Legal Guide For Starting And Running A Small Business

Nolo’s Legal Updater

We’ll send you an email whenever a new edition of your book

is published! Sign up at

www.nolo.com/legalupdater

.

Updates @ Nolo.com

Check

www.nolo.com/updates

to fi nd recent changes

in the law that aff ect the current edition of your book.

Nolo Customer Service

To make sure that this edition of the book is the most

recent one, call us at

800-728-3555

and ask one of

our friendly customer service representatives.

Or fi nd out at

www.nolo.com

.

e law changes, but Nolo is always on top of it! We off er several

ways to make sure you and your Nolo products are always up to date:

NOLO

always up to date

always up to date

2

1

3

We believe accurate and current legal information should help you solve

many of your own legal problems on a cost-effi cient basis. But this text

is not a substitute for personalized advice from a knowledgeable lawyer.

If you want the help of a trained professional, consult an attorney

licensed to practice in your state.

NOLO

please note

EIGHTH EDITION MARCH 2005

Editor ILONA BRAY

Illustration MARI STEIN

Book Design TERRI HEARSH

Cover Design SUSAN PUTNEY

Production SARAH HINMAN

Proofreading ROBERT WELLS

Index MICHAEL FERREIRA

Printing DELTA PRINTING SOLUTIONS, INC.

Steingold, Fred.

Legal guide for starting & running a small business / by Fred S. Steingold ; edited by

Ilona Bray. -- 8th ed.

p. cm.

Includes index.

ISBN 1-4133-0177-0

1. Small business--Law and legislation--United States--Popular works. 2. Business

enterprises--Law and legislation--United States--Popular works. I. Title: Legal guide for

starting and running a small business II. Bray, Ilona M., 1962- III.Title

KF1659.Z9S76 2005

346.73’0652—dc22

2004065486

Copyright © 1992, 1995, 1997, 1998, 1999, 2001, 2003, and 2005 by Fred Steingold

All rights reserved. Printed in U.S.A.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the

prior written permission of the publisher and the author.

For information on bulk purchases or corporate premium sales, please contact the Special Sales

Department. For academic sales or textbook adoptions, ask for Academic Sales. Call 800-955-4775

or write to Nolo, 950 Parker Street, Berkeley, CA 94710.

ACKNOWLEDGMENTS

Special thanks to Nolo Publisher Jake Warner—the cheerful perfectionist whose ideas infuse every page

of this book—and to Nolo Editor Mary Randolph, who deftly whipped the early manuscripts into final

shape.

Thanks, too, to the rest of the remarkable Nolo family for their invaluable contributions—especially

Steve Elias, Robin Leonard, Barbara Hodovan, Jackie Mancuso, Tony Mancuso, Barbara Kate Repa,

Beth Laurence, and Ilona Bray.

In addition to the folks at Nolo, these other professionals generously shared their expertise to make this

book possible:

• Attorneys Charles Borgsdorf, Larry Ferguson, Sandra Hazlett, Peter Long, Michael Malley,

Robert Stevenson, Nancy Welber, and Warren Widmayer.

• Certified Public Accountants Mark Hartley and Lonnie Loy.

• Insurance Specialists James Libs, Mike Mansel, and Dave Tiedgen.

Finally, thanks to my small business clients, who are a constant source of knowledge and inspiration.

INTRODUCTION

A. Is This Book for You? ...................................................................................... I/2

B. How This Book Will Help ............................................................................... I/3

C. Nonlegal Matters to Attend To ........................................................................ I/6

CHAPTER 1

Which Legal Form Is Best for Your Business?

A. Sole Proprietorships ....................................................................................... 1/4

B. Partnerships ................................................................................................. 1/7

C. Corporations.............................................................................................. 1/11

D. Limited Liability Companies........................................................................... 1/21

E. Choosing Between a Corporation and an LLC ................................................. 1/23

F. Special Structures for Special Situations .......................................................... 1/26

CHAPTER 2

Structuring a Partnership Agreement

A. Why You Need a Written Agreement .............................................................. 2/2

B. An Overview of Your Partnership Agreement...................................................... 2/3

C. Changes in Your Partnership ......................................................................... 2/13

CHAPTER 3

Creating a Corporation

A. The Structure of a Corporation ........................................................................ 3/2

B. Financing Your Corporation............................................................................ 3/5

C. Compensating Yourself .................................................................................. 3/6

Table of Contents

D. Do You Need a Lawyer to Incorporate? ........................................................... 3/7

E. Overview of Incorporation Procedures .............................................................. 3/8

F. Twelve Basic Steps to Incorporate.................................................................... 3/8

G. After You Incorporate .................................................................................. 3/17

H. Safe Business Practices for Your Corporation ................................................... 3/17

CHAPTER 4

Creating a Limited Liability Company

A. Number of Members Required ........................................................................ 4/2

B. Management of an LLC ................................................................................. 4/3

C. Financing an LLC .......................................................................................... 4/3

D. Compensating Members ................................................................................ 4/5

E. Choosing a Name........................................................................................ 4/6

F. Paperwork for Setting Up an LLC ..................................................................... 4/7

G. After You Form Your LLC............................................................................... 4/11

H. Safe Business Practices for Your LLC ............................................................... 4/13

CHAPTER 5

Preparing for Ownership Changes With a Buy-Sell Agreement

A. Major Benefits of Adopting a Buy-Sell Agreement ............................................... 5/3

B. Where to Put Your Buy-Sell Provisions ............................................................... 5/7

C. When to Create a Buy-Sell Agreement ............................................................. 5/8

CHAPTER 6

Naming Your Business and Products

A. Business Names: An Overview ....................................................................... 6/4

B. Mandatory Name Procedures ......................................................................... 6/7

C. Trademarks and Service Marks ..................................................................... 6/10

D. Strong and Weak Trademarks ...................................................................... 6/11

E. How to Protect Your Trademark ..................................................................... 6/12

F. Name Searches ......................................................................................... 6/13

CHAPTER 7

Licenses and Permits

A. Federal Registrations and Licenses ................................................................... 7/3

B. State Requirements ........................................................................................ 7/4

C. Regional Requirements ................................................................................... 7/6

D. Local Requirements........................................................................................ 7/7

E. How to Deal With Local Building and Zoning Officials ....................................... 7/9

CHAPTER 8

Tax Basics for the Small Business

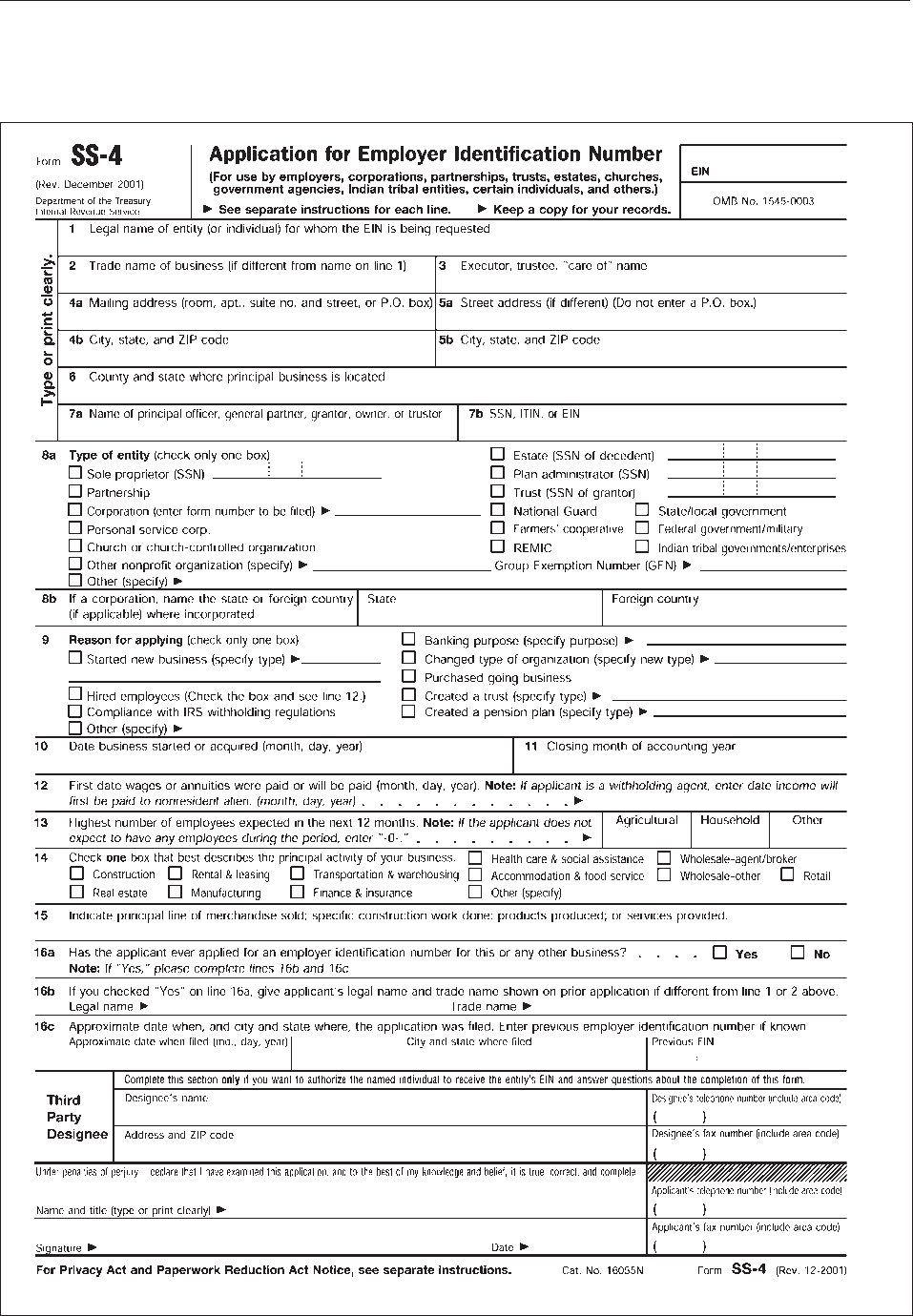

A. Employer Identification Number....................................................................... 8/2

B. Becoming an S Corporation ........................................................................... 8/6

C. Business Taxes in General .............................................................................. 8/7

D. Business Deductions .................................................................................... 8/14

E. Tax Audits ................................................................................................. 8/19

CHAPTER 9

Raising Money for Your Business

A. Two Types of Outside Financing...................................................................... 9/3

B. Thirteen Common Sources of Money ................................................................ 9/8

C. Document All Money You Receive ................................................................. 9/15

CHAPTER 10

Buying a Business

A. Finding a Business to Buy ............................................................................. 10/3

B. What’s the Structure of the Business You Want to Buy? ..................................... 10/4

C. Gathering Information About a Business .......................................................... 10/8

D. Valuing the Business .................................................................................... 10/9

E. Other Items to Investigate ........................................................................... 10/12

F. Letter of Intent to Purchase .......................................................................... 10/14

G. The Sales Agreement ................................................................................. 10/16

H. The Closing ............................................................................................. 10/25

I. Selling a Business ..................................................................................... 10/25

CHAPTER 11

Franchises: How Not to Get Burned

A. What Is a Franchise? .................................................................................. 11/3

B. The Downsides of Franchise Ownership.......................................................... 11/4

C. Investigating a Franchise .............................................................................. 11/8

D. The Uniform Franchise Offering Circular.......................................................... 11/9

E. The Franchise Agreement ........................................................................... 11/15

F. Resolving Disputes With Your Franchisor ....................................................... 11/19

CHAPTER 12

Insuring Your Business

A. Working With an Insurance Agent................................................................. 12/2

B. Property Coverage ...................................................................................... 12/4

C. Liability Insurance........................................................................................ 12/8

D. Other Insurance to Consider ....................................................................... 12/12

E. Saving Money on Insurance ....................................................................... 12/14

F. Making a Claim ....................................................................................... 12/17

CHAPTER 13

Negotiating a Favorable Lease

A. Finding a Place .......................................................................................... 13/3

B. Leases and Rental Agreements: An Overview................................................... 13/3

C. Short-Term Leases (Month-to-Month Rentals) ...................................................... 13/4

D. Written Long-Term Leases ............................................................................. 13/5

E. Additional Clauses to Consider ................................................................... 13/17

F. Shopping Center Leases ............................................................................ 13/18

G. How to Modify a Lease ............................................................................. 13/19

H. Landlord-Tenant Disputes ............................................................................ 13/19

I. Getting Out of a Lease .............................................................................. 13/21

J. When You Need Professional Help ............................................................. 13/22

CHAPTER 14

Home-Based Business

A. Zoning Laws .............................................................................................. 14/2

B. Private Land Use Restrictions ......................................................................... 14/7

C. Insurance .................................................................................................. 14/8

D. Deducting Expenses for Business Use of Your Home........................................ 14/10

CHAPTER 15

Employees and Independent Contractors

A. Hiring Employees ....................................................................................... 15/3

B. Job Descriptions.......................................................................................... 15/6

C. Job Advertisements ...................................................................................... 15/7

D. Job Applications ......................................................................................... 15/7

E. Interviews ................................................................................................ 15/11

F. Testing .................................................................................................... 15/11

G. Investigating Job Application Information ....................................................... 15/20

H. Immigration Law Requirements..................................................................... 15/22

I. Personnel Practices.................................................................................... 15/22

J. Illegal Discrimination ................................................................................. 15/23

K. Wages and Hours .................................................................................... 15/26

L. Occupational Safety and Health ................................................................. 15/29

M. Workers’ Compensation ........................................................................... 15/30

N. Termination............................................................................................. 15/31

O. Unemployment Compensation ..................................................................... 15/33

P. Independent Contractors ............................................................................ 15/34

CHAPTER 16

The Importance of Excellent Customer Relations

A. Developing Your Customer Satisfaction Policy .................................................. 16/3

B. Telling Customers About Your Policies............................................................. 16/5

CHAPTER 17

Legal Requirements for Dealing With Customers

A. Advertising ................................................................................................ 17/2

B. Retail Pricing and Return Practices .................................................................. 17/5

C. Warranties ................................................................................................ 17/9

D. Consumer Protection Statutes ...................................................................... 17/15

E. Dealing With Customers Online .................................................................. 17/16

CHAPTER 18

Cash, Credit Cards, and Checks

A. Cash ........................................................................................................ 18/2

B. Credit Cards.............................................................................................. 18/2

C. Checks ..................................................................................................... 18/4

CHAPTER 19

Extending Credit and Getting Paid

A. The Practical Side of Extending Credit ............................................................ 19/2

B. Laws That Regulate Consumer Credit.............................................................. 19/8

C. Becoming a Secured Creditor ....................................................................... 19/9

D. Collection Problems .................................................................................. 19/10

E. Collection Options .................................................................................... 19/14

CHAPTER 20

Put It in Writing: Small Business Contracts

A. What Makes a Valid Contract ...................................................................... 20/3

B. Unfair or Illegal Contracts............................................................................. 20/5

C. Misrepresentation, Duress, or Mistake ............................................................ 20/6

D. Must a Contract Be in Writing?..................................................................... 20/7

E. Writing Business-to-Business Contracts .......................................................... 20/10

F. The Formalities of Getting a Contract Signed ................................................. 20/14

G. Enforcing Contracts in Court ....................................................................... 20/17

H. What Can You Sue For?............................................................................ 20/19

CHAPTER 21

The Financially Troubled Business

A. Thinking Ahead to Protect Your Personal Assets ................................................ 21/2

B. Managing the Financially Troubled Business .................................................... 21/5

C. Seeking an Objective Analysis ...................................................................... 21/8

D. Workouts ................................................................................................ 21/10

E. Selling or Closing the Business .................................................................... 21/13

F. Understanding Bankruptcy .......................................................................... 21/15

CHAPTER 22

Resolving Legal Disputes

A. Negotiating a Settlement.............................................................................. 22/2

B. Understanding Mediation ............................................................................. 22/3

C. Arbitration ................................................................................................. 22/5

D. Going to Court........................................................................................... 22/8

CHAPTER 23

Representing Yourself in Small Claims Court

A. Deciding Whether to Represent Yourself ......................................................... 23/2

B. Learning the Rules ....................................................................................... 23/4

C. Meeting the Jurisdictional Limits ..................................................................... 23/4

D. Before You File Your Lawsuit ......................................................................... 23/6

E. Figuring Out Whom to Sue .......................................................................... 23/8

F. Handling Your Small Claims Court Lawsuit ...................................................... 23/8

G. Representing Yourself If You’re the Defendant ................................................. 23/11

H. Appealing Small Claims Decisions ............................................................... 23/12

I. Collecting Your Judgment ........................................................................... 23/12

CHAPTER 24

Lawyers and Legal Research

A. How to Find the Right Lawyer ....................................................................... 24/3

B. Fees and Bills............................................................................................. 24/5

C. Problems With Your Lawyer .......................................................................... 24/6

D. Do-It-Yourself Legal Research ......................................................................... 24/7

APPENDIX A

APPENDIX B

INDEX

I

Introduction: Using This Book to Start

or Run a Business

A. Is This Book for You? ...................................................................................... I/2

B. How This Book Will Help ............................................................................... I/3

1. Choosing the Best Legal Entity (Chapters 1 Through 5) .................................... I/3

2. Choosing Your Business and Product Names Wisely (Chapter 6) ...................... I/3

3. Obtaining License and Permits (Chapter 7) .................................................... I/3

4. Meeting the IRS Rules (Chapter 8)................................................................ I/3

5. Raising Money for Your Business (Chapter 9) ................................................. I/4

6. Alternatives to Starting From Scratch (Chapters 10 and 11) .............................. I/4

7. Buying Business Insurance (Chapter 12)........................................................ I/4

8. Finding Space for Your Business (Chapters 13 and 14) ................................... I/5

9. Hiring and Managing Employees (Chapter 15) ............................................. I/5

10. Dealing With Customers (Chapters 16 Through 19) ....................................... I/5

11. Entering Into Contracts (Chapter 20) ............................................................ I/5

12. When Trouble Comes (Chapters 21 Through 24)........................................... I/5

C. Nonlegal Matters to Attend To ......................................................................... I/6

1. Choose the Right Business for You ............................................................... I/6

2. Do a Break-Even Analysis ........................................................................... I/7

3. Consider Writing a Business Plan ................................................................ I/8

INTRODUCTION/2 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

S

tarting and running a small business—one

that’s both profitable and emotionally satisfy-

ing—is a dream that you share with millions of

other Americans. Being an entrepreneur offers re-

wards of many sorts: the opportunity to spread your

wings and use your natural talents, the freedom of

being your own boss, the possibility of huge finan-

cial success, and more. And in an era when job se-

curity is a relic of a bygone era, owning a business

means you never have to worry about being fired

or outsourced.

Of course, nothing this exciting ever comes with-

out risk. Demographic changes, recessions, chang-

ing tastes and styles, new technologies—any of

these factors can challenge even the most astute

and experienced businessperson. There’s no guar-

antee that any venture will succeed. But the positive

side of being self-employed often outweighs the po-

tential risks. That’s especially true if you have confi-

dence in your own judgment and abilities. You

stand to earn more money than you ever have be-

fore—and to achieve a high level of self-fulfillment.

In a November 2004 Wall Street Journal survey, 86%

of small business owners said they’d do it all over

again, and 76% said they believe they’re better off

financially than if they’d worked for another com-

pany.

What’s more, the existence of risk doesn’t mean

you’re helpless in the hands of the fates. You can

greatly increase the chances of success by working

hard and planning carefully. In particular, knowing

how the law affects your business can help you

avoid many costly risks. More and more, the law

affects every aspect of a small business operation,

from relationships with landlords, customers, and

suppliers to dealings with governmental agencies

over taxes, licenses, and zoning. That’s where this

book comes in.

For starters, this book will help you take key

preventive measures that will dramatically cut the

number of expensive visits you’d otherwise make to

a lawyer’s office. You’ll know exactly where you

may be vulnerable to lawsuits so you can wisely

take steps to reduce the risks. And you’ll know

when it makes sense to call in a lawyer or a tax pro

for special assistance so that small problems don’t

turn into huge ones.

This book uses plain English to cover all the ma-

jor legal issues that a business is likely to face, in-

cluding:

• Will I be personally liable for business debts?

• How is business income taxed?

• Does it make sense for me to form a corpora-

tion? How about an LLC?

• How can I protect my business name?

• Do I need a license or permit?

• What forms do I need to file with the IRS?

• How do I raise money for my business?

• What are the steps in buying an existing busi-

ness?

• Is buying a franchise a good idea?

• What kind of insurance should I carry?

• How do I negotiate a lease?

• Will zoning affect my home-based business?

• What’s the best way to avoid being sued by

employees—or former employees?

This book provides easy-to-follow answers to

these and dozens of other legal questions so that

you can spend your time on what really counts:

running a sound and successful business.

A. Is This Book for You?

This book focuses on starting and running a small

business. Though much of what you learn here will

also apply to larger enterprises, this book definitely

is not concerned with the sorts of businesses that

make headlines in The Wall Street Journal. We’re

focused on readers who fit this profile:

• You’re looking to start (or buy) a small retail,

service, or manufacturing business—for ex-

ample, a restaurant or bakery, a dry cleaning

establishment, a crafts gallery, an electrical

contracting firm, or a modest manufacturing

operation.

INTRODUCTION/3

• You anticipate owning the business yourself,

or with one, two, or a handful of other

people.

• You’d consider setting up a corporation or

LLC if doing so would be legally advanta-

geous.

• You plan to play an active role in running the

business—and perhaps even expect that it

will provide your main source of income.

Does this sound like you? If it does, then this

book has exactly the information you need to take

the right legal steps and guard against lawsuits and

other unexpected consequences.

B. How This Book Will Help

This book guides you through the many legal con-

cepts and procedures that affect a small business.

Here’s a preview of what lies ahead.

1. Choosing the Best Legal Entity

(Chapters 1 Through 5)

We start with the pros and cons of the types of le-

gal entities used by small businesses—the sole pro-

prietorship, the partnership, the limited liability

company (LLC), and the corporation. You’ll learn

how each type of entity treats your personal liability

for business debts. For example, can business credi-

tors or lawsuit plaintiffs seize your house and per-

sonal bank accounts if the business falls on hard

times? And you’ll learn just how each entity gets

taxed. For tax reasons, you may decide you’d prefer

to have an S corporation rather a C corporation. (If

these terms seem like a foreign language to you,

don’t worry. We’ll get to them soon.)

Once you understand the differences between

the basic legal entities, and have chosen one for

your business, you’ll go to a chapter that tells you

how to create the entity—the documents you need

to prepare and sign and, in some cases, register

with a government agency. And if you decide to

form a corporation or LLC, you’ll find time-tested

tips for using the entity to the maximum extent pos-

sible to shield your home and other personal assets

from business creditors.

If you aren’t the only owner of your business, be

sure to spend time with Chapter 5, which explains

how to lay the groundwork for ownership changes

with what’s called a “buy-sell agreement.”

2. Choosing Your Business and

Product Names Wisely (Chapter 6)

You may already have a clever name for your busi-

ness or product in mind. But don’t start using it un-

til you’re sure you won’t step on the toes of existing

businesses. This chapter will explain how to re-

search whether other businesses are using the

names you’re considering, register and protect the

names you choose, obtain an Internet address

(URL), and more.

3. Obtaining License and Permits

(Chapter 7)

Chances are good that your business needs some

sort of license or operating permit, whether from

your federal, state, regional, county, or city govern-

ment. Chapter 7 will alert you to types of businesses

or activities that normally need licenses or permits,

and explain where to go for details.

4. Meeting the IRS Rules (Chapter 8)

If the only tax return you’ve ever filed is the familiar

Form 1040, you’re nowhere near prepared for the

complexities of business taxes. But with the help of

this book, the task should be easier than you’d ex-

pect. You’ll learn how to apply for an Employer

Identification Number (which your business may

need even if it doesn’t have employees at first).

INTRODUCTION/4 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

You’ll find out, too, whether your business must

pay income tax to the IRS, or whether you and any

other business owners will personally bear the tax

burden. In either case, you’ll discover which tax

forms to file and why. And since business deduc-

tions are always a good thing—they reduce the bot-

tom line on which taxes are computed—you’ll ap-

preciate learning the ins and outs of deductions and

depreciation.

Maybe you’ve never been audited before—but

your luck may run out if you own a small business.

The IRS views small businesses as an attractive au-

dit target. So you’ll find it comforting to learn how

to deal with the IRS if your business does get au-

dited. Knowing what to expect can reduce your

anxiety and help you successfully complete the au-

dit process.

5. Raising Money for Your

Business (Chapter 9)

We’ll cover in detail the two main ways to get

money for setting up or expanding your business:

loans and equity financing. (Most entrepreneurs

prefer, if possible, to take out loans, so they can

keep the business ownership all to themselves; eq-

uity financing involves shared ownership.) You’ll

find out where to look for money and how to cre-

ate legal safeguards so that your interests are ad-

equately protected. And you’ll also learn about the

protections that lenders and investors might seek

for themselves.

Finally, if you think a bank is the only place to

get money, you’ll be pleased to discover that a

number of other excellent sources are available.

This is especially important for first-time business

owners, given that banks are understandably reluc-

tant to lend money to would-be entrepreneurs with

no track record.

6. Alternatives to Starting From

Scratch (Chapters 10 and 11)

While this book discusses many aspects of starting a

business from scratch, we haven’t forgotten that it’s

not the only way to go. Other options include buy-

ing an existing business or buying a franchise.

Buying an existing business is often an attractive

choice because someone else has done the hard

startup work. And the business has a financial his-

tory—you can tell whether it’s has been successful

so far. If so, you can be reasonably sure that it will

continue to be profitable. But you may have to pay

more for an existing business, since the seller will

want to be rewarded for taking the startup risks.

Buying a franchise can also be tempting—but, as

Chapter 11 will explain, you’ll need to be aware of

many hidden problems. You’ll probably be asked to

sign a long-term contract with terms that heavily

favor the franchisor. Of course, it’s true that once in

business, you’ll get the benefit of the franchisor’s

advertising and brand name. But offsetting this ad-

vantage, you’ll be locked into a more-or-less rigid

format for running the business—something that a

freedom-loving entrepreneur may balk at.

7. Buying Business Insurance

(Chapter 12)

Avoiding risk is a major theme of this book—and

when it comes to the biggest risks, such as fire, in-

jured customers, or lawsuits stemming from your

own negligence, having an insurance policy in

place can save you a bundle. On the other hand,

you don’t need to go hog wild buying insurance

policies. This chapter will help you evaluate what

insurance you do and don’t need, and how to go

about getting it at a reasonable price.

INTRODUCTION/5

8. Finding Space for Your Business

(Chapters 13 and 14)

Unless you sit in a coffee shop and conduct a Web-

based business from your laptop, you’ll probably

have to think about where to locate your business.

Chapter 13 discusses renting business space. You’ll

learn how to read the landlord’s lease form and ne-

gotiate for more favorable terms. You’ll be better

prepared to avoid hidden costs and arbitrary actions

by a landlord.

Chapter 14 discusses the ins and outs of running

a business out of your own home. You’ll find out

how to comply with zoning ordinances, and see

how the tax laws let you deduct some repair, utility,

and other expenses associated with your home.

9. Hiring and Managing

Employees (Chapter 15)

Even if you start out running the business yourself,

sooner or later you’ll probably need to hire employ-

ees. This can be one of the most legally challenging

tasks you’ll face. Federal and state laws regulate al-

most every aspect of the employment relationship.

You’ll need to know about wages and overtime

pay, workers compensation, immigration law re-

quirements, and numerous antidiscrimination laws

such the Americans with Disabilities Act.

Even if you do everything right, you may eventu-

ally have to fire an employee. Termination can be a

very delicate matter if you wish to avoid being sued

for wrongful discharge. The information in this

book will introduce you to safe hiring and firing

practices so that you’ll sleep better at night.

10. Dealing With Customers

(Chapters 16 Through 19)

There’s nothing so joyful as watching your first cus-

tomers walk in the door. And there’s nothing so

frustrating and frightening as having them fail to

pay their bills, sue you out of disgruntlement with

your products or services, or complain about you to

all their friends. Fortunately, many of these issues

can be avoided—or at least prepared for—by devel-

oping customer policies that are friendly as well as

legally sound. Chapters 16 through 19 will help you

do this, with explanations of such issues as advertis-

ing, warranties, accepting payment by different

methods, and extending credit.

11. Entering Into Contracts

(Chapter 20)

Whether you’re making agreements with customers

or other businesses, chances are you’ll want to com-

mit some of these to writing. In this chapter, you’ll

learn what makes a valid contract, how to write a

contract that will hold up legally, and when you can

sue someone for breaching your contract.

12. When Trouble Comes (Chapters

21 Through 24)

Despite your best efforts, your business may run

into financial trouble. Chapter 21 will help you turn

your financially troubled business around, and if

that’s impossible, sell or close your business. Chap-

ter 22 will teach you how to use tools like media-

tion or the court system to resolve legal disputes.

Because many business disputes involve only a few

thousand dollars (not enough to hire a lawyer for)

we devote all of Chapter 23 to representing yourself

in small claims court. However, if you do need a

lawyer, see Chapter 24 on how to find the right one

and make the most of your relationship.

INTRODUCTION/6 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

C. Nonlegal Matters to

Attend To

Dealing effectively with legal matters—the focus of

this book—is a key component of running a suc-

cessful business. But before you start a business or

buy one, there are also a number of important prac-

tical and financial matters that need your attention.

Here, we’ll briefly review the most important ones,

and direct you to other relevant resources for help.

1. Choose the Right Business

for You

Your business should have a solid chance at turning

a profit—but it should also suit your particular skills

and strengths. It helps to start or buy a business that

you know intimately—one that matches your expe-

rience, training, talents, and, hopefully, your pas-

sions. To put it bluntly, don’t open a garden-supply

shop unless you have a green thumb and are up to

date on the state of the art in gardening products.

Still Tempted to Sell Something

You Know Nothing About?

You wouldn’t be the first businessperson to

attempt a stretch beyond your own knowledge

base. Many people have been lured by watch-

ing others make quick profits at say, “the latest

thing.” And some folks have plunged ahead

rashly after waking up with a “million-dollar”

idea or just a yen to do something new and

unusual. You’ll see headlines about the people

who make it—but these obscure the stories of

the thousands of enthusiastic but unprepared

dreamers whose businesses crashed and

burned.

If you’re still inclined to leap into largely

unknown territory, at least take steps to ex-

pand your knowledge before you proceed.

Your best bet is often to become an employee

in a similar business—even for free, if no one

will pay a novice like you. From that insider’s

position, you stand to learn about every aspect

of the business. And you’ll soon find out

whether you enjoy that line of work. If not,

move on to something else.

Assuming you’re thinking of making a business

out of something you know and love, the next step

is to talk to others in the industry to learn what it

takes to run that kind of business. Learn all you can

about startup costs, overhead and expenses, and

how much revenue you can expect to take in.

Maybe you have several interests and are not sure

which business would work out the best. You can

research the marketplace to see which types of

businesses are most needed in your community.

Judge your ability and desire to handle every as-

pect of the business. If you want to become the mil-

lionaire next door, you have to be willing and able

to handle many diverse chores—such as dealing

with customers, keeping the books, and even flip-

INTRODUCTION/7

ping the burgers when your employees are out sick.

Although employees can ordinarily handle many of

the day-to-day operations, you may have to person-

ally pitch in more often than you might imagine. If

this is a turnoff, another business may suit you bet-

ter.

Some businesses require extra caution. For ex-

ample, there are inherent risks in businesses that

use hazardous materials, make edible goods, care

for children, sell alcohol, or build or repair build-

ings or vehicles. But you can usually reduce the

risks to manageable proportions by forming a cor-

poration or LLC, and by carrying adequate liability

insurance.

2. Do a Break-Even Analysis

No one can tell for sure whether a particular busi-

ness idea will be profitable. You can, however,

make an informed judgment by doing what’s called

a “break-even analysis.” This shows you how much

money you’ll need to bring in to cover your ex-

penses, even before you make a dime of profit. You

don’t want to start or buy a business unless you’re

reasonably sure that sales will far exceed your costs

of doing business.

To perform a break-even analysis, you’ll have to

make educated guesses about your expenses and

revenues. This requires some preliminary research.

To make the job easier, take advantage of business

planning books and software, as well as the free

Web resources listed below.

Here are the most important facts and figures

you’ll need to assemble for your break-even analy-

sis:

• Fixed costs. These costs—sometimes called

“overhead”—stay pretty much the same from

month to month. They include rent, insur-

ance, utilities, and other expenses that must

be paid regardless of how much you produce

or sell. Be sure to add another 10% to cover

unexpected fluctuations in these costs, such

as a boost in insurance premiums or the price

of natural gas to heat your business premises.

• Sales revenue. This is the total amount the

business brings in each month or year. Be re-

alistic in figuring the volume of business you

can expect. You’ll need to specifically identify

your customer base, then do some demo-

graphic research to find out how many

people who fit that profile you can expect to

reach and attract.

• Average gross profit for each sale. This is

how much you earn from each sale after pay-

ing the direct costs of the sale. For example,

if you pay an average of $200 for each bi-

cycle that you sell at an average price tag of

$300, your average gross profit per sale is

$100.

• Average gross profit percentage. This tells

you how much of each dollar of sales income

is gross profit. You divide your average gross

profit (from above) by the average selling

price. In the bicycle example, the gross profit

percentage is 66.7% ($200 divided by $300).

Now you’re ready to figure out the break-even

point. Divide your estimated fixed costs total by

your gross profit percentage. This tells you the

amount of sales revenue you’ll need to bring in just

to break even. For example, if your fixed costs are

$6,000 a month and your expected profit margin is

66.7%, your break-even point is $9,000 in sales rev-

enue per month ($6,000 divided by .667). This

means you must make take in $9,000 each month

just to pay your fixed costs and your direct (prod-

uct) costs. At the break-even point, there’s no salary

or profit for you.

If your break-even point is higher than your ex-

pected revenues, you’ll need to figure out whether

you can change your plan to make the numbers

work better. For example, can you: Find a less ex-

pensive source of supplies? Do without an em-

ployee? Save rent by doing business out of your

home? Sell your product or service at a higher

price?

INTRODUCTION/8 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

If you can work out a realistic break-even point

that gives you reasonable assurance of earning a

decent profit, you can move ahead with a more de-

tailed business plan. Otherwise, you’ll need to come

up with a different business idea.

Want more information on researching and

developing your break-even analysis? Check

the following Websites:

• www.businessknowhow.com/startup/break-

even.htm

• www.toolkit.cch.com/text/P06_7530.asp

• www.businesstown.com/accounting/projec-

tions-breakeven.asp.

3. Consider Writing a Business

Plan

You may find it useful to capture your thinking

about your business in a written business plan. If

you need to raise money to start your business, a

written plan will make it easier to explain your vi-

sion to lenders or investors. And even if you al-

ready have enough seed money, a written business

plan can be a good idea. Putting your thoughts

down on paper can help you fine tune your con-

cept and spot any trouble areas.

Many excellent books are available to guide you,

including How to Write a Business Plan, by Mike

McKeever (Nolo), and The Successful Business Plan:

Secrets and Strategies, by Rhonda Abrams (The

Planning Shop). For software, Business Plan Pro, by

Palo Alto software, comes very highly rated. Also,

several websites offer practical suggestions and pro-

vide sample plans. You might start with the U.S.

Small Business Administration site at www.sba.gov/

starting_business/planning/writingplan.html, where

you’ll find advice and, through a link, can review

dozens of real business plans.

But whatever source you turn to for ideas for

writing a business plan, keep in mind that a short,

simple plan is usually better than a long, complex

one—especially for a small business that’s just start-

ing out. Formality can get in the way. One good ap-

proach to the task is to imagine that you’re sitting

across a table from a friend and want to take a few

minutes to explain your business idea. What are the

key things you’d say? What kind of language would

you use? Try to capture that clear, conversational

tone in your written plan.

There are many ways to organize your business

plan. But however you decide you do it, you’ll

probably want to cover four main areas.

a. A Description of Your Business

Start with the business name and your Internet do-

main name, if you already have one. Then specify

the products and services you plan to sell, and tell

how your business will meet the needs of custom-

ers and clients. You can also describe where your

business will be physically located—in rented,

downtown space, for example, or in your home. It’s

also important to analyze the competition you’ll

face and why you think your business will survive

and thrive despite it. This part of the plan is also

the place to describe any demographic, economic,

and industry trends that you believe will help the

business get off to a good start.

b. Your Marketing Program

Here, you can set down your thoughts on who your

customers and clients will be, and how they’ll learn

about your new business and be motivated to give

it a try. First, you’ll need to develop a profile of

your typical customer. For example, if you’re plan-

ning to start a self-storage facility, your customers

may be apartment dwellers from nearby apartment

complexes who lack sufficient closet space. Or if

you’re starting a landscaping service, your target cli-

ents may be people who are buying homes in new,

suburban subdivisions. Once you have a good no-

INTRODUCTION/9

tion of the kind of customers you’d like to reach,

think about the methods you’ll use.

It’s said that word of mouth is the best way for a

business to build a loyal following, but that takes

time. With a brand-new business, you’ll have to

prime the pump. There are lots of ways you might

do this. Traditional advertising in newspapers and

on radio or television is just the tip of the iceberg.

Among other things, you might consider news-

letters; direct mail; a website linked to high-traffic

sites; trade show exhibits; billboards; the Yellow

Pages; discount coupons; event sponsorship; free

classes; telemarketing; and favorable press reports.

Many businesses use the sides of their vans and

trucks to capture people’s attention. (For more on

advertising and marketing, see Chapters 16 and 17.)

c. How You’ll Operate the Business

A key concern here is the competence of those who

will be running the business. Be sure to include

your own qualifications and those of any co-owners

and managers in any plan that you’ll be showing to

others. List past business experience and any em-

ployment or training that’s relevant to your new

business. If a small business is organized as a cor-

poration, then most likely the owners will be the

board of directors. But if you’ll have some outsiders

serving on the board, you can name them here and

give their qualifications. And consider naming your

professional team—a lawyer and accountant whom

you may consult from time to time.

You might also mention the number of employ-

ees—full-time and part-time—you expect to hire at

the beginning, and give some idea of what their

jobs will consist of. If you’ll rely on independent

contractors for some work, you can spell out their

duties.

In addition to describing the business’s work-

force, it’s often worth describing other aspects of

your business operations, such as any special

equipment you’ll be using and your arrangements

with suppliers. You might also describe any im-

provements you’ll be making to the premises the

business will occupy—usually rented space for a

new business. If you already have some contracts

lined up with customers or clients, that’s great be-

cause you have a running head start. It makes sense

to mention these in your business plan.

For many businesses, order fulfillment and cus-

tomer service play a major role. Your business plan

can explain how your business intends to handle

these functions—hopefully in a way that will keep

customers happy and coming back for more.

d. The Financial Highlights

Here, you should list your fixed costs and your esti-

mates for other costs, and how much you’ll need in

startup funds—that is, funds to buy needed equip-

ment, supplies, and inventory, with enough cash

left in the till to cover other bills until adequate

money starts rolling in (which may take several

months). Explain where the startup funds will come

from: your own funds on hand, or loans or cash

from investors. Be sure to include your break-even

analysis, too (see Section 2, above).

Probably the most difficult part of the financial

highlights portion of your business plan will be

your projections for gross income for the first three

years. When you start a business from scratch, this

is a largely unknown number. At best you’ll be

making a rough approximation. It’s better to esti-

mate on the low side and be pleasantly surprised if

the income exceeds your expectations. If you esti-

mate too high and it turns out there’s not enough

income to meet expenses, the business will struggle

to stay alive and may ultimately fail. To be as accu-

rate as possible in projecting revenues, you’ll need

to rely on your business acumen, information from

multiple industry sources, and perhaps input from

an accountant or other business consultant. With

careful preparation, you can significantly reduce the

risk that your income forecast will be far too high.

INTRODUCTION/10 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

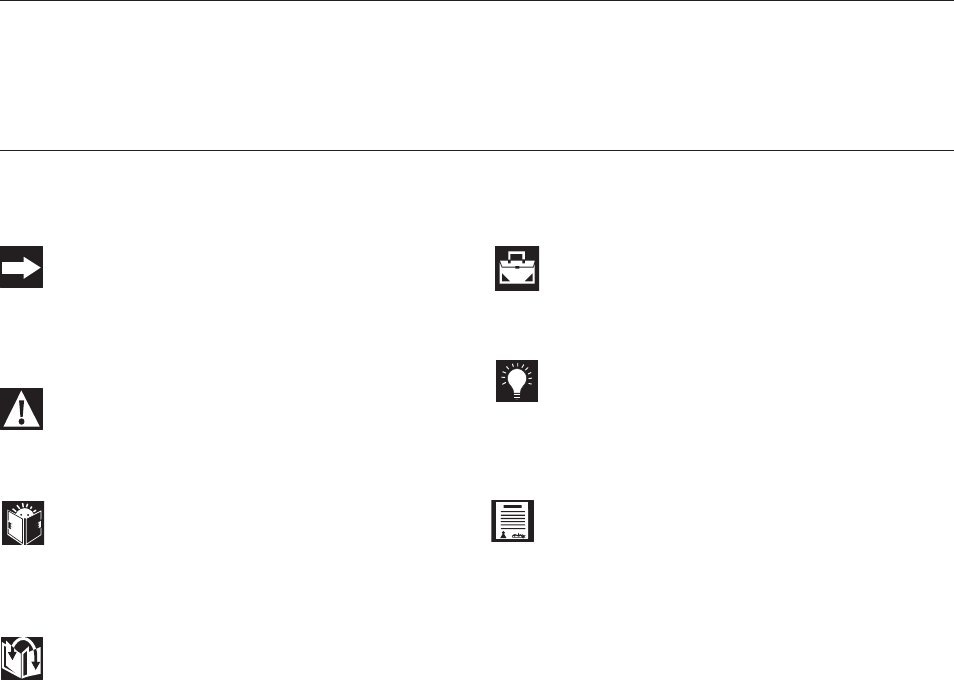

ICONS

Throughout the book, these icons alert you to certain information.

Fast Track

We use this icon to let you know when you

can skip information that may not be relevant to

your situation.

Warning

This icon alerts you to potential problems.

Recommended Reading

When you see this icon, a list of additional

resources that can assist you follows.

Cross-Reference

This icon refers you to a further discussion

of the topic elsewhere in this book.

See an Expert

Lets you know when you need the advice

of an attorney or other expert.

Tip

A legal or commonsense tip to help you

understand or comply with legal requirements.

Recommended Forms

This icon refers you to a related chapter in

Legal Forms for Starting & Running a Small Busi-

ness, by Fred S. Steingold (Nolo), which contains le-

gal forms and checklists. ■

CHAPTER

1

Which Legal Form Is Best for Your Business?

A. Sole Proprietorships ....................................................................................... 1/4

1. Personal Liability ...................................................................................... 1/4

2. Income Taxes .......................................................................................... 1/5

3. Fringe Benefits ........................................................................................ 1/5

4. Routine Business Expenses ......................................................................... 1/7

B. Partnerships ................................................................................................. 1/7

1. Personal Liability ...................................................................................... 1/8

2. Partners’ Rights and Responsibilities ............................................................. 1/9

3. Income Taxes ........................................................................................ 1/10

4. Fringe Benefits and Business Expenses ....................................................... 1/10

C. Corporations.............................................................................................. 1/11

1. Limited Personal Liability .......................................................................... 1/11

2. Income Taxes ........................................................................................ 1/13

3. Attracting Investors ................................................................................. 1/19

D. Limited Liability Companies........................................................................... 1/21

1. Limited Personal Liability .......................................................................... 1/21

2. Number of Owners ................................................................................ 1/22

3. Tax Flexibility ........................................................................................ 1/22

4. Flexible Management Structure................................................................. 1/22

5. Flexible Distribution of Profits and Losses .................................................... 1/23

E. Choosing Between a Corporation and an LLC ................................................. 1/23

F. Special Structures for Special Situations .......................................................... 1/26

1. Limited Partnerships ................................................................................ 1/26

2. Choices for Professionals ........................................................................ 1/27

3. Nonprofit Corporations........................................................................... 1/30

4. Cooperatives and Cooperative-Type Organizations ..................................... 1/31

1/2 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

W

hen you start a business, you must decide

on a legal structure for it. Usually you’ll

choose either a sole proprietorship, a part-

nership, a limited liability company (LLC), or a cor-

poration. There’s no right or wrong choice that fits

everyone. Your job is to understand how each legal

structure works and then pick the one that best

meets your needs.

The best choice isn’t always obvious. After read-

ing this chapter, you may decide to seek some

guidance from a lawyer or an accountant.

For many small businesses, the best initial choice

is either a sole proprietorship or—if more than one

owner is involved—a partnership. Either of these

structures makes especially good sense in a busi-

ness where personal liability isn’t a big worry—for

example, a small service business in which you are

unlikely to be sued and for which you won’t be

borrowing much money. Sole proprietorships and

partnerships are relatively simple and inexpensive

to establish and maintain.

Forming an LLC or a corporation is more compli-

cated and costly, but it’s worth it for some small busi-

nesses. The main feature of LLCs and corporations

that attracts small businesses is the limit they provide

on their owners’ personal liability for business debts

and court judgments against the business. Another

factor might be income taxes: You can set up an LLC

or a corporation in a way that lets you enjoy more

favorable tax rates. In certain circumstances, your

business may be able to stash away earnings at a

relatively low tax rate. In addition, an LLC or corpo-

ration may be able to provide a range of fringe ben-

efits to employees (including the owners) and deduct

the cost as a business expense.

Given the choice between creating an LLC or a

corporation, many small business owners will be bet-

ter off going the LLC route. For one thing, if your

business will have several owners, the LLC can be

more flexible than a corporation in the way you can

parcel out profits and management duties. Also, set-

ting up and maintaining an LLC can be a bit less

complicated and expensive than a corporation. But

there may be times a corporation will be more ben-

eficial. For example, because a corporation—unlike

other types of business entities—issues stock certifi-

cates to its owners, a corporation can be an ideal ve-

hicle if you want to bring in outside investors or re-

ward loyal employees with stock options.

Keep in mind that your initial choice of a busi-

ness form doesn’t have to be permanent. You can

start out as sole proprietorship or partnership and,

later, if your business grows or the risks of personal

liability increase, you can convert your business to

an LLC or a corporation.

For some small business owners, a less

common type of business structure may

be appropriate. While most small businesses will

find at least one good choice among the four basic

business formats described above, a handful will

have special situations in which a different format is

required or at least is desirable. For example, a pair

of dentists looking to limit their personal liability

may need to set up a professional corporation (PC)

or a professional limited liability company (PLLC). A

group of real estate investors may find that a limited

partnership is the best vehicle for them. These and

other special types of business organizations are

summarized in Section F at the end of this chapter.

You may need professional advice in

choosing the best entity for your business.

This chapter gives you a great deal of information to

assist you in deciding how to best organize your

business. Obviously, however, it’s impossible to cover

every relevant nuance of tax and business law—es-

pecially if your business has several owners with dif-

ferent and complex tax situations. And for busi-

nesses owned by several people who have different

personal tax situations, sorting out the effects of

“pass-through” taxation (where partners and most

LLC members are taxed on their personal tax returns

for their share of business profits and losses) is no

picnic, even for seasoned tax pros. The bottom line is

that unless your business will start small and have a

very simple ownership structure, before you make

WHICH LEGAL FORM IS BEST FOR YOUR BUSINESS? 1/3

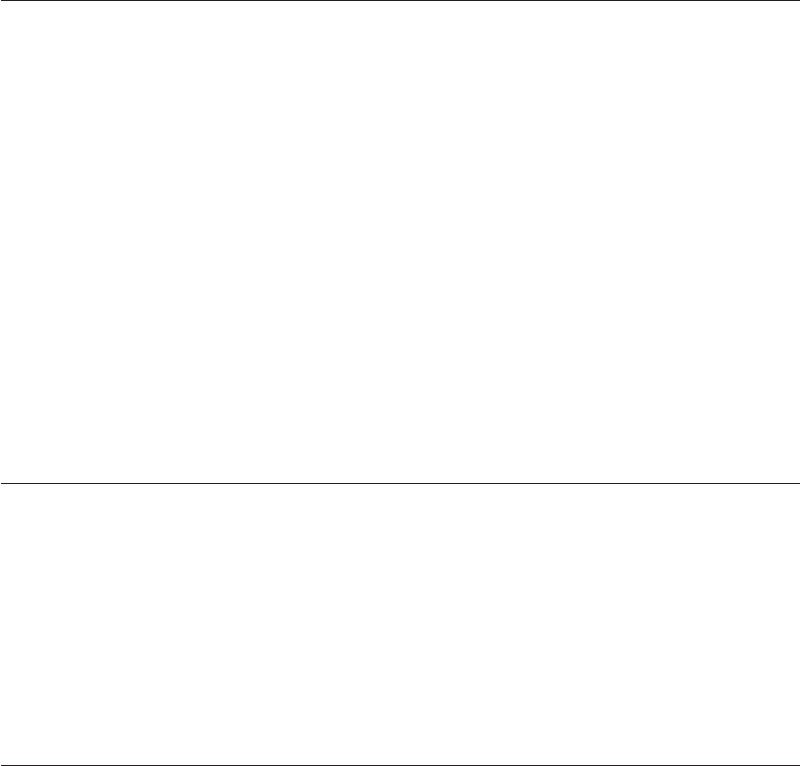

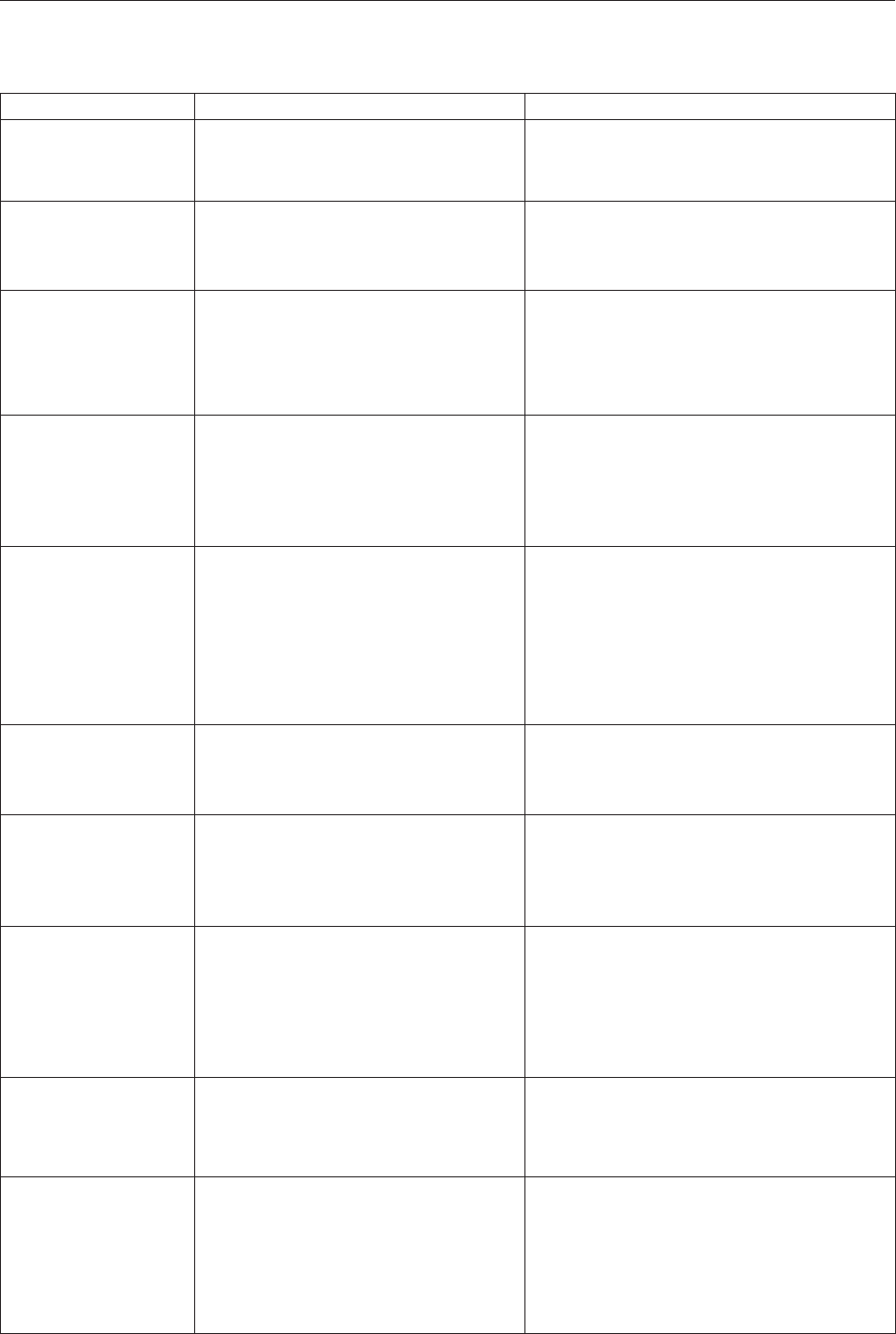

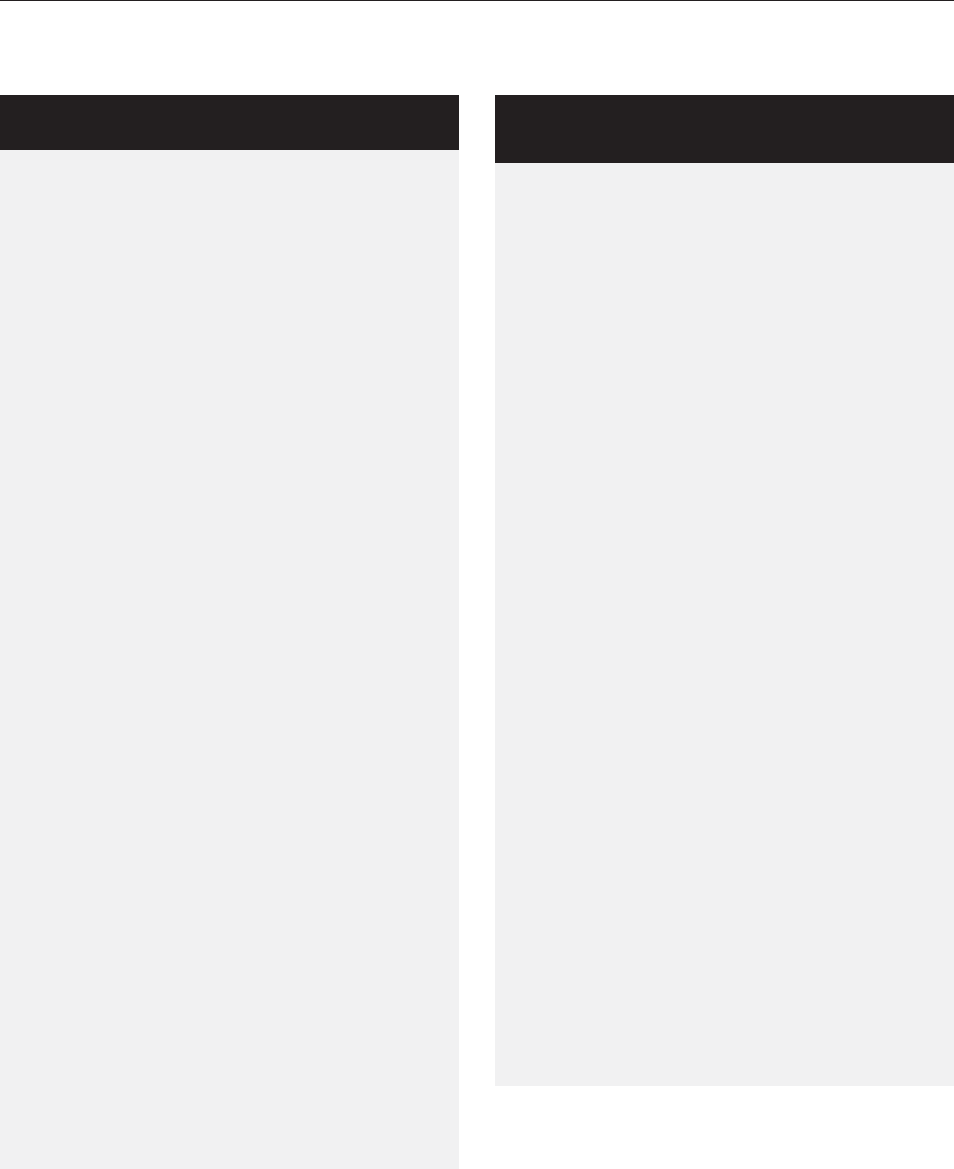

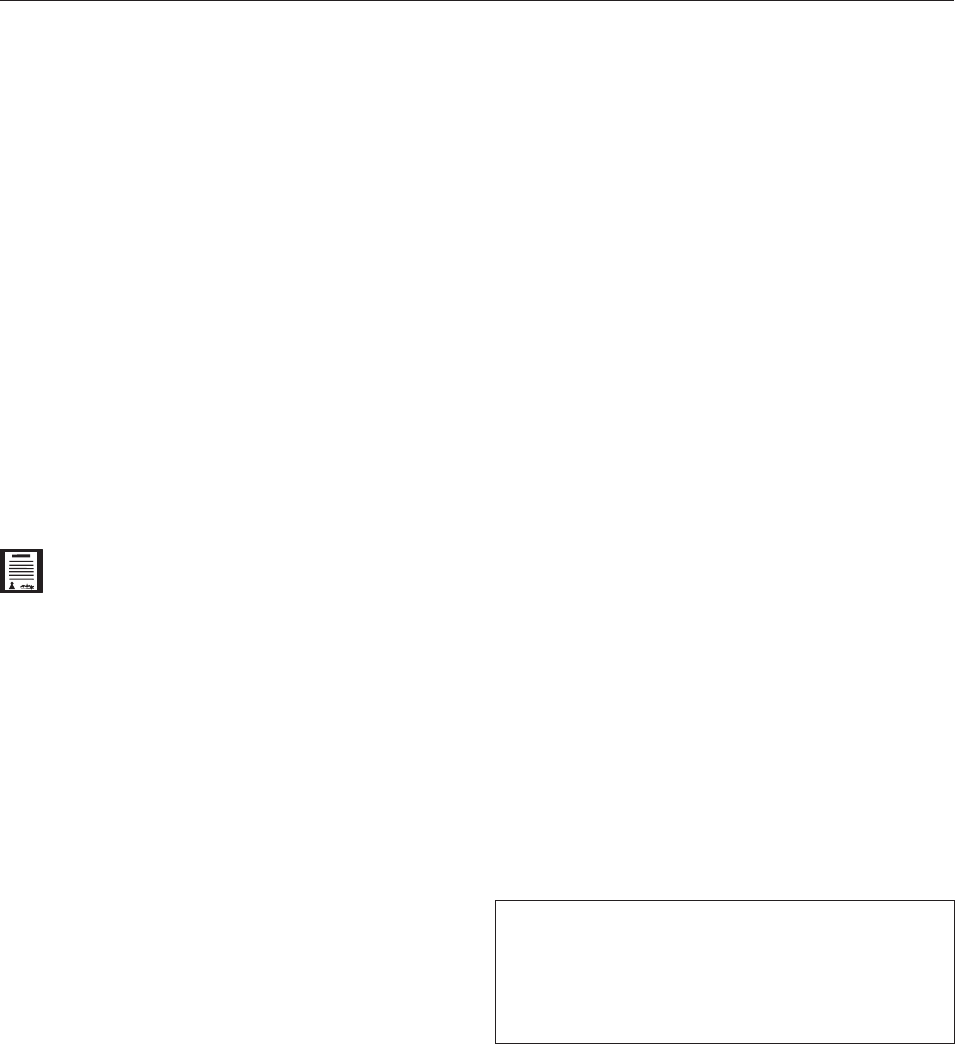

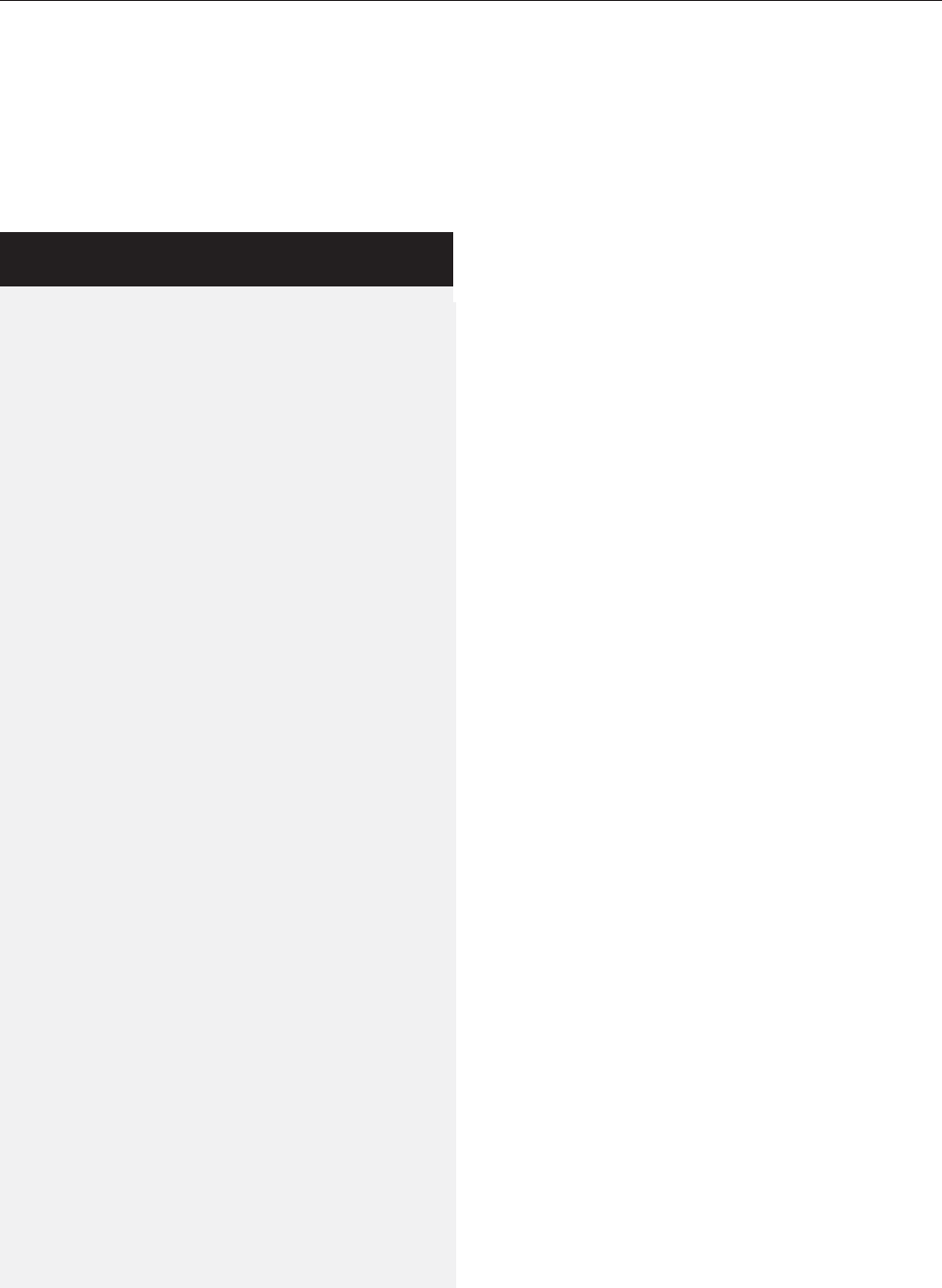

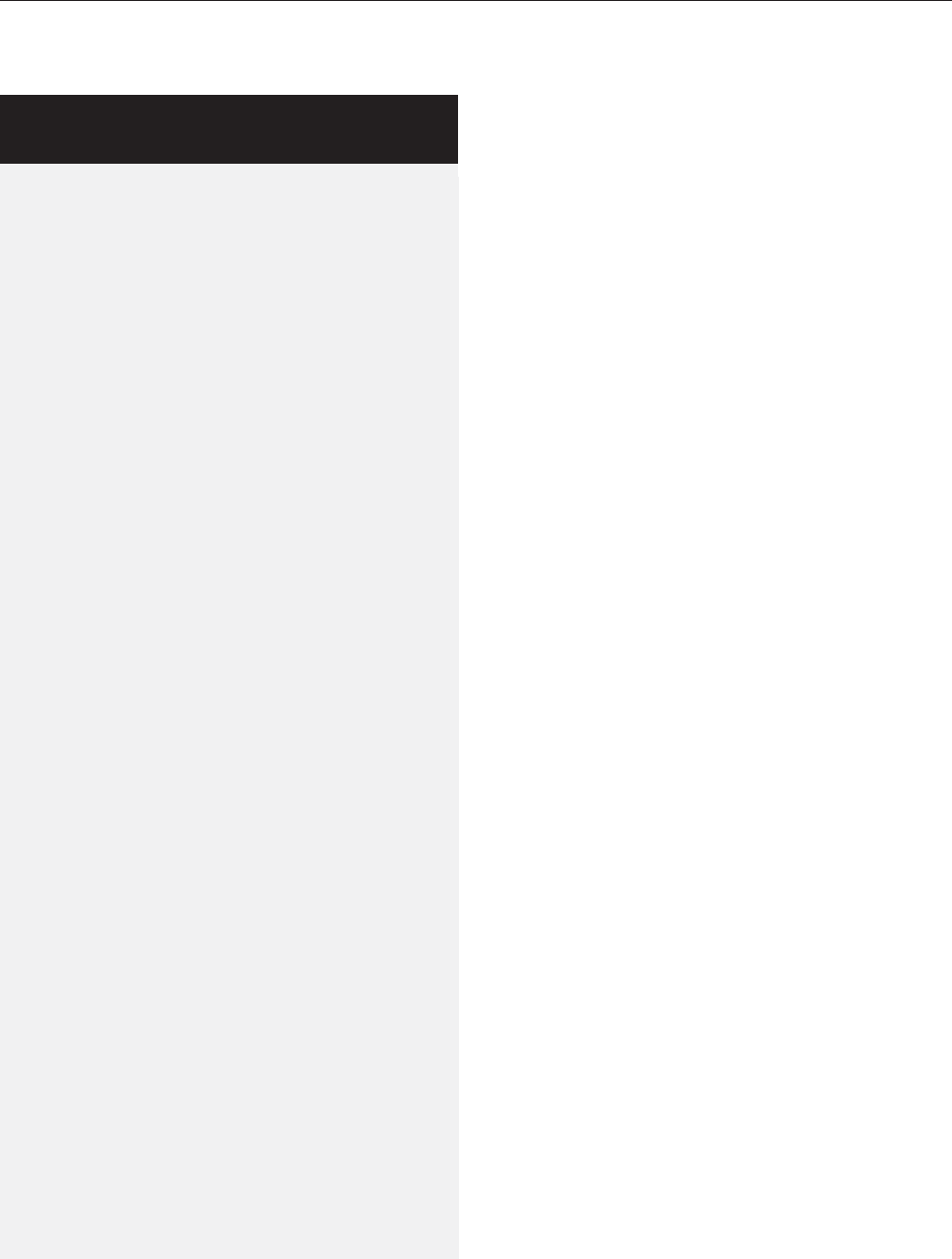

TYPE OF ENTITY

Sole Proprietorship

(Section A)

General Partnership

(Section B)

Limited Partnership

(Section F)

Regular Corporation

(Section C)

S Corporation

(Section C)

Professional Corporation

(Section F)

Nonprofit Corporation

(Section F)

Limited Liability Company

(Section D)

Professional Limited

Liability Company

(Section F)

Limited Liability

Partnership

(Section F)

MAIN ADVANTAGES

Simple and inexpensive to create and operate

Owner reports profit or loss on his or her

personal tax return

Simple and inexpensive to create and operate

Owners (partners) report their share of profit

or loss on their personal tax returns

Limited partners have limited personal liability

for business debts as long as they don’t participate

in management

General partners can raise cash without involving

outside investors in management of business

Owners have limited personal liability for

business debts

Fringe benefits can be deducted as business expense

Owners can split corporate profit among owners

and corporation, paying lower overall tax rate

Owners have limited personal liability for

business debts

Owners report their share of corporate profit

or loss on their personal tax returns

Owners can use corporate loss to offset income

from other sources

Owners have no personal liability for malpractice

of other owners

Corporation doesn’t pay income taxes

Contributions to charitable corporation are

tax-deductible

Fringe benefits can be deducted as business expense

Owners have limited personal liability for business

debts even if they participate in management

Profit and loss can be allocated differently than

ownership interests

IRS rules allow LLCs to choose between being

taxed as partnership or corporation

Same advantages as a regular limited liability company

Gives state licensed professionals a way to enjoy those

advantages

Mostly of interest to partners in old-line professions

such as law, medicine, and accounting

Owners (partners) aren’t personally liable for the

malpractice of other partners

Owners report their share of profit or loss on their

personal tax returns

MAIN DRAWBACKS

Owner personally liable for business debts

Owners (partners) personally liable for business debts

General partners personally liable for business debts

More expensive to create than general partnership

Suitable mainly for companies that invest in real estate

More expensive to create than partnership or sole proprietorship

Paperwork can seem burdensome to some owners

Separate taxable entity

More expensive to create than partnership or sole proprietorship

More paperwork than for a limited liability company, which offers

similar advantages

Income must be allocated to owners according to their

ownership interests

Fringe benefits limited for owners who own more than

2% of shares

More expensive to create than partnership or sole proprietorship

Paperwork can seem burdensome to some owners

All owners must belong to the same profession

Full tax advantages available only to groups organized for

charitable, scientific, educational, literary, or religious purposes

Property transferred to corporation stays there; if corporation

ends, property must go to another nonprofit

More expensive to create than partnership or sole proprietorship

State laws for creating LLCs may not reflect latest federal

tax changes

Same as for a regular limited liability company

Members must all belong to the same profession

Unlike a limited liability company or a professional limited

liability company, owners (partners) remain personally liable

for many types of obligations owed to business creditors,

lenders, and landlords

Not available in all states

Often limited to a short list of professions

WAYS TO ORGANIZE YOUR BUSINESS

1/4 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

your final decision on a business entity, check with

a tax advisor after learning about the basic at-

tributes of each type of business structure (from this

chapter and Chapters 2, 3, and 4).

A. Sole Proprietorships

The simplest form of business entity is the sole pro-

prietorship. If you choose this legal structure, then

legally speaking you and the business are the same.

You can continue operating as a sole proprietor as

long as you’re the only owner of the business.

Establishing a sole proprietorship is cheap and

relatively uncomplicated. While you do not have to

file articles of incorporation or organization (as you

would with a corporation or an LLC), you may have

to obtain a business license to do business under

state laws or local ordinances. States differ on the

amount of licensing required. In California, for ex-

ample, almost all businesses need a business li-

cense, which is available to anyone for a small fee.

In other states, business licenses are the exception

rather than the rule. But most states do require a

sales tax license or permit for all retail businesses.

Dealing with these routine licensing requirements

generally involves little time or expense. However,

many specialized businesses—such as an asbestos

removal service or a restaurant that serves liquor—

require additional licenses, which may be harder to

qualify for. (See Chapter 7 for more on this subject.)

In addition, if you’re going to conduct your busi-

ness under a trade name such as Smith Furniture

Store rather than John Smith, you’ll have to file an

assumed name or fictitious name certificate at a lo-

cal or state public office. This is so people who deal

with your business will know who the real owner

is. (See Chapter 6 for more on business names.)

From an income tax standpoint, a sole propri-

etorship and its owner are treated as a single entity.

Business income and business losses are reported

on your own federal tax return (Form 1040, Sched-

ule C). If you have a business loss, you may be able

to use it to offset income that you receive from

other sources. (For more tax basics, see Chapter 8.)

Legal Forms for Starting & Running a

Small Business

contains a checklist for start-

ing a sole proprietorship.

1. Personal Liability

A potential disadvantage of doing business as a sole

proprietor is that you have unlimited personal liabil-

ity on all business debts and court judgments re-

lated to your business.

EXAMPLE 1: Lester is the sole proprietor of a

small manufacturing business. Believing that his

business’s prospects look good, he orders

$50,000 worth of supplies and uses them up.

Unfortunately, there’s a sudden drop in demand

for his products, and Lester can’t sell the items

he’s produced. When the company that sold

Lester the supplies demands payment, he can’t

pay the bill.

As sole proprietor, Lester is personally li-

able for this business obligation. This means

that the creditor can sue him and go after not

only Lester’s business assets, but his other prop-

erty as well. This can include his house, his car,

and his personal bank account.

EXAMPLE 2: Shirley is the sole proprietor of a

flower shop. One day Roger, one of Shirley’s

employees, is delivering flowers using a truck

owned by the business. Roger strikes and seri-

ously injures a pedestrian. The injured pedes-

trian sues Roger, claiming that he drove care-

lessly and caused the accident. The lawsuit

names Shirley as a codefendant. After a trial,

the jury returns a large verdict against Roger—

and Shirley as owner of the business. Shirley is

WHICH LEGAL FORM IS BEST FOR YOUR BUSINESS? 1/5

personally liable to the injured pedestrian. This

means the pedestrian can go after all of

Shirley’s assets, business and personal.

One of the major reasons to form a corporation

or a limited liability company (LLC) is that, in theory

at least, you’ll avoid most personal liability. (But see

Chapter 12, Section C, for a discussion of how a

good liability insurance policy may be enough pro-

tection against personal liability for a sole propri-

etor.)

2. Income Taxes

As a sole proprietor, you and your business are one

entity for income tax purposes. The profits of your

business are taxed to you in the year that the busi-

ness makes them, whether or not you remove the

money from the business (called “flow-through”

taxation, because the profits “flow through” to the

owner’s income tax return). You report business

profits on Schedule C of Form 1040.

By contrast, if you form an LLC or a corporation,

you have a choice of two different types of tax

treatment.

• Flow-Through Taxation. One choice is to

have the IRS tax your LLC or corporation like

a sole proprietorship or partnership (dis-

cussed above). The owners report their share

of LLC or corporate profits on their own tax

returns, whether or not the money has been

distributed to them.

• Entity Taxation. The other choice is to make

the business a separate entity for income tax

purposes. If you form an LLC and make that

choice, the LLC will pay its own taxes on the

profits of the LLC. And as a member of the

LLC, you won’t pay tax on the money earned

by the LLC until you receive payments as

compensation for services or as dividends.

Similarly, if you form a corporation and

choose this option, you as a shareholder

won’t pay tax on the money earned by the

corporation until you receive payments as

compensation for services or as dividends.

The corporation will pay its own taxes on the

corporate profits.

In Section E of this chapter, I’ll explain the me-

chanics of choosing between these two methods.

For now, just be aware that this tax flexibility of

LLCs and corporations offers some tax advantages

over a sole proprietorship if you’re able to leave

some income in the business as “retained earnings.”

For example, suppose you want to build up a re-

serve to buy new equipment or your small label-

manufacturing company accumulates valuable in-

ventory as it expands. In either case, you might

want to leave $50,000 of profits or assets in the

business at the end of the year. If you operated as a

sole proprietor, those “retained” profits would be

taxed on your personal income tax return at your

marginal tax rate. But with an LLC or corporation

that’s taxed as a separate entity, the tax rate will al-

most certainly be lower.

You can share ownership of your

business with your spouse and still main-

tain its status as a sole proprietorship.

If you

choose to do this, in the eyes of the IRS you’ll be co-

sole proprietors. You can either split the profits from

your business if you and your spouse file separate

returns (and separate Schedule Cs), or you can put

them on your joint Schedule C if you file a joint re-

turn. Only a spouse can be a co-sole proprietor. If

any other family member shares ownership with

you, the business must be organized as a partner-

ship, corporation, or limited liability company.

3. Fringe Benefits

If you operate your business as a sole proprietor-

ship, tax-sheltered retirement programs are available.

A Keogh plan, for example, allows a sole proprietor

to salt away a substantial amount of income free of

current taxes. So does a one-person 401(k). You

can’t really do any better by setting up an LLC or a

corporation.

1/6 LEGAL GUIDE FOR STARTING & RUNNING A SMALL BUSINESS

A “C” corporation or an LLC that chooses to be

taxed as a separate entity does have an advantage

when it comes to medical expenses for the owner

and his or her spouse and dependents. As a sole

proprietor, you are limited as to how much you can

deduct for medical expenses on your personal tax

return: You can deduct only the amount that ex-

ceeds 7.5% of your adjusted gross income for the

year. If you form an LLC or a corporation, however,

and choose to have it taxed as a separate entity,

you can have your business pay all of your family’s

medical expenses (so long as they’re not covered

by insurance) and then take these amounts as a

business deduction. You won’t be personally taxed

for the value of this employment benefit.

In the past, sole proprietors could deduct only a

portion of health insurance premiums for them-

selves and family members, while LLCs and corpo-

rations (if separate taxable entities) could deduct

100%. That sometimes provided a reason to form an

LLC or corporation, but no longer. A self-employed

person can now deduct 100% of those premiums.

If you form an LLC or a corporation, however,

and choose to have it taxed as a separate entity, you

can have the business hire you as an employee. The

business can pay 100% of your family’s health insur-

ance premiums and uncovered medical expenses

and then take these amounts as a business deduc-

tion; you won’t be personally taxed for the value of

this employment benefit.

Hiring Your Spouse

Can Have Tax Benefits

If you choose to do business as a sole propri-

etor, there’s a way you can deduct more of

your family’s medical expenses. First, hire your

spouse at a reasonable wage. Then, set up a

written health benefit plan covering your em-

ployees and their families. A sample form is

shown below. Your business can then deduct

100% of the medical expenses it pays.

But balance whether such a plan can save

you enough money to justify the effort. There

may be some expense for setting up the plan

and handling the associated paperwork. And

remember that your business will be obligated

for payroll taxes on your spouse’s earnings.

(See Chapter 8, Section C, for information on

payroll taxes.) But this isn’t all bad, since your

spouse will become eligible for Social Security

benefits in his or her own right, which can be

of some value—especially if he or she hasn’t

already worked long enough to qualify.

If you’re audited, the IRS will look closely

to make sure your spouse is really an em-

ployee and performing needed services for the

business.

To learn about how a person qualifies for

Social Security benefits, see Social Security,

Medicare & Government Pensions, by Joseph L.

Matthews with Dorothy Matthews Berman (Nolo).