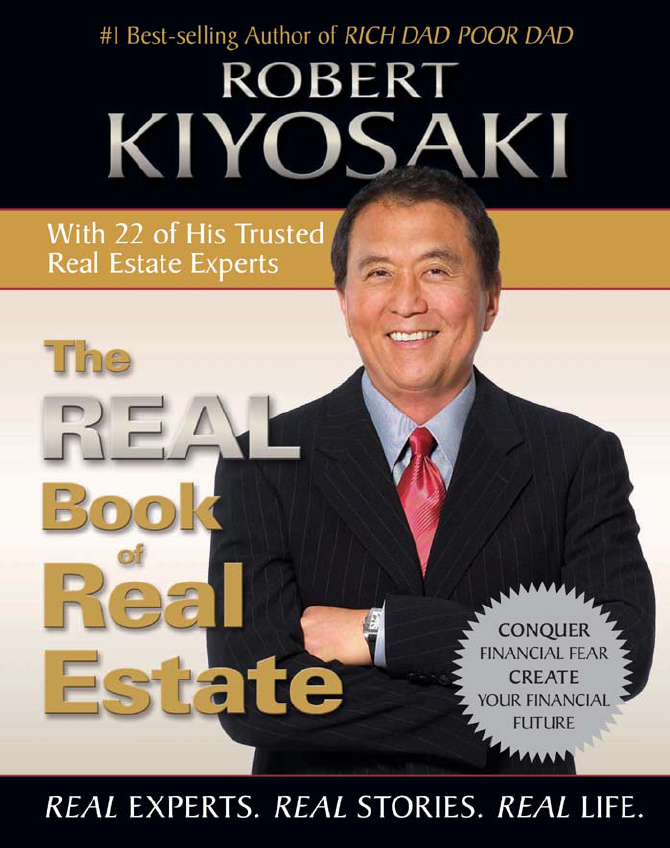

Robert Kiyosaki The Real Book Of Real Estate

The REAL Book

of

Real Estate

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page i

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page ii

This page intentionally left blank

The REAL Book

of

REAL EXPERTS. REAL STORIES. REAL LIFE.

Robert Kiyosaki

Real Estate

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page iii

Copyright © 2009 by Robert T. Kiyosaki

Published by Vanguard Press

All rights reserved. No part of this publication may be reproduced, stored in a retrieval

system, or transmitted, in any form or by any means, electronic, mechanical, photocopying,

recording, or otherwise, without the prior written permission of the publisher. Printed in

the United States of America. For information and inquiries, address Vanguard Books,

387 Park Avenue South, 12th Floor, New York, NY 10016, or call (800) 343-4499.

Designed by Anita Koury

Set in 10.5 point Mercury

Library of Congress Cataloging-in-Publication Data

The real book of real estate : real experts, real advice, real success stories/Robert Kiyosaki.

p. cm.

Includes index.

ISBN 978-1-59315-532-2

1. Real estate investment. 2. Real estate business. I. Kiyosaki, Robert T., 1947-

HD1382.5.R33 2009

333.33—dc22

2009008346

ISBN 13: 978-1-59315-532-2

Vanguard Press books are available at special discounts for bulk purchases in the United

States by corporations, institutions, and other organizations. For more information, please

contact the Special Markets Department at the Perseus Books Group, 2300 Chestnut Street,

Suite 200, Philadelphia, PA 19103, or call (800) 810-4145, extension 5000, or e-mail

special.markets@perseusbooks.com.

10 9 8 7 6 5 4 3 2 1

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page iv

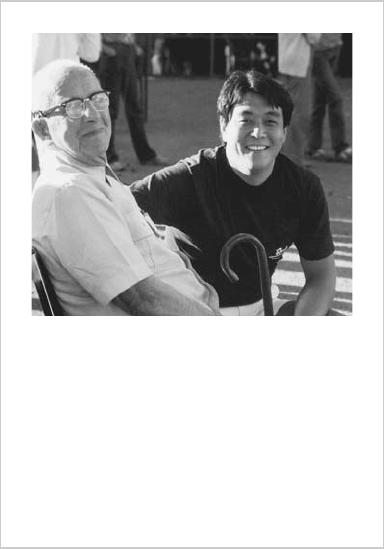

"I'm not a genius. I'm just a tremendous bundle of experience."

—Dr. R. Buckminster “Bucky” Fuller

From left to right: Dr. R. Buckminster

“Bucky” Fuller at eighty-six years old with

Robert Kiyosaki in 1981. Buckminster Fuller

was an American architect, author,

designer, futurist, inventor, and visionary.

Recognized as one of the most

accomplished Americans in history, he

dedicated his life to a world that worked

for all things and all people.

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page v

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page vi

This page intentionally left blank

Contents

Acknowledgments ix

Introduction, Robert Kiyosaki 1

PART 1:

The Business of Real Estate

1 The Business of Real Estate, Tom Wheelwright 5

2 A Real Estate Attorney’s View of Assembling and Managing Your

Team, Charles W. Lotzar 29

3 The Way to Exotic Wealth, Wayne Palmer 53

4 Profits from the Ground Up, Ross McCallister 71

5 Master Your Universe, Craig Coppola 89

6 10 Rules for Real Estate Asset Protection, Garrett Sutton 108

7 Of Marbles and Capital, Wayne Palmer 133

8 How to Avoid and Handle Real Estate Disputes, Bernie Bays 152

PART 2:

Your Real Estate Project

9 Buy by the Acre, Sell by the Foot: Understanding Real Needs,

Financial Logic, and Asking Questions, Mel Shultz 173

10 It’s All About Adding Value, Curtis Oakes 184

11 Analyzing the Deal, or Adventures in Real Estate, John Finney 200

12 Real Estate Due Diligence, Scott McPherson 222

13 Creating Value from the Inside Out, Kim Dalton 233

14 Financing for Real Estate Investors, Scott McPherson 251

15 Lease It and Keep It Leased, Craig Coppola 262

16 The Perils of Careless Property Management, Ken McElroy 276

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page vii

PART 3: Creative Ways to Make Money in Real Estate

17 Getting from A to B Without Paying Taxes, Gary Gorman 293

18 No Down Payment, Carleton Sheets 306

19 Marketing: Your Ticket to Finding and Profiting from Foreclosures,

Dean Graziosi 326

20 Entitlements: The Sleeping Giant of Real Estate Profitability,

W. Scott Schirmer 341

21 The Tax Lien Investment Strategy, Tom Wheelwright 371

22 Horse Trading: The Original Way to Wealth on the Great American

Frontier, Wayne Palmer 390

23 How to Create Retail Magic: A Tale of Two Centers,

Marty De Rito 409

PART 4:

Lessons Learned

24 What One Property Can Teach You, Kim Kiyosaki 433

25 In the Beginning... , Donald Trump 451

26 What Is the Most Important Thing You’ve Learned From Your

Father About Real Estate?, Donald Trump Jr. and Eric Trump 458

27 Overcoming the Fear of Failing, Robert Kiyosaki 466

Index 481

Credits 501

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page viii

F

or years I have been an advocate for financial education.While many other

financial advisors are telling people what they should invest in, I have been

telling people to invest in themselves—to invest in their own knowledge. That

is what I have done, and it has made me rich. I have also been telling people to

surround themselves with great teachers who are actively practicing what they

preach. The creation of this book was made possible because of the people I

consider my teachers. Each one has a lifetime of experience and a lifetime of

knowledge. And each one knows the importance of continual learning.

The contributors to this book generously gave of their time and their talent

so that you could see the possibilities, avoid the pitfalls, and understand the

methods of building wealth through real estate. They have recollected their

great achievements, and they have revealed their painful failures. I thank them

for their openness. The lessons we learn from our own mistakes and the mis-

takes of others are the most powerful.

These people are not only my advisors, but they are also my friends. Together

we have been through the ups and downs of the real estate cycle, ridden each

wave, and made money doing it. These are the friends I run my ideas and my

deals by. And because they are friends, I know that they will give me their

honest opinions. I thank them for that, too.

Acknowledgments

ix

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page ix

I’d also like to thank Jan Ayres and Kathy Heasley of Heasley & Partners,

Inc., who took this book from ideas on a flip chart to a finished manuscript.

Special thanks to Rhonda Shenkiryk of The Rich Dad Company and Charles

McStravick of Artichoke Design for their work on the book’s cover. Finally,

thank you to my wife, Kim, who more than twenty years ago said yes to a guy

with no money and a lot of ideas.

x ACKNOWLEDGMENTS

9781593155322_FM:real estate_new 3/25/09 3:52 PM Page x

T

here are four reasons why I think a real book of real estate is important at

this time.

First, there will always be a real estate market. In a civilized world, a roof

over your head is as essential as food, clothing, energy, and water. Real estate

investors are essential to keeping this vital human need available at a reasonable

price. In countries where investing in real estate is limited or excessively con-

trolled by the government, such as it was in former Communist Bloc countries,

people suffer, and real estate deteriorates.

Second, there are many different ways a person can participate and prosper

with real estate. For most people, their only real estate investment is where they

live. Their home is their biggest investment. During the real estate boom from

2000 to 2007, many amateurs got involved with flipping houses—buying low

and hoping to sell higher. As you know, many flippers flopped and lost every-

thing. In true investor vocabulary, flipping is known as speculating or trading.

Some people call it gambling. While flipping is one method of investing, there

are many, more sophisticated, less risky ways to do well with real estate. This

book is filled with the knowledge and experiences of real, real estate investors—

real estate professionals who invest rather than flip, speculate, trade, or gamble.

Third, real estate gives you control over your investments, that is, if you

have the skills. In the volatile times of early 2009, millions of people were losing

1

Introduction: A Note from

Robert Kiyosaki

Why a Real Book of Real Estate

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 1

trillions of dollars simply because they handed over control of their wealth to

other people. Even since the middle of 2008, the great Warren Buffett’s fund,

Berkshire Hathaway, has lost 40 percent of its value! Millions of people have

lost their jobs, which means they had no control over their own employment

either. The real, real estate professionals in this book have control over both

their businesses and investments. They will share their good times and the bad

times with you. They will share what they have learned while learning to control

their investments and their financial destiny. The learning process is continual.

And, finally, here’s my real reason for this book. I am sick and tired of finan-

cial experts giving advice on real estate, especially when they do not actually

invest in real estate. After my book Rich Dad Poor Dad came out, I was on a tel-

evision program with a financial author and television personality. At the time,

in 1999, the stock market was red hot with the dot-com boom. This financial

expert, who was a former stockbroker and financial planner, was singing the

praises of stocks and mutual funds. After the stock market crashed in 2001, this

man suddenly resurfaced with a new book on real estate, portraying himself as

a real estate expert. His real estate advice was beyond bad. It was dangerous.

Then the real estate market crashed and he dropped out of sight again. The last

time I saw him, he had written a book on investing in solar energy and was

claiming to be a green entrepreneur. If he were to write a book about what he

really does, his new book would be about raising bulls... and selling BS.

There are other financial “experts” who know nothing about real estate, yet

they speak badly about real estate and say it is risky. The only reason real estate

is risky for them is because they know nothing about investing in it. Instead,

they recommend saving money and investing in a well-diversified portfolio of

mutual funds—investments which I believe are the riskiest investments in the

world, especially in this market. Why do they recommend investing in savings

and mutual funds? The answer is obvious: Many of these professionals are en-

dorsed by banks, mutual fund companies, and the media. It’s good business to

plug your sponsors’ businesses and products.

Commissioning this book gives the public its first chance to learn from real,

real estate investors, friends, and advisors—people who have been through the

ups and the downs and who walk their talk. This book gives them the opportu-

nity to share the spotlight with the many media financial “experts” and speak

the truth. These real estate experts are true pros, and you’re about to move be-

yond the media hype. I hope you are ready. The Real Book of Real Estate is the

real deal.

2 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 2

PART 1

The Business

of Real Estate

•

TOM WHEELWRIGHT

•

CHARLES LOTZAR

•

WAYNE PALMER

•

ROSS MCCALLISTER

•

CRAIG COPPOLA

•

GARRETT SUTTON

•

BERNIE BAYS

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 3

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 4

This page intentionally left blank

T

om Wheelwright is a rare combination of CPA, real estate investor, and

teacher. He has the ability to take the complex and often boring subject of

tax and tax law and make it into something that’s simple enough for a person like

me to understand.

Tom understands the tax code. He actually enjoys reading the tax code, and be-

cause he is such a student of it, he understands this lengthy document better than

anyone I know. Most CPAs focus on a very small part of the tax code. They focus

on the part that lets you and most Americans defer taxes until retirement—the

code relating to IRAs, 401(k)s, and other so-called retirement plans. Tom also pays

close attention to the other, much lengthier part of the code that shows you how to

reduce or eliminate your taxes permanently. The difference between Tom and

other CPAs is that Tom understands the purpose of the tax code. It’s not just a set

of rules. It’s a document that when followed is designed to reward certain behaviors

through lowering or eliminating taxes. Does your CPA see the tax code this way?

I consider Tom to be a very moral and ethical man. He is very religious, raised

in the Mormon faith. While I am not Mormon, I do share many of the values of

the Mormon religion—values such as tithing, giving at least 10 percent to spiritual

matters, and dedicating a number of years as a missionary. While I have never

1Tom WHEELWRIGHT

The Business of Real Estate

5

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 5

been a religious missionary, I have spent nearly ten years as a military missionary:

a Marine Corps pilot in Vietnam, serving my country.

One important lesson I have learned from Tom and others of the Mormon faith

is the saying, “God does not need to receive, but humans need to give.” This reminds

me of the importance of being generous. It is my opinion that greed rather than

generosity has taken over the world. Every time I meet someone who is short of

money, or if I am short of money, I am reminded to be generous and to give what I

would like to get. For example, if I want money, I need to give money. Having

been out of money a number of times in my life, I have had to remind myself to

give money at times when I needed money the most. Today I make a point of do-

nating regularly to charities and causes that are dear to my heart. My opinion is,

if I cannot personally work at a cause near to my heart, then my money needs to

work there for me. Going further, if I want kindness, then I need to give more

kindness. If I want a smile, then I need to first give a smile. And if I want a punch

in the mouth, then all I have to do is throw the first one.

I asked my friend Tom Wheelwright to be a part of this book not only because

he is a smart accountant—a team player that anyone who wants to be rich needs

to add to his his team—but also because he comes from a generous and sound

philosophical background.

Tom is a smart CPA who is an advocate of investing in real estate. Why? Be-

cause he knows that tax laws reward real estate investors more than they reward

stock investors. He is a great teacher, a generous man, and, most importantly, a

friend I respect.

—Robert Kiyosaki

I

was one of the fortunate few growing up. Unlike much of the rest of the

world—people who have been told to save their pennies and invest in mutual

funds—my parents taught me to invest in real estate and business. My father

had a printing business, and my mother handled their real estate portfolio.

So, it was natural that once I had received my education, both formal and

work related, I opened my own business. (I had a lot of education before I

finally opened my own business—a master’s degree in professional accounting,

thirteen years of experience with international accounting firms, as well as ex-

perience as the in-house tax advisor to a Fortune 1000 company. I was a little

slow to realize the power of business.) When I started my accounting firm, I

did it like most people: I worked all hours of the day and rarely took a vacation.

6 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 6

When I did take a vacation, I still took calls from clients and colleagues. After

all, business never rests, so why should I?

Several years into my business, we had experienced significant growth, but I

was still working day and night and never taking a real vacation. And outside of

my business, I had no substantial assets. That’s when I read Rich Dad Poor Dad

and first met Robert Kiyosaki. He helped me realize that I was thinking about

business all wrong. It was not about how hard I worked, but rather about how

smart I worked.

Like many of you, my first real experience with Robert was at a Rich Dad

seminar. There I was, sitting next to my business partner, Ann Mathis, and her

husband, Joe. Robert was talking about a subject near and dear to my heart—

the tax benefits of real estate. Out of the blue, Robert asked me to come up to

the front of the room to explain the tax benefits of depreciation, introducing

me as his “other accountant.”

I had come to learn about Robert Kiyosaki and Rich Dad only a few months

earlier. One of my good friends, George Duck, had become the chief financial

officer at Rich Dad and had introduced us. I’m not sure who was more nervous

that first time I went on stage, Robert or me. Can you imagine putting an ac-

countant on stage? Robert had no idea that I had spent my life teaching in one

capacity or another, but he took the chance and put me up there anyway. This

began a long and inspiring relationship between us, and it really launched my

journey toward financial freedom.

I remember one of the first times Robert and I worked together. He used me

as “muscle.” That’s right, he used his accountant as his muscle. Robert had been

asked by a reporter to give an interview for the business section of the Arizona

Republic. The primary topic was how Robert could claim that he routinely re-

ceived 40 percent returns on his investments.

I went as the authoritative backup to Robert’s ideas. After all, someone might

not believe a marketing genius (i.e., Robert) when he says he gets these levels

of returns, but who wouldn’t believe an accountant? When it comes to investing,

numbers are everything, and who better to support the numbers than someone

who spends his life documenting, reviewing, and analyzing them?

That was one of the first opportunities I had to explain the benefits of lever-

age that comes from real estate. Not long before, I had started my own real

estate investing. You would think that with parents who were real estate in-

vestors, that I, too, would become a real estate investor. I had even spent my ca-

reer helping real estate investors and developers reduce their tax burdens.

ROBERT KIYOSAKI 7

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 7

Not so. I didn’t actually begin investing in real estate until after the first time

I played Robert’s game, CASHFLOW 101®. This game had a powerful impact

on me. I saw, with my own eyes, the power of leverage in real estate. The game

was so powerful that the next day after playing the game, I called one of my

clients who had been investing in real estate for several years and asked him to

meet with me to show me how I could begin my own real estate investing.

And then I began making serious changes to my business. My partner, Ann, a

systems genius, created the systems, policies, and procedures in our firm so we

could focus on running the business and not working in the business. It took a

few years, but eventually we were able to step away from working for hourly

professional fees and instead supervise and grow a business that worked without

us.

Now, I can take three weeks off each year with no e-mail or phone access, as

I did just recently when I took my oldest son on a trip to the châteaux region of

northern France. I didn’t have to worry about my accounting firm or my real

estate investments while I was gone because they were both running without

my daily attention.

Real estate investing is a business and should be run like a business.

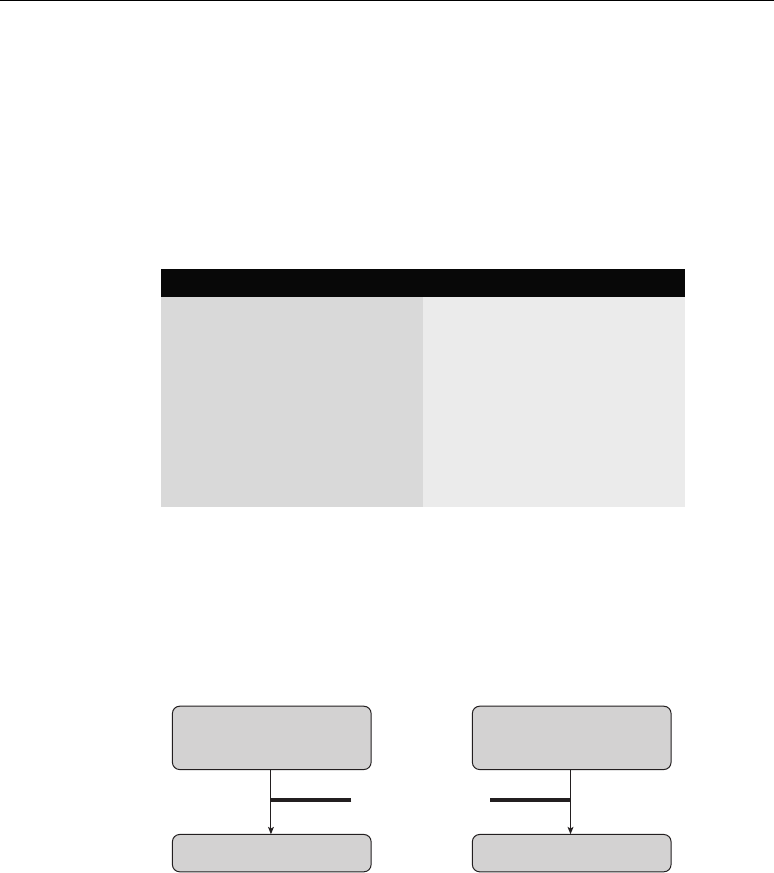

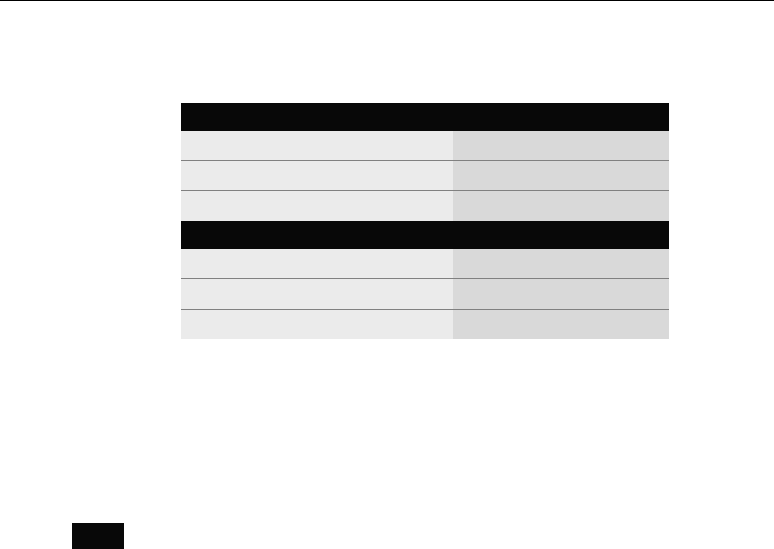

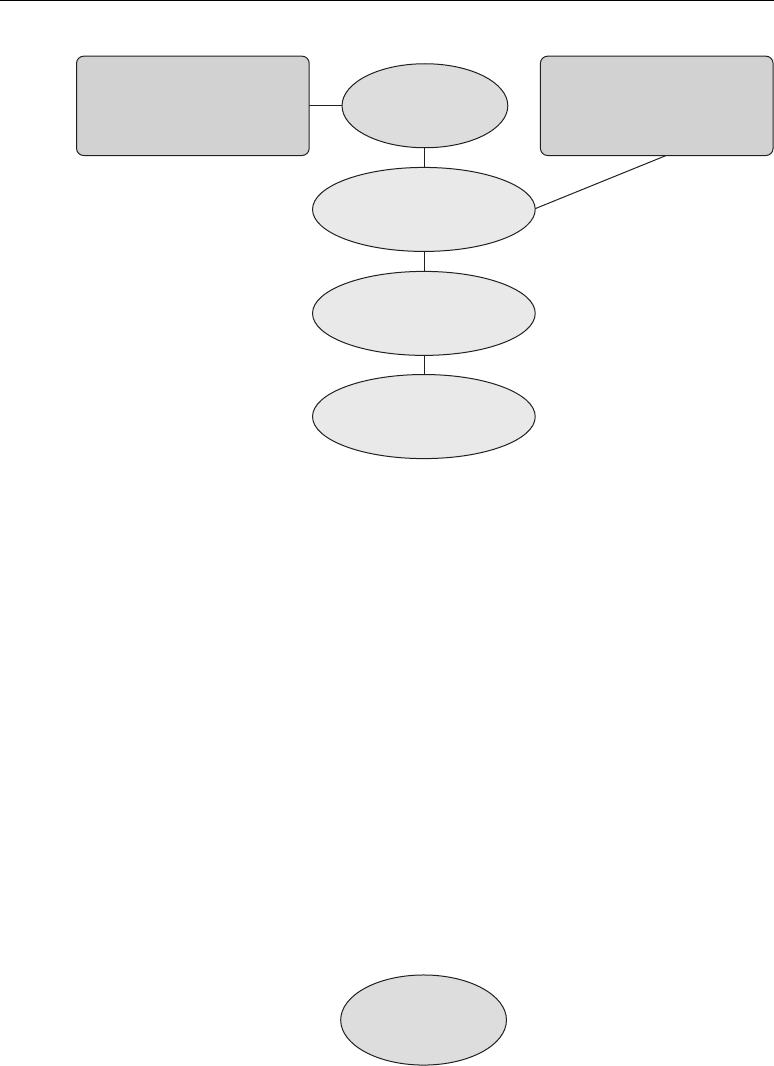

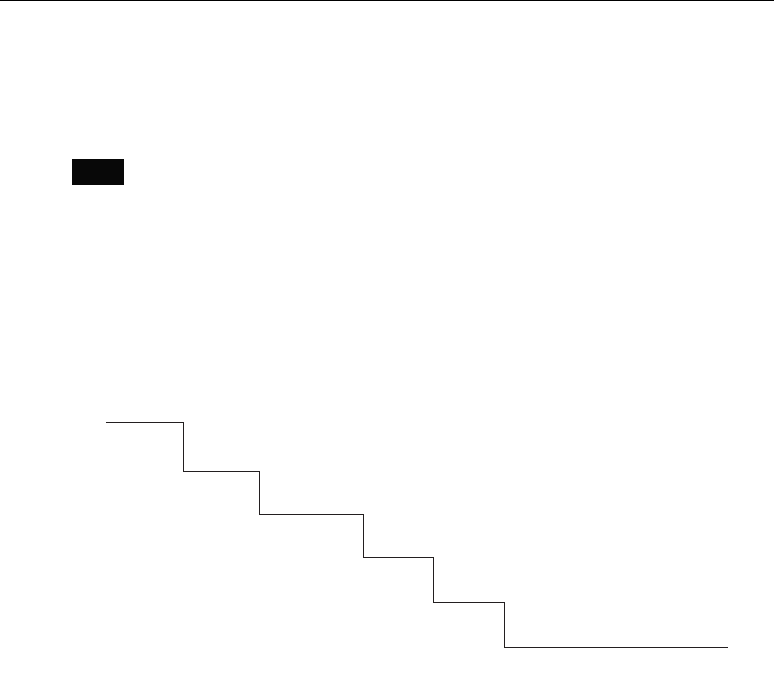

Robert talks a lot about the CASHFLOW Quadrant, with each labeled as E,

S, B, and I. He emphasizes that we need to move out of the E (employee) and S

(self employed) quadrants and into the B (business) and I (investor) quadrants.

I have learned to take this one step further. That is, to move all I-quadrant in-

vesting into the B quadrant.

Think about what you could do with the time you would have if you didn’t

have to worry about tenants, repairs, and cash flow. How would it feel to elimi-

nate the frustration that comes from constantly watching your real estate in-

vestments and worrying about if a tenant might call you in the middle of the

night with a problem? You can eliminate all of this stress and free up hundreds

of hours of your time simply by running your real estate investments as a B-

quadrant business.

TIP

8 THE REAL BOOK OF REAL ESTATE

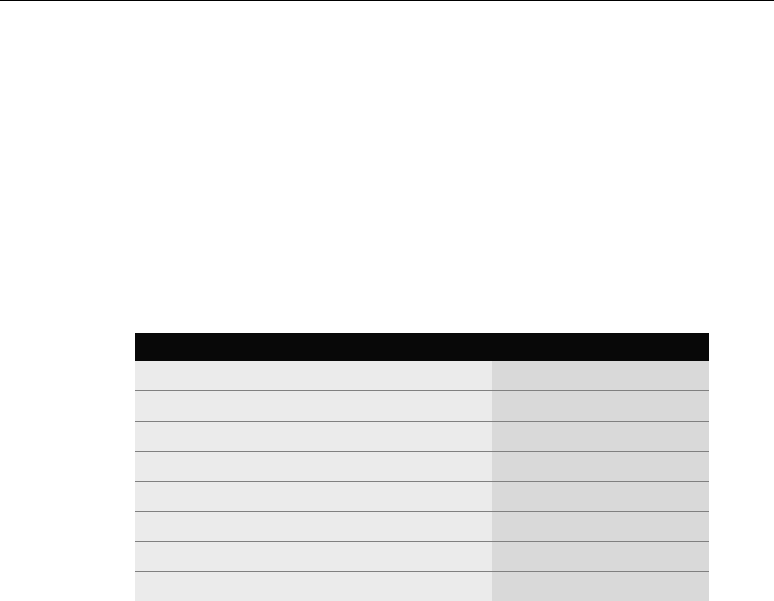

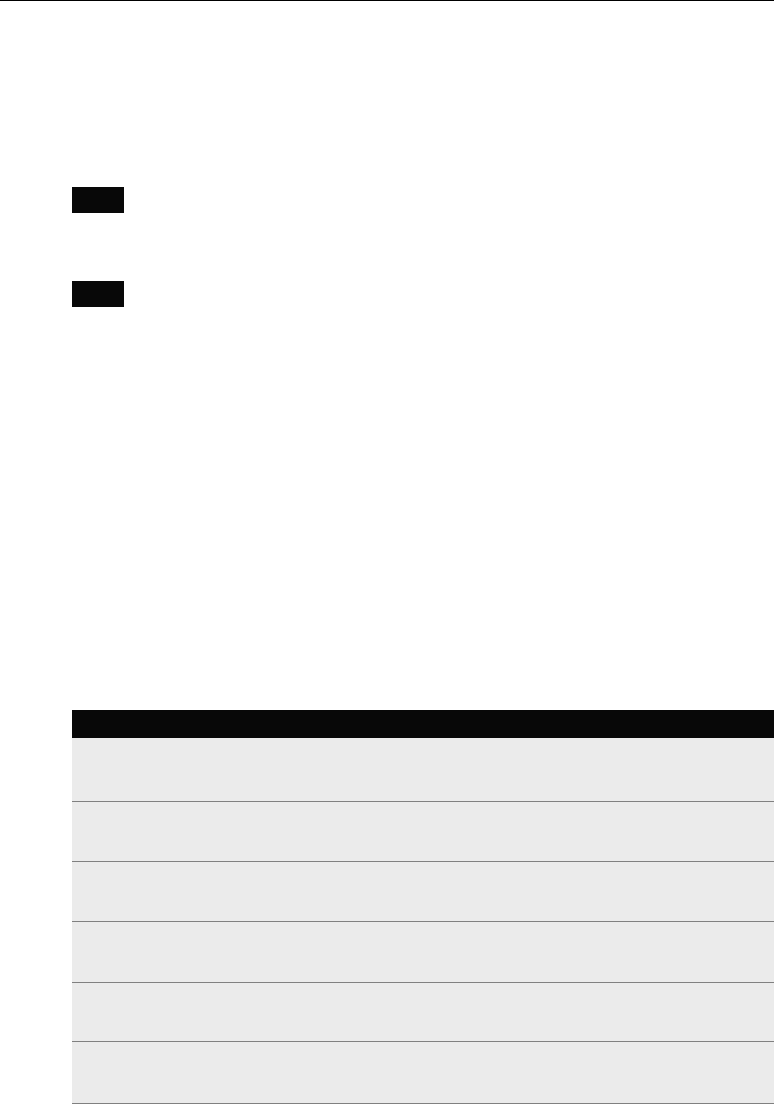

FIGURE 1.1 I’ve learned to take the quadrant a step further and

free up hundreds of hours of my time simply by running my real

estate investments like a B-quadrant business.

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 8

It’s really not that difficult. You simply have to start acting like a business

and apply fundamental business principles to your real estate investing.

Business Principle No. 1: Strategy

Every business has to have a plan. Your real estate investing business is no dif-

ferent. A strategy is simply a systematic plan of action designed to accomplish

specific goals. There are seven simple steps to creating a successful strategy.

Step 1: Imagine

Begin your strategy with goals. Imagine where you would like your real estate

investing to take you. It may be a white sand beach in the Caribbean, unlimited

time with your family, or working for your favorite charity. My favorite places

in the world are Hawai’i, France, Arizona, and Park City, Utah. So my dream is

to own a house in each of these locations.

Don’t be afraid of being too aggressive. These are your dreams, after all, not

some number that is artificially imposed by a financial advisor. Our clients fre-

quently have dreams of financial freedom in as few as five to ten years. And

with a good strategy in place, anyone can be financially free in less than ten

years if they just start by applying these few basic business principles to their

real estate investing. So far, after six years of investing, I now have houses in

Hawai’i, Arizona, and Park City. France is on the agenda for next year. Pretty

aggressive goals, but I have been able to reach them in six short years by apply-

ing basic business principles to my real estate and business.

Step 2: Financial Goals

Determine what it will take to realize these dreams in terms of wealth and cash

flow. And commit to a date for accomplishing this goal. Then write down what

you currently have available in terms of investable assets less the liabilities.

This is your current wealth (also called net worth).

Step 3: Cash Flow Target

Of course, you will need to figure out the amount of wealth that it will take in

order to create your desired cash flow. A simple rule of thumb for calculating

this number is to multiply your desired cash flow by twenty. For me, I needed

$5 million in order to create an after-tax cash flow of $250,000 each year.

ROBERT KIYOSAKI 9

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 9

Step 4: Current Wealth

Once you have your dream firmly in mind, the next step is to identify where

you are today. When considering where you are today, list only your real assets,

that is, those that are available to invest. Don’t list your car or your jewelry. But

do list the amount of equity in your home if it can be made available for investing

through a home equity loan. Here is an example of what I mean:

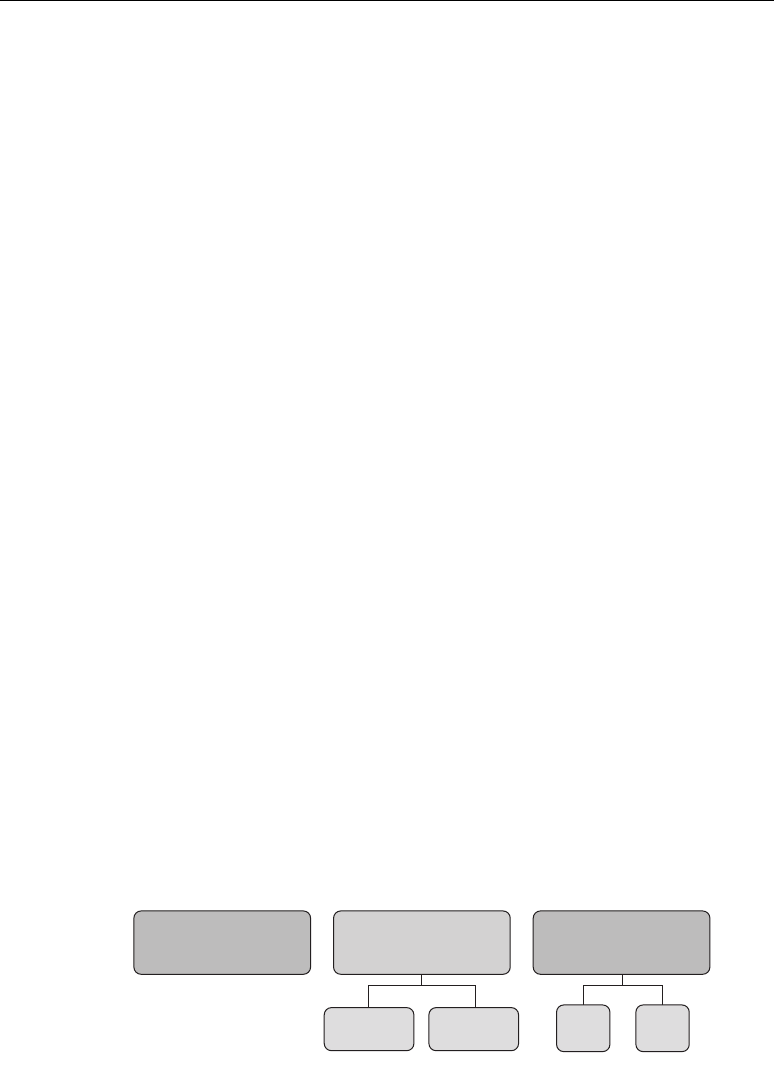

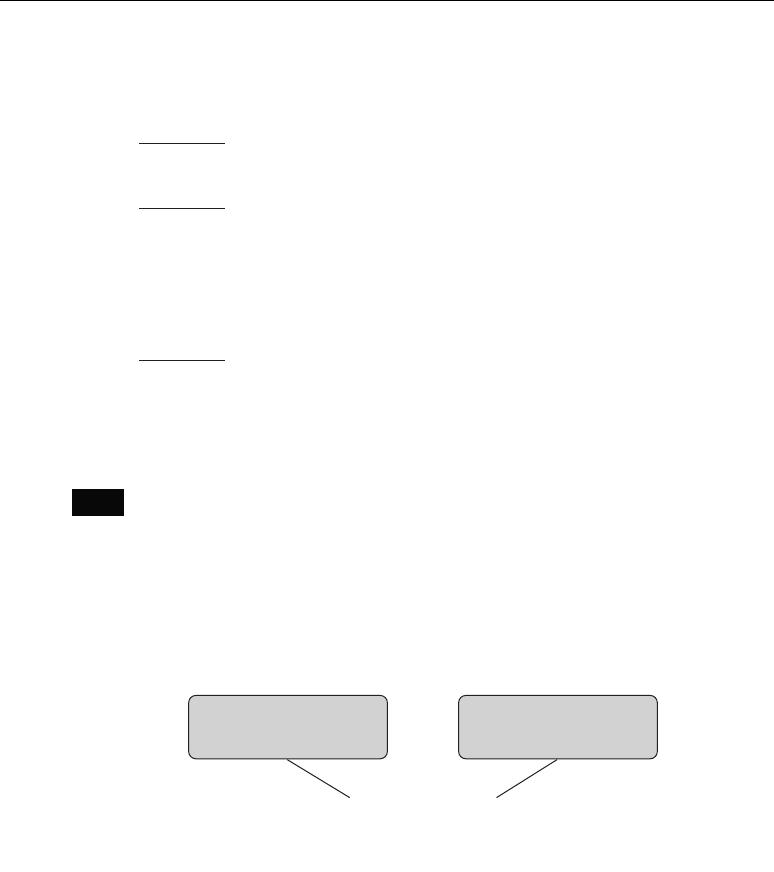

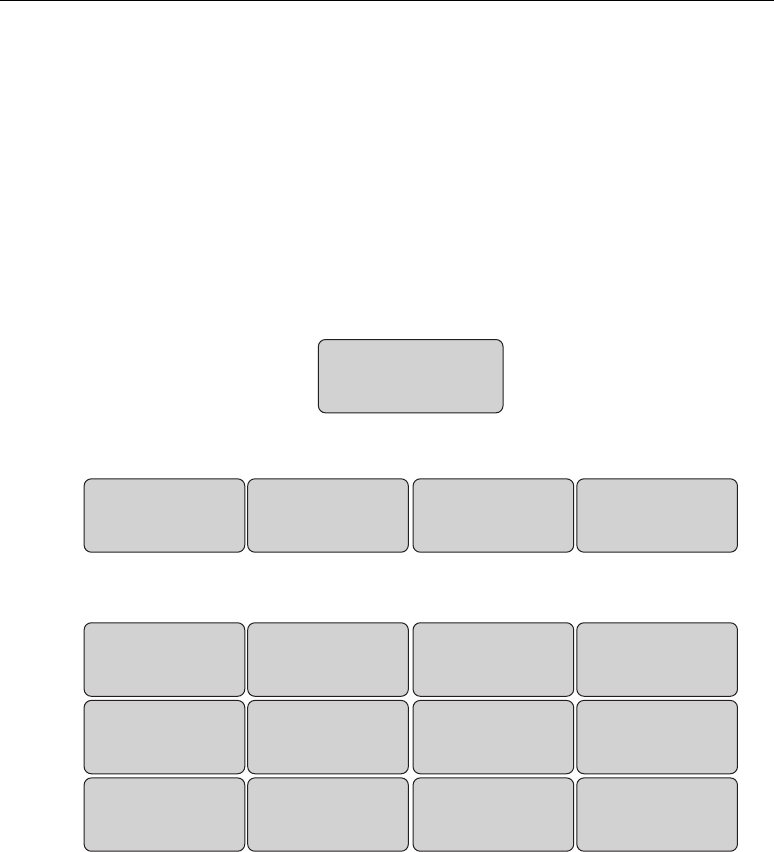

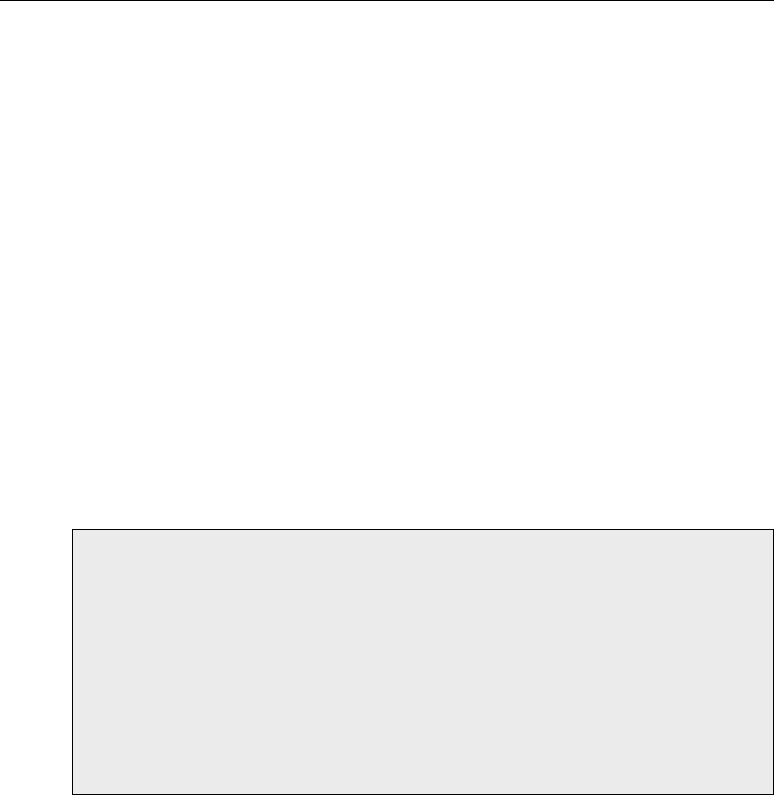

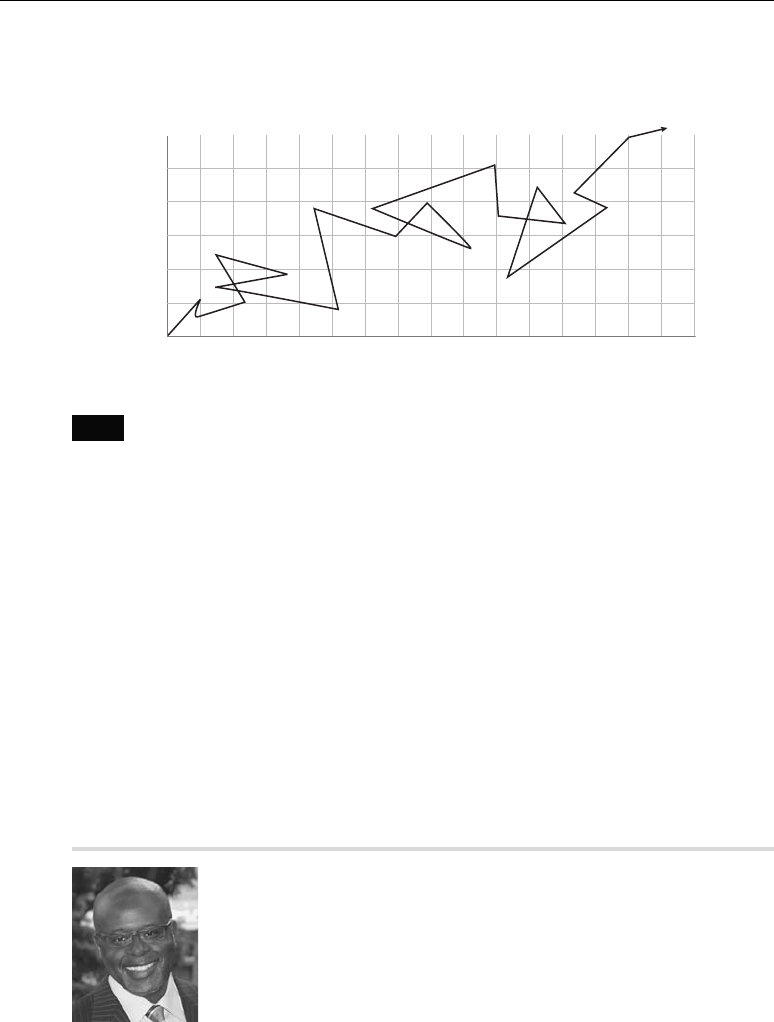

These first four steps are the essence of a process referred to as “dreamlin-

ing,” and I will use a simple illustration to show you what I mean. Here is what

my dreamline looked like when I first met Robert and started down my road to

financial freedom.

Step 5: Vision, Mission, and Values

After you have your dreamline in place, you can make a plan to reach those

dreams. This plan should include your vision, mission and values, the type of

real estate you will specialize in buying, and the criteria you use for choosing

your real estate investments.

10 THE REAL BOOK OF REAL ESTATE

July 1, this year July 1, 5 years

1 million investable

Net Worth

$250,000 Cash Flow

$5,000,000 Net Worth

Wealth Strategy

TABLE 1.1

Liquid: Long-Term:

Savings Loans

Stocks & Bonds Real Estate

Mutual Funds Oil & Gas

CDs Business

Other Intellectual

Other Other

Sub-Total: Sub-Total:

FIGURE 1.2 Tom’s “Dreamline” When He First Met Robert Kiyosaki

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 10

At this point, you may be wondering if I have truly lost my mind. After all,

aren’t vision, mission, and value statements only for true businesses? Exactly!

And your real estate investments are a true business. At least they should be if

you are going to reach your dreams in the shortest amount of time possible and

with the least amount of work.

When creating your vision, remember that this represents your focus for the

future, that is, what you want your life to look like when everything is in place.

Your mission is simply a statement of how you are going to go about your in-

vesting business. And your values are the values that you insist everyone you

work with in real estate share with you.

Tom’s Personal

Vision, Mission, and Values

Vision. My vision for financial freedom means having the time and resources to do

what I want, when I want. I know I have reached financial freedom when I can travel

anytime I desire, spend quality time with family and friends, and go on missions for

my church.

Mission. My mission to reach financial freedom is to invest in highly appreciating sin-

gle-family homes by researching foreclosures, borrowing from banks and sellers, hold-

ing properties for five to ten years, and obtaining tax leverage through depreciation.

Values. My values are these: abundance—recognizing that there are plenty of re-

sources and real estate deals to go around; caring—being kind and expressing grat-

itude; learning—taking the time to grow and improve my real estate knowledge;

and respect—treating others the way I want to be treated.

Step 6: Investment Niche

Once you have your vision, mission, and values in place, you can begin looking

at what type of real estate makes sense for you. Every successful business owner

knows that you are always most successful when you focus your attention on

something you enjoy doing and for which you have a natural ability. At my com-

pany, ProVision, we have a variety of tools we use to help people figure out

which type of real estate they will enjoy the most—multifamily, commercial,

industrial, raw land or single-family homes. My personal investment niche re-

mains highly appreciating single-family homes.

ROBERT KIYOSAKI 11

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 11

Step 7: Criteria

The final step in your strategy—determining your investment criteria—is some-

thing that few people take time to do. And yet, if you can determine your in-

vestment criteria as part of your strategy, you can avoid a lot of headaches,

stress, and wasted time. You can also avoid making costly mistakes. And you

will save a considerable amount of time and energy, enabling you to focus on

only those investments that meet your criteria. As an example, here are my per-

sonal investment criteria:

You may be asking why you need to spend so much time and effort developing

a strategy. We teach our ProVision clients about the importance of strategy by

playing CASHFLOW 101® with them in a very specific way. If you have played

the game, you realize that, on average, it will take two and a half hours. We in-

struct our clients that their team (the players at their table) must spend the

first thirty minutes developing a strategy to win the game. This strategy includes

the type of assets they will invest in and their criteria for investing. All members

of their team, though playing as individuals, must follow the strategy precisely.

The result is astonishing. Each player gets out of the Rat Race and wins the

game in less than two hours. So even though they have spent an enormous per-

centage of their allotted time developing their strategy (roughly 20 percent),

they finish substantially earlier than they would have without their strategy.

This happens every time, so long as each team member adheres to the strategy.

Business Principle No. 2: Team

Just as every good business has a strategy, every successful business owner has

a very carefully chosen team of individuals and companies to help him/her

12 THE REAL BOOK OF REAL ESTATE

TABLE 1.2 Tom’s Personal Investment Criteria

Criteria Decision

Minimum appreciation 10%

Minimum rate of return 50%

Cash flow or cash on cash return -0-

Price range $200,000-$600,000

Maximum amount of investment/deal $80,000

Maximum time commitment 5 hours per month

Location of investment Western U.S.

Price as a % of value 85%

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 12

succeed. Your team will add considerable leverage to your investing. You can

take advantage of your team members’ time, talents, contacts, knowledge, and

resources.

Tips for Building a Team

Plan. Think carefully about what skills you need on your team. For example,

you are going to need an attorney, an accountant, a banker, at least one property

manager, and others. Decide on the skill sets you need before you decide on

which people will fill those roles.

Referrals. The best team members almost always come as a referral from some-

one you trust. But make sure the person referring is also a real estate investor

and is knowledgeable about your situation and needs. A trusted advisor, such

as an attorney, accountant, mentor or wealth coach, can be a good source of

referrals.

Agreements. Make sure you have good, clear agreements in place with each of

your team members so they know what is expected of them and what they can

expect from you.

Before we leave the concept of a team, let me give you my personal experi-

ence with developing a real estate team. Anyone who knows me realizes that I

spend most of my day growing my business. This doesn’t leave me much time

for real estate investing. But I love real estate investing and understand com-

pletely the importance of it in my wealth strategy.

I estimate the time I spend each week on real estate to be no more than one

hour. Yet, I make in excess of $100,000 per month through my real estate in-

vesting, all because I have developed a great team and applied the other business

principles we are talking about in this chapter. This brings me to our next prin-

ciple: accounting.

Business Principle No. 3: Accounting

You may wonder if I include accounting as a basic principle of business because

of my accounting background. While I have to admit to a natural bias in favor

of good accounting, I believe that if you were to ask one hundred successful

business owners if good accounting (including good reporting) were critical to

their business, at least ninety-five of them would agree.

Why? Because good accounting leads to good reporting, and good reporting

leads to good decisions. If you don’t have the information you need, how are

you going to make good decisions, such as when you should sell a piece of real

estate or how to know if your portfolio is producing the desired results?

ROBERT KIYOSAKI 13

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 13

Great entrepreneurs understand the purpose of accounting. Here are a few

of my personal keys to great accounting.

Key No. 1: Purposeful Accounting

Accounting should never be done solely (or even mainly) to satisfy the IRS or

other regulators. Accounting’s primary purpose should be to provide accurate

and useful information so that you can make the best decisions. Poor investors

think that the only reason to keep records is so their accountant can prepare

their tax return at the end of the year.

This is a huge mistake. Good accounting is critical to good decision making.

Without current, accurate numbers, how are you going to make the decision to

buy, sell, or refinance your property? And how will you know which property is

doing well and which is doing poorly? You won’t even know if your property

manager is doing a good job or not.

Several years ago, Ann and I purchased a group of fourplexes in Mesa, Ari-

zona. The price was good based on the information we had at the time. We kept

14 THE REAL BOOK OF REAL ESTATE

Real Life Story: My Team Took Care of It All

S

o how do I make time for real estate? You guessed it—I have a terrific team.

They are so good, in fact, that the only time I have to spend is to quickly review

reports, make decisions (which are pretty easy, since I have very well-defined in-

vestment criteria), and sign documents. I remember one time recently when I was

speaking to my team leader and he informed me that a tenant had vacated a house

unexpectedly and not turned off the water. My team leader, who is not the property

manager, drops by all of my houses on a regular basis and noticed that the tenant

had left. He rushed into the house only to discover that the pipes had broken (this

was in Utah in the dead of winter), and the house was flooded. The cost of repair

was in the neighborhood of $50,000.

My team leader immediately took action. After turning the water off, he called

the property manager and the insurance agent. He arranged for the repair company

to renovate the property, made sure the insurance accepted the claim (before

spending any money), and went after the property manager and tenant for any

damages not paid for by the insurance company. I did not have to worry about a

thing. And I probably spent only thirty minutes total dealing with this mess (signing

authorizations and talking to my team leader).

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 14

ROBERT KIYOSAKI 15

very close track of the cash flow and the income from these properties. But

after a year or so, it became clear to us that these properties were not going to

generate positive cash flow in the near future. At the same time, we noticed

that cap rates (see Principle No. 4, p. 17) were going down. So, based on our

numbers, we sold the fourplexes. Because of the decrease in cap rates, we were

able to make a significant profit, and we stopped losing money each month.

Key No. 2: Accurate Bookkeeping

While good accounting should go far beyond mere bookkeeping, it begins with

accurate and appropriate bookkeeping entries. Accurate bookkeeping is the ba-

sis for creating useful reports and analysis.

Bookkeeping is merely the process of entering the results of transactions

into a record that can be used for reporting and analysis. I suggest to most of

my clients that they outsource their bookkeeping to their accountant or some

other professional bookkeeping service. For those who want to do it themselves,

I recommend using a very simple accounting software program, such as Quick-

books.

Key No. 2a: Chart of Accounts

Begin by setting up a chart of accounts (this is just a list of the accounts you are

going to use to classify your receipts and expenditures). The accounts you use

should be those that make the most sense to you. For example, one person may

list printer paper as an office supply while another may list it in the more general

category of office expense. It’s simply a matter of how detailed you want your

reporting to be. Just remember that if you did not create an account for it, you

cannot create a report for it.

Here’s a little trick for you: You don’t have to create a separate chart

of accounts for every property. Instead, you can create a “class” for each

property. This allows you to do all of the bookkeeping for your real estate

business in one Quickbooks “company” while creating the detail and report

options that you need in order to understand what is happening with each

property.

If you need help setting up your chart of accounts, ask your accountant/

CPA—a critical member of your team—to lend you a hand. This person should

be happy to help, and can do this fairly quickly for you.

TIP

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 15

Key No. 2b: Detailed Data Entry

Once you have your chart of accounts set up, you are ready to begin entering

your data. Remember that you need to enter the details of every transaction.

Most transactions will have some cash involved, so if you enter the details every

time you receive or spend money, you probably will catch 98 percent of your

transactions. Some transactions don’t have cash involved, such as recording de-

preciation expense. These are done through journal entries. Since you will likely

have some journal entries to do, I will give you a brief explanation of how to do

these.

Understand that every transaction has two sides to it for accounting pur-

poses; a debit side and a credit side (think left and right so the total of the left

side always equals the total of the right side). Expenditures are always a debit

to the expense, income, or asset account (left side), and a credit to cash (right

side). Receipts are always a credit to an income, expense, or liability account

(left side), and a debit to cash (right side). To increase an expense or an asset,

you debit that account, and to increase income or a liability, you credit that

account.

Key No. 2c: Journal Entries

When you enter a receipt or an expenditure into Quickbooks, the software au-

tomatically creates both the debit and the credit. But sometimes you will need

to make a correction or adjustment to your books when there has not been a

cash transaction. You do this with a journal entry. When you make a journal

entry, you simply enter both a credit and a debit. Let’s use our depreciation

journal entry as an example, since everyone has to make this journal entry at

least once a year:

Debit to Depreciation Expense in the amount of depreciation calculated for

the period (usually based on tables provided by the Internal Revenue Service or

your accountant). See page 26 for more details about the Magic of Depreciation.

Credit to Accumulated Depreciation in the same amount (this account is an

offset to the asset account for the asset you are depreciating, such as a building).

See? It’s simple.

Key No. 3: Consistency

Learn to use the correct accounts, and use the same accounts for all similar re-

ceipts and expenditures. If you decide to put paper costs into office supplies,

always put purchases of paper into office supplies. Don’t put them into the

office supply account one month and the office expense account the next month.

16 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 16

Key No. 4: Frequency

Do your bookkeeping no less than once a week. Two problems happen when

you get behind. First, it becomes overwhelming, and you will tend to continue

putting it off until the end of the year when it becomes urgent for your tax re-

turns. This creates the second problem: Not having up-to-date bookkeeping

means you cannot get good reports to make good decisions.

Key No. 5: Online Banking

Personally, I do my bookkeeping every Friday morning. It takes me less than

one hour because I use the systems that are available to me, such as online

banking and automatic bill pay. Quickbooks will automatically classify all of my

online banking to the right accounts with a few clicks of the mouse. I actually

find it quicker to do the bookkeeping myself using these systems than if I were

to use an outside bookkeeper (I tried that once and found it took me more time

to correct the bookkeeping than if I just did it myself using online banking).

The next principle I’m going to share with you is how to get good reports

from your bookkeeping software. If you review these reports each month, you

will be able to make good decisions about your real estate business quickly and

effectively.

Business Principle No. 4: Reporting

All successful entrepreneurs understand the importance of managing their busi-

ness by metrics. Metrics is simply a measurement of the day-to-day results of the

business. Sometimes these measurements are raw numbers, such as cash flow.

Other times they take the form of ratios. And still other times these measurements

are comparisons, either to a previous period, to targets, or industry averages.

If you don’t know your numbers, you don’t know your business.

Report No. 1: Statement of Cash Flows

Let’s start with the king of all raw numbers: cash flow. Unfortunately, it’s rare

that a real estate investor has a clear picture of his/her true cash flow. You should

know the cash flow from each property as well as the overall cash flow for your

real estate business.

There is a tendency among real estate investors to believe that all they need to

know about cash flow is the difference in their bank account from the beginning

of the month to the end of the month. But the real key to using cash flow as a tool

TIP

ROBERT KIYOSAKI 17

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 17

is to understand where the cash came from and where it went. A standard ac-

counting report that you can use to figure this out is the Statement of Cash Flows.

This report, though rarely used among real estate investors, is the most important

report of all.

It begins with operating income. Operating income includes rents minus nor-

mal cash expenses, including repairs, maintenance, and management fees. It

then details nonoperating items such as financing transactions and investing

transactions. Financing transactions include any money that flows to or from

your business because of loans. These include your mortgage payments as well

as any loans you take out or money you put it. Investing transactions include any

money that flows to or from your business because of investing activities. These

include down payments on properties and cash from the sale of a property.

The end result is the increase or decrease in the amount of cash you have at

the end of the period (month, quarter, or year) compared to what you had at

the beginning of the period. This report makes it clear how much of your posi-

tive or negative cash flow is coming from operations versus other activities,

such as financing or investing. Wouldn’t it be great to know this and be able to

18 THE REAL BOOK OF REAL ESTATE

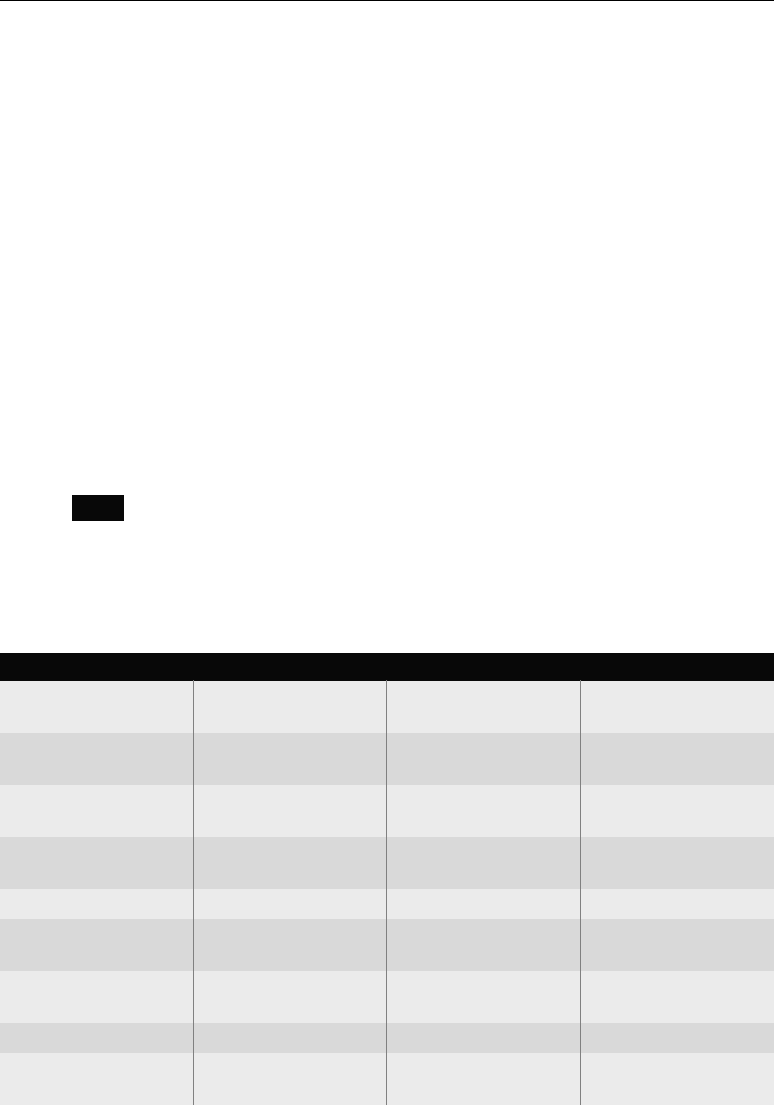

TABLE 1.3 Tom’s Statement of Cash Flow

Property A Oct - Dec

OPERATING ACTIVITIES

Net Income -6,706.40

Adjustments to reconcile Net Income

to net cash provided by operations:

Escrow Accounts -174.40

Security Deposits 800.00

Net cash provided by Operating Activities -6,080.80

INVESTING ACTIVITIES

Accumulated depreciation 6,790.00

Accumulated amortization 18.00

Net cash provided by Investing Activities 6,808.00

FINANCING ACTIVITIES

Mortgage Payable -258.34

Net cash provided by Financing Activities -258.34

Net cash increase for period 468.86

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 18

ROBERT KIYOSAKI 19

TABLE 1.4 Most Common Ratios Used to Analyze Property Results

Ratio Numerator Denominator Tells You

Cap rate

Net Operating

Income

Property

Value

How much the

property is earning

ROI

Annual increase in value

plus income

Cash invested Total return

Cash on Cash

return

Net cash from

investment after taxes

Cash invested Cash return

Current ratio Current assets

Current

liabilities

Ability to pay

liabilities

Debt/equity ratio Total de b t Net Equity Leverage

Return on

assets

Net operating

income

Total assets Profitability

Debt coverage

Net operating

income

Annual debt

service

Ability to service debt

from cash flow

Loan to value (LTV) Debt Value of Property Leverage

Internal Rate

of Return (IRR)

Complex formula

Average annual

return on investment

find out this information at any time? Table 1.3 is an example of a statement of

cash flows for one of my properties. I pulled this report directly from my Quick-

books.

This report tells me several things about this property. First, it tells me there

was positive cash flow. Second, it tells me that there was a loss for tax purposes

(net income was negative), producing additional cash flow for me through de-

preciation. Third, it tells me that I paid down my mortgage by $258, which is

an additional benefit to me. If all I knew was that my cash had increased by

$468 for the period, I would never have learned these other important benefits

from this property and may have thought the property wasn’t doing too well.

Report No. 2: Ratio Analysis

While raw numbers are helpful to know, serious analysis of your real estate

business comes from ratios and comparisons. A list of the most common ratios

used to analyze your results is found in Table 1.4.

Two of the most important ratios are the cap rate on your properties

and your return on investment (ROI).

TIP

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 19

Ratio No. 1: Cap Rate

Your cap rate (or capitalization rate) is simply your net operating income di-

vided by the value of your property. Remember that this figure represents the

value of the property, not the cost of the property. Let’s look at an example.

Suppose your property produces $10,000 per month in rent, or $120,000 for

the year. And suppose your operating expenses (remember, this doesn’t include

mortgage interest or principal payments, or depreciation) are $70,000. This

means that your net operating income (NOI) is $50,000. If your property is

worth $500,000, then your cap rate is 10 percent.

You can use this information to make decisions. Let’s suppose

that you have a loan on the property with a 7 percent interest rate. If your

cap rate goes below 7 percent, then you need to think about selling the

property. Why? Because now you have what is called “negative leverage.”

Negative leverage occurs when your return is less than you are paying

on your loan. At this point, it is actually costing you money to borrow

because the cap rate is lower than your borrowing rate.

When Ann and I sold our fourplexes in Mesa, the cap rate had dipped down

around 5 percent. The interest rate on our mortgage was 6.5 percent. So we

were now into negative leverage. On top of that, we had negative cash flow. So

it was time to sell the properties. And we did so at a substantial profit because

we watched the cap rate. When we purchased the properties, the cap rate was

around 10 percent. Though our net operating income never increased, our prop-

erty value doubled simply because of the cap rate decreasing from 10 percent

to 5 percent.

Ratio No. 2: ROI

Another ratio we review is Return on Investment, or ROI. This ratio tells us

how a property is doing overall. It’s critical to review this ratio on a regular

basis. I know several investors who calculate expected ROI when buying a prop-

erty but never again. Like the cap rate, your ROI can tell you if you should be

holding on to the property or if you need to do something different with the

property.

For example, one of my criteria for investing is an after-tax return of at least

30 percent. This includes cash flow from the property and the appreciation on

the property plus my tax benefits from the property and principal reduction

TIP

20 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 20

on my mortgage. A few years ago, I bought a property in Utah that looked like

it would have an ROI of 35 percent over a five-year period. But it turned out

that the property was very difficult to rent, so the ROI was less than expected.

Once it was clear the ROI was going to fall below my 30 percent requirement, I

sold the property and found another property that better fit my investment cri-

teria. It should be obvious to you by now that a lot depends on coming up with

the appropriate investment criteria. Many of your decisions will be based on

these.

Working through your numbers and applying them to your criteria is where

another member of your team—your wealth coach—will be critical. Everyone

should have a coach for his/her business. Your coach should be someone well

versed in real estate and in overall wealth strategies. Go to www.ProVision

Wealth.com/wealthstrategies.asp for more information on wealth coaching.

Report No. 3: Comparison Reports

The third type of reporting is comparison reporting. Comparison reports take

the actual data from your real estate business and compare it to some other

data, such as industry standards, past performance, or expected/budgeted per-

formance. Let’s suppose that when you bought your property, you expected

that it would appreciate 10 percent per year. Suppose the actual appreciation is

15 percent.

Your appreciation report should show you not only your current apprecia-

tion, but also your expected appreciation and perhaps the average appreciation

in the market. This gives you a good idea of how you are doing compared to the

market and to your own expectations and whether you might want to consider

buying more property in that market or selling what you have so you can buy

other property that better meets your criteria.

Can you see how important it is to have good reports? It’s not just the raw

data you want; it’s also the ratios and the comparisons. One of my biggest com-

plaints about many property managers is that they produce terrible reports. Typ-

ically, they give you only the raw data, and frequently even that is impossible to

understand. Let me show you the type of report my property manager gives me.

While it doesn’t give me any analysis, at least it gives me the data in a way I

can create my own analysis. I can see immediately that I have positive cash

flow, which meets my criteria. I now need to take this information and put it

into my reporting system (Quickbooks or something similar), and from that

system I can create reports that give me cap rates, ROI, and other analyses.

ROBERT KIYOSAKI 21

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 21

Business Principle No. 5: Taxes

If you want to make an immediate impact on the return on your real estate, you

need to pay close attention to tax laws.

The fastest way to increase your ROI on a property is to take advantage

of the tax laws in place to encourage real estate investment.

The single biggest expense for most people is taxes. In the United States,

which is routinely considered to be a low-tax country, the average business

owner earning $100,000 pays more than 50 percent of his earnings to the gov-

ernment in some form of taxes. These include income taxes, property taxes,

transfer taxes, sales taxes, employment taxes, and excise taxes, not to mention

estate taxes.

Some ancient civilizations equated a 50 percent tax to being in bondage. Yet

here we are in the twenty-first century paying more than 50 percent of our in-

come in taxes and accepting this as okay. The good news is that if you are in

business, and particularly if that business is real estate investment, you can eas-

ily lower this rate from 50 percent to 20 or 30 percent. In fact, many of our

clients at ProVision who are serious real estate investors legally pay no income

tax at all.

Think about what you could do with the extra money you would have if you

reduced your income taxes by even 20 or 30 percent. How much more real es-

tate could you buy? How much faster would your portfolio grow? I once calcu-

lated that someone in the 30 percent tax bracket could double his investment

portfolio over seven years if he simply maximized his tax benefits from real es-

tate and reinvested these savings into his portfolio.

TIP

22 THE REAL BOOK OF REAL ESTATE

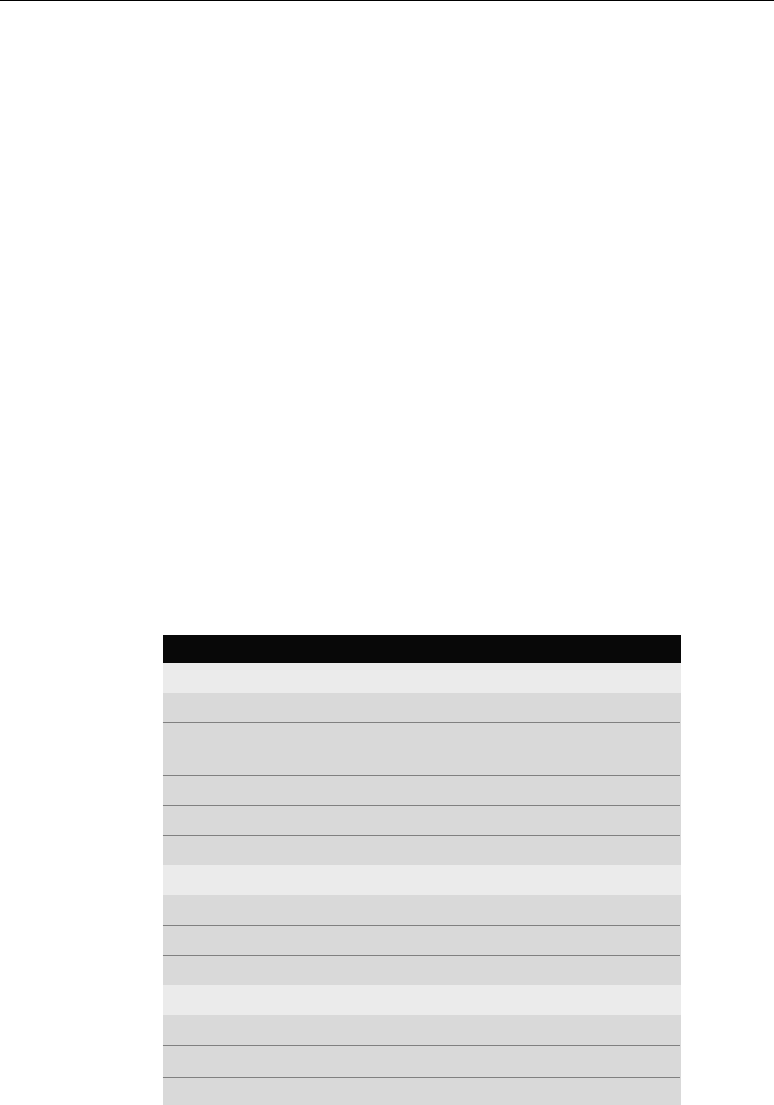

TABLE 1.5 Real Life Example of

a Good Property Report

Property Address Lease Rate: $1200/mo

Rent Collected: $1200.00

Less 8% Management Fee: $96.00

Expenses-HOA Fee: $105.00

Amount to Owner $999.00

Mortgage Payment: $987.90

March 2009 Cashflow: $11.10 +

April 2009 Projection: $999.00

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 22

When I tell people that they can legally reduce their income tax by 30 percent

or more, they are immediately skeptical. They think I must be getting my clients

into some tax shelter. They are correct. That tax shelter is real estate investing.

And it doesn’t matter whether it is residential, commercial, or industrial prop-

erty. In the United States and many other countries, real estate is a highly fa-

vored investment under the tax laws.

In the United States and many other countries, real estate is a highly

favored investment under the tax laws.

So let’s talk about what you can do to receive the maximum tax benefit from

your real estate. We will focus on the laws of the United States, but keep in

mind that many other countries have similar laws. So even if you don’t invest in

the United States, these tax reduction principles may apply to your real estate

investments in Canada, Europe, or other areas of the world. Here are five ways

to reduce your income tax by 30 percent or more.

Tip No. 1: Tax Strategy

What? A tax strategy? Didn’t we just talk about creating a business strategy for

our real estate earlier in this chapter? And now we are going to create a tax

strategy? That’s right. A tax strategy: a systematic plan of action for permanently

reducing or eliminating income taxes.

A good tax strategy is like a good business strategy in many ways. You have

to look at the big picture, including not only your real estate but also any other

businesses and investments you own. And you have to look at it from a long-

term perspective. My personal tax strategy includes aspects relating to my two

sons. One of my sons, Sam, works in both of my businesses and wants to be in-

volved for many years to come. My other son, Max, has no interest in business

and wants to write children’s books. So my tax strategy keeps my sons’ interests

in mind. They both own parts of my business, but I have to structure their own-

ership differently, since one is actively involved and the other is not.

Many of our clients work together as a couple on their business. My wife, on

the other hand, has no interest in business per se and is interested in helping

me only with the speaking part of my business (she is a wonderful speaker and

entertainer). So my tax strategy cannot, for example, include my wife as a real

estate professional.

A good tax strategist could really help here. So, another team member

for you is a tax advisor who specializes in tax strategies.

TIP

TIP

ROBERT KIYOSAKI 23

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 23

Your tax strategy needs to be a plan that you can readily accomplish without

making life too complicated. Of course, a good tax strategist could really help

here. So, another team member for you is a tax advisor who specializes in tax

strategies.

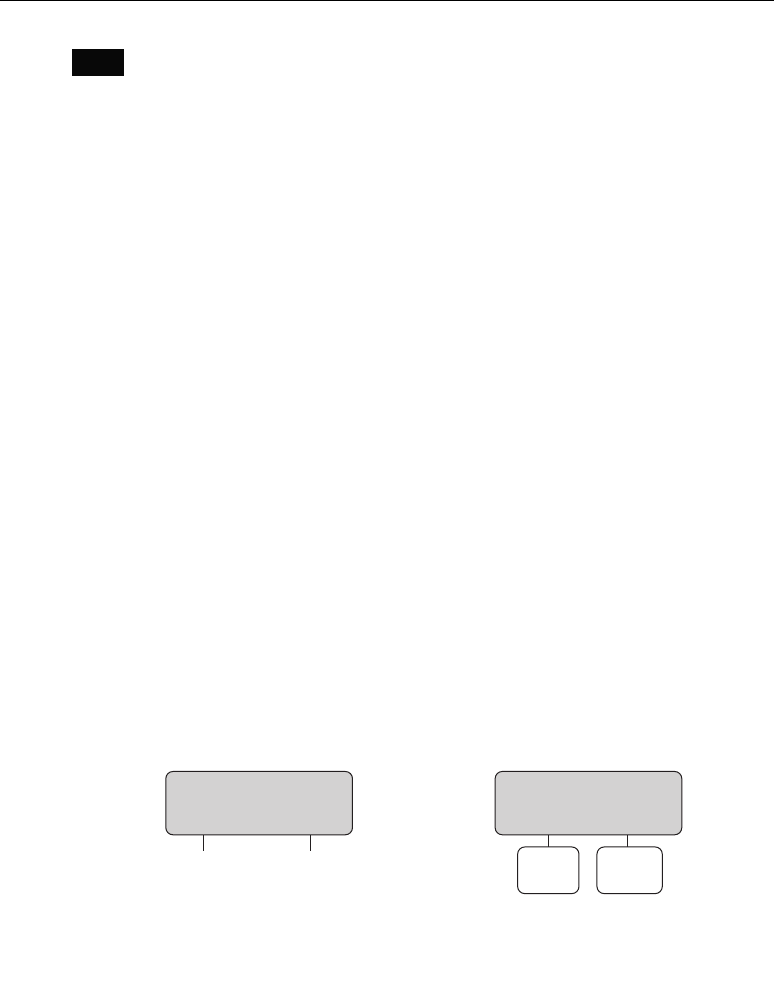

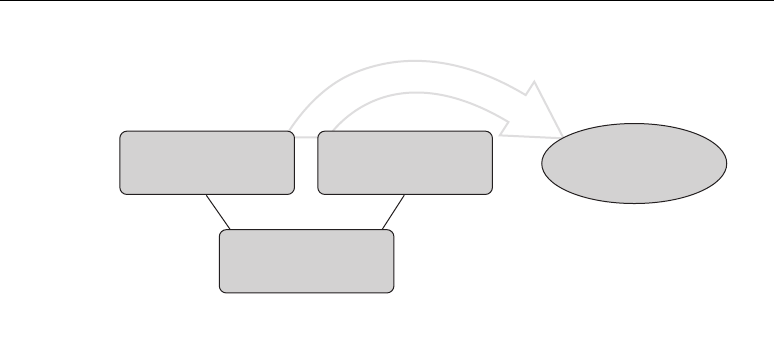

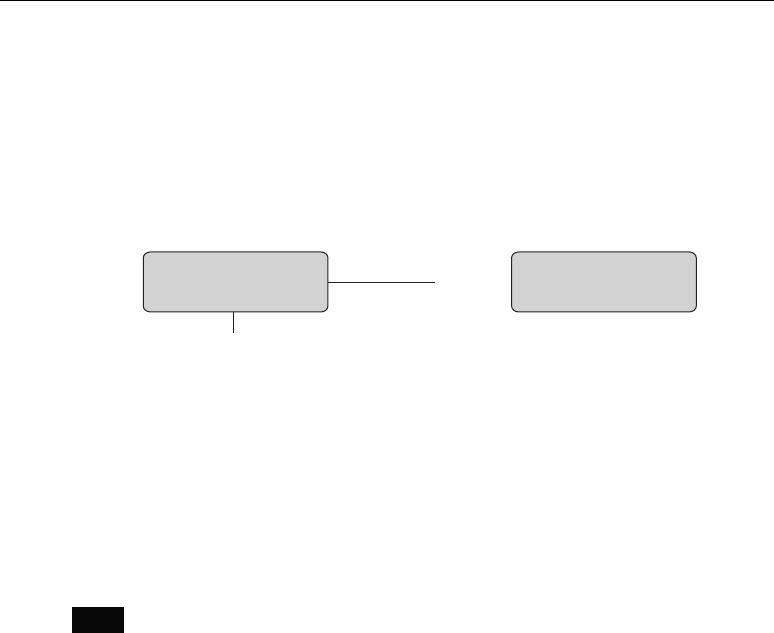

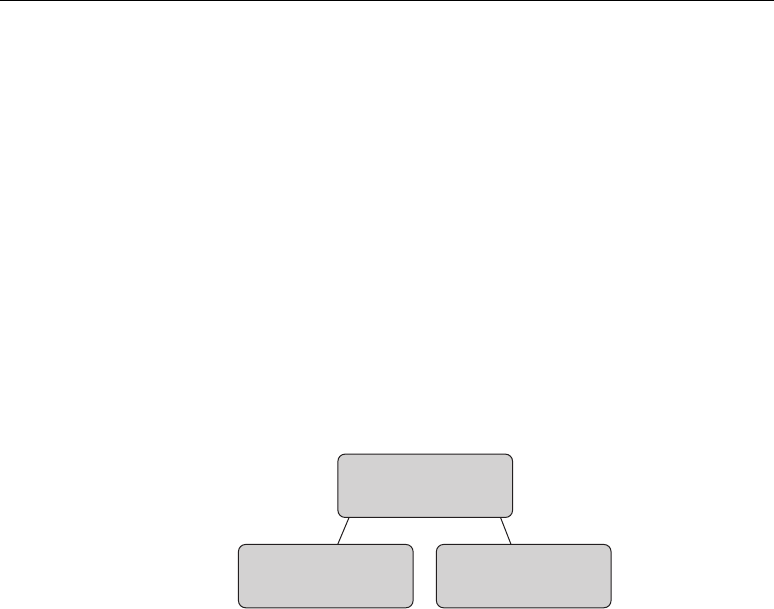

Tip No. 2: Entity Structure

Which type of entity should you use? Should you use a limited liability company

(LLC), a corporation, or a partnership? Or should you avoid using an entity at

all? In some countries, where there is not a lot of litigation, you may not need a

separate entity for your real estate. But in the United States, where 95 percent

of lawsuits worldwide are filed, the proper entity is essential. Let’s look at a

quick overview of the tax entities available in the United States.

While every person’s situation is different, let me give you a few pointers

about which entity you may want to consider for holding your real estate in-

vestments. From an asset protection standpoint (discussed in detail in another

chapter of this book), LLCs are frequently the best entity to use. One of the

great things about LLCs is that they don’t have any tax consequence. You can

elect to tax an LLC anyway you want. An LLC can be treated as a sole propri-

etorship, a partnership, an S corporation, or a C corporation.

For most real estate rental properties, you will want to be taxed either as a

part nership or a sole proprietorship. Don’t make the mistake of putting your real

estate rentals into an S corporation or a C corporation. This could spell disaster

if you ever have to take the property out of the corporation to refinance it; you

will be taxed as if the corporation sold the property to you at its fair market

value. I had someone in my office recently who owned his investment property

in an S corporation. We estimated the tax cost of refinancing to be in the neigh-

borhood of $250,000 simply because of the entity structure.

24 THE REAL BOOK OF REAL ESTATE

Business Structures

Partnership

General Limited

Sole

Proprietorship

Corporation

SC

FIGURE 1.3 Overview of Entities

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 24

Don’t make the mistake of putting your real estate rentals into an

S corporation or a C corporation. This could spell disaster if you ever have to

take the property out of the corporation to refinance it; you will be taxed as

if the corporation sold the property to you at its fair market value.

If you are a real estate dealer or developer, you may want to consider S cor-

poration taxation. This includes those of you who want to fix and flip properties.

The reason? You can significantly lower your social security taxes by owning

your property in an S corporation. And since you probably won’t need to dis-

tribute the property out of the company except when you sell it, you won’t have

the bad income tax consequences I spoke of earlier.

Tip No. 3: Travel, Meals, and Entertainment

Remember that the United States and most other countries tax only the net in-

come from a business. So any expenses that you can treat as deductible expenses

lower your income tax. The most overlooked deductions in the real estate busi-

ness are travel, meals, and entertainment expenses. The rule in the United States

for meals and entertainment is that if you discuss business before, during, or

after the meal or entertainment and the discussion is necessary and ordinary

for your business, then you get to deduct the cost of the meal or entertainment.

I’m not talking about going to dinner with your real estate agent or your ac-

countant (though I’m sure they would appreciate it). I’m talking about going to

dinner or a sporting event with your partner. For most of you, your business

partner in real estate is your spouse. My experience with business owners is

that when they go to dinner with their spouses they almost always talk about

business. And if you and your spouse are working on the real estate business

together, I can virtually guarantee that you are talking about your real estate

every time you go out to eat.

My wife and I eat out once or twice a week on average. I cannot even re-

member the last time we had dinner out and did not discuss business. These

discussions are essential to our success as business owners, even though she

does not maintain a very active role in any of our businesses. She has a perspec-

tive, though, that I find extremely useful as I make business decisions.

So stop paying for your meals out of your personal bank account, and start

paying for them from your real estate business bank account.

Travel is a little more difficult to deduct, but not much. If you are traveling

within the United States, you simply have to prove that your primary reason

for the trip was business. You prove this by showing that you spent more than

TIP

ROBERT KIYOSAKI 25

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 25

50 percent of each eight-hour workday discussing or working on your real estate

investment business. This could include your annual meeting or you could sim-

ply be investigating real estate opportunities in that location.

We had one client who applied these principles and ended up with a $1 mil-

lion deal. He really liked to travel to New Mexico. Knowing that he had to look

at real estate to deduct his travel expense, he set up a meeting with a local real

estate agent to review land development opportunities in his vacation spot. He

ended up finding a deal that netted him $1 million. And, of course, he got to

deduct his travel expenses.

Tip No. 4: Depreciation

After Robert and I met with the Arizona Republic journalist to discuss 40 per-

cent returns, we walked across the street to have lunch at a local restaurant.

Robert asked me what I thought about depreciation. I told him I thought it was

like magic. Where else can you get a tax deduction for something you didn’t

pay for and that is appreciating in value? Yet that is exactly what happens with

depreciation in the United States, Canada, and many other countries. Here’s

how it works:

Say you pay $500,000 for a house that you are going to rent. You put $100,000

of your own money into the house, and the bank loans you $400,000. You get a

deduction for a portion of the cost of the house each year—not just a portion of

your $100,000, but of the entire purchase price. Let me show you the calculation

for U.S. tax purposes.

Let’s estimate that 20 percent (or $100,000) of the cost of the house was for

the land. Even the IRS recognizes that land does not wear out, so we don’t get

to depreciate the land. But we do get to depreciate the remaining $400,000. At

a minimum for residential property, we should get a deduction of 3.636 percent

or $14,545 each year. And that’s assuming that the entire $400,000 is allocated

to the building. You can increase this deduction by doing what’s called a cost

segregation or chattel appraisal.

Briefly, here is what happens in a cost segregation. Your accountant or his

engineer goes through your property and segregates (on paper) everything that

could easily be removed from the building and is not necessary for its basic op-

eration from the building itself. Those items that can be removed are called

personal property or chattels. Personal property can be depreciated at 20 per-

cent or more per year.

In our case, let’s suppose that $100,000 of costs is segregated from the build-

ing. This would increase our annual depreciation deduction from $14,545 to

26 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 26

$30,900—more than double. So while our property appreciates, we still get a

tax deduction for depreciation of more than $30,000. This is the best of all de-

ductions, since there is no cash outlay involved other than the down payment

on the property.

So if our cash flow is $30,900 or less, we will not pay any income tax on our

monthly cash flow. And if our cash flow is less than our depreciation, then we

create a tax loss from the property that we can use (with proper planning) to

offset income from other sources. This is the primary reason many real estate

investors are able to reduce their income tax by 30 percent or more and why

some real estate investors pay no income tax at all. See how this can increase

your return on investment?

Tip No. 5: Documentation

Last but not least, let’s talk briefly about the importance of properly document-

ing our real estate transactions and expenses. Without good documentation,

the IRS has the right to disallow your deductions. What a waste of good deduc-

tions! We have already discussed the most important form of documentation—

good accounting.

In addition, there are other forms of documentation you must keep. For travel,

meals, and entertainment, you must keep receipts, and you must note who you

were with, where you went, what you discussed, the date of the event, and why

you incurred the expense. For automobile deductions, you need to maintain a

log of business versus personal miles driven. And for your entities, you need to

write down minutes that detail all of your meetings and major transactions.

Documentation is not the most fun part of real estate, but it’s not too difficult

if you just take a few minutes a week to take care of it. Stay on top of it. If you

don’t know exactly what you need to document, consult with your tax preparer.

Remember that if it isn’t documented, then you probably cannot prove to the

IRS that it was a legitimate deduction.

So there you have it—five easy opportunities to reduce your income taxes

while making tons of money in your real estate business. Now you can see why

smart business owners include tax planning as one of their keys to success. Ap-

plying these basic principles to your real estate business will enable you to build

enormous wealth in a very short time. Remember to begin with a strategy, add

a team, maintain good accounting, regularly review your reports, and minimize

your taxes by creating a long-term tax strategy. The sooner you begin treating

your real estate investing as a real business, the sooner you can stop working so

hard and start reaping the profits that are there for all good real estate investors.

ROBERT KIYOSAKI 27

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 27

Ways to Learn More

ProVision Wealth Strategy U—a free resource at www.ProVisionWealth.com/

WealthStrategyU

ProVision Business Start-up Kit—a series of five training modules on starting

up your real estate business. Includes courses on bookkeeping, year-round tax

planning, entity structuring, and setting up a business.

ProVision School of Wealth Strategy—a monthly subscription to compre-

hensive training materials on building wealth. Includes courses on creating

your wealth vision, building your wealth team, and designing your personal

wealth strategy.

ProVision School of Tax Strategy—a monthly subscription to comprehensive

training materials on permanently reducing taxes. Includes courses on design-

ing your family tax strategy, involving your children in your real estate business,

and getting the greatest tax benefits out of your real estate.

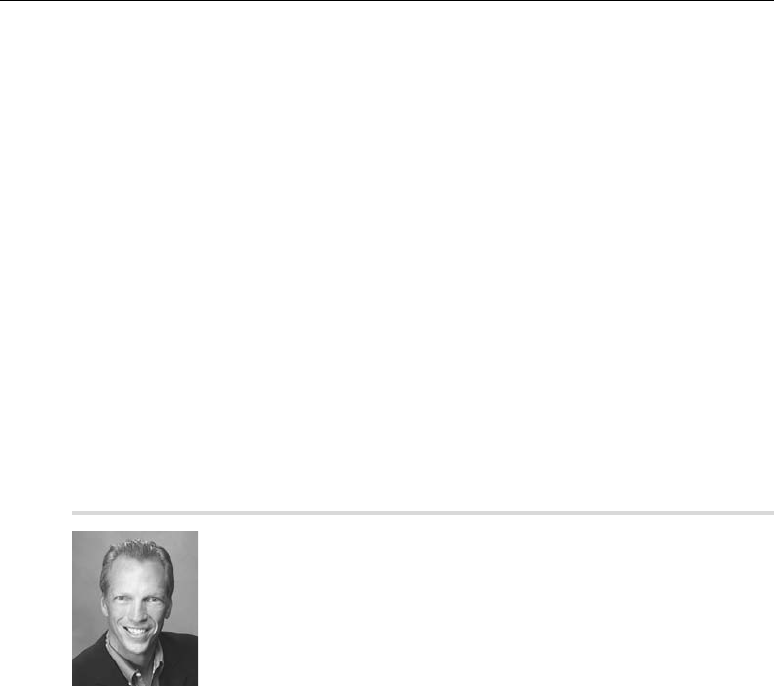

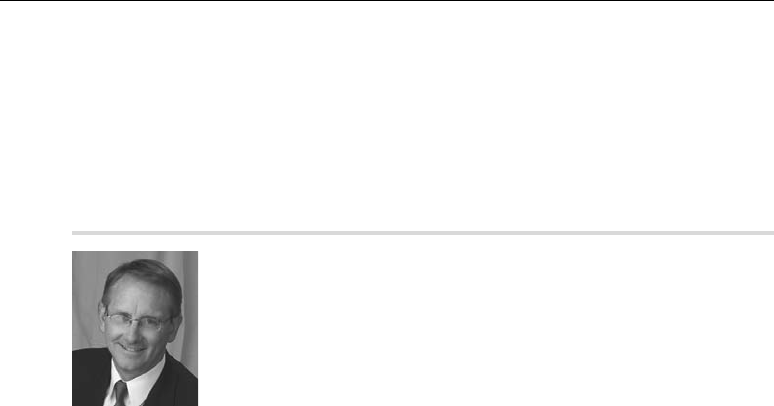

For more than twenty-five years, Tom Wheelwright has strategically de-

veloped innovative tax, business, and wealth strategies for sophisticated

investors and business owners across the United States and around the

world, resulting in millions of dollars in profits. His goal is to teach people

how to create a strategic and proactive approach to wealth that creates

lasting success. As the founder of ProVision, Tom is the innovator of

proactive consulting services for ProVision’s premium clientele, who on average, pay much

less in taxes and earn much more on their investments. He coaches select clients on their

wealth, business, and tax strategies; lectures on wealth and tax strategies around the world;

and is an adjunct professor at Arizona State University.

28 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 28

I

first met Chuck Lotzar in 2001 or so when he was a senior partner in a national

law firm. At Chuck’s former law firm, I delivered a presentation to approxi-

mately ten attorneys that covered my rich dad’s philosophy on money, wealth cre-

ation, and wealth management. Chuck seemed to be the only one out of the ten

who understood or was interested in what I was saying.

In 2003, Kim and I used Chuck to finalize one of our biggest real estate invest-

ments. It was a zero-down deal that would put more than $30,000 a month net

income in our pockets. If not for Chuck, this deal could have been our biggest

nightmare. He found irregularities that most people, including most lawyers,

would have missed. On top of that, after the deal was closed, Chuck offered to give

us a discount on some of his firm’s legal fees since he felt his firm did not work as

effectively as it could have. Needless to say, we told him to bill us in full and keep

the money. He had more than earned it.

In 2007, Chuck again came to our rescue, this time as our personal attorney

against our former business partner. The lawsuit was the worst, most vile event in

Kim’s and my life. If not for Chuck, I do not know where Kim and I would be today.

The good news is that Chuck Lotzar has turned out to be far more than our real

estate attorney. Through Chuck’s guidance, the Rich Dad Company has emerged

stronger, better staffed, and much more profitable. Personally, I have emerged more

2Charles W. LOTZAR

A Real Estate Attorney’s View

of Assembling and Managing

Your Team

29

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 29

mature, wiser, and less of a hothead, which is a miracle. Chuck has not only made

Kim and me vastly richer; we have become better entrepreneurs and investors.

The lesson again is this: It is often through our worst deals with the worst

people that the best people emerge.

—Robert Kiyosaki

I

know attorneys see the world differently than most people. A working rela-

tionship isn’t just a working relationship; it ideally should be a contract be-

tween two parties with built-in protections, limitations, and provisions, just in

case the relationship goes south. A piece of real estate isn’t just a piece of prop-

erty; it’s an asset that brings with it the need for appropriate entity structure,

identification of risk, allocation of risk, mitigation of risk and liabilities, and a

host of other legal protections and caveats associated with its development,

management, and eventual sale.

I know you’re thinking life is easier when you are not an attorney. You’re

probably right! But for me life as an attorney and particularly a real estate at-

torney is full of the excitement, the challenges, and the accomplishments that

can come only from working with people so that they sleep well at night, have

their family fortunes protected, and bring their dreams to life. It’s a profession

that keeps me continually learning, which I love. Real estate is a dynamic field

that keeps every day at the office new and fresh.

The likelihood that you are reading the chapter written by an attorney first

is slim, so I’ll assume you’ve read at least a few chapters before mine. If you

have, you’ve probably noticed that there are a number of references in them to

team members: the professionals it takes to make a real estate deal actually

happen. Many of the contributors list the types of team members that they need

in the type of real estate work that they do and how they have helped.

Well, I will echo their beliefs. Team members are the deciding factors in

spelling success or disaster for a real estate project. In my practice, I have seen

teams that operate seemingly effortlessly and others that are clumsy and doomed

to failure. So how do you assemble one that works effortlessly, and avoid the

kinds that are disasters waiting to happen? The answer is, you can’t. You can

only try to do your best and know that the reality of your team—particularly as

you are just starting out—will fall somewhere in the middle of those two ex-

tremes. Your job will be to assemble and manage a group of pros that makes its

way progressively more efficient to close every deal you do.

My perspective on teams and team members is different from the views of

many in this book because I am one of those team members. Many of the others

30 THE REAL BOOK OF REAL ESTATE

9781593155322_1:real estate_new 3/25/09 4:04 PM Page 30

in this book are the investors who drive the team. They delegate to team mem-

bers who advise them. I’m the one they delegate to and who advises them on

how to lead the team. That gives me a slightly different perspective. Combine

that with my attorney’s perspective and you have a chapter with three primary

purposes:

1.To tell you who you need on your team and how to know you have a winner.

2.To identify known risks and make sure that they are properly allocated

among other writing parties, including the members of your team.

3.To establish performance measures and deadlines, and to follow up to make

sure that each of those performance measures and deadlines are met in a

timely manner.

See, this is where my lawyer’s mentality comes into play. I know your team

will not be perfect, no matter how perfectly you follow this book’s directions,

how well you interview potential team members, or how ironclad their refer-

ences were. Life and real estate deals are not that cut and dried. So what do you

do? Well, quite simply, you do your best on the front end, and you attempt to

protect yourself on the back end.

Three Rules of the Game

Before you say to yourself, “This team thing seems like more trouble than it is

worth. For my project, I’ll keep it simple and do most of the work I need alone.

I’ll keep the team small—as small as possible—and that will minimize my prob-

lems,” understand that it is very hard to do anything in real estate alone. It is a

team sport and as such, I have assembled my Three Rules of the Game.

Nowhere else will your team come into play more than when it is time to

perform your due diligence. It’s a necessary part of every real estate deal, and

with the right team it can be your best friend and actually a lot of fun because

you often find the hidden gems that can signal great opportunity. On the other

hand, it can be the beginnings of a vivid nightmare you are living because you

are the proud owner of a “problem-property,” thanks to a team that missed

something big during due diligence. Again, the first camp is the place to be.

You’ll recall that the due diligence period is usually not less than sixty days

in length. Its purpose is to discover any problems and opportunities with a

property to determine whether you want to go through with the transaction,

and if so with what specific stipulations. It’s also designed to allocate and alle-

viate risk among various parties: the buyer, the seller, the lender, and the various

third-party professionals on your team.

ROBERT KIYOSAKI 31