Property Management Kit For Dummies

Property

Management Kit

FOR

DUMmIES

‰

2ND EDITION

by Robert Griswold

Host of radio’s Real Estate Today! With Robert Griswold

01_293294-ffirs.indd i01_293294-ffirs.indd i 7/22/08 11:12:36 PM7/22/08 11:12:36 PM

01_293294-ffirs.indd v01_293294-ffirs.indd v 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

Property

Management Kit

FOR

DUMmIES

‰

2ND EDITION

by Robert Griswold

Host of radio’s Real Estate Today! With Robert Griswold

01_293294-ffirs.indd i01_293294-ffirs.indd i 7/22/08 11:12:36 PM7/22/08 11:12:36 PM

Property Management Kit For Dummies

®

, 2nd Edition

Published by

Wiley Publishing, Inc.

111 River St.

Hoboken, NJ 07030-5774

www.wiley.com

Copyright © 2008 by Wiley Publishing, Inc., Indianapolis, Indiana

Published by Wiley Publishing, Inc., Indianapolis, Indiana

Published simultaneously in Canada

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form

or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as

permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior

written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to

the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-646-8600.

Requests to the Publisher for permission should be addressed to the Legal Department, Wiley Publishing,

Inc., 10475 Crosspoint Blvd., Indianapolis, IN 46256, 317-572-3447, fax 317-572-4355, or online at http://

www.wiley.com/go/permissions.

Trademarks: Wiley, the Wiley Publishing logo, For Dummies, the Dummies Man logo, A Reference for the

Rest of Us!, The Dummies Way, Dummies Daily, The Fun and Easy Way, Dummies.com and related trade

dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United

States and other countries, and may not be used without written permission. All other trademarks are the

property of their respective owners. Wiley Publishing, Inc., is not associated with any product or vendor

mentioned in this book.

LIMIT OF LIABILITY/DISCLAIMER OF WARRANTY: THE PUBLISHER AND THE AUTHOR MAKE NO

REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE ACCURACY OR COMPLETENESS OF

THE CONTENTS OF THIS WORK AND SPECIFICALLY DISCLAIM ALL WARRANTIES, INCLUDING WITH-

OUT LIMITATION WARRANTIES OF FITNESS FOR A PARTICULAR PURPOSE. NO WARRANTY MAY BE

CREATED OR EXTENDED BY SALES OR PROMOTIONAL MATERIALS. THE ADVICE AND STRATEGIES

CONTAINED HEREIN MAY NOT BE SUITABLE FOR EVERY SITUATION. THIS WORK IS SOLD WITH THE

UNDERSTANDING THAT THE PUBLISHER IS NOT ENGAGED IN RENDERING LEGAL, ACCOUNTING, OR

OTHER PROFESSIONAL SERVICES. IF PROFESSIONAL ASSISTANCE IS REQUIRED, THE SERVICES OF

A COMPETENT PROFESSIONAL PERSON SHOULD BE SOUGHT. NEITHER THE PUBLISHER NOR THE

AUTHOR SHALL BE LIABLE FOR DAMAGES ARISING HEREFROM. THE FACT THAT AN ORGANIZATION

OR WEBSITE IS REFERRED TO IN THIS WORK AS A CITATION AND/OR A POTENTIAL SOURCE OF FUR-

THER INFORMATION DOES NOT MEAN THAT THE AUTHOR OR THE PUBLISHER ENDORSES THE INFOR-

MATION THE ORGANIZATION OR WEBSITE MAY PROVIDE OR RECOMMENDATIONS IT MAY MAKE.

FURTHER, READERS SHOULD BE AWARE THAT INTERNET WEBSITES LISTED IN THIS WORK MAY HAVE

CHANGED OR DISAPPEARED BETWEEN WHEN THIS WORK WAS WRITTEN AND WHEN IT IS READ.

For general information on our other products and services, please contact our Customer Care

Department within the U.S. at 800-762-2974, outside the U.S. at 317-572-3993, or fax 317-572-4002.

For technical support, please visit www.wiley.com/techsupport.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may

not be available in electronic books.

Library of Congress Control Number: 2008933076

ISBN: 978-0-470-29329-4

Manufactured in the United States of America

10 9 8 7 6 5 4 3 2 1

01_293294-ffirs.indd ii01_293294-ffirs.indd ii 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

About the Author

Robert S. Griswold is the coauthor of Real Estate Investing For Dummies with

Eric Tyson. He has earned a bachelor’s degree and two master’s degrees in

real estate and related fields from the University of Southern California’s

Marshall School of Business. His professional real estate management and

investing credentials include the CRE (Counselor of Real Estate), the CPM

(Certified Property Manager), the ARM (Accredited Residential Manager), the

CCIM (Certified Commercial Investment Member), PCAM (Professional

Community Association Manager), and the GRI (Graduate, Realtor Institute).

Robert is a hands-on property manager with more than 30 years of practical

experience, having managed more than 800 properties representing more

than 45,000 rental units. He owns and runs Griswold Real Estate Management,

Inc., a property management firm with offices in southern California and

southern Nevada.

Since 1995, Robert has been the Real Estate Expert for NBC San Diego, a

network-owned and number-one-rated station. Every Saturday, he provides

impromptu answers to viewers’ real estate questions live on the air during

NBC News this Weekend.

Once a week for 14 years, Robert hosted a live, call-in real estate news and

information talk show called Real Estate Today! with Robert Griswold, heard

throughout southern California on Clear Channel’s AM 600 KOGO radio and

around the world on the show’s Web site at www.retodayradio.com. He

has been twice named the #1 Radio or Television Real Estate Journalist in the

Country by the National Association of Real Estate Editors in their Annual

National Journalism competition. The first award was for Real Estate Today!

with Robert Griswold, and the second was for his work for NBC News.

Robert is the lead columnist for the syndicated Rental Roundtable landlord-

tenant Q & A column at www.rentalroundtable.com, which is also fea-

tured in the San Diego Union-Tribune and the San Francisco Chronicle. He also

writes a nationally syndicated column, Rental Forum, at www.inman.com.

He’s a nationally recognized real estate litigation expert, having been

retained on more than 1,000 real estate legal matters — as well as serving

more than 150 times as a court-appointed receiver, referee, or bankruptcy

custodian.

Robert is a member of the National Faculty of IREM and a National Apartment

Association (NAA) and California Department of Real Estate Certified

Instructor. He’s a licensed California and Nevada real estate Broker, a

Realtor, and an active member of NAA and his local apartment association,

the San Diego County Apartment Association. Since 2005, he has served as a

Planning Commissioner in the City of San Diego.

01_293294-ffirs.indd iii01_293294-ffirs.indd iii 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

In his spare time (?!), he enjoys travel (especially cruising!), watching his

children excel in soccer, and participating in family activities with his wife,

Carol, and their four teenagers, Sheri, Stephen, Kimberly, and Michael. Above

all, he tries to retain his sense of humor and truly enjoy what he’s doing!

Dedication

I dedicate this book to my father, Westcott Griswold, who’s greatly admired by

all who know him. I also want to thank my best friend and wife, Carol, for her

25+ years of love, support, patience, and persistence in attempting to bring the

proper balance to my life. Of course, life’s always exciting and has real meaning

thanks to my four great teenagers — Sheri, Stephen, Kimberly, and Michael.

I also want to express my appreciation to my mom, Carol, for her unconditional

love and infinite encouragement. Most of all, I want to praise and thank God for

the wonderful gifts and incredible opportunities He has given me.

Author’s Acknowledgments

This book was made possible through the efforts of some very fine people

at Wiley Publishing, Inc. Mark Butler initially believed in my concept for the

first edition of Property Management For Dummies. Lindsay Lefevere was very

supportive of my efforts to include a CD-ROM with forms for the second

edition.

My Project Editor, Chad Sievers, made the rewrite fairly painless with some

great suggestions, which have led to a phenomenal resource book for rental

owners and property managers. My thanks also go to Copy Editor Jennifer

Tucci for a masterful job. I’d also like to thank technical editor, Joe DeCarlo,

who helped make sure that the information was accurate and that my advice

hit the mark.

My interest in real estate can be traced back to my father and mentor,

attorney Westcott Griswold, who advised me to excel in real estate, not law;

and my friend and first real estate professor at USC, Dr. Rocky Tarantello.

Thank you!

I was blessed to formally begin my real estate management career working

with two of the most savvy, knowledgeable, and ethical men in real estate —

thank you, Rod Stone and George Fermanian, for starting me on the right

track. In my property management days, I’ve met many fine people, and two

of the best are my friends property manager Wade Walker and attorney

Steve Kellman. I also want to thank attorney Kathy Belville-Ilaqua for her

review and sage advice on fair housing materials covered in the new edition.

01_293294-ffirs.indd iv01_293294-ffirs.indd iv 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

I’ll always be thankful to Carl Larsen, Homes Editor of the San Diego Union-

Tribune, who started me in my writing career when he gave me a shot with

the first Rental Roundtable column while his lovely wife, Sharon Larsen,

assisted in creating my original book proposal.

My heartfelt appreciation also goes to the late syndicated columnist and

newsletter author Bob Bruss, who offered encouragement and invaluable

advice for my first two books and who reinforced the importance of sharing

my personal experiences to illustrate my points.

Finally, I’d like to thank all of my NBC news viewers, Rental Roundtable and

Rental Forum readers, and radio listeners who’ve educated me with their

interesting and thought-provoking questions on literally every aspect of real

estate management.

01_293294-ffirs.indd v01_293294-ffirs.indd v 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

Publisher’s Acknowledgments

We’re proud of this book; please send us your comments through our Dummies online registration

form located at www.dummies.com/register/.

Some of the people who helped bring this book to market include the following:

Acquisitions, Editorial, and

Media Development

Project Editor: Chad R. Sievers

(Previous Edition: Elizabeth Kuball)

Acquisitions Editor: Lindsay Lefevere

Copy Editor: Jennifer Tucci

Editorial Program Coordinator:

Erin Calligan Mooney

Technical Editor: Joe DeCarlo

Media Development Producer: Josh Frank,

Jenny Swisher

Editorial Manager: Michelle Hacker

Editorial Assistants: Joe Niesen,

Jennette ElNaggar, David Lutton

Cover Photos: Ablestock.com

Cartoons: Rich Tennant (www.the5thwave.com)

Composition Services

Project Coordinator: Katie Key

Layout and Graphics: Reuben W. Davis,

Stephanie D. Jumper, Christin Swinford,

Christine Williams

Proofreaders: John Greenough, Penny L. Stuart

Indexer: Sherry Massey

Publishing and Editorial for Consumer Dummies

Diane Graves Steele, Vice President and Publisher, Consumer Dummies

Joyce Pepple, Acquisitions Director, Consumer Dummies

Kristin A. Cocks, Product Development Director, Consumer Dummies

Michael Spring, Vice President and Publisher, Travel

Kelly Regan, Editorial Director, Travel

Publishing for Technology Dummies

Andy Cummings, Vice President and Publisher, Dummies Technology/General User

Composition Services

Gerry Fahey, Vice President of Production Services

Debbie Stailey, Director of Composition Services

01_293294-ffirs.indd vi01_293294-ffirs.indd vi 7/22/08 11:12:37 PM7/22/08 11:12:37 PM

Contents at a Glance

Introduction ................................................................ 1

Part I: So You Want to Be a Landlord? .......................... 7

Chapter 1: Property Management 101 ............................................................................9

Chapter 2: Do You Have What It Takes to Manage Your Own Rental Property? .....21

Chapter 3: Managing Your Property Yourself or Hiring a Pro ...................................33

Chapter 4: Taking Over the Proper ty ............................................................................47

Part II: Renting Your Property .................................... 57

Chapter 5: Getting Your Rental Property Ready for Prospective Tenants ..............59

Chapter 6: Rent, Security Deposits, and Rental Contracts:

The Big Three of Property Management ....................................................................75

Chapter 7: FOR RENT: Generating Interest in Your Rental .........................................91

Chapter 8: Handling Prospects When They Come A’Calling ....................................117

Chapter 9: Strutting Your Property’s Stuff: Making Your Property Stick Out .......141

Chapter 10: Eenie, Meenie, Miney, Mo: Selecting Your Tenants ..............................161

Part III: The Brass Tacks of Managing Rentals ........... 189

Chapter 11: Moving In the Tenants .............................................................................191

Chapter 12: Collecting and Increasing Rent ...............................................................213

Chapter 13: Keeping the Good Tenants — and Your Sanity ....................................229

Chapter 14: Dealing with Problem Tenants ................................................................239

Chapter 15: Moving Out the Tenants ..........................................................................253

Part IV: Techniques and Tools

for Managing the Property ....................................... 269

Chapter 16: Working with Employees and Contractors............................................271

Chapter 17: Maintaining the Property ........................................................................283

Chapter 18: Keeping Safety and Security in Mind .....................................................297

Part V: Money, Money, Money!................................. 311

Chapter 19: Two Necessities of Property Management: Insurance and Taxes .....313

Chapter 20: Financial Management and Recordkeeping ...........................................325

Chapter 21: Finding New Ways to Increase Your Cash Flow:

Only for the Daring ......................................................................................................335

02_293294-ftoc.indd vii02_293294-ftoc.indd vii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Part VI: The Part of Tens .......................................... 353

Chapter 22: Ten Reasons to Become a Rental Property Owner ..............................355

Chapter 23: Ten Ways to Rent Your Vacancy ............................................................359

Appendix A: On the CD ............................................. 363

Appendix B: State Statutes

for Landlord-Tenant Laws ......................................... 371

Index ...................................................................... 393

02_293294-ftoc.indd viii02_293294-ftoc.indd viii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Table of Contents

Introduction ................................................................. 1

About This Book ..............................................................................................1

Conventions Used in This Book .....................................................................2

What You’re Not to Read ................................................................................2

Foolish Assumptions .......................................................................................2

How This Book Is Organized ..........................................................................3

Part I: So You Want to Be a Landlord? ................................................3

Part II: Renting Your Property ..............................................................4

Part III: The Brass Tacks of Managing Rentals ...................................4

Part IV: Techniques and Tools for Managing the Property ..............4

Part V: Money, Money, Money! ............................................................5

Part VI: The Part of Tens .......................................................................5

Icons Used in This Book .................................................................................5

Where to Go from Here ...................................................................................6

Part I: So You Want to Be a Landlord? ........................... 7

Chapter 1: Property Management 101 . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

Understanding What Property Management Really Is ..............................10

Considering the pros ...........................................................................10

Confronting the icky parts ..................................................................11

Eyeing the Types of Real Estate Available .................................................12

Renting Your Property ..................................................................................13

Preparing the property .......................................................................14

Knowing how much to charge ............................................................15

Arousing prospects’ interest ..............................................................16

Turning prospects’ interest into property visits .............................16

Picking your tenants and signing the deal ........................................17

Getting Your Hands Dirty: Managing the Property ...................................17

Moving tenants in and out ..................................................................18

Collecting rent and keeping the good tenants .................................18

Handling troublesome tenants ...........................................................19

Maintaining the property ....................................................................19

Protecting your investment ................................................................20

02_293294-ftoc.indd ix02_293294-ftoc.indd ix 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Property Management Kit For Dummies, 2nd Edition

x

Chapter 2: Do You Have What It Takes to Manage

Your Own Rental Property? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .21

Understanding That Managing Rental Property Is a People Business ...22

Identifying the Types of Real Estate Owners .............................................22

The inadvertent rental property owner ............................................22

The long-term investment rental property owner ...........................23

Recognizing the Advantages of Owning Rental Property .........................24

Eyeing the Unique Characteristics of a Good Manager ............................25

Realizing that good management makes a difference .....................26

Separating your personal style from sound management ..............27

Managing your time .............................................................................28

Delegating management activities .....................................................28

Knowing that your style is unique .....................................................30

Being Honest with Yourself about Your Skills and Experience ...............30

Chapter 3: Managing Your Property Yourself or Hiring a Pro . . . . . . .33

Managing Your Rental Yourself ...................................................................33

Recognizing the advantages of self-management ............................34

Paying attention to the drawbacks ....................................................34

Managing your property from a distance .........................................35

Exploring Professional Management ...........................................................36

Eyeing the pros and cons of using a pro ...........................................36

Understanding what a property manager does ...............................38

Telling the good from the bad ............................................................39

Compensating your property manager .............................................42

Making sense of management agreements .......................................44

Being aware of the tax consequences ...............................................45

Chapter 4: Taking Over the Proper ty. . . . . . . . . . . . . . . . . . . . . . . . . . . . .47

Knowing What to Get Upfront ......................................................................47

A list of personal property included in the sale ..............................48

A copy of all tenant files ......................................................................49

A seller-verified rent roll and list of all tenant

security deposits ..............................................................................49

A copy of all required governmental licenses and permits............50

A copy of all the latest utility bills .....................................................50

A copy of every service agreement or contract...............................51

A copy of the seller’s current insurance policy ...............................51

Working with the Current Tenants during the Transition .......................52

Meeting with the tenants in person ...................................................53

Inspecting the rental unit ....................................................................53

Using a new lease or rental agreement .............................................54

Evaluating the current rent ................................................................55

02_293294-ftoc.indd x02_293294-ftoc.indd x 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

xi

Table of Contents

Part II: Renting Your Property .................................... 57

Chapter 5: Getting Your Rental Property Ready

for Prospective Tenants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .59

Coming Up with a Plan to Handle Vacancies .............................................59

Considering renovations and upgrades ............................................60

Paying attention to the exterior and common areas.......................62

Making sure the interior is up to snuff ..............................................63

Preparing Your Rental Unit the Right Way .................................................66

General cleaning...................................................................................66

Maintenance and repairs ....................................................................67

Painting .................................................................................................69

Final cleaning ........................................................................................70

Carpet or floor covering cleaning ......................................................71

Inspecting Safety Items .................................................................................72

Using Outside Contractors ...........................................................................73

Chapter 6: Rent, Security Deposits, and Rental Contracts:

The Big Three of Property Management . . . . . . . . . . . . . . . . . . . . . . . . .75

Setting the Rent ..............................................................................................75

Examining the return on your investment ........................................76

Conducting a market analysis of rents in your area........................77

Coming Up with a Fair Security Deposit .....................................................82

Figuring what you can legally charge ................................................82

Keeping security deposits separate from your other funds ..........83

Avoiding nonrefundable deposits......................................................84

Paying interest on security deposits .................................................85

Increasing deposits ..............................................................................86

Choosing the Type of RentalContract You Want ......................................86

Contemplating a lease .........................................................................86

Eyeing a periodic rental agreement ...................................................87

Getting your contract in writing ........................................................88

Chapter 7: FOR RENT: Generating Interest in Your Rental . . . . . . . . . .91

Developing a Marketing Plan ........................................................................91

Determining your target market ........................................................92

Thinking about what your renters stand to gain

from your property ..........................................................................93

Understanding the Importance of Good Advertising ................................93

Eyeing the different approaches ........................................................94

Knowing which approach gives you the most bang

for your buck ....................................................................................95

Getting your property to rent itself ...................................................97

Being Aware of Fair Housing Laws ..............................................................97

02_293294-ftoc.indd xi02_293294-ftoc.indd xi 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Property Management Kit For Dummies, 2nd Edition

xii

Analyzing Your Advertising Options ...........................................................99

Talking the talk: Word-of-mouth referrals ......................................100

Showcasing your site: Property signs .............................................101

Broadening your horizons: The Internet ........................................103

Reading all about it: Newspapers ....................................................105

Papering the neighborhood: Flyers .................................................109

Focusing on rental publications.......................................................112

Creating chat: Community bulletin boards ....................................113

Going where the jobs are: Local employers ...................................113

Meandering through other tactics to try ........................................114

Chapter 8: Handling Prospects When They Come A’Calling . . . . . . .117

Understanding Why First Impressions Are Important ............................117

Making the Most of Technology ................................................................119

Using your phone to your advantage ..............................................119

Knowing which devices you need ...................................................122

Preparing for Rental Inquiry Phone Calls .................................................122

Having the basic tools ready ............................................................123

Answering the phone ........................................................................128

Providing and obtaining the basic info ...........................................130

Selling the prospect on your property ............................................132

Prequalifying the prospect over the phone ...................................132

Handling phone objections ...............................................................134

Converting phone calls to rental showings ....................................135

Planning Ahead for Open Houses and Walk-Throughs ...........................137

Holding an open house .....................................................................137

Scheduling individual appointments ...............................................138

Providing directions to the property ..............................................139

Chapter 9: Strutting Your Property’s Stuff:

Making Your Property Stick Out . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .141

Showing Your Rental Unit ...........................................................................141

Showing a vacant rental ....................................................................142

Showing an occupied rental .............................................................143

Taking the First Steps to Get the Renter Interested ................................144

Prequalifying your prospect during the rental showing ...............145

Resolving your prospect’s objections .............................................145

Convincing your prospect ................................................................146

Inviting your prospect to sign on ....................................................147

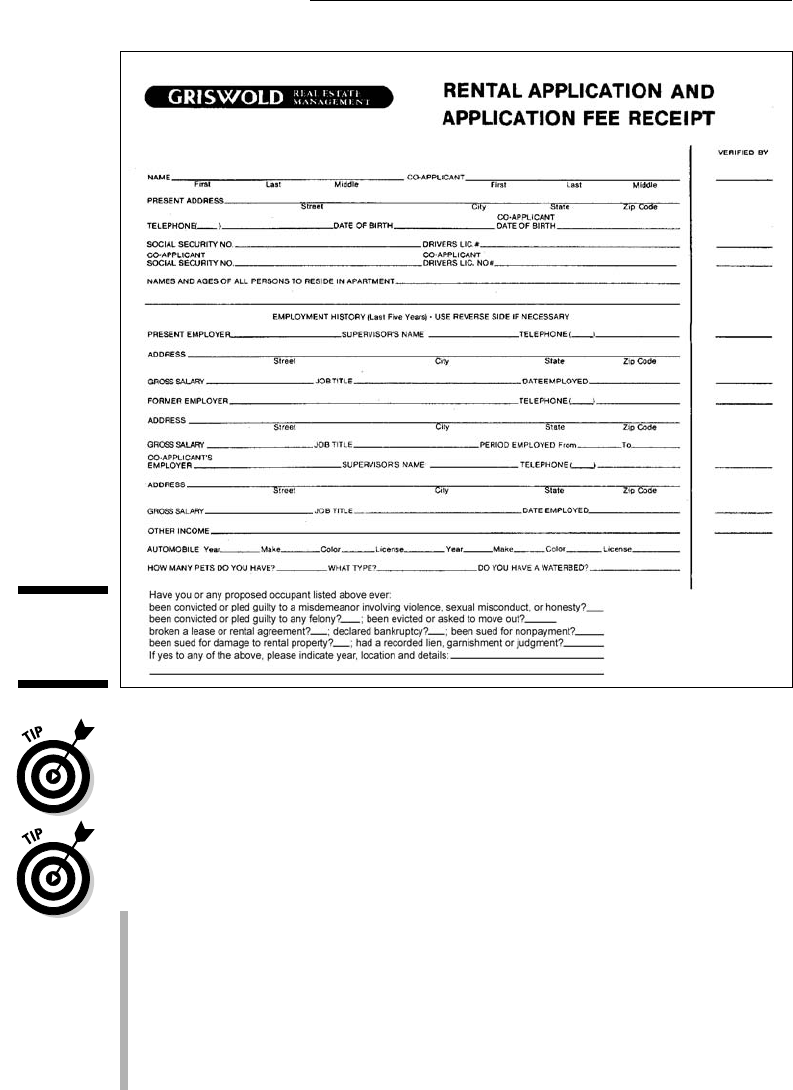

Having your prospect complete a rental application ...................147

Holding your prospect’s deposit .....................................................149

Developing priority waiting lists ......................................................151

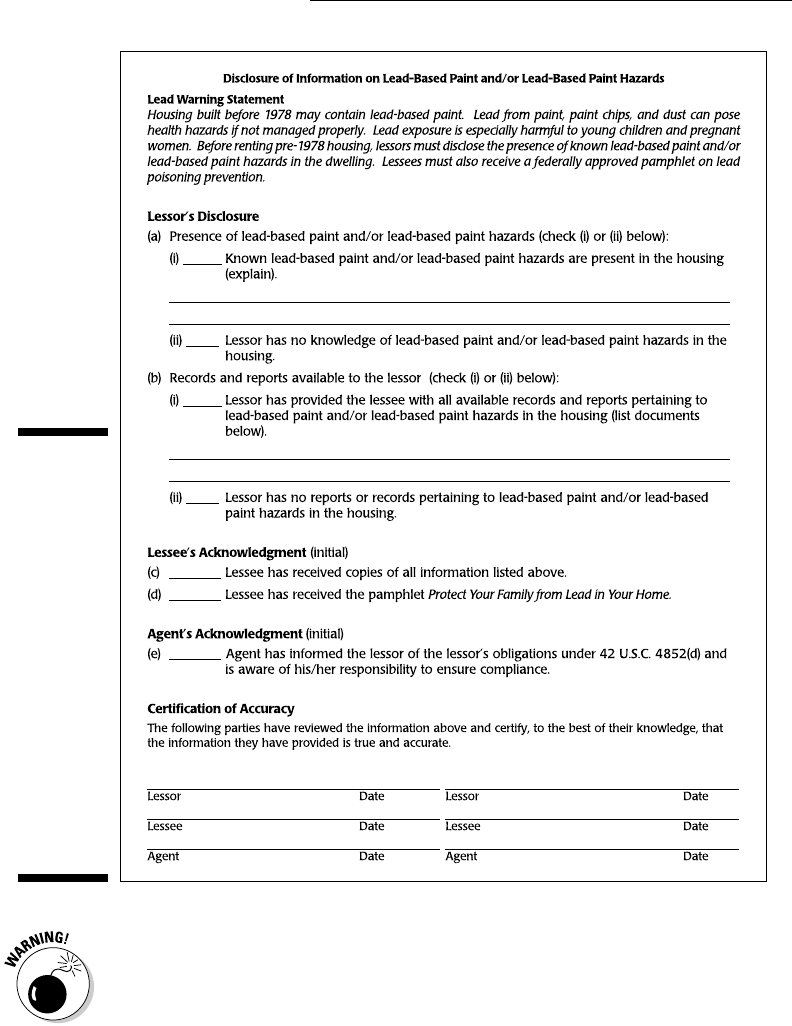

Handling Mandatory Disclosures and Environmental Issues ................152

Lead-based paint ................................................................................152

Asbestos ..............................................................................................155

Radon ..................................................................................................157

Sexual offenders .................................................................................159

02_293294-ftoc.indd xii02_293294-ftoc.indd xii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

xiii

Table of Contents

Chapter 10: Eenie, Meenie, Miney, Mo: Selecting Your Tenants . . .161

Understanding the Importance of Screening ...........................................162

Establishing Tenant Selection Criteria .....................................................162

Why having criteria is important .....................................................163

How to create your criteria ..............................................................164

Verifying Rental Applications ....................................................................165

Confirming identity ............................................................................165

Going over occupancy guidelines ....................................................166

Investigating rental history ..............................................................167

Validating employment and income ................................................168

Reviewing credit history ...................................................................169

Checking criminal history .................................................................173

Talking with all personal references ...............................................175

Dealing with guarantors ....................................................................175

Making your final decision ................................................................177

Notifying the Applicant of Your Decision .................................................178

Avoiding Housing Discrimination Complaints .........................................180

The ins and outs of Fair Housing .....................................................180

Steering and chilling ..........................................................................182

Children ...............................................................................................183

Reasonable accommodations ..........................................................184

Reasonable modifications .................................................................185

Companion or service animals .........................................................186

Americans with Disabilities Act .......................................................187

Sexual harassment .............................................................................188

Part III: The Brass Tacks of Managing Rentals ........... 189

Chapter 11: Moving In the Tenants . . . . . . . . . . . . . . . . . . . . . . . . . . . . .191

Establishing the Move-In Date ...................................................................192

Meeting with a Tenant Prior to Move-In ...................................................193

Covering the rules with your new tenant .......................................193

Reviewing and signing documents ..................................................196

Collecting the money from your tenant ..........................................203

Inspecting the property with your tenant before move-in ...........204

Giving your tenant an informational letter prior to move-in........207

Distributing the keys to your tenant ...............................................210

Setting Up the Tenant File ..........................................................................211

Preparing a Welcome Package for Your New Tenant .............................212

Chapter 12: Collecting and Increasing Rent . . . . . . . . . . . . . . . . . . . . .213

Creating a Written Rent Collection Policy ................................................214

When rent is due ................................................................................214

Where rent is paid .............................................................................217

How rent is paid .................................................................................218

02_293294-ftoc.indd xiii02_293294-ftoc.indd xiii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Property Management Kit For Dummies, 2nd Edition

xiv

Dealing with Rent Collection Problems ....................................................220

Collecting late rent ............................................................................221

Charging late fees...............................................................................222

Handling returned rent payments ...................................................223

Dealing with partial rent payments .................................................225

Serving legal notices ..........................................................................225

How to Handle Increasing the Rent ...........................................................226

Figuring out how to raise the rent ...................................................226

Keeping your tenants (relatively) happy ........................................227

Chapter 13: Keeping the Good Tenants — and Your Sanity. . . . . . . .229

Knowing What Tenants Want .....................................................................229

Timely and effective communication ..............................................230

Quick responses to maintenance requests ....................................231

Consistent respect for their privacy ...............................................231

Equal enforcement of house rules ...................................................232

Fair rental rates and increases .........................................................232

Recognizing the Ins and Outs of Renewing Leases .................................233

Reducing your turnover ....................................................................233

Offering incentives for tenants to stay ............................................236

Following up with tenants after move-out ......................................238

Chapter 14: Dealing with Problem Tenants. . . . . . . . . . . . . . . . . . . . . .239

Recognizing and Responding to Common Tenant Problems .................239

Late or nonpayment of rent ..............................................................240

Additional occupants ........................................................................241

Inappropriate noise level ..................................................................242

Unsupervised children ......................................................................243

Exploring Alternatives to Eviction ............................................................243

Negotiating a voluntary move-out ...................................................244

Using mediation or arbitration services .........................................244

Taking your tenant to court .............................................................244

Giving ’Em the Boot: Evicting a Tenant ....................................................245

Serving legal notices ..........................................................................245

Collecting judgments .........................................................................248

Handling Unusual Tenant Situations .........................................................249

Bankruptcies.......................................................................................249

Illegal holdovers .................................................................................249

Broken rental contracts ....................................................................250

Assignments or subleases ................................................................251

Departing roommates........................................................................251

Domestic problems............................................................................252

Tenant deaths.....................................................................................252

02_293294-ftoc.indd xiv02_293294-ftoc.indd xiv 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

xv

Table of Contents

Chapter 15: Moving Out the Tenants. . . . . . . . . . . . . . . . . . . . . . . . . . . .253

Requiring Written Notice of Your Tenant’s Move-Out Plans .................254

Providing Your Tenant with a Move-Out Information Letter .................256

Walking Through the Unit at Move-Out ....................................................257

Getting the 411 on the walk-through ...............................................258

Paying (or not paying!) the security deposit ..................................259

Defining ordinary wear and tear ......................................................260

Using a Security Deposit Itemization Form ....................................261

Deducting from the security deposit ..............................................262

Dealing with Special Situations ..................................................................264

Forking out the dough: When damage and unpaid rent

exceed the security deposit ..........................................................265

Having your facts straight: When disputes arise

about the security deposit ............................................................265

Reclaiming what’s yours: When the rental is abandoned ............266

Part IV: Techniques and Tools

for Managing the Property ........................................ 269

Chapter 16: Working with Employees and Contractors . . . . . . . . . . .271

Hiring Employees .........................................................................................271

Establishing job duties, work schedule, and compensation ........272

Screening employees .........................................................................273

Knowing your responsibilities .........................................................275

Working with your manager .............................................................276

Firing an employee ............................................................................277

Building Your Contractor and Vendor Dream Team ..............................279

Recognizing what to look for ............................................................279

Avoiding common pitfalls .................................................................280

Chapter 17: Maintaining the Property . . . . . . . . . . . . . . . . . . . . . . . . . .283

Recognizing the Importance of a Maintenance Plan ...............................284

Being Prepared for Maintenance Issues ...................................................285

Emergency maintenance ...................................................................285

Preventive maintenance ...................................................................286

Corrective maintenance ....................................................................287

Custodial maintenance ......................................................................287

Cosmetic maintenance ......................................................................288

Handling Rental Property Maintenance ....................................................288

Responding to tenant maintenance request ..................................289

Keeping tenants from doing repairs ................................................292

Purchasing parts and supplies .........................................................295

02_293294-ftoc.indd xv02_293294-ftoc.indd xv 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Property Management Kit For Dummies, 2nd Edition

xvi

Chapter 18: Keeping Safety and Security in Mind . . . . . . . . . . . . . . . .297

Tackling Crime in and around Your Rental Property .............................297

Turning to crime prevention programs ..........................................298

Paying attention to tenant questions and complaints

about safety-related issues ...........................................................299

Responding to crimes when they occur .........................................301

Taking Necessary Security Precautions ...................................................301

Keys and access-control systems ....................................................302

Lighting ...............................................................................................303

Security firms .....................................................................................304

Addressing Environmental Issues .............................................................305

Fire safety............................................................................................305

Carbon monoxide ..............................................................................306

Electromagnetic fields .......................................................................307

Mother Nature’s wrath ......................................................................307

Mold .....................................................................................................309

Part V: Money, Money, Money! ................................. 311

Chapter 19: Two Necessities of Property Management:

Insurance and Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .313

Cover Me, I’m Going In: Making Sure You Have

the Insurance You Need ..........................................................................313

Telling the difference among the types of insurance

coverage you can get .....................................................................314

Determining the right deductible ....................................................317

Letting your tenants know about renter’s insurance ....................318

Handling potential claims .................................................................319

The Tax Man Cometh: Knowing Which Taxes You’re

Responsible for Paying ............................................................................321

Making sense of income taxes ..........................................................321

Grasping (and appealing) property taxes .......................................324

Chapter 20: Financial Management and Recordkeeping . . . . . . . . . .325

Organizing Your Files ..................................................................................325

Maintaining Property Records ...................................................................327

Taking Care of Business: Accounting ........................................................328

Creating a budget and managing your cash flow ...........................329

Using computers for financial management ...................................330

Chapter 21: Finding New Ways to Increase Your Cash Flow:

Only for the Daring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .335

Considering Non-Rent Revenue .................................................................335

Earning some cash with the wash: Laundry machines .................336

Stowing some dough: Storage ..........................................................337

Selling your space: Parking ...............................................................337

02_293294-ftoc.indd xvi02_293294-ftoc.indd xvi 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

xvii

Table of Contents

Converting the World Wide Web to cash: Internet access ...........338

Cashing in on the ol’ dining room set: Furnished rentals .............338

Putting Lease Options to Work for You ....................................................339

Taking Advantage of Government Programs ...........................................341

The scoop on rental subsidy programs ..........................................342

The lowdown on Section 8 ................................................................342

The 4-1-1 on rehabilitation loans .....................................................346

Working in Niche Markets ..........................................................................347

Taking another look at your pet policy ...........................................347

Renting to students ...........................................................................348

Catering to senior citizens ................................................................349

Designating your rental units smoke-free .......................................350

Part VI: The Part of Tens ........................................... 353

Chapter 22: Ten Reasons to Become a Rental Property Owner. . . . .355

You Can Diversify Your Investments ........................................................355

You Don’t Need Much Money to Start ......................................................355

It Can Be a Second Income .........................................................................356

You Gain Tax Advantages ...........................................................................356

Real Estate Holds Its Value .........................................................................357

You Get Leverage .........................................................................................357

It Beats Inflation ...........................................................................................357

You Can Shelter Your Income ....................................................................358

You Get a Positive Cash Flow .....................................................................358

It Can Help You Retire .................................................................................358

Chapter 23: Ten Ways to Rent Your Vacancy . . . . . . . . . . . . . . . . . . . .359

Maintain Curb Appeal .................................................................................359

Keep the Unit in Rent-Ready Condition ....................................................359

Establish a Competitive Rent .....................................................................360

Offer Prospects a Rate Guarantee .............................................................360

Stay Ahead of the Technology Curve ........................................................360

Offer Referral Fees .......................................................................................361

Accept Pets ...................................................................................................361

Offer Move-In Gifts or Upgrades ................................................................361

Contact Corporate Relocation Services ....................................................362

Accept Section 8 ..........................................................................................362

Appendix A: On the CD ............................................. 363

System Requirements .................................................................................363

Using the CD .................................................................................................364

Software ........................................................................................................ 364

What You’ll Find on the CD ........................................................................365

Forms ...................................................................................................365

Legal information ...............................................................................367

02_293294-ftoc.indd xvii02_293294-ftoc.indd xvii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Property Management Kit For Dummies, 2nd Edition

xviii

Bonus Part of Tens chapter ..............................................................368

Educational opportunities and professional designations ...........368

Resources ...........................................................................................369

Troubleshooting ..........................................................................................370

Appendix B: State Statutes

for Landlord-Tenant Laws .......................................... 371

Landlord-Tenant Statutes by State ............................................................372

Scenario-Specific Laws by State .................................................................382

Index ....................................................................... 393

02_293294-ftoc.indd xviii02_293294-ftoc.indd xviii 7/22/08 11:12:54 PM7/22/08 11:12:54 PM

Introduction

W

elcome to Property Management Kit For Dummies, 2nd Edition. You

can discover many of life’s lessons by doing some on-the-job trial and

error. But property management shouldn’t be one of them — the mistakes

are too costly and the legal ramifications too severe. This book gives you

proven strategies to make rental property ownership and management both

profitable and pleasant.

About This Book

Many landlord-tenant relationships are strained, but they don’t have to be

that way. A rental property owner who knows how to properly manage his

rental property and responds promptly to the legitimate concerns of his ten-

ants will be rewarded with good people who stick around. The key is prop-

erly maintaining your rental property and constantly investing in upgrades

and improvements. By doing this, you can be successful in meeting your

long-term financial goals and realize that being a landlord is an excellent pri-

mary or secondary source of income.

This book is based on hands-on experience and lessons from my own real-life

examples. I have an entirely different view from other property managers

that your tenants are your customers, not your enemies, and as such, they

should be treated with respect. Not everyone is cut out to be a property man-

ager, and I want to make sure you understand not only the basics of the

rental housing business but also some of the tricks that can make you glad

you’re a real estate investor.

Although this book is overflowing with useful advice and information, it’s pre-

sented in a light, easy-to-access format. It explains how to wear many hats in

the property management business: advertiser/promoter (in seeking ten-

ants), host (in showing the property), handyman (in keeping up with and

arranging for repairs), bookkeeper (in maintaining records), and even coun-

selor (in dealing with tenants and their problems). Just as important, this

book helps you maintain your sense of humor — and your sanity — as you

deal with these challenges and more.

03_293294-intro.indd 103_293294-intro.indd 1 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

2

Property Management Kit For Dummies, 2nd Edition

I wrote this book in essentially chronological order — from your first entry

into the world of rental property ownership and your corresponding steps to

prepare and promote your property to showing your rental and selecting the

right tenants. As a result, reading the book cover to cover makes sense, but

feel free to read the sections that are most relevant to you at any given time.

Skip around and read about those areas that are giving you problems, and

I’m confident that you’ll find some new solutions to try.

To make your life easier, I’ve included many of the forms you need to be

successful in managing your rental — whether you’re just starting out with a

single-family rental home or condo, you have a handful of rental units, or you

possess a whole portfolio of rental properties. These forms are all on the

included CD-ROM, so you can just print them right out, have your local legal

counsel review them, and start putting them to use.

Conventions Used in This Book

To help you navigate this book, I use the following conventions:

Italics highlight new, somewhat technical terms, such as estoppel

agreement, and emphasize words when I’m making a point.

Boldface text indicates key words in bulleted and numbered lists.

Monofont highlights Web sites and e-mail addresses.

What You’re Not to Read

I’d certainly love for you to read every single word I’ve written in this book,

but I understand that you’re a busy person. Face it: Managing rental property

takes time, so you want to read just the essential info to help you find suc-

cess. In that case, feel free to skip the following:

The sidebars: These gray-shaded boxes are full of fun bits or humorous

stories that are quite interesting (if I do say so myself), but not essential

for you to understand just what you need to know.

Text with True Story icons: These passages contain some of my real-life

experiences to help keep you from making my mistakes.

Foolish Assumptions

In this book, I’m making some general assumptions about who you are:

03_293294-intro.indd 203_293294-intro.indd 2 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

3

Introduction

You’re an unintentional property owner — someone who, through a

series of circumstances, suddenly and unexpectedly came upon an

opportunity to own property. Perhaps you inherited a house from a rela-

tive and, not wanting it to sit idle, you decided to rent it out. Or maybe

you transferred to a job in another city and, because you’ve been unable

to sell your home, you’ve been forced to rent the property to help cover

the mortgage and operating expenses. Many property owners find them-

selves in the rental housing business almost by accident, so if you count

yourself in this group, you’re not alone.

You’re one of those people who has made a conscious decision to

become a rental property owner. Perhaps, like many rental owners with

a plan, you needed to buy a new, larger home and decided to keep your

existing home as a rental property. Or maybe, while you were looking

to own your own place, you found a great duplex and decided to live in

one unit while renting out the other. In a world where people seem to

have more and more demands on their time, many aspects of rental

property ownership — like the capacity to supplement a retirement plan

with additional sources of cash flow or the proven opportunity to build

wealth — are very appealing. The key to achieving this success is finding

a way to make money while still retaining control over your life.

Real estate offers one of the best opportunities to develop a steady stream of

residual income that’s being earned whether you’re sleeping, participating in

your favorite leisure activity, enjoying your retirement, or relaxing on vaca-

tion. Whatever the circumstances, the bottom line is the same: You hope to

generate sufficient income from the property to cover the debt service, pay

for all operating expenses, and possibly provide some cash flow along with

tax benefits, appreciation, and equity buildup. The key to your success is

knowing how to manage people and time. And this book has plenty to offer

you on that front.

How This Book Is Organized

Property Management Kit For Dummies, 2nd Edition, is organized into six

parts. The chapters within each part cover specific topic areas in more

detail. So you can easily and quickly scan a topic of interest or troubleshoot

the source of your latest headache! Each part addresses a major area of

rental housing management. Following is a brief summary of what I cover:

Part I: So You Want to Be a Landlord?

Managing rental property isn’t everyone’s cup of tea. The chapters in this

part assist you in evaluating your skills and personality to see whether you

have what it takes to manage rental units — or whether you should call in the

03_293294-intro.indd 303_293294-intro.indd 3 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

4

Property Management Kit For Dummies, 2nd Edition

property management cavalry. If a management company is the answer to

your prayers, I show you how to select one, what to expect, and how much

it’ll cost in this part. Finally, the day of your escrow closing has arrived and

the ink is dry, so flip here to find out what your immediate priorities are as

you take over your new rental property.

Part II: Renting Your Property

The most important aspect of rental housing is keeping the unit occupied

with paying tenants who don’t destroy it or terrorize the neighbors. In this

part, you figure out how to prepare the property for rent, set the rents and

security deposits, develop a comprehensive (yet cost-effective) advertising

campaign, and show your rental unit to prospective tenants. Because all

tenants look great on paper, I also fill you in on some tricks and techniques

for establishing good tenant selection criteria.

Part III: The Brass Tacks

of Managing Rentals

This part takes you from moving in your new tenants to moving them out —

and everything in between. You get some strategies for collecting and

increasing rent, retaining tenants, and dealing with those few tenants who

give you a headache whenever your paths cross. Minimizing vacancies

and retaining tenants is the key to success as a rental owner. But when your

tenants complain incessantly, decide to repaint in nontraditional colors,

or stop paying the rent, the real challenge of managing rental housing

begins. In this part, you discover techniques for dealing with these issues

and more.

Part IV: Techniques and Tools

for Managing the Property

Assembling the right team of professionals — from employees to

contractors — is one of the main ways to find success as a landlord.

Another way involves maintenance, which can be one of the largest

controllable expenses most rental owners face. In this part, I also shed

light on how to meet the minimum standards required for your rental

property to be habitable and the pros and cons of different alternatives for

handling maintenance.

03_293294-intro.indd 403_293294-intro.indd 4 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

5

Introduction

Last but most certainly not least, because landlords and property managers

are sued more than any other business entity, you definitely want to review

the issues of crime, fire protection, environmental hazards, and the safety

and security of your rentals — and I help you do that here, too.

Part V: Money, Money, Money!

Having the proper insurance for your rental properties and property manage-

ment activities can be a complex topic, so in this part, I guide you through

the ins and outs of insurance. Taxes are another inevitability of the rental

property business, so here’s where you can find basic info on property taxes,

the way rental property income is taxed, and some of the tax advantages of

owning rental property. With all that money going out for insurance and

taxes, you also want to know just how much cash flow your rental empire is

generating, so I provide you with some basics on rental accounting and

recordkeeping.

Every seasoned rental owner should look for additional sources of income

beyond rent, including the opportunities and pitfalls of lease options, which I

cover in this part. The effect of government-subsidized housing programs

continues to play an important role in many communities, so here you can

find info on the advantages and disadvantages of working with public rental

assistance programs. Niche rental markets — like those catering to students

and pet owners — are also worthy of your consideration, and I let you know

how you can use them to your advantage.

Part VI: The Part of Tens

Here, in a concise and lively set of condensed chapters, are the tips to make

the difference between success and foreclosure. In this part, I address the

benefits of owning rental properties and tips to rent your vacancy today. I

also suggest you check out the CD for a bonus Part of Tens chapter on ten

common management mistakes and how to avoid them.

Property management and rental housing laws are dynamic, with something

new arising every day. So because I’m just that nice of a guy, I also offer an

appendix to help you navigate them. Count on the invaluable resources in

this appendix to keep you current and improve your management skills.

Icons Used in This Book

Scattered throughout the book are icons to guide you along your way

and highlight some of the suggestions, solutions, and cautions of property

management.

03_293294-intro.indd 503_293294-intro.indd 5 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

6

Property Management Kit For Dummies, 2nd Edition

Keep your sights on the bull’s-eye for important advice and critical insight into

the best practices in property management.

Remember these important points of information, and you’ll have great

success as a rental property owner.

This icon highlights the landmines that both novice and experienced rental

property owners need to avoid.

This icon points your page-turnin’ fingers to the enclosed CD-ROM to review

(and ideally use) the file or form being referenced.

Focus on this icon for real-life anecdotes from my many years of experience

and mistakes. When you’ve managed more than 40,000 rental units in 30 years,

you see some interesting situations. Now, I share them with you.

Where to Go from Here

Like any great resource book, you must read it! Property Management Kit For

Dummies, 2nd Edition, is designed to be perfect for experienced or seasoned

landlords, as well as rookies who still think all tenants are nice and prompt

with rent payments.

Whether you’re contemplating rental real estate, looking to fine-tune your

proven landlord secrets, or facing total financial ruin at the hands of the

Tenant from Hell, Property Management Kit For Dummies, 2nd Edition, offers

chapter after chapter of solid rental property management advice, especially

for the small rental property owner. It explains how to attract qualified pros-

pects; select and screen tenants; maintain the rental rate; handle security

deposits, rental contracts, broken water pipes, late rents, tenants who over-

stay (and don’t pay), and more. Find the topic you want to know more about

and start reading right there. Remember: Everything is manageable and

workable — if you know what you’re doing!

Property Management Kit for Dummies, 2nd Edition, helps you protect your

investment and maintain your sense of humor, as well as your sanity, as

you deal with one of the most unpredictable professions in life — property

management. Consider this book your Property Management Bible, written

just for you.

03_293294-intro.indd 603_293294-intro.indd 6 7/22/08 11:13:31 PM7/22/08 11:13:31 PM

Part I

So You Want

to Be a Landlord?

04_293294-pp01.indd 704_293294-pp01.indd 7 7/22/08 11:14:29 PM7/22/08 11:14:29 PM

In this part . . .

M

anaging rental property isn’t for the faint of heart,

but it can be very rewarding for the right person.

The chapters in this part guide you through the process

of figuring out whether you have what it takes to manage

rental property or whether you’re better off leaving it to a

pro — someone you hire to do the dirty work for you. I

also fill you in on what you need to know if you’re taking

over ownership of a rental property, including how to deal

with the current tenants and inform them of your policies

and procedures. This is the part for you if you’re just

starting to think about purchasing a rental property but

aren’t quite sure what that entails.

04_293294-pp01.indd 804_293294-pp01.indd 8 7/22/08 11:14:31 PM7/22/08 11:14:31 PM

Chapter 1

Property Management 101

In This Chapter

Figuring out what property management is all about and determining whether it’s in

your future

Exploring different types of real estate

Recognizing the steps involved in renting your property

Walking through the important day-to-day details of property management

Y

ou probably already have some idea of what property management

is about, because you’ve likely rented an apartment or house at some

point in your life. Even if you haven’t, I bet you’ve noticed the less-than-

flattering portrayal of landlords on television shows such as I Love Lucy

or Three’s Company. Or perhaps you’ve heard horror stories from rental

property managers you know about tenants who make their lives a living

nightmare.

The movies have also been quite unkind to rental property owners and

managers. I often feel it should be mandatory for all rental property owners

and managers to watch Pacific Heights. This film tells the infamous story of

a young couple who scrimped and saved every nickel they could to invest

in a pricey Victorian-era subdivided house in the Pacific Heights neighbor-

hood of San Francisco, only to have a con man destroy their dreams as he

systematically breaks every rule in the book — including the breeding of

roaches and physical destruction of the premises.

But don’t be fooled into thinking that property management isn’t important

or rewarding. The key to long-term success and wealth building through real

estate ownership lies in the foundation you acquire as a hands-on property

manager. For instance, often you start out managing rental properties owned

by someone else and gain a great deal of experience that you can use for

your own portfolio.

There are many positive reasons for becoming a rental property owner or

manager — and just as many ways of doing so. Perhaps you’ve saved up

the down payment to purchase your first small rental unit and hope to see

your investment grow over the years as a nice retirement nest egg or a

supplement to your current source of income. Maybe you want to invest in

05_293294-ch01.indd 905_293294-ch01.indd 9 7/22/08 11:15:54 PM7/22/08 11:15:54 PM

10

Part I: So You Want to Be a Landlord?

a medium-sized apartment building and build some equity as well as rental

income to supplement or replace your current source of income. Perhaps

you’ve inherited Aunt Gertrude’s run-down cottage and need to find a good

tenant who’ll care for it and pay the rent on time. Or maybe you’ve recently

closed on your new primary residence only to find that selling your existing

home isn’t as easy as the real estate agent promised.

Whether you plan to become a full- or part-time property manager, you need

to know what you’re doing — legally and financially. This chapter serves

as a jumping-off point to the rental property world. Here you can find useful,

practical info, tips, and checklists suitable for novice or seasoned rental

property managers. So get ready for some practical advice from the Tenant

Trenches to help you handle situations when they arise!

Understanding What Property

Management Really Is

Property managers provide consumers with a product known as shelter.

In other words, as a property manager, you’re supplying tenants with a place

to live in exchange for the payment of rent. Although property management

doesn’t seem that complex, you can avoid the many mistakes unprepared

property managers make by knowing what you’re getting into.

The following sections give you a quick overview of the pros and cons of

property management. Chapter 2 provides more in-depth analysis of these

advantages and disadvantages to help you determine whether renting your

property’s the right choice for you.

Considering the pros

Property management can be a rewarding and fun venture. I can’t imagine my

life without some aspect of property management in it (why else would I have

written this book, right?). Following are some of the reasons I get such a kick

out of this business:

Variety: Personally, I enjoy the variety of tasks and challenges found in

property management. Sure, some aspects of it are repetitious. Rent’s

due every month after all. But for the most part, every day in property

management is something new.

Interaction with different people: If you’re a people person, you’ll find

that property management is a great opportunity to meet all types of

people. Not everyone you encounter will be someone you want to make

your close friend, but you’ll certainly have the chance to work with a

smorgasbord of personalities.

05_293294-ch01.indd 1005_293294-ch01.indd 10 7/22/08 11:15:54 PM7/22/08 11:15:54 PM

11

Chapter 1: Property Management 101

Development of skills: Property management requires diverse skills,

because you must handle so many different tasks (like marketing,

screening, and maintenance, just to name a few). But it also allows you

to grow those skills beyond the basics through patience and passion,

like by moving from advertising your rental unit in a basic way to analyz-

ing ad campaigns for unrelated products and applying those concepts

to rental housing.

Experience with real estate investment: As you manage rental property,

you obtain the necessary skills to become a successful real estate

investor. Of course, some real estate investors succeed without ever

being hands-on property managers because they hire others to handle

the task for them. However, I believe every rental property owner

should gain that real estate investment expertise by actively working as

a property manager for several years.

Confronting the icky parts

You can’t expect all aspects of property management to be fun. Just like your

primary job, some days run smoothly; others are filled with problems. Here

are a couple of the bad aspects to being a property manager:

Long hours: Because you’re dealing with housing, you can’t guarantee

when you’re going to be needed. It may be 3 p.m. or 3 a.m. Like me, you

can expect to be constantly on-call, even when you’re on vacation, in

order to deal with issues that only the rental owner or property manager

can decide. Fortunately, you can minimize these inconveniences by

planning carefully and hiring competent and reliable employees and

vendors who can prevent many unexpected emergencies through good

management and maintenance. However, owning and managing rental

property remains a 24/7, year-round commitment.

Difficult tenants: Despite the great people you meet, property manage-

ment has its fill of difficult and challenging personalities, including

people who’re downright mean and unpleasant. As a rental property

owner and manager, you have to be prepared for adversarial and

confrontational relationships with others. Collecting the rent from a

delinquent tenant, listening to questionable excuses, or demanding

a contractor come back and do the job properly requires patience,

persistence, and a fair but firm approach.

The good news is that these negatives can be found in many other careers or

professions that don’t offer the benefits and satisfaction you can get from

property management. So in my opinion, the pros outweigh the cons.

05_293294-ch01.indd 1105_293294-ch01.indd 11 7/22/08 11:15:54 PM7/22/08 11:15:54 PM

12

Part I: So You Want to Be a Landlord?

Eyeing the Types of Real

Estate Available

Before you run out and purchase a rental property, you first need to have

a good idea of the different types you can own. Most real estate investors

specialize in properties with specific uses. Investment properties fall into

classifications such as residential, commercial, industrial, and retail.

For the purpose of this book, I focus only on residential real estate, because

the majority of rental real estate is housing, and the basic concepts are

easy to understand and master. (After you master the basic concepts of

residential real estate, you may want to consider other types of property

management.) The best practices I present here are applicable for these

types of residential rental properties:

Single-family houses and condominiums or townhomes: Most real

estate investors start with a rental home, condo, or townhome, because

these properties are the easiest ones for most novice landlords to gain

experience on. They may be located in a community association prop-

erty where all the common areas are the association’s responsibility.

Duplexes and small multi-family or subdivided houses: This category

includes properties with 2 to 4 units but can be up to 15 units. Often

these properties are the first choice for real estate investors who plan to

live in one of the units or want to take the next step up from investing in

a single-family rental home or condo.

Small multi-family apartment buildings: These buildings usually have

between 15 and 30 units and are best run with on-site management and

regularly scheduled maintenance and contractor visits.

Renters drive rental property management

The Census Bureau reports that more than one-

third of the U.S. population, or 80 million people,

are renters occupying 36 million rental units,

including nearly 12 million single-family home

rental properties.

Despite these impressive numbers, the individ-

ual property owner still dominates the rental

housing industry. According to the National

Multi-Housing Council, individuals own nearly

85 percent of the small rental properties

with 2 to 4 units and nearly 60 percent of the

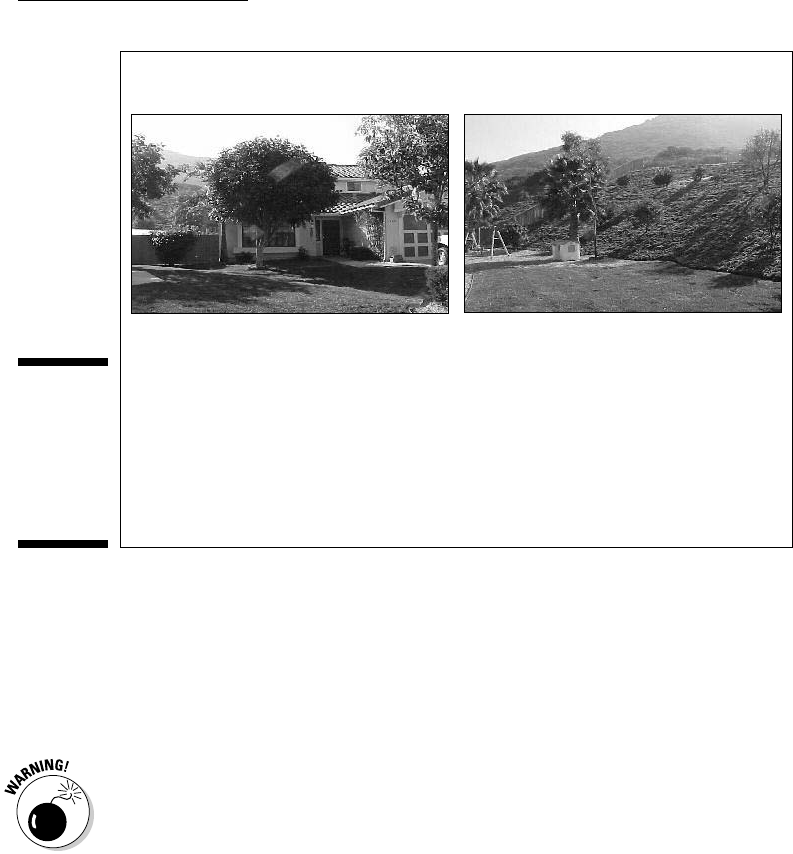

residential income properties with 5 to 49 rental