roadblock could be a stubborn seller. Here you

have to find out exactly why he or she does not want to sell, then in a

determined way, answer each issue.

Other possible roadblocks could be denial of a zoning variance or

a building permit. Again, you have to approach the problem tena-

ciously. Find out what the bureaucrats’ specific concerns with your

plans are, then address these issues.

TRUMP STRATEGIES FOR REAL ESTATE

20

Everything worth doing is difficult, and in order to accomplish

it, you have to be tenacious.

S

UMMARY

I deliberately started this book with a chapter on personal qualities

because most people don’t realize the role that people skills play in

real estate investing success. It is not just a matter of financing, buy-

ing the right property, getting tenants, and so on. All these elements

are built on a foundation of having the right personal qualities. Great

real estate investors like Trump are also great entrepreneurs. They

know that they know how to get people excited about their bold

ideas, and they are undaunted by the setbacks, problems, and disap-

pointments that cause most people to give up.

21

2

T

HINK

B

IG

How Trump Chooses

Properties to Invest In

K

EY

P

OINTS

•Be willing to pay a premium for a prime location.

•

Don’t buy without a creative vision for adding

significant value.

•Four things Trump looks for in a location.

•Creative problem solving leads to big profits.

•Write a preliminary business plan before you buy.

23

Y

OU

’

VE HEARD THE

cliche about the three most important things

in real estate being “location, location, location.” Trump thinks

this is misleading. Location is important, but having a great location

doesn’tguarantee anything. It’s a starting point for what could be a

great investment. However, an inept real estate investor could own

property at a great location and lose a fortune. One of the corner-

stones of Trump’s philosophy is “Improve any Location.” In other

words, use creativityandvisiontochange the way your location is

utilized. Trump never gets involved with something that’s just ordi-

nary—it has to be very special. If he’s building an apartment building,

it has to be the most luxurious, and the biggest and best in the area.

Small investors can adapt this principle by doing something radical to

their property, changing the zoning, changing the way the property

is used, or renovating it sostrikingly that people think about the lo-

cation in a new way. That’s what he decidedtodowhenheconceived

theideafor Tr umpWorld To weratthe United Nations Plaza.

DEAL CASE STUDY

T

RUMP

W

ORLD

T

OWER AT THE

U

NITED

N

ATIONS

When Donald first discovered this property in 1997 it contained a

sprawling two-story building situated across the street from the

United Nations in New York City. The building was the headquarters

of an engineering society whose officers decided to sell the building

because the value of land for new construction had skyrocketed, and

TRUMP STRATEGIES FOR REAL ESTATE

24

given the prime location they believed they could get a high price and

move their offices into better space nearer the business hub of New

Yo r k C i t y. The zoning ordinance affecting the site limited the size of

any new building on the property to a 10:1 ratio: Any new structure

could be no bigger than 10 times the square-footage of the land. Since

the land area was approximately 37,000 square feet this would have

limited Trump to constructing a 370,000 square foot building on the

site. Trump knew that the property was very expensive but it was an

entire block from 47th Street to 48th Street with an unparalleled view

of the United Nations headquarters and the East River. He felt he had

to build something extraordinary that would justify the high price of

the land and take advantage of the sight lines of the property. Fortu-

itously, the existing zoning covering the property permitted the trans-

fer of unused “air rights” from one parcel of land to a contiguous

parcel on the same block. When the city wrote its zoning law, it

wanted to limit the amount of bulk on a particular block but not nec-

essarily building height. It didn’t care if the bulk was in one building or

20 buildings. In other words, if a building on Parcel A was 10,000

square feet but the zoning permitted a 30,000-square-foot building,

the owner of Parcel A could sell the excess 20,000 square feet of

building coverage (“air rights”) to the owner of Parcel B. In fact, the

building department liked the idea of the bulk being in one structure

because it gave you more light and air everywhere else in the neigh-

borhood. Since there was little likelihood that the owner of the un-

used air rights would ever use them, their sale to an adjoining owner

who wanted them could fetch a price far in excess of their worth to

the owner who had them.

After making preliminary evaluations, Trump, “thinking big” as he

typically does, decided to build a huge luxury condominium tower

using air rights from adjoining underbuilt properties. No other devel-

oper recognized this possibility, and it was the key to Trump turning

this “ordinary” property into something extraordinary. But the process

T

HINK

B

IG

25

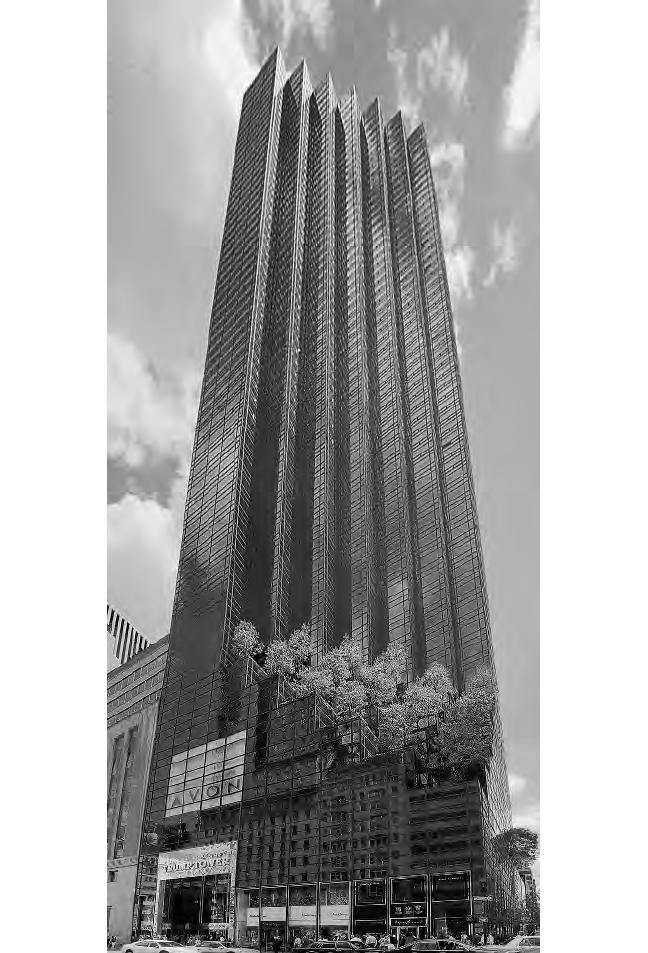

Tr ump World Tower at United Nations Plaza

TRUMP STRATEGIES FOR REAL ESTATE

26

would be extremely difficult. First, Trump would have to agree to buy

the engineering society’s property. Then he would have to convince

the owners of the adjacent properties to sell him their unused air

rights. In complete compliance with the law, Trump could then incor-

porate these air rights with the parcel he was buying and get a build-

ing permit for a much larger building. If he could buy enough air rights,

he could build something really unique—the tallest residential building

in New York City.

The keytomaking this concept work was to acquire the air rights of

adjacent buildings quietly. Building owners in New York City with ex-

cess air rights are often willing to sell them freely because they con-

siderthe dollars they get for the air rights as “found money.” But if

word got out to nearby building owners about what Trump was doing,

theprices for those air rights on parcels on the same block might have

escalatedthrough the roof. A difficult problem to be overcome was

that only air rights on contiguous parcels were of value. He had to

makeadeal for the air rights on one parcel adjoining the one he was

buying,and then work his way down the block to acquire the air rights

on several parcels that adjoined one another. So he took options on

various properties, offering the owners a high price, subject to his

abilitytoacquire the air rights needed to form the chain permitted by

thezoning. The outright purchase of all the adjacent parcels was im-

possible because one of the parcels was a church that might be willing

to sell its air rights but never the church.

Thus, we had several negotiations going on concurrently, and we

had to conduct all the negotiations secretly. To help keep our negoti-

ations for air rights simple, we offered the same price per square foot

for the air rights to all adjoining property owners. If one owner got a

higher price per square foot, we agreed that all other owners would

get that same price. That way no owner could feel cheated. In some

cases, we actually told an owner, “This is the price per square foot

T

HINK

B

IG

27

we agreed to pay John Smith for his air rights, and we are offering

you the same deal.”

Having assembled air rights from seven adjoining parcels, we ap-

plied to the building department for a building permit to build a

towering 677,000-square-foot building with 376 condominium

units—the tallest residential building in New York City. We showed

the City that we were in full compliance with the zoning resolutions

and were entitled to the issuance of a building permit. We would be

building as “a matter of right” meaning we didn’t need any special

permission from the zoning board. The building department of the

City of New York agreed. Some representatives said, “We might not

like the proposed building, but it’s perfectly legal to build it.” They

felt that if they denied issuing a building permit, their denial would

be overturned in court and possibly lead to a huge damage award.

So, the building department issued the permit. Trump immediately

began construction. He did this to gain the advantage of having al-

ready broken ground, in the event a lawsuit was filed seeking an in-

junction against construction.

As the scope of the building as the tallest residential building in

New York City and maybe the entire world became evident, a num-

ber of prominent residents in the community decided to oppose it.

They tried to use political pressure but were told Trump was acting

well within the law. A group of wealthy residents in the area, includ-

ing Walter Cronkite, filed a lawsuit to stop construction, arguing that

“the zoning in this neighborhood was intended to permit something

completely different; you can’t build a 90-floor monster right in front

of the U.N.” We explained that it wasn’t 90 floors, it was 72 floors (it

was 90 stories high because of higher than normal ceiling heights

(ceiling heights did not affect permitted square footage). The opposi-

tion didn’t like that fact either, but what we did was entirely within

the law.

TRUMP STRATEGIES FOR REAL ESTATE

28

It is easy to understand that when this lawsuit was filedtostopthe

building, the lenders who had agreed to finance the construction of

the buildinggot nervous. They felt that there was a real possibility

that the building might never be built as Trump envisioned it. But

Tr ump had a Plan B. He established a relationship with Daewoo—

one of the largest corporations in Korea—who was willing to be his

partner and would guarantee repayment of the loan if the planned

building did not materialize. So now the mortgage lender wasn’t wor-

ried about the adverse publicity or the lawsuit because they had this

billion dollar company, Daewoo, which is the equivalent of General

Motors in Korea, to guarantee repayment of the loan if necessary.

Meanwhile, the building kept going up. The opposition tried to stop

the construction. They claimed that if Trump’s building was allowed to

be built they would lose their beautiful views of the East River. They

filed a lawsuit against Donald Trump and the City of New York for

wrongfully issuing the building permit; but Trump filed a countersuit

that sought damages as a result of the opposition’s lawsuit and a judg-

ment that the building permit was properly issued. The court basically

ruled that the city had every right to issue the permit and Mr. Trump

had every right to build the building under the permit. They were not

going to issue an injunction in this case because the damages would

be horrendous and it was unlikely that Trump’s position would be

overturned on appeal. They allowed the construction to proceed.

The opposition lost in the lower courts and eventually took their

lawsuit to the Court of Appeals—the highest New York State court.