Nolo's Essential Guide To Buying Your First Home

Bu y i n g Yo u r

Home

Nolo’s Essential Guide to

• Negotiate a great price

• Get a low mortgage rate

• Make the most of today’s

market

5TH EDITION

Ilona Bray, J.D.

Alayna Schroeder, J.D.

& Marcia Stewart

Free Legal Updates at Nolo.com

“ Nolo’s excellent guide for novice home buyers provides

fresh, updated information about the whole process that

even those in the know will find useful.”

LIBRARY JOURNAL

Downloadable

FORMS

With

is Book Comes With Lots of

FREE Online Resources

Nolo’s award-winning website has a page

dedicated just to this book. Here you can:

DOWNLOAD FORMS – Access forms and

worksheets from the book online

KEEP UP TO DATE – When there are important

changes to the information in this book, we’ll

post updates

GET DISCOUNTS ON NOLO PRODUCTS – Get

discounts on hundreds of books, forms, and

software

READ BLOGS – Get the latest info from Nolo

authors’ blogs

LISTEN TO PODCASTS – Listen to authors

discuss timely issues on topics that interest you

WATCH VIDEOS – Get a quick introduction to a

legal topic with our short videos

And that’s not all.

Nolo.com contains

thousands of articles

on everyday legal and

business issues, plus

a plain-English law

dictionary, all written by

Nolo experts and available

for free. You’ll also nd

more useful

books,

software, online apps,

downloadable forms,

plus a lawyer directory.

LAW for ALL

Get forms and more at

www.nolo.com/back-of-book/HTBH.html

Downloadable

FORMS

With

“ e most complete home-buying book you will nd…doesn’t leave out any

of the essentials. On my scale of one to 10, this superb new book rates an o-

the-chart 12.”

—Robert Bruss, syndicated real estate columnist

“ Coming from a gal that knows tools, this book is a must-have tool for any

home buyer. It oers so much essential information, purchasing a home

without it would be like trying to drive a nail without a hammer!”

—Norma Vally, host of Toolbelt Diva (Discovery Home) and

author of Chix Can Fix: 100 Home Improvement Projects and

True Tales From the Diva of Do-It-Yourself

“ Any rst-time homebuyer owes it to him or herself to get this book. It’s

packed with information you won’t nd anywhere else, yet is remarkably

accessible, even when covering complex nancial issues.”

—Elisabeth DeMarse, CEO, Creditcards.com,

former CEO, Bankrate.com

“ Enthusiasm, hints and tips all rolled into a great read for rst-timers.”

—Pat Lashinsky, President of ZipRealty

“ …Provides in-depth insight and helpful advice that is easy to understand

and use.”

—Rob Paterkiewicz, CAE, IOM,

Executive Director, American Society of Home Inspectors

“Like having over a dozen real estate experts over for dinner.”

—Steve Kropper, President, Bank on Real Estate,

founder of Domania.com

“Nolo’s excellent guide for novice home buyers provides fresh, updated

information about the whole process that even those in the know will nd

useful.”

—Library Journal

5th Edition

Nolo’s Essential Guide to

Buying Your

First Home

Ilona Bray, J.D.,

Alayna Schroeder, J.D.,

& Marcia Stewart

LAW for ALL

FIFTH EDITION JANUARY 2015

Editor ILONA BRAY

Cover Design SUSAN WIGHT

Book Design SUSAN PUTNEY

Proofreading ROBERT WELLS

Index SONGBIRD INDEXING SERVICES

Printing BANG PRINTING

Bray, Ilona M., 1962-

Nolo’s essential guide to buying your rst home / by Ilona Bray, Alayna Schroeder & Marcia

Stewart. -- 5th edition.

pages cm

Includes index.

ISBN 978-1-4133-2118-0 (pbk.) -- ISBN 978-1-4133-2119-7 (epub ebook)

1. House buying. I. Schroeder, Alayna, 1975- II. Stewart, Marcia. III. Title.

HD1390.5.B734 2014

643'.120973--dc23

2014019577

is book covers only United States law, unless it specically states otherwise.

Copyright © 2007, 2009, 2011, 2012, and 2015 by Nolo. All rights reserved. e NOLO

trademark is registered in the U.S. Patent and Trademark Oce. Printed in the U.S.A.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying, recording, or otherwise without

prior written permission. Reproduction prohibitions do not apply to the forms contained in this

product when reproduced for personal use.

Please note

We believe accurate, plain-English legal information should help you solve many of

your own legal problems. But this text is not a substitute for personalized advice

from a knowledgeable lawyer. If you want the help of a trained professional—and

we’ll always point out situations in which we think that’s a good idea—consult an

attorney licensed to practice in your state.

Acknowledgments

is book was a 100% team eort and couldn’t have been written without

the advice, stories, and ideas of real estate experts and homebuyers from

around the United States. First and foremost, we thank the members of our

advisory board, who spent countless hours reviewing chapters, explaining

local practices, and sharing the best and worst memories from their

professional experiences.

Special thanks to the late Broderick Perkins, a real estate journalist

based in San Jose, California, who reviewed and contributed to every

chapter of this book’s early editions.

Our other invaluable sages included:

• Nancy Atwood, real estate broker with ZipRealty in Framingham,

Massachusetts (www.ziprealty.com)

• Amy Bach, J.D., consumer advocate and Executive Director and

cofounder of United Policyholders, a national nonprot (www.

uphelp.org), based in San Francisco, California

• Timothy Burke, founder and CEO of National Family Mortgage

(www.nationalfamilymortgage.com), based in Waltham,

Massachusetts

• Alicia Champagne, real estate attorney (www.champagneand

marchand.com), short sale negotiator, and Realtor education

teacher in Wilmington, Massachusetts

• Marjo Diehl, Mortgage Adviser at RPM Mortgage in Alamo,

California (www.rpm-mtg.com)

• Sandy Gadow, expert on real estate closing and escrow, and best-

selling author of e Complete Guide to Your Real Estate Closing

(www.escrowhelp.com)

• Kenneth Goldstein, Boston-area attorney with the law rm of Goldstein

& Herndon, LLP (www.brooklinelaw.com), and Chairman of the

Board of Selectman of the Town of Brookline, Massachusetts

• Paul Grucza, Director of Education and Client Engagement for

e CWD Group, Inc. AAMC

®

in Seattle, Washington (www.

cwdgroup.com)

• Richard Leshnower, New York-based real estate attorney

• Paul A. Rude, professional inspector and owner of Summer Street

Inspections, in Berkeley, California (www.summerinspect.com)

• Bert Sperling, city and neighborhood expert and author in Portland,

Oregon, and founder of www.bestplaces.net

• Daniel Stea, broker/owner/attorney at Stea Realty Group in Berkeley,

California (www.stearealtygroup.com)

• Fred Steingold, attorney and author in Ann Arbor, Michigan (many

of his books on small business and other legal matters can be found

on www.nolo.com)

• Russell Straub, founder, President, and Chief Executive Ocer of

LoanBright, a mortgage marketing service based in Evergreen, Colorado

(see www.loanbright.com and www.compareinterestrates.com)

• Tara Waggoner, MBA, real estate broker and Market Manager at

Redn in Houston, Texas (www.redn.com).

A number of other experts provided additional advice—you’ll see many

of them quoted in this book. ey include Neil Binder, New York real

estate investment expert (www.bellmarc.com); Elisabeth DeMarse, CEO

and president at eStreet, Inc., and New York-based real estate industry

expert (www.demarseco.com); Kartar Diamond (www.fengshuisolutions.

net); Debbie Ostrow Essex, child and family therapist based in Berkeley,

California; Stephen Fishman, attorney and Nolo author; Joanna Hirsch,

real estate agent with Pacic Union in Oakland, California (jhirsch@

pacunion.com); Joel Kinney, attorney with Fort Point Legal in Boston,

Massachusetts (fortpoint.me); Annemarie Devine Kurpinsky, associate with

George Devine, Realtor

®

; Pat Lashinsky, former President, ZipRealty; Je

Lipes, Vice President at Rockville Bank in Hartford, Connecticut; Maxine

Mackle, Connecticut Realtor

®

(www.halstead.com); Paul MacLean, retired

home inspector in Austin, Texas; Mark Nash, Associate Broker with

Coldwell Banker, who serves the Chicago, Evanston, Skokie, and Wilmette

areas of Illinois (www.marknashrealtor.com), and author of 1001 Tips for

Buying & Selling a Home; Carol Neil, independent broker and Realtor

®

in

Berkeley, California (www.pacicunion.com); Fiore Pignataro, Realtor

®

with Windermere Realty in Seattle, Washington (www.windermere.com);

Lorri Lee Ragan, formerly of the American Land Title Association (www.

alta.org); Mary Randolph, attorney and author; Frank Rathbun, Vice

President of Communications, Community Associations Institute (www.

caionline.org); Ira Serkes, Berkeley Realtor

®

with Pacic Union (www.

berkeleyhomes.com); Viviane M. Shammas, attorney and real estate broker

in Ann Arbor, Michigan (www.vivianeshammas.com); Debbie Stevens,

Oregon real estate agent (www.ramsayrealty.com); Rich Stim, attorney and

Nolo author; Craig Venezia, real estate author (www.craigvenezia.com);

and Loretta Worters, Vice President of Communications for the Insurance

Information Institute.

No amount of advice can substitute for a personal story, so we’d also

like to thank the many homebuyers who shared the good, the bad, and the

ugly of their own experiences or told us what they’d like from this book,

including Amy Blumenberg, Laurie Briggs, Dave and Danielle Burge, Karen

Cabot, Linda Chou, Jennifer Cleary, Jaleh Doane, Phil Esra, Lisa Guerin,

Gabrielle Hecht, Pat Jenkins, Ellie Kania, Justin and Tamara Kennerly, Chris

and Libby Kurz, Talia Leyva, Willow Liro, Meggan O’Connell, Evan and

Tammy Ohs, Leny and Frank Riebli, Leah Scheibe, Diane Sherman, Bruce

Sievers, Luan Stauss, Tom and Heather Tewksbury, Catherine Topping, Josh

and Gillian Viers, Julie and Malachi Weng-Gutierrez, and Kyung Yu.

Within Nolo, we got huge amounts of help from our talented

colleagues. Rich Stim did an excellent job with the audio interviews.

Other colleagues who lent a hand, researching everything from 50-state

legal matters to fun facts, included Cathy Caputo, Lexi Elmore, Jessica

Gillespie, Stan Jacobsen, Terry McGinley, Kathleen Michon, Stephen

Stine, Leah Tuisavalalo, Charles Walmann, and Jo Warner. Sandy Coury

and Sigrid Metson helped line up advisory board members. Particularly

heartfelt thanks go to the late Steve Elias, whose energy and expertise on

foreclosure matters are sorely missed by everyone at Nolo.

Big thanks to our colleagues in the editorial department, who supported

us through the (long) process of writing this comprehensive (and yet fun!)

text. Kudos to Susan Putney in Nolo’s Production Department who took

a challenging compilation of information and turned it into a beautifully

designed book.

anks also to Nolo founder Jake Warner, who championed this book

idea for many years.

Our basements may be cluttered, our gardens may need weeding, and

our oors may need a good scrubbing—but we love our homes. anks

to the people who helped us get there—professionals (some who taught

us what to do, others who taught us what not to do!) and our families,

who share the joy of homeownership with us.

About the Authors

Ilona Bray is an attorney, author, and legal editor at Nolo. Her other real

estate books include e Essential Guide for First-Time Homeowners and

Selling Your Home: Nolo’s Essential Guide. Her working background

includes solo practice, nonprot, and corporate stints. She sold her rst

home at a prot—despite being in the middle of a real estate downturn—

and bought a larger home. Her fantasy house would be a Greene &

Greene mansion of the same style (like the Gamble House in Pasadena),

with a large sun porch and lots of surrounding trees.

Alayna Schroeder is an attorney whose legal experience has included

everything from work at a corporate law rm to editing and writing

to a stint in the Peace Corps. According to Sacramento Magazine, her

rst home, which she shared with her husband, twin babies, and a

Bolivian-born dog, Luna, was in one of the Sacramento area’s ten Great

Neighborhoods—a fact Alayna tried to remember as she redid the aging

plaster and desperately searched for adequate closet space into which to

stu modern-day baby gear. Alayna’s idea of a fantasy house is always

changing, but she’d settle for an A-frame in the woods with a lake view, big

deck, and gourmet kitchen.

Marcia Stewart is the author or editor of many Nolo real estate books,

including the best-selling Every Landlord’s Legal Guide. Years ago, she

found the perfect “starter” house in one of her favorite neighborhoods.

As her family started to grow, so did the house, with a new second story

and deck. Most recently she (nally!) remodelled her 1950s kitchen. Her

fantasy house would be a Queen Anne Victorian with a home theater and

a beautiful garden and pool.

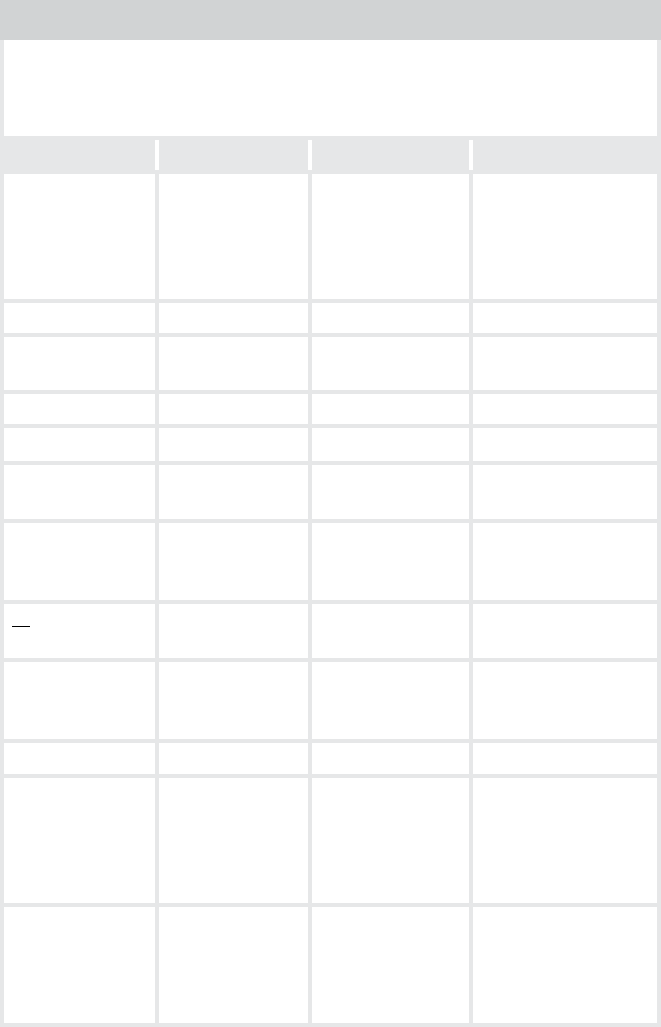

Your Homebuying Companion ...........................................................................1

1

What’s So Great About Buying a House? .................................................5

Investment Value: Get What You Pay For … And en Some ......................8

Tax Breaks: Benefits From Uncle Sam .........................................................................11

Personality and Pizzazz: Your Home Is Your Castle ...........................................14

No More Landlord: Say Goodbye to Renting .........................................................15

You Can Do It … If You Want To ..................................................................................16

2

What Do You Want? Figuring Out Your

Homebuying Needs ......................................................................................................23

Know Your Ideal Neighborhood: Why Location Matters ..............................26

Know Yourself: How Your Lifestyle, Plans, and Values Affect

Your House Priorities .........................................................................................................28

Know Your Ideal House: Old Bungalows, New Condos, and More .........30

Would You Like Land With at? Single-Family Houses ................................30

Sharing the Joy, Sharing the Pain: Condos and Other

Common Interest Properties........................................................................................33

Factory Made: Modular and Manufactured Homes ......................................... 37

Putting It All Together: Your Dream List ..................................................................38

3

Does is Mean I Have to Balance My Checkbook?

Figuring Out What You Can Afford ............................................................47

Beyond the Purchase Price: e Costs of Buying and Owning a Home

........51

Spend Much? How Lenders Use Your Debt-to-Income Ratio ..................... 57

Blasts From the Past: How Your Credit History Factors In ............................59

What’s Your Monthly Budget? Understanding Your Finances ...................65

Table of Contents

Getting Creative: Tips for Overcoming Financial Roadblocks .....................67

e Power of Paper: Getting Preapproved for a Loan ...................................... 68

4

Stepping Out: What’s on the Market and at What Price ....... 73

What’s the Buzz? Checking Out Neighborhoods From Your Chair ........76

See for Yourself: Driving rough Neighborhoods ............................................85

On Foot: Talking to the Natives......................................................................................86

Sunrise, Sunset: Getting Day and Night Perspectives ....................................... 87

Got Houses? Finding Out What’s Locally Available ...........................................88

How Much Did at One Go For? Researching “Comparable” Sales .....90

Hot or Cold? Take the Market’s Temp ........................................................................92

Just Looking: e Open House Tour ...........................................................................94

Nothing to Look at Yet? Finding Your Dream Development .....................95

5

Select Your Players: e Real Estate Team .......................................... 97

Your Team Captain: e Real Estate Agent .........................................................100

Your Cash Cow: e Mortgage Broker or Banker .............................................114

Your Fine Print Reader: e Real Estate Attorney ............................................120

Your Sharp Eye: e Property Inspector ................................................................ 128

Your Big Picture Planner: e Closing Agent .......................................................132

Strength in Numbers: Other Team Members .................................................... 136

6

Bring Home the Bacon: Getting a Mortgage ..................................137

Let’s Talk Terms: e Basics of Mortgage Financing ....................................... 140

Who’s Got the Cash? Where to Get a Mortgage .............................................. 146

Narrowing the Field: Which Type of Mortgage Is Best for You? ............. 146

Getting Your Cash Together:

Common Down Payment

and Financing Strategies .............................................................................................................. 153

Where Do I Look? Researching Mortgages ............................................................ 155

I’ll Take at One! Applying for Your Loan .......................................................... 156

New-Home Financing ........................................................................................................ 162

Unique Financial Considerations for Co-op Buyers ........................................164

7

Mom and Dad? e Seller? Uncle Sam?

Loan Alternatives ......................................................................................................... 165

No Wrapping Required: Gift Money From Relatives or Friends ............ 168

All in the Family: Loans From Relatives or Friends ......................................... 172

A One-Person Bank: Seller Financing ....................................................................... 182

Backed by Uncle Sam: Government-Assisted Loans ....................................... 185

8

I Love It! It’s Perfect! Looking for the Right House...................191

How Your Agent Can Help ............................................................................................. 194

e Rumor Mill: Getting House Tips From Friends ........................................ 197

Keeping Track of New Listings ...................................................................................... 197

Planning Ahead for House Visits ................................................................................. 198

Come on In: What to Expect as You Enter ........................................................... 199

Do We Have a Match? Using Your Dream List ................................................... 203

All the World’s Been Staged: Looking Past the Glitter ................................ 203

Recent Remodels: What to Watch Out For ......................................................... 204

Walk the Walk: Layout and Floor Plan ....................................................................205

What Do ey Know? Reviewing Seller Disclosure Reports ......................206

Reviewing the Seller’s Inspection Reports (If Any) ...........................................211

Poking Around: Doing Your Own Initial Inspection .......................................215

Hey, Nice Dirt Pile! Choosing a Not-Yet-Built House .......................................215

Buying a New or Old Condo or Co-op? Research the Community .......219

9

Plan B:

Fixer-Uppers, FSBOs, Foreclosures, and More ................. 225

Castoffs: Searching for Overlooked Houses ......................................................... 228

Look What’s Back on the Market! ..............................................................................230

A Foot in the Door: Buying a Starter House ........................................................ 231

Have It Your Way:

Buying a Fixer-Upper or House You Can Add on To ....... 232

Share Your Space: Buying Jointly ................................................................................ 235

Subdivide Your Space: Renting Out a Room ....................................................... 238

Hey, Where’s eir Agent? Looking for FSBOs (For Sale by Owners) ...... 239

Buying a Short Sale Property ..........................................................................................242

Buying a Foreclosure Property ..................................................................................... 246

Buying a House in Probate .............................................................................................. 252

10

Show em the Money: From Offer to Purchase

Agreement........................................................................................................................... 255

Start to Finish: Negotiating and Forming a Contract .................................... 259

More an Words: What’s in the Standard Purchase Contract .............264

Too Much? Not Enough? How Much to Offer ...................................................268

Keeping Your Exit Routes Open: Contingencies .............................................. 273

Putting Your Money Where Your Mouth Is: e Earnest

Money Deposit ................................................................................................................... 278

Divvy It Up: Who Pays What Fees ..............................................................................280

Deal or No Deal: Picking an Expiration Date .......................................................280

ink Ahead: Closing Date ............................................................................................. 281

Strategies in a Cold Market: What to Ask For ....................................................282

Strategies in a Hot Market: Making Your Offer Stand Out ...................... 283

Contracting to Buy a Brand-New Home................................................................284

11

Toward the Finish Line: Tasks Before Closing ...............................287

Wrappin’ It Up: Removing Contingencies ............................................................. 291

Will It Really Be Yours? Getting Title Insurance.................................................301

Yours, Mine, or Ours? What to Say on the Deed ..............................................306

Get Ready, ‘Cause Here I Come: Preparing to Move .......................................310

12

Send in the Big Guns: Professional Property Inspectors .......317

Home Inspection Overview: What, When, and at What Cost? ............... 320

House Calls: Your General Home Inspection ...................................................... 322

Tagging Along at Your General Home Inspection ........................................... 325

Say What? Understanding Your General Home Inspection Report ..........327

Termite or Pest Inspections ............................................................................................ 329

When to Get Other, Specialized Inspections .......................................................331

Trouble in Paradise: Inspecting Newly Built Homes ....................................... 333

13

Who’s Got Your Back?

Homeowners’ Insurance

and Home Warranties ..........................................................................................................337

Coverage for Your House .................................................................................................340

Damage Your Homeowners’ Insurance Won’t Cover .................................... 345

Protection for Others’ Injuries: Liability Insurance .......................................... 347

Your Out-of-Pocket: Homeowners’ Insurance Costs...................................... 350

Insurance Deductibles ........................................................................................................351

Shopping Around for Homeowners’ Insurance ................................................. 354

Types of Insurance Companies......................................................................................355

Jointly Owned, Jointly Insured: What Your Community

Association Pays For ...................................................................................................... 356

Home Warranties for Preowned Houses ............................................................... 357

Home Warranties for Newly Built Houses ............................................................ 358

14

Seal the Deal: Finalizing Your Homebuying Dreams ............. 361

Preview of Coming Attractions: What Your Closing Will Involve ..........364

Is It Really Empty? Final Walk-rough of an Existing House ....................369

Is It Really Finished? Final Walk-rough of a New House .......................... 372

Your Last Tasks Before the Closing .............................................................................375

e Drum Roll, Please: Attending the Closing ..................................................382

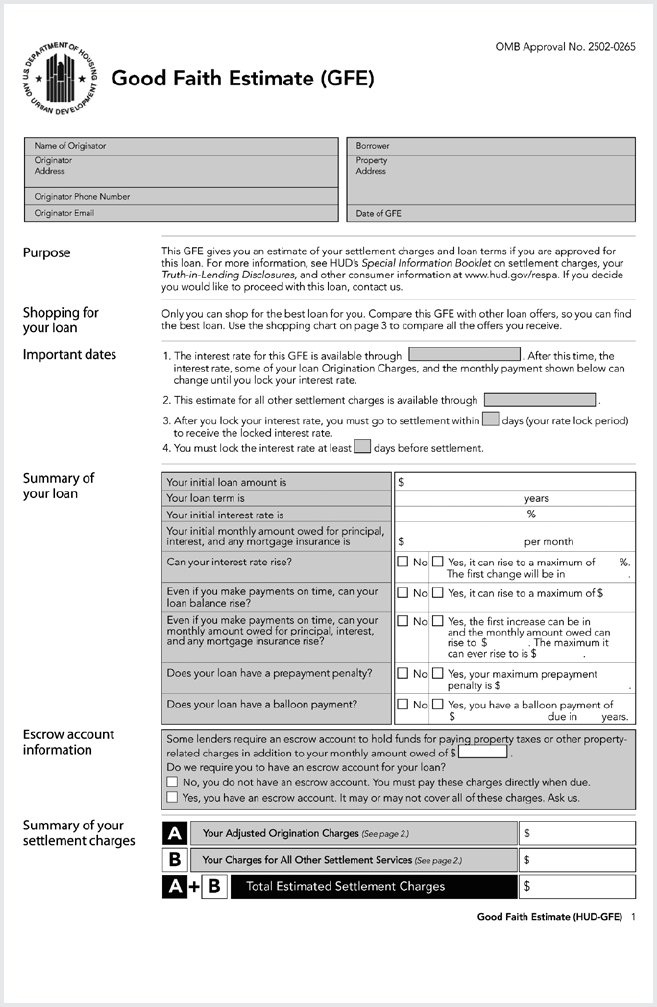

Closing Documents Related to Your Mortgage Loan .................................... 383

Closing Documents Related to Transferring the Property ......................... 385

Can I Move In? Taking Possession...............................................................................386

15

Settling Into Your New Home ........................................................................389

Tell the World You’ve Moved ........................................................................................392

Home, Hearth, and Hors d’Oeuvres: Settle in Socially ..................................394

e Safest Home in Town: Yours ................................................................................ 396

Cozy Up …Without Breaking the Bank .................................................................. 397

ere’s a Place for It: Organize Your Records ......................................................403

Back to the Future: Get Your Finances on Track ..............................................407

A

Using the Interactive Forms ............................................... 409

Editing RTFs ............................................................................................................................... 410

List of Forms ..............................................................................................................................411

Index............................................................................................................................................413

Your Homebuying Companion

B

uying your rst house may be one of the rst certiably grown-

up things you ever do. And no matter how ready you feel,

taking a major step like this—particularly one where there

are so many zeros on the price tag—can make you want to just close

your eyes and get it over with.

But if you’re going to invest your time and money, you want to

make sure you don’t nd just any house—you nd the right house, at

the right price, with the right loan. A house you’re happy to stay in for

a long time, no matter what the market does. To do that, you need a

lot of information.

is book is full of nuts-and-bolts information about the homebuy-

ing process. But it’s also got anecdotes and advice that we hope will

remind you to enjoy this exciting, if sometimes frustrating or nerve-

wracking process. Keep in mind what you’re aiming for: your own

home, where you’re free to pound nails in the wall, get a cat, or paint

your bedroom any color you want, without asking the landlord!

By the time you’ve read the key information here (don’t worry,

you won’t have to read every chapter or every section), you’ll truly be

ready. We’ll show you how to:

• choose the appropriate house in the best possible neighborhood,

whether it’s an old bungalow on a tree-lined street, a condo in

the city center, or a custom-built home in a new development

• narrow in on a realistic price range based on your budget, and

strategize ways to aord more

• select from a variety of nancing options, from a 30-year xed

rate mortgage (like the one Mom and Dad got) to a private loan

from a relative or friend

• pick a great real estate agent, mortgage broker, home inspector,

and other professionals

• negotiate and sign an agreement to buy a house (nd out what’s

important in all that ne print)

2

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

• wrap up your nancing, get inspections, and take care of other last

tasks, and nally

• close the deal, arrange your move, and settle into your new home.

You’re going to benet from the expertise of a team of 14 advisers from

around the country who have reviewed this book and added the kinds

of insights you usually get only in personal conversations. For instance,

you’ll meet a mortgage broker who explains why you should avoid oral

loan preapprovals; a real estate agent who cautions against dressing too

well at open houses (it can hurt your negotiating position); a closing

expert with straightforward advice on why you should care about things

like “easements” and title insurance; and a lawyer who suggests how to

save on attorney’s fees.

With this book comes special access to electronic materials on Nolo’s

website. ere you’ll nd a Homebuyer’s Toolkit with over two dozen

forms, checklists, and letters to help keep you organized and on track

during every stage of the process. Whether it’s a “Dream List” that prompts

you to set out your priorities, checklists to carry when you tour a house or

condo, or a set of interview questions for potential real estate agents, you’ll

nd it there. And as a bonus, it includes MP3s with interviews of several of

our advisers, plus this book’s authors, who share their insights.

CHAPTER 1

Learn the

benefits

CHAPTER 2

Decide what

you want

CHAPTER 4

Check out

the market

CHAPTER 5

Choose

professionals

CHAPTER 3

Make a budget

START

Navigating the path to

YOUR FIRST HOME

CHAPTER 1 | YOUR HOMEBUYING COMPANION | 3

e three authors of this book, Ilona, Alayna, and Marcia, bring not

only years of legal and real estate expertise, but also dierent rst-time

homebuying perspectives of our own. One of us bought with a 15-year

mortgage, (since paid o) so she had no house payments when it came time

to pay her son’s college tuition. Another bought with the help of family

members and now has probably the lowest mortgage payment on the block

in one of the city’s up-and-coming neighborhoods. And the third bought

a modest starter home with a hybrid adjustable rate mortgage, xed it up,

and managed to ride out the down market until she could sell.

Our varied experiences help us understand that everyone has dierent

objectives when buying and special challenges when buying for the rst

time. You may just be looking for a place—any place—to get started, you

may want the challenge of a xer-upper, or you might need the convenience

of a low-maintenance condo. We know that you might be doing this alone,

with your spouse or partner, or even with a friend. No matter who you are

or what your goals and objectives may be, we hope you recognize yourself

in some of the stories and experiences reected in this book.

So hang on tight—to this book, that is. It will be your companion,

providing advice, information, and inspiration all along the path to your

new front door.

CHAPTERS 6/7

Get a

mortgage

CHAPTERS 8/9

Find your house

CHAPTER 10

Negotiate

the deal

CHAPTERS 11/12 /13

Inspect, insure, prepare

to move

CHAPTER 14

Seal the deal

CHAPTER 15

Settle in! You’re

HOME

4

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

Get Updates, Worksheets, and More at is Book’s

Companion Page on Nolo.com

When there are important changes to the information in this book,

we’ll post updates online, on a dedicated page:

www.nolo.com/back-of-book/HTBH.html

And if you notice a useful sample form in this book, such as a letter

or checklist, you’ll have access to a digital version via the same

companion page. You‘ll find other useful information on that page,

too, such as podcast interviews with the authors and some of the

advisers you’ll get to know in this book. See the appendix for a full list

of forms and podcasts on Nolo’s website.

Investment Value: Get What You Pay For … And en Some ...............................8

Leverage .................................................................................................................................................... 8

Equity, Baby ............................................................................................................................................ 9

It Beats Paying Rent ............................................................................................................................9

You Can Live in Your Investment .............................................................................................10

You Can Borrow on Your Investment ....................................................................................10

My, You’re Looking Creditworthy! ...........................................................................................10

at House Is Yours ..........................................................................................................................11

Tax Breaks: Benefits From Uncle Sam .................................................................................... 11

Tax Credits ............................................................................................................................................11

Mortgage Interest .............................................................................................................................12

Other Tax-Deductible Expenses ................................................................................................12

Itemizing Your Deductions ..........................................................................................................13

Capital Gains Tax Relief When You Sell.................................................................................14

Personality and Pizzazz: Your Home Is Your Castle.....................................................14

No More Landlord: Say Goodbye to Renting ....................................................................15

You Can Do It … If You Want To ..............................................................................................16

“But … I Like Renting” ......................................................................................................................16

“But … I Can’t Afford It” .................................................................................................................17

“But … I’m Single” ..............................................................................................................................18

“But… It’s Too Much Responsibility!” .....................................................................................19

“But…Maybe Prices Will Go Down!” .....................................................................................20

“But … I’m Still Scared!” ..................................................................................................................20

CHAPTER

1

What’s So Great About Buying a House?

6

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

Meet Your Adviser

Daniel Stea, broker/owner/attorney at Stea Realty Group,

in Berkeley, California (www.stearealtygroup.com).

What he does “I spend a great deal of my day simply talking with buyers and

sellers, as well as evaluating properties for them. We‘re always

running ‘comps.’ Prospective buyers want to make sure they’re

not paying too much; sellers want to make sure they’re not

asking too little. We’re always looking at what other properties

recently sold for, since that’s a key indication of where the

market is currently at. Sure, many websites will give you real

estate ‘comparables,’ but these are generally based on the

average price per square foot of other properties that have

recently sold. But it takes a human who has actually walked

through all of those properties to start adding and subtracting

for various attributes such as location, condition, schools, and

so on. at’s one of the values of what brokers bring to the table

and why their services will always be in demand.”

First house

“It was an adorable English Tudor in the Oakland hills, which I

bought for $190,000. Built in 1927, it was full of character—and had a

$90,000 pest report and leaked like a sieve. e original roof was still

there, with multiple subsequent roofs layered right over it. It was a

memorable home! I lived there for five years, completely rehabilitated

it, and then sold it when Oakland real estate was finally coming

around and moved to a home closer to my office in Berkeley.”

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 7

Fantasy house “I’m not sure it exists! Like most of our clients, I’d love to have a

place that’s highly walkable to everything urban. But I’d also like a

view of the San Francisco Bay, which is tough to get unless you’re

a considerable distance up the hills. Only a few homes exist in

that sweet spot in between. And they obtain multiple offers and

sell for a premium price in the current market. Style-wise, I see

something to appreciate in almost every type of house: from the

old ones that need a lot of work to the modern ones with walls of

glass and high ceilings, many of which have more character than

they are given credit for.”

Likes best

about his work

“Finding that we can bring clarity to people’s confusion.

Homebuyers show up full of questions, wondering things like,

‘What is the process?’ and ‘How much should we offer?’ We

educate them about the market and the process and give them

the tools they need to feel empowered. Once they feel confident,

we’re ready to begin shopping.”

Top tip for

first-time

homebuyers

“Be patient. A lot of people come to us in a panic, saying, for

example, ‘We just got into town, we don’t want to waste our

precious money on these exorbitant rents, and we need to buy

something right away.’ But the process will go much smoother if

you give yourself some time—ideally, six months to a year—to get

to know the market, walk the neighborhoods, and learn about

the homebuying process. In fact, if you’re relocating here from

Washington, DC, New York, or Boston, like many of our clients have,

I’d say rent first! It’s very difficult to come into a new city for a month

and know where you want to live. Begin working with a Realtor

®

long before you’re ready to make your first purchase offer. We earn

the same commission whether our buyers purchase now or in a

year—and it’s important for them to be pleased with the home they

select so that they’ll refer us to their family, friends and coworkers.”

8

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

P

icking up a book on homebuying for some light reading? We’re

guessing not. If you’re reading this, you’re probably seriously

interested in buying a house. But before we launch into how, let’s

explore why—just in case you’ve got any lingering doubts about whether

it’s a good idea. is chapter will preview some of the primary nancial

and personal benets to buying a home (and you’ll nd details on many

of the subjects covered, such as tax benets, in later chapters). en we’ll

talk about some common myths and fears, and how to get over them.

ever did

est thing I

B

Buy my first home. Although Leah was happy with her

rental place, she says, “I wanted a place that I could call

my own, with a backyard for my cats, and space for an office so I could work at

home full time. After three weeks of looking, I found it! And after a year, some of

the best parts of homeownership are things I wasn’t even expecting—like having

already gotten to know more neighbors than I did during a whole six years in

my apartment. Plus, although I’ve never thought of myself as domestic, I’ve had

a surge of interest in decorating—I put up Roman blinds, have been picking out

paint colors, and just bought my first Christmas tree!”

Investment Value:

Get What You Pay For … And en Some

You’ve probably heard people talk about real estate as a great investment.

But what exactly do you get out of the deal? Well, a few things: You’ll build

equity instead of spending cash on rent, you gain immediate benets (a

place to live!), and you’ll eventually have full ownership of an asset that—at

least over the long term—has a good chance of appreciating in value.

Leverage

Buying a home is one of those rare instances where you can control a

very large and potentially appreciating asset with a comparatively small

initial cash investment (your down payment). Better yet, notes adviser

Daniel Stea, “You’re using the proverbial ‘OPM’ (other people’s money)

for the balance of the investment, and that money is being lent to you

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 9

at comparatively low cost given the historically low interest rates we’ve

experienced these past few years. Yet you get to enjoy the appreciation on

the full value of the investment, not just your cash component. It almost

doesn’t seem right!”

Equity, Baby

Over time, as you patiently pay your mortgage, two things may start

happening—your principal loan balance will go down, and the house’s

market value may go up. Both of these mean that you’re accruing equity.

Equity is the dierence between the market value of a house (what it’s

currently worth) and the claims against it (what you have left to pay on

any mortgages or loans you’ve taken out against it). You’d be hard-pressed

to nd another investment where you can borrow a large amount of

money, pay a modest interest rate, and reap every bit of the gain yourself.

EXAMPLE: Hugo buys a home for $300,000 with a $60,000 down

payment (20%) and a $240,000 mortgage. If the market value of the

house is $300,000, Hugo’s current equity in the home is $60,000

(market value minus mortgage debt). A few years later, Hugo has

reduced the principal on the mortgage by $5,000, to $235,000.

Meanwhile, the house’s value has risen to $310,000. Hugo now has

$75,000 in equity: ($310,000 minus $235,000). at’s $15,000 more

than he originally invested.

Of course recent history has shown that the value of a property

doesn’t always increase: It can also decrease, sometimes dramatically.

Fortunately, houses rarely drop in value permanently. And after some

precipitous value drops in the early 2000s, home appreciation in 2013

was running at an average of around 12%, according to the S&P/Case

Shiller Home Price indexes.

It Beats Paying Rent

A good chunk of the money you’ll use to nance your home is money

you’re already spending anyway, on rent. When you buy a house, that

cash is actually going into your investment.

10

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

You Can Live in Your Investment

Some people like to call a mortgage a forced savings plan, because it

makes you sock a little cash away every month in the form of a mortgage

payment—money you will, with any luck, get back when you sell the

place. On the other hand, you might call it a smart investment plan,

because it gives you both a roof over your head and a way to convert your

cash into a potentially appreciating asset.

You Can Borrow on Your Investment

Eventually, as your equity in your home builds, you can borrow against

it at relatively low interest rates, using a home equity loan or a HELOC

(home equity line of credit). ese are also commonly referred to as

“second mortgages.”

e interest rates on these tend to be higher than on primary mortgages,

but lower than on the typical credit card. e money borrowed can be used

for any number of purposes, such as home improvements, college tuition,

or a car. Better yet, if you use the money for home improvements, the

interest is tax deductible, up to $1 million.

Of course, there are risks—if you default and your house goes into

foreclosure, the lender is second in line to be paid from the proceeds of

the sale of your house, after the primary mortgage holder.

My, You’re Looking Creditworthy!

We hear so much about people who ruined their credit score by getting

foreclosed on that it’s hard to remember the reverse side of the picture:

A mortgage is seen as “good debt.” When you successfully pay it down,

credit-reporting companies view that as a sign that you’re responsible and

able to handle a large loan.

“is can do wonders for your credit rating,” says adviser Daniel Stea.

“It makes you a much better credit risk (statistically speaking), which

becomes especially useful if you decide to apply for an auto loan, small-

business loan, student loan for your kid’s college tuition, and so on.”

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 11

at House Is Yours

One benet to buying a house is kind of obvious ... you’re becoming a

homeowner, and when the loan is paid o, you won’t have to pay for a

place to live. You could keep renting the same place you’re in now for 50

years, and at the end of that time you’ll still have to pay monthly rent

checks to your landlord.

Tax Breaks: Benefits From Uncle Sam

You’ll get to claim various federal tax deductions and credits for home-

related expenses. ese can add up to some serious savings.

Tax Deductions Versus Tax Credits

Be careful not to confuse a tax deduction with its more valuable cousin,

a tax credit. A tax deduction is an amount you subtract from your gross

income (all the money you earned during the year) to figure out how

much of your income is subject to tax. For example, if your gross income

is $80,000, and you have a $2,000 tax deduction, your taxable income is

reduced to $78,000.

A tax credit, by contrast, is a dollar-for-dollar reduction in your tax

liability. If your taxable income is $80,000, and you qualify for a $2,000

tax credit, your taxable income is still $80,000, but you get to reduce the

amount of tax you ultimately owe by $2,000.

Tax Credits

As a new homeowner, you may be entitled to certain tax credits.

• Tax credit for first-time homebuyers. At the time this book went to

print, all the tax credits for rst-time homebuyers had expired—but

keep an eye on the news and www.irs.gov for anything new that

might come along.

12

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

• Tax credits for energy-efficiency. A tax credit good through 2016 lets

you claim 30% of the cost of installing geothermal heat pumps,

small wind turbines, fuel cells, or solar energy systems. For more

information, visit www.energystar.gov (search for “tax credit”).

Mortgage Interest

One of the biggest deductions will be the interest you pay on your home

mortgage (available for mortgages of up to $1 million for individuals and

married couples ling jointly and $500,000 for marrieds ling separately).

is one’s particularly advantageous during the rst few years of a xed rate

mortgage, when most of your payment will be put toward interest.

Other Tax-Deductible Expenses

You can also deduct certain other expenses, such as:

• Property taxes. While the amount varies between states and localities,

most people pay around 1% of the home’s value each year in state

property tax. is amount is deductible from your federal taxes if

you itemize.

• Points. Points are additional and usually optional fees paid when

you buy your mortgage (you get a reduced interest rate in return).

ey’re tax-deductible in the year you pay them.

• Interest on a home improvement loan. If you take out a loan to make

improvements that increase your home’s value, prolong its life, or

adapt its use—for example, by adding a deck or a new bathroom—

you can deduct the interest on that loan, with no limit. But you

can’t deduct interest on loans used to make normal repairs, such as

repainting the kitchen or xing a broken window.

• Interest on home equity debt. Sometimes you can deduct interest

on a home equity loan even if the money isn’t used to buy, build,

or improve your home—for example, if you use it toward a child’s

college tuition or family medical bills. e deduction is limited to a

maximum loan amount or the total fair market value of the home

less other mortgages. e maximum loan amount is $100,000

for an individual or married couple ling jointly and $50,000 if

married but ling separately.

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 13

• Home office expenses. If you use part of your home exclusively and

regularly for a home-based business, you may be able to deduct a

portion of the related expenses—including the costs of some home

repairs, or even things like landscaping if your home’s appearance

will be important to visiting clients.

• Moving costs. If you move because of a new job that’s more than 50

miles from your current residence, you may be able to deduct your

moving expenses.

• Prepayment penalties. Although we advise against getting a mortgage

with a prepayment penalty (as discussed in Chapter 6), if you do,

and then you make a prepayment, the penalty you pay will be tax-

deductible.

Itemizing Your Deductions

To take advantage of house-related tax deductions, you’ll need to itemize

your tax deductions, rather than take the standard deduction (for 2014 tax

returns, $6,200 for individuals and $12,400 for marrieds ling jointly).

e true tax savings comes in the dierence between your tax liability

when you take the standard deduction and your tax liability when you

itemize. Itemizing involves a step up from the good old 1040EZ, but it’s

not all that complicated. To make it worthwhile, your itemized deductions

should exceed the standard deduction. With the high price of real estate,

it’s not usually too hard to outpace the standard deduction with deductible

homeowner costs, not to mention other deductible expenses like donations

to your favorite charity.

EXAMPLE: Let’s say you get a $200,000 xed rate loan at 4% interest

in 2014. You’re looking at paying nearly $8,000 the rst year in inter-

est alone. at doesn’t count property taxes, points on the mortgage,

or any other tax-deductible expenses.

If you’re single, the standard deduction is $6,200. But if you itemize

your deductions, you could deduct the $8,000 in interest payments

instead. By itemizing even this one deduction, almost $2,000 less of

your income will be taxed.

14

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

TIP

Keep good records. You’ll be able to reap the benefits of itemizing

your deductions only if you know about them and are prepared to prove them

to the IRS—all of them, not just the house-related ones. Keep a file of receipts for

the more common deductions, such as unreimbursed business expenses (office

equipment and travel); educational expenses (tuition and books); charitable

contributions; and unreimbursed medical expenses. Consider getting help from a

tax professional—even your meeting might be tax-deductible!

CHECK IT OUT

Go straight to the source. See IRS Publication 530, Tax Information

for Homeowners, available at www.irs.gov. is publication will give you more

detailed information about the tax benefits of buying a home.

Capital Gains Tax Relief When You Sell

While it may be too soon for you to imagine selling your rst home,

another important benet is available if and when you do. anks to the

Taxpayer Relief Act of 1997, you don’t pay capital gains tax (usually 15%)

on the rst $250,000 you make on the place. Double that to $500,000 if

you’re married and ling jointly, or to $250,000 per person if you co-own

the place.

To qualify, you must (with a few exceptions) have lived in the home

two out of the previous ve years before selling. Many rst-time buyers

use this tax break to move from modest starter homes to roomier homes

that cost more.

Personality and Pizzazz:

Your Home Is Your Castle

If you’ve always been a renter, you know the drill: ings stay the way

they were when you moved in. White walls stay white, ugly carpeting

stays ugly, and the funky bathroom light xture stays funky.

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 15

When it’s your home, you get to make your mark. ere’s just no

way to quantify the psychological advantage of personalizing your space.

Even people who’ve never taken an interest in home decorating, repair,

or gardening nd themselves hooked on the creativity and self-expression

possible with home projects.

No More Landlord:

Say Goodbye to Renting

Expressing your personality isn’t the only advantage to leaving rental

living behind. Say goodbye to things like waiting around for things to

get xed, wondering whether the landlord will raise your rent or kick you

out anytime soon, and being

surprised by landlords who stop

by at their own convenience.

Even reasonable landlords

who make prompt and thorough

repairs and never raise the rent

can pull surprises or sell the

property. Owning your own house

reduces the stress and uncertainty

of renting. You’re in charge of

when you move on, who comes

in the front door and when,

and what gets done to the place. While that means you’ve got some extra

responsibilities, you’ve denitely got some extra security and benets, too.

ever did

est thing I

B

Make monthly payments to myself, not the landlord.

At age 25, Talia had only toyed with the idea of buying a

house—she’d thought that, despite her full-time job, it was financially impossible.

But then her landlord raised the rent. Talia says, “I looked into loan options—and

to my surprise, I qualified. Within two months, I bought a converted first-floor

apartment with a little patio, in a safe neighborhood. I love not having to share

a washer and dryer with other people anymore. But even better is the feeling of

independence of having my own place: Because I’m building equity, I like to think

The Future’s So… Expensive!

If you pay $1,000 in monthly rent now,

approximately how much will you be paying

in 40 years, assuming average inflation

(4% per year) and no rent control?

a. $2,500 b. $3,400 c. $4,800

d. None of the above,

because I’ll own a home.

Answer: c or d.

16

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

I’m making those mortgage checks to myself—and they’re not that much higher

than my rent checks were, plus I can claim some significant tax deductions.”

You Can Do It … If You Want To

Are you still on the fence about homebuying? Some people just don’t

feel ready to take the plunge. Below are a list of common “I can’t do

it because …” excuses. Don’t get us wrong: Not every excuse is a bad

excuse. You just need to know whether yours are based on solid facts

rather than plain old fear.

“But … I Like Renting”

Maybe you’re thinking, I really love my apartment or, I’m getting such a

good deal. But even if your current rent seems cheap, cheap is never as

good as free. Yes, we’re aware that buying a house isn’t free. But at some

point, you won’t be paying a mortgage anymore. at will never be true if

you rent.

CHECK IT OUT

Run your own numbers. ese calculators compare the costs of

renting and buying:

• www.nytimes.com(searchfor“Isitbettertobuyorrent?”)

• www.nolo.com/legal-calculators(click“ShouldIrentorbuy?”).

While you’ll need to guess how much you’ll spend on a home to use these

calculators, the result will at least give you a rough comparison. Revisit the

calculators after you’ve looked at Chapters 3 and 6 (covering the financial details

of buying a house).

All that being said, renting might be best in the following situations:

• You plan on moving from the area within the next few years. Buying is

a long-term strategy, with signicant up-front costs. Plus, it’s easier

to move out of a rental than a home you own—selling is almost as

complicated as buying.

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 17

• You need flexibility. Buying is best for people whose lives are fairly

stable. If your rst priority is being able to quit your job any time a

friend proposes a round-the-world sailing trip, maybe homeowner-

ship will feel more like a trap than a positive step. (en again, we’ve

met travelers who’ve sublet their house and supported their travels

with the rent payments!)

• You expect your income to decrease soon. If you’re planning to

return to school or quit your 9 to 5 to pursue an acting career, you

might not want to lock yourself into a mortgage. Still, you may be

a potential homebuyer if you can aord something more modest

within your anticipated future income or can pay the mortgage by

co-owning the property or taking in renters.

• It will cost you far more to buy than to rent. Run those numbers,

using calculators like the ones listed above. In a few markets, you

can still rent for less than you can buy—even after you factor in tax

deductions and ination. If that’s the case, you might be better o

renting and investing elsewhere—or simply renting a bigger and

better place than you could hope to buy.

“But … I Can’t Afford It”

Maybe your main reservation about buying a home is that you simply

can’t aord one. Scraping together a 20% down payment can be no small

task when you’ve already got your plate full with your current bills. Or

perhaps you’re afraid you won’t qualify for the gigantic loan you’ll need or

won’t be able to pay it once you get it.

we ever did

est thing

B

Focus on the spaghetti. Caryn and her husband Alec

were stretching to their financial limits to buy a house,

and Caryn says, “We were nervous, but our agent told us, ‘You’ll just need to eat

spaghetti for about a year, and then things will even out.’ For some reason, that

image stuck in my head, and I thought, okay, I can handle eating spaghetti for

a while. In fact, that’s about the way it worked. e first year, we depleted our

savings, not only with the house closing but with repainting and buying furniture.

Now we’ve settled in, and owning a home doesn’t feel like such a big load on our

shoulders anymore.”

18

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

If you’re trying to get a down payment together and nding your

eorts frustrated, don’t lose heart. ere are alternatives: For example, you

may be able to augment your down payment with a loan from a family

member, or even enter into a cobuying arrangement with a friend.

As for the mortgage payment, people who think they can’t aord it

often focus only on the big number—the ve-, six-, or even seven-digit

gure that says what a house is

going to cost. But a mortgage

allows you to spread that

number out over a big portion of

your life.

Finally, let’s not forget that

the rst home you buy isn’t

necessarily going to be the

one you’ll live in forever. By

remaining exible, and starting

with a not-quite-perfect house,

you can break into the housing

market. at’s why they call it a “starter” house—it’s only the beginning.

e equity that you accrue may very well help you get into that next place.

“But … I’m Single”

Some people are reluctant to buy a house because they’re single now, but

hope to be part of a couple before long. But did you know that nearly one-

fth of homebuyers today are single women? Obviously they have gured

out that there’s no secret rule that says only couples get to buy houses.

ever did

est thing I

B

Invest in my present as well as my future. Real estate

agent Joanna knows about not wanting to buy a house

as a single woman—she’s seen it in many of her clients. But, says Joanna, “e

problem with waiting to do something the traditional way is, what do you lose

during that waiting period? I was in my early 30s and ready to have a place of my

own. Plus, it makes sense to spend the money and get a tax write-off rather than

Small Can Be Beautiful

If you think living in a small space means

you’ll be cramped, uncomfortable, and

aesthetically disappointed, check out

www.apartmenttherapy.com. Under

“Tours,” your secret voyeur can look at tiny

spaces other people have transformed into

fabulous homes. Be inspired!

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 19

pour it into rent. is isn’t to say that buying alone wasn’t stressful—I stretched

financially to make it work. But since buying, my house has gone up in value.”

Maybe you’re worried that you’ll have to move as soon as you meet Mr.

or Ms. Right. While that admittedly is possible, it’s also possible that in

the meantime, the increased value of your place will help, not hinder, your

happily-ever-after. If the value of your home increases and you pay down the

mortgage, the two of you will have equity you can use to buy a place together.

Besides—a house that’s perfect for one may accommodate two just ne.

we ever did

est thing

B

Combine our homes. Hannah says, “I was a young profes-

sional and very single when I bought a condo. Two years later,

I

met Chad, who also owned a small home. Before I knew it, we were married and

living in the house, renting out the condo. en we had kids, and the house was just

too small. We sold my place and Chad’s, using the equity to buy a house big enough

to accommodate our kids. It’s nice to have a place that we chose together, with our

family in mind.”

“But… It’s Too Much Responsibility!”

For some, the idea of owning a home just seems like too much to handle.

Admittedly, renting is much simpler than owning. You write a rent check,

and you’re covered for the month. And in many rental arrangements, you

can leave with just a month’s notice—perfect for those with wanderlust.

Telling yourself that renting doesn’t involve responsibility isn’t really

true, though. After all, what happens if you don’t pay the rent? You get

evicted—and then where do you go? Back to Mom and Dad’s? Most people

would rather do whatever it takes to make that monthly payment happen.

So if you’ve already lived away from home, you’re familiar with what’s

needed to make monthly payments and handle monthly nances. Of

course, when you buy you’ll have other responsibilities, like taking care

of your yard or doing repairs, but you’re in charge of prioritizing what

happens when. If you decide you don’t want to repair the creaky stairwell

until you’ve redone your kitchen cabinets, that’s up to you.

20

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

“But…Maybe Prices Will Go Down!”

Trying to time the real estate market? Timing is denitely important,

but it’s not easy to get in to the market at the perfect moment. Even

experienced real estate pundits get it wrong. If prices look to be stable and

you’re just waiting until you can aord to get in, that’s one thing. But if

you’re trying to out-clever the real estate market, you’re likely to nd that

by the time you notice a trend everyone else will have, too; and prices

may jump up before you know it.

So if you’ve watched your local market and economic news carefully,

and have a solid sense of what’s ahead, perhaps waiting for a price drop

makes sense. But don’t put your life on hold. at’s particularly true if

you’re getting married, having a baby, moving into a retirement home, or

doing something else that comes with its own timing demands.

“But … I’m Still Scared!”

Buying a home may seem overwhelming, even if you’ve always wanted to

do it. e process is unfamiliar, there’s a lot of money at stake, and you may

fear getting swept up into buying a place you don’t even like or that will

drop in value. But fear shouldn’t stop you from realizing your homebuying

dreams. To help calm the butteries, take constructive steps such as these:

• Know your strengths and weaknesses going in. en nd ways to address

them, for example with self-education or by hiring professionals.

• Learn what you can expect from professionals. Understand what real estate

agents, mortgage brokers, home inspectors, and other professionals do,

and put them to work for you, saving time and money.

• Observe your local real estate market. We’ll show you how to research

the trends in your area, in order to reassure yourself that you’re

not buying an asset that may drop in value, and has long-term

appreciation potential.

• Understand the process. Read up on all steps of the homebuying

process now, so that you won’t be confused—or need to do any

late-night remedial study—when the process kicks into high gear.

• Get organized. Use all the worksheets and checklists in the

Homebuyer’s Toolkit on the Nolo website to stay on top of key

CHAPTER 1 | WHAT’S SO GREAT ABOUT BUYING A HOUSE? | 21

What’s Next?

Once you’ve decided you’re ready to buy, it’s time to figure out what’s important

to you. In the next chapter, we’ll discuss how to examine and settle on your

priorities regarding types of houses and neighborhoods.

tasks, such as choosing a real estate agent or inspector or pulling

together nancial papers for the lender.

is book will help you accomplish all those goals. It will tell you

where you are at every step, so that you can breathe, get your bearings,

and proceed with condence. Get the facts, and you’ll be ready.

Know Your Ideal Neighborhood: Why Location Matters ........................................26

Neighborhood Features for Daily Living ...............................................................................26

Neighborhood Features at Boost Resale Value ...........................................................28

Know Yourself: How Your Lifestyle, Plans, and Values Affect

Your House Priorities .........................................................................................................................28

Know Your Ideal House: Old Bungalows, New Condos, and More ...................30

Would You Like Land With at? Single-Family Houses ..........................................30

Old (or Not-So-New) Houses: Benefits and Drawbacks ...............................................31

Newly Built Houses: Benefits and Drawbacks .................................................................... 32

Sharing the Joy, Sharing the Pain: Condos and Other Common

Interest Properties ...............................................................................................................................33

Condominiums: Benefits and Drawbacks ............................................................................34

Townhouses and Duplexes: Benefits and Drawbacks ....................................................36

Co-ops: Benefits and Drawbacks ..............................................................................................37

Factory Made: Modular and Manufactured Homes ...................................................37

Putting It All Together: Your Dream List .............................................................................38

Dream List Directions .....................................................................................................................45

CHAPTER

2

What Do You Want?

Figuring Out Your Homebuying Needs

24

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

Meet Your Adviser

Paul Grucza, CMCA, AMS, PCAM, a community

association expert and educator, author, and association

strategist located in Seattle, Washington.

What he does With 30-plus years of real estate-related experience (including as

a licensed real estate salesperson and property manager), Paul is

now an active lecturer and consultant, and faculty member for

(and past President of) the Community Associations Institute

(CAI, at www.caionline.org). CAI provides nationwide training,

guidance, and resources to the volunteer homeowners who

govern community associations. Paul received CAI’s 1999–2000

“Educator of the Year” award. He established and hosted an

award-winning community association issues television program

for the Dallas-Fort Worth market which is viewed by well over

one million people per week. He’s also the Director of Education

and Client Engagement for e CWD Group, Inc. AAMC

®

in

Seattle, Washington (www.cwdgroup.com), which provides

professional management and consultant services for a variety of

condominiums and planned communities.

First house “It was an absolutely rundown but gorgeous Mission-style bungalow

built around 1922, in one of the first incorporated subdivisions

outside Buffalo, New York. e house was the builder’s model for

that subdivision, so it had all the features, including inlaid floors,

woodwork, and leaded glass. I spent the next 11 or so years lovingly

restoring it—regrouting the bathroom tile, refinishing the woodwork,

rebronzing the heat duct covers, replacing the modernized light

fixtures through a restoration company, and much more. It turned

out to be the most beautiful home I’ve ever owned.”

CHAPTER 2 | WHAT DO YOU WANT? FIGURING OUT YOUR HOMEBUYING NEEDS | 25

Fantasy house

“My true fantasy house would be a comfortably sized home

situated on a bluff that overlooks Puget Sound and the mountains.

Living in Seattle affords the opportunity to evaluate lots of

wonderful properties, but since working with an architect, my

fantasy will become a ‘fantasy retirement home,’ one that meets

the need for view and accessibility. A redo of a midcentury rambler

would be nice, but a built-from-the-ground-up is not bad, either.”

Likes best

about his work

“My daily interaction with a wide variety of people. Solving

homeowner issues. Training and speaking to a variety of groups.

ey include homeowners, developers, service professionals,

managers, and board members. is brings me more joy than

anything—and after nearly 33 years, I’d better enjoy my work!”

Top tip for

first-time

homebuyers

“Regardless of the type of property you’re looking for—whether

a house, a condo, a cabin, a doublewide, or whatever—leave

your emotions at home. Look at the property and its practical

application in your life, and at what it will cost to turn it into

your home.”

26

|

NOLO’S ESSENTIAL GUIDE TO BUYING YOUR FIRST HOME

Y

ou know you’re ready to buy but are probably wondering, “Where

do I start?” ere’s a lot to think about, like what kind of home or

neighborhood you want, and what features you can’t possibly live

without. is chapter will help you:

• identify neighborhood characteristics that t your personality and

that maximize house-resale value

• understand how your lifestyle and plans should play into your

choice of house

• learn the benets and drawbacks of dierent types of properties

(single-family houses, condominiums, or co-ops, plus new or old

places), and nally

• create a Dream List, describing and organizing your priorities, to

use when house shopping.

Later chapters will teach you how to do the looking, how to gure out

whether you can aord what you want, and what to do once you’ve found

a place. For now, focus on organizing your thoughts and priorities.

Know Your Ideal Neighborhood:

Why Location Matters

If you’re a lifetime renter, you’ve probably always thought about location

in the short term, knowing you could move at the end of your lease.

Buying is dierent: You’re committing yourself to a location for at

least a few years. And you’ll probably feel a sense of investment in your

community that you didn’t before. So get serious about identifying your

location preferences, then make sure these preferences won’t mean buying

a house with low resale prospects.

Neighborhood Features for Daily Living

Not everyone wants the same features in a neighborhood, and you’re the

one who’s got to live there. Before letting anyone else tell you what the best

neighborhoods are, consider your preferences and priorities regarding:

CHAPTER 2 | WHAT DO YOU WANT? FIGURING OUT YOUR HOMEBUYING NEEDS | 27

• Character and community. For some, the uniformity of well-planned

developments is pleasing; others enjoy the variety of older, one-of-a-

kind homes. Visualize your ideal neighborhood, whether it features

trees and parks or

restaurants and bars.

• Safety. While most

everyone prefers less

crime, safety often

comes with a trade-o.

For example, a rural

neighborhood might

be safe, but a city’s

resources and nightlife

will be very far away.

• Resources and

accessibility. ink where

the important places and

resources in your life

are, like your workplace,

child’s school or day

care, grocery stores, health care providers, public transportation or

major roadways, cultural amenities, and more. How much time are

you willing to spend traveling to those places?

• Schools. If you’re planning on sending children to public schools, the

quality of nearby schools will be important.