Landlords, Tenants, And Property Management Book

CITE THIS READING MATERIAL AS:

first tuesday

Landlords,

Tenants and

Property

Management

Eighth Edition

Cutoff Dates:

Legal editing of this book was

completed June 2014.

Monthly updates of this text, including errata and recent developments,

are available on your Student Homepage at rsttuesday.us.

Copyright © 2014 by rst tuesday

P.O. Box 5707, Riverside, CA 92517

All rights reserved. No part of this publication may be reproduced or transmit-

ted in any form or by any means, electronic or mechanical, including photocopy,

recording, or any information storage or retrieval system, without permission in

writing from the publisher.

Printed in California

Editorial Staff

Legal Editor/Publisher:

Fred Crane

Project Editor:

Connor P. Wallmark

Senior Editor:

Giang Hoang-Burdette

Contributing Editors:

Fernando Nuñez

Carrie B. Reyes

Matthew Taylor

Sarah Kolvas

Graphic Designer:

Mary LaRochelle

Comments or suggestions to:

rst tuesday, P.O. Box 5707, Riverside, CA 92517

editorial@rsttuesday.us

Table of Contents i

Table of

Contents

Table of Forms ..................................................................................................................iv

Introduction ....................................................................................................................vi

Glossary .............................................................................................................................441

Ownership

and

Possession

Chapter 1 Fee vs. leasehold

A matter of possession ......................................1

Chapter 2 The tenancies in real estate

Know your tenancy or lose time ...............................9

Chapter 3 Landlord’s right to enter

Conflict with occupant’s right to privacy ...................21

Chapter 4 Tenant leasehold improvements

Ownership rights when a tenant vacates ..................37

Chapter 5 Options and the right of first refusal to buy

Tenants with rights to acquire the premises ................51

Chapter 6 Property management licensing

When is a CalBRE license required? ........................61

Chapter 7 Property management agreement

Authority to operate a rental property .....................69

Chapter 8 A property manager’s responsibilities

An evolving standard of conduct ............................ 77

Chapter 9 Resident managers

Employees: not independent contractors, not tenants .... 95

Chapter 10 Identification of property manager or owner

Notice to tenant of agent-for-service .......................107

Chapter 11 Exclusive authorization to lease

Leasing agent’s bargain for fees. . . . . . . . . . . . . . . . . . . . . . . . . . .113

Chapter 12 Exclusive authorization to locate space

A leasing agent and the nonresidential tenant ...........123

Chapter 13 Cost of operating in leased space

Disclosures by leasing agents ...............................133

Agency

and

Property

Management

ii Landlords, Tenants and Property Management, Eighth Edition

Chapter 14 Security deposits and pre-expiration inspections

Cover for a tenant’s nonperformance .....................141

Chapter 15 Residential turnover cost recovery

Rent is set to include all operating expenses ...............155

Chapter 16 Accepting partial rent

Residential and nonresidential landlord rights ...........163

Chapter 17 Changing terms on a month-to-month tenancy

Landlord’s notice to tenant ..................................171

Chapter 18 Forfeiture of the lease

Lease agreement obligations survive ......................179

Chapter 19 Surrender cancels the lease agreement

Lost ability to recover future rents ..........................191

Chapter 20 Delinquent rent and the three-day notice

Pay or forfeit your right of possession .....................201

Chapter 21 Three-day notices to quit for nonmonetary breaches

Curable and incurable nonmonetary breaches

...........

213

Chapter 22 Other amounts due under three-day notices

Know what the judge will allow ............................231

Chapter 23 Notices to vacate

Termination of periodic tenancies . . . . . . . . . . . . . . . . . . . . . . . . . 241

Chapter 24 Personal property recovered by tenant

Reclaim it on notice or lose it ...............................255

Chapter 25 Constructive eviction cancels the lease

Interference forces the tenant to vacate ...................267

Chapter 26 Care and maintenance of property

Tenant obligations and remedies ...........................277

Chapter 27 Implied warranty of habitability

Safe and sanitary living conditions ........................289

Chapter 28 Security to prevent crimes

Protective measures and warnings ........................303

Chapter 29 Dangerous on-site and off-site activities

Duty to all to remove on-site dangers ......................309

Deposits

and

Rents

Enforcing

Rents;

Forfeiting

Tenancies

Maintenance

and

Security

Table of Contents iii

Chapter 30 Nonresidential lease agreements

The conveyance of a leasehold .............................321

Chapter 31 Rent provisions in nonresidential leases

Setting the rent ............................................341

Chapter 32 Adjustable rent provisions

Economic goals of nonresidential landlords ..............349

Chapter 33 Nonresidential use-maintenance provisions

Shifting ownership obligations to tenants ................359

Chapter 34 Lease assignments and subleases

Consent conditioned on exactions .........................373

Chapter 35 Residential rental and lease agreements

A review of periodic vs. fixed-term tenancies .............385

Chapter 36 Civil rights and fair housing laws

Property rights and an individual’s status .................395

Chapter 37 Residential rent control

Police power and rent control ..............................411

Chapter 38 Attornment clauses in nonresidential leases

Altering priorities for lenders ..............................419

Chapter 39 Due-on-leasing regulations

Rising interest rates bring lender interference

............

433

Nonresidential

Lease

Provisions

Residential

Leases and

Rental

Agreements

Lender

Considerations

iv Landlords, Tenants and Property Management, Eighth Edition

Table of

Forms

No. Form Name Page

111 Exclusive Authorization to Locate Space ............................................. 127

113 Schedule of Leasing Agent’s Fee .............................................................. 332

1 1 6 R i g h t t o E n t e r a n d E x h i b i t U n i t t o B u y e r s —

For Residential and Nonresidential Rentals ........................................26

116-1 Notice to Occupant of Entry and Completion of Showing —

For Residential and Nonresidential Rentals ........................................27

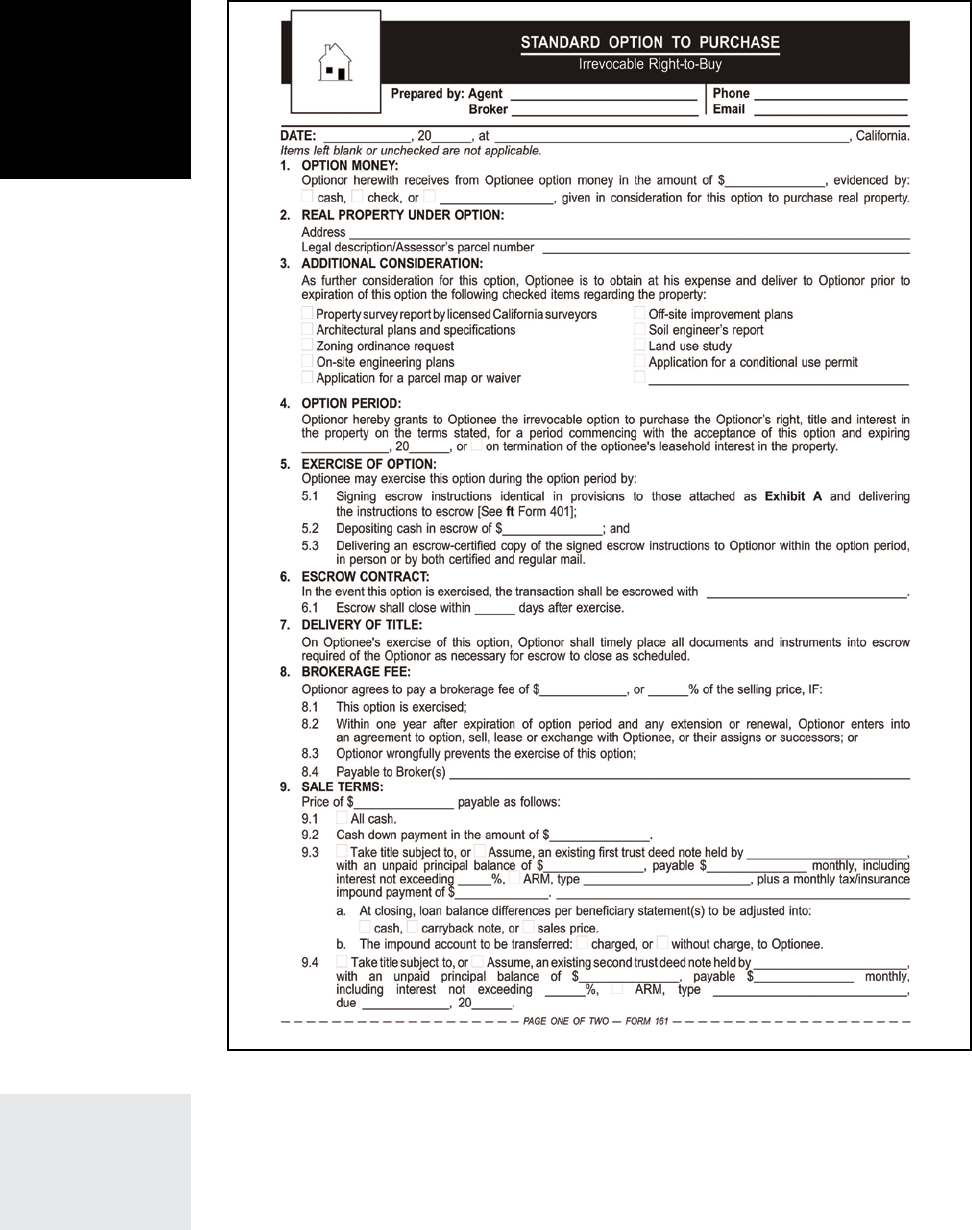

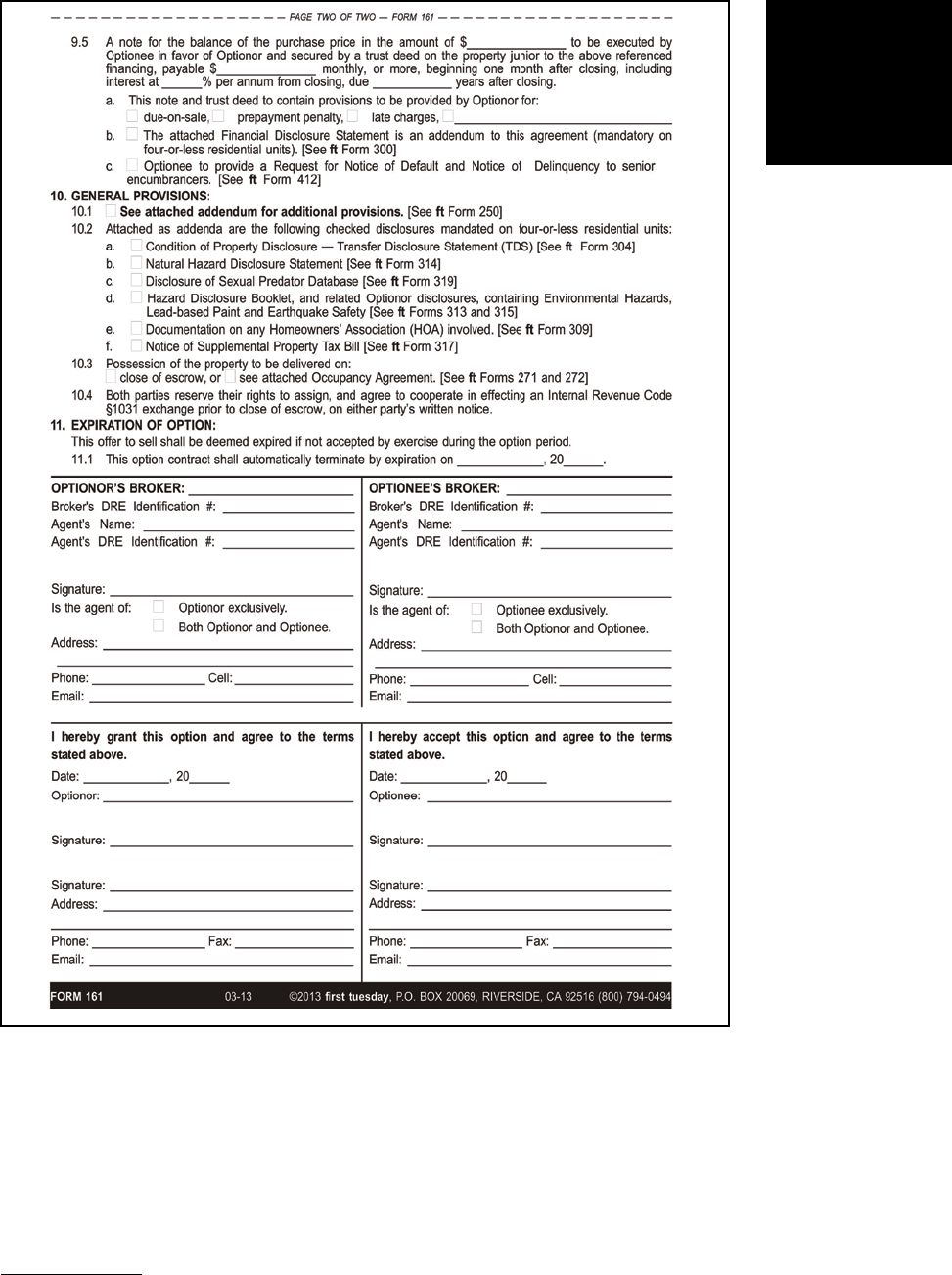

161 Standard Option to Purchase —

Irrevocable Right-to-Buy ................................................................................ 54

552 Nonresidential Lease Agreement Addendum —

Alienation of Leasehold ...............................................................................383

554 Change of Owner of Property Manager —

Addendum to Rental or Lease Agreement ......................................... 110

558 Partial Payment Agreement — Nonresidential .............................. 165

559 Partial Payment Agreement — Residential ....................................... 168

560 Condition of Premises Addendum .......................................................... 278

561 C o ndit i o n of F u r nis h i ngs A d d end u m —

And Inventory ..................................................................................................280

562 Tenant’s Property Operating Expense Prole .................................... 136

567 Notice of Intent to Enter Dwelling ............................................................25

567-1 Notice of Right to Request a

Joint Pre-Expiration Inspection ............................................................... 146

567-3 Statement of Deciencies on

Joint Pre-Expiration Inspection ............................................................... 148

569 30-Day Notice to Vacate —

For Use by Residential Landlord ............................................................. 243

569-1 60-Day Notice to Vacate –

For Use by Residential Landlord ............................................................. 244

570 30-Day Notice of Change in Rental Terms .......................................... 173

572 30-Day Notice to Vacate — From Tenant ............................................ 174

573 90-Day Notice to Quit Due to Foreclosure —

To Holdover Residential Tenant .............................................................. 252

57 5 T h ree - Day N o tic e t o Pa y Ren t o r Qu i t —

With Rent-Related Fees ................................................................................ 203

Full

Forms

Full-size, fillable copies of all 350+ first tuesday forms can be found

in the Forms-on-CD accompanying this course.

Table of Forms v

No. Form Name Page

575 - 1 Thre e - Day N o t ice t o Pay R e n t or Q u i t —

Without Rent-Related Fees ........................................................................235

576 Three-Day Notice to Perform or Quit ..................................................... 215

577 Three-Day Notice to Quit —

Residential and Nonresidential ............................................................... 217

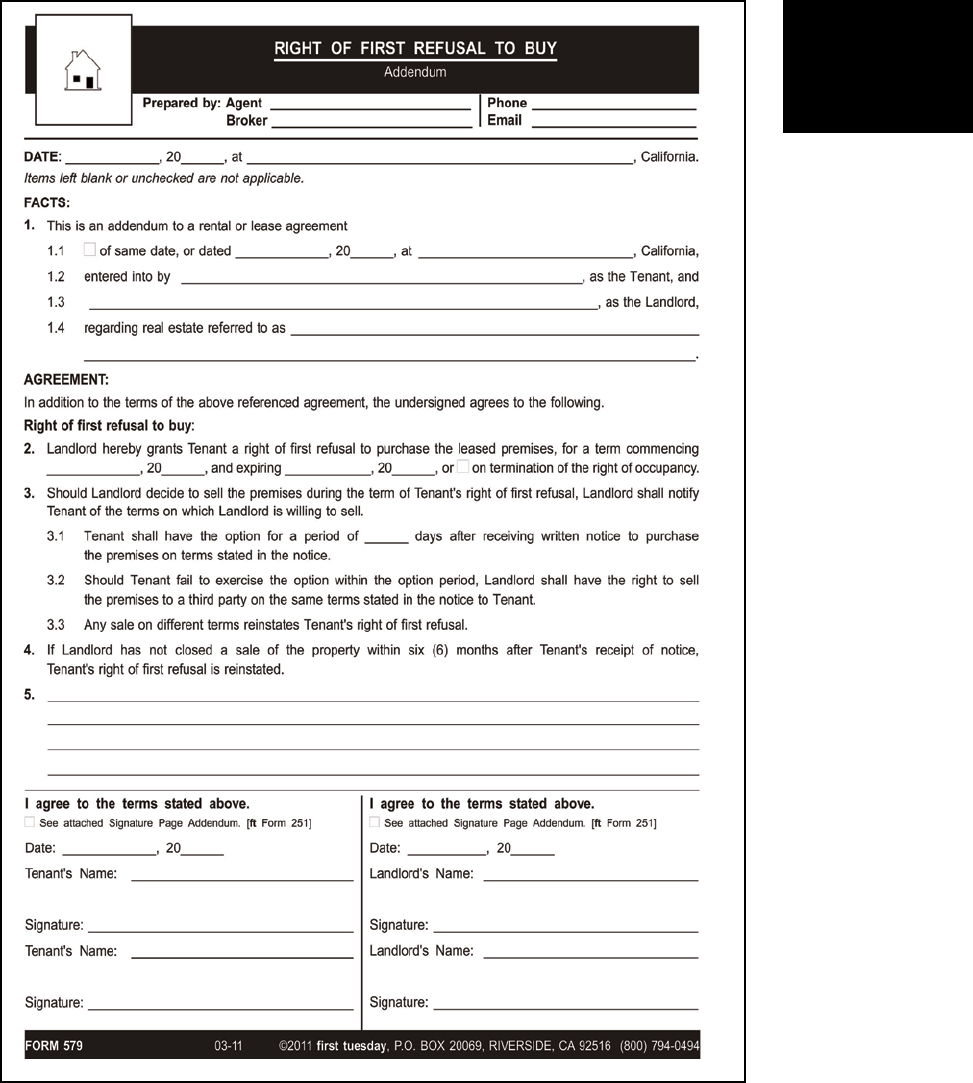

579 Right of First Refusal to Buy — Addendum .......................................... 57

580 Proof of Service —

For Service of Notice to Real Estate Tenants ...................................... 225

582 Notice to Landlord to Surrender Personal Property —

For Use by Residential Tenants Only .................................................... 259

582-1 Costs Payable to Reclaim Personal Property ..................................... 265

584 Notice of Right to Reclaim Personal Property —

To Residential Tenant After Termination of Tenancy ................... 257

584-1 Notice of Right to Reclaim Personal Property —

To Others with an Interest in Property ................................................. 261

585 Security Deposit Disposition

On Vacating Residential Premises .......................................................... 150

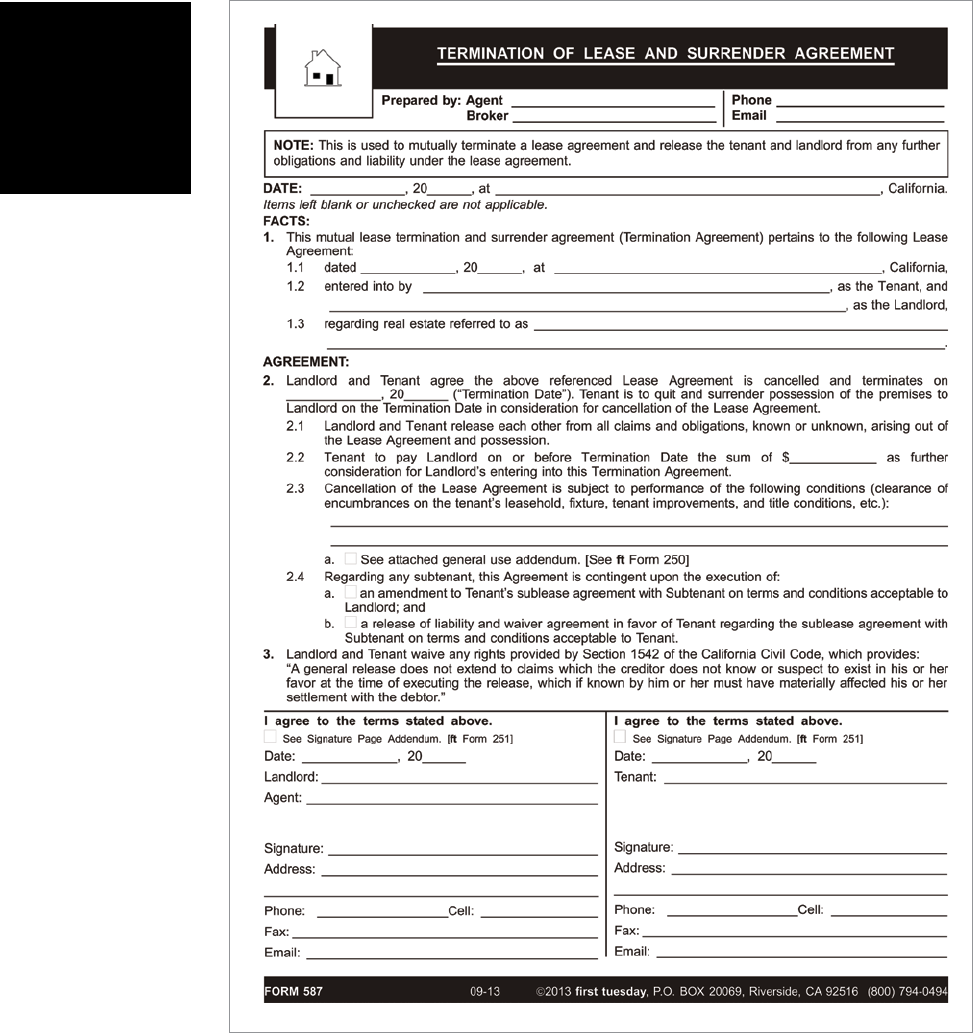

587 Termination of Lease and Surrender Agreement ............................ 194

591 Resident Manager Agreement .....................................................................98

597 Notice of Nonresponsibility —

From Landlord (Calif.Civil Code §3094) ...................................................4 7

110 Exclusive Authorization to Lease Property ........................................ 115

135 Request for Homeowner Association Documents .............................74

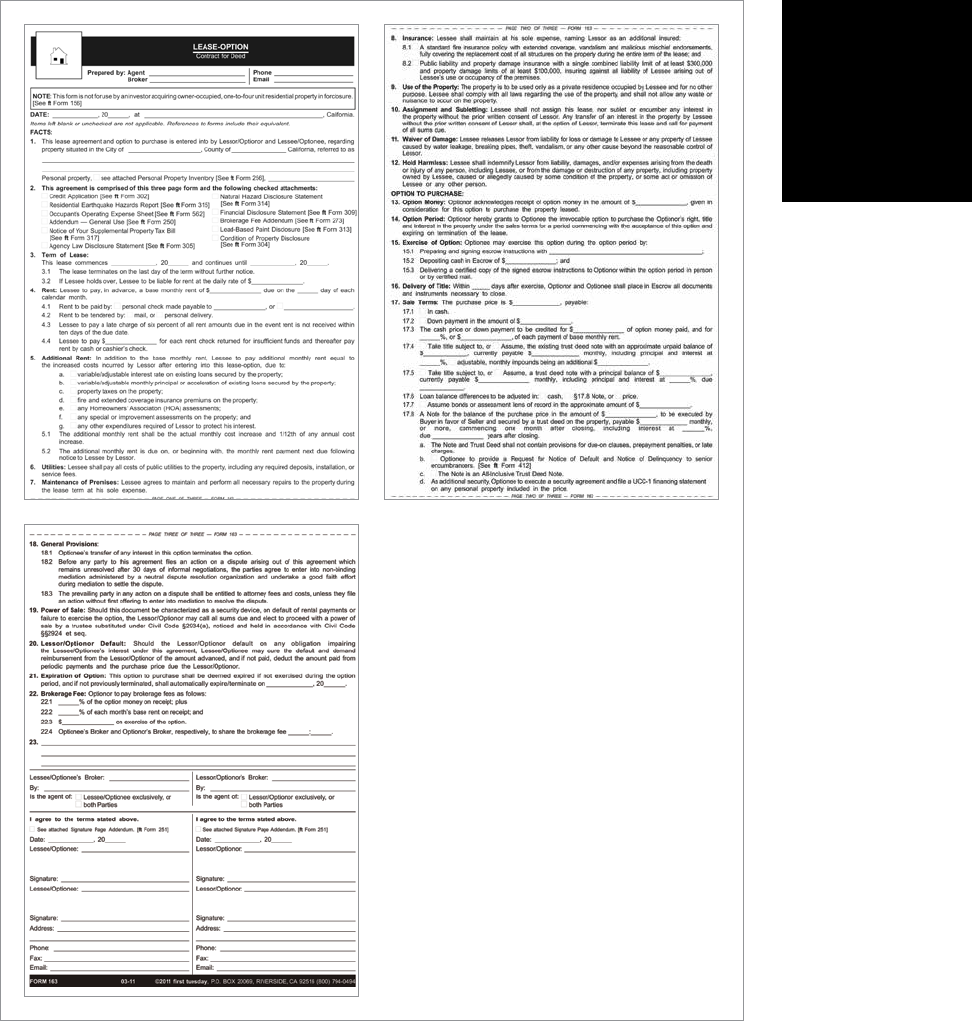

163 Lease-Option – Contract for Deed ...............................................................59

185 Letter of Intent .................................................................................................. 137

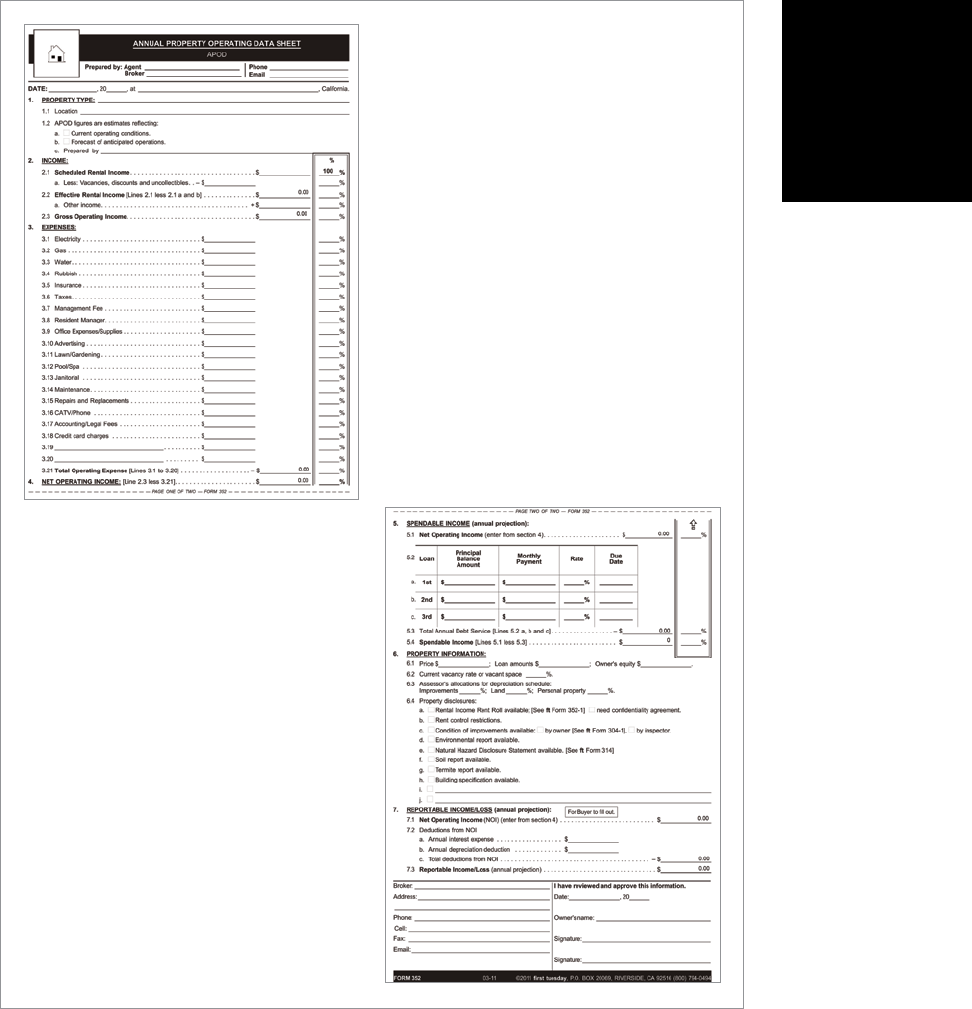

352 Annual Property Operating Data Sheet (APOD) .............................. 161

436-1 UCC-1 Financing Statement ..........................................................................48

550 Residential Lease Agreement ....................................................................387

552 Nonresidential Lease Agreement — Single Tenant Gross ..... 6, 323,

346, 350, 351, 361-363, 368-370, 374, 382, 429

552-4 Nonresidential Lease Agreement — Percentage Lease ................ 355

552-8 Lender Subordination and Attornment Provisions .............. 421, 427

590 Property Management Agreement ...........................................................71

Partial

Forms

vi Landlords, Tenants and Property Management, Eighth Edition

Landlords, Tenants and Property Management is written for real

estate licensees, landlords, property managers, attorneys and investors.

The course material is designed to be an educational tool for use in the

classroom and in correspondence studies as well as a strong technical

research and reference tool.

The objective of Landlords, Tenants and Property Management

is to inform the reader of federal, state and local landlord/tenant rights

and obligations. This book examines the exacting rules of leasing and

renting both residential and nonresidential income properties. Also

included are examples that vividly present and resolve landlord/

tenant situations encountered by owners and real estate licensees

who manage income property or perform services as leasing agents.

A distinction exists between nonresidential (commercial, industrial,

etc.) and residential landlord-tenant relationships. This distinction

lies in the residential rental exception carved out of the general, long-

standing landlord-tenant rules once applicable to both residential and

nonresidential property. General landlord-tenant rules apply fully to

nonresidential leasing arrangements and, to the extent not overridden

by extensive residential exceptions, apply to residential leasing

arrangements as well.

Included in each chapter is a summary of issues reviewed in the

chapter with definitions of the key terms essential to the reader’s

comprehension of the topic. Unless a form cited in the book says, “See

Form XXX accompanying this chapter” [emphasis added], it is not

in the book. However, the reader has access to a fillable and savable

version of all referenced first tuesday forms on the first tuesday

Forms-on-CD delivered with the course enrollment package. The CD

contains 400+ first tuesday real estate forms, plus a digital version

of our library of the sixteen volumes comprising the first tuesday

Realtipedia publication.

All materials are also accessible online from the reader’s Student

Homepage at www.firsttuesday.us during their one-year enrollment

period.

Future errata, supplemental material and recent developments specific

to Landlords, Tenants and Property Management are available

for further research within the Online Reading section of the reader’s

Student Homepage at www.firsttuesday.us.

Introduction

Chapter 1: Fee vs. leasehold 1

Fee vs. leasehold

After reading this chapter, you will be able to:

• identify the different possessory interests held in real estate, and

the rights and obligations associated with each;

• distinguish the individual rights which collectively comprise real

property;

• identify the different types of leasehold interests held by tenants;

• understand leasehold interests which convey special rights, such

as a ground lease, master lease or sublease.

Chapter

1

Real estate, sometimes legally called real property or realty, consists of:

• the land;

• the improvements and fixtures attached to the land; and

• all rights incidental or belonging to the property.

1

1 Calif. Civil Code §658

estate

fee estate

fixed-term tenancy

ground lease

impairment

leasehold estate

legal description

life estate

master lease

parcel

profit a prendre

sublease

tenancy-at-sufferance

tenancy-at-will

Key Terms

Learning

Objectives

A matter of

possession

2 Landlords, Tenants and Property Management, Eighth Edition

A parcel of real estate is located by circumscribing its legal description on

the “face of the earth.” Based on the legal description, a surveyor locates and

sets the corners and surface boundaries of the parcel. The legal description is

contained in deeds, subdivision maps or government surveys relating to the

property.

All permanent structures, crops and timber are part of the parcel of real estate.

The parcel of real estate also includes buildings, fences, trees, watercourses

and easements within the parcel’s boundaries.

A parcel of real estate is three dimensional. In addition to the surface area

within the boundaries, a parcel of real estate consists of:

• the soil below the parcel’s surface to the core of the earth, including

water and minerals; and

• the air space above it to infinity.

For instance, the rental of a boat slip includes the water and the land below

it. Both the water and land below the boat slip comprise the real estate, the

parcel leased. Thus, landlord/tenant law controls the rental of the slip.

In the case of a statutory condominium unit, the air space enclosed within

the walls is the real estate conveyed and held by the fee owner of the unit.

The structure, land and air space outside the unit are the property of the

homeowners’ association (HOA).

The ownership interests a person may hold in real estate are called estates.

Four types of estates exist in real estate:

• fee estates, also known as fee simple estates, inheritance estates,

perpetual estates, or simply, the fee;

• life estates;

• leasehold estates, sometimes called leaseholds, or estates for years; and

• estates at will, also known as tenancies-at-will.

2

In practice, these estates are separated into three categories: fee estates,

life estates and leasehold estates. Estates at will are considered part of the

leasehold estates category. Leasehold estates are controlled by landlord/

tenant law.

A person who holds a fee estate interest in real estate is a fee owner. In a

landlord/tenant context, the fee owner is the landlord.

Editor’s note — If a sublease exists on a nonresidential property, the master

tenant is the “landlord” of the subtenant.

A fee owner has the right to possess and control their property indefinitely.

A fee owner’s possession is exclusive and absolute. Thus, the owner has the

2 CC §761

estate

The ownership interest

a person may hold in

real estate.

fee estate

An indefinite, exclusive

and absolute legal

ownership interest in a

parcel of real estate.

Fee estates:

unbundling

the rights

Possessory

interests in

real estate

parcel

A three-dimensional

portion of real estate

identified by a legal

description.

legal description

The description used

to locate and set

boundaries for a parcel

of real estate.

Chapter 1: Fee vs. leasehold 3

right to deny others permission to cross their boundaries. No one can be on

the owner’s property without their consent, otherwise they are trespassing.

The owner may recover any money losses caused by the trespass.

A fee owner has the exclusive right to use and enjoy the property. As long as

local ordinances such as building codes and zoning regulations are obeyed, a

fee owner may do as they please with their property. A fee owner may build

new buildings, tear down old ones, plant trees and shrubs, grow crops or

simply leave the property unattended.

A fee owner may occupy, sell, lease or encumber their parcel of real estate,

give it away or pass it on to anyone they choose on their death. The fee estate

is the interest in real estate transferred in a real estate sales transaction, unless

a lesser interest such as an easement or life estate is noted. However, one

cannot transfer an interest greater than they received.

A fee owner is entitled to the land’s surface and anything permanently

located above or below it.

3

The ownership interests in one parcel may be separated into several fee

interests. One person may own the mineral rights beneath the surface,

another may own the surface rights, and yet another may own the rights

to the air space. Each solely owned interest is held in fee in the same parcel.

[See Case in point, “Separation of fee interests”]

In most cases, one or more individuals own the entire fee and lease the

rights to extract underground oil or minerals to others. Thus, a fee owner

can convey a leasehold estate in the oil and minerals while retaining their

fee interest. The drilling rights separated from the fee ownership are called

profit a prendre.

4

Profit a prendre is the right to remove profitable materials from property

owned and possessed by another. If the profit a prendre is created by a lease

agreement, it is a type of easement.

5

3 CC §829

4 Rousselot v. Spanier (1976) 60 C3d 238

5 Gerhard v. Stephens (1968) 68 C2d 864

Consider a fee owner who grants separate fee interests in their property to two individuals.

One individual receives the land’s surface and air space rights. The other individual receives

the subsurface oil and mineral rights.

The surface owner claims title to the entire parcel of real estate should be vested — quieted

— in their name. The subsurface owner objects, claiming the surface owner’s real estate

interest is less than the entire fee estate in the property.

Here, the surface owner’s fee interest in the parcel of real estate is separate from the

subsurface ownership and possession of the oil and mineral rights. Also, they are not co-

owners of the real estate. Both owners hold an individual fee estate in mutually exclusive

and divided portions of the same parcel. [In re Waltz (1925) 197 C 263]

profit a prendre

The right to remove

minerals from

another’s real estate.

Case in point

Separation of

fee interests

Separate

interests

4 Landlords, Tenants and Property Management, Eighth Edition

A life estate is an interest in a parcel of real estate lasting the lifetime of an

individual, usually the life of the tenant. Life estates are granted by a deed

entered into by the fee owner, an executor under a will or by a trustee under

an inter vivos trust.

Life estates are commonly established by a fee owner who wishes to provide

a home or financial security for another person (the life tenant) during that

person’s lifetime, called the controlling life.

Life estates terminate on the death of the controlling life. Life estates may also

be terminated by agreement or by merger of different ownership interests in

the property.

For example, the fee owner of a vacation home has an elderly aunt who

needs a place to live. The fee owner grants her a life estate in the vacation

home for the duration of her lifetime. The aunt may live there for the rest of

her life, even if she outlives the fee owner who granted her the life estate.

Although the aunt has the right of exclusive possession of the entire parcel of

real estate, the fee owner retains title to the fee estate. Thus, the conveyance

of a life estate transfers a right of possession which has been “carved out” of

the fee estate. This is comparable to possession under a leasehold estate since

it is conveyed for its duration out of a fee estate. Unlike a lease, a life estate

does not require rent to be paid.

On the aunt’s death, possession of the property reverts to the fee owner, their

successors or heirs. The right of possession under the life estate is extinguished

on the aunt’s death.

The holder of a life estate based on their life has the right of possession until

death, as though they were the owner in fee. The holder of a life estate is

responsible for taxes, maintenance and a reasonable amount of property

assessments.

6

The holder of a life estate may not impair the fee interest.

7

For instance, the holder of a life estate may not make alterations which

decrease the property’s value, such as removing or failing to care for valuable

plants or demolishing portions of the improvements or land.

Conversely, the owner of the life estate has the right to lease the property to

others and collect and retain all rents produced by the property during the

term of the life estate.

In addition, a life tenant is entitled to be reimbursed by the fee owner for the

fee owner’s share of the costs to improve the property.

6 CC §840

7 CC §818

The life estate

improves or

impairs the

fee

impairment

The act of injuring or

diminishing the value

of a fee interest.

life estate

An interest in a parcel

of real estate lasting

the lifetime of the life

tenant.

Life estates

and the life

tenant

Chapter 1: Fee vs. leasehold 5

Leasehold estates, or tenancies, are the result of rights conveyed to a tenant

by a fee owner (or by the life estate tenant or master lessee) to possess a parcel

of real estate.

Tenancies are created when the landlord and the tenant enter into a rental

or lease agreement that conveys a possessory interest in the real estate to the

tenant.

The tenant becomes the owner of a leasehold with the right to possess and

use the entire property until the lease expires. The ownership and title to

the fee interest in the property remains with the landlord throughout the

term of the leasehold. The landlord’s fee interest is subject to the tenant’s

right of possession, which is carved out of the fee on entering into the lease

agreement.

In exchange for the right to occupy and use the property, the landlord is

entitled to rental income from the tenant during the period of the tenancy.

Four types of leasehold estates exist and can be held by tenants. The interests

are classified by the length of their term:

• a fixed-term tenancy, simply known as a lease and legally called an

estate for years;

• a periodic tenancy, usually referred to as a rental;

• a tenancy-at-will, previously introduced as an estate at will; and

• a tenancy-at-sufferance, commonly called a holdover tenancy.

A fixed-term tenancy lasts for a specific length of time as stated in a lease

agreement entered into by a landlord and tenant. On expiration of the lease

term, the tenant’s right of possession automatically terminates unless it is

extended or renewed by another agreement, such as an option agreement.

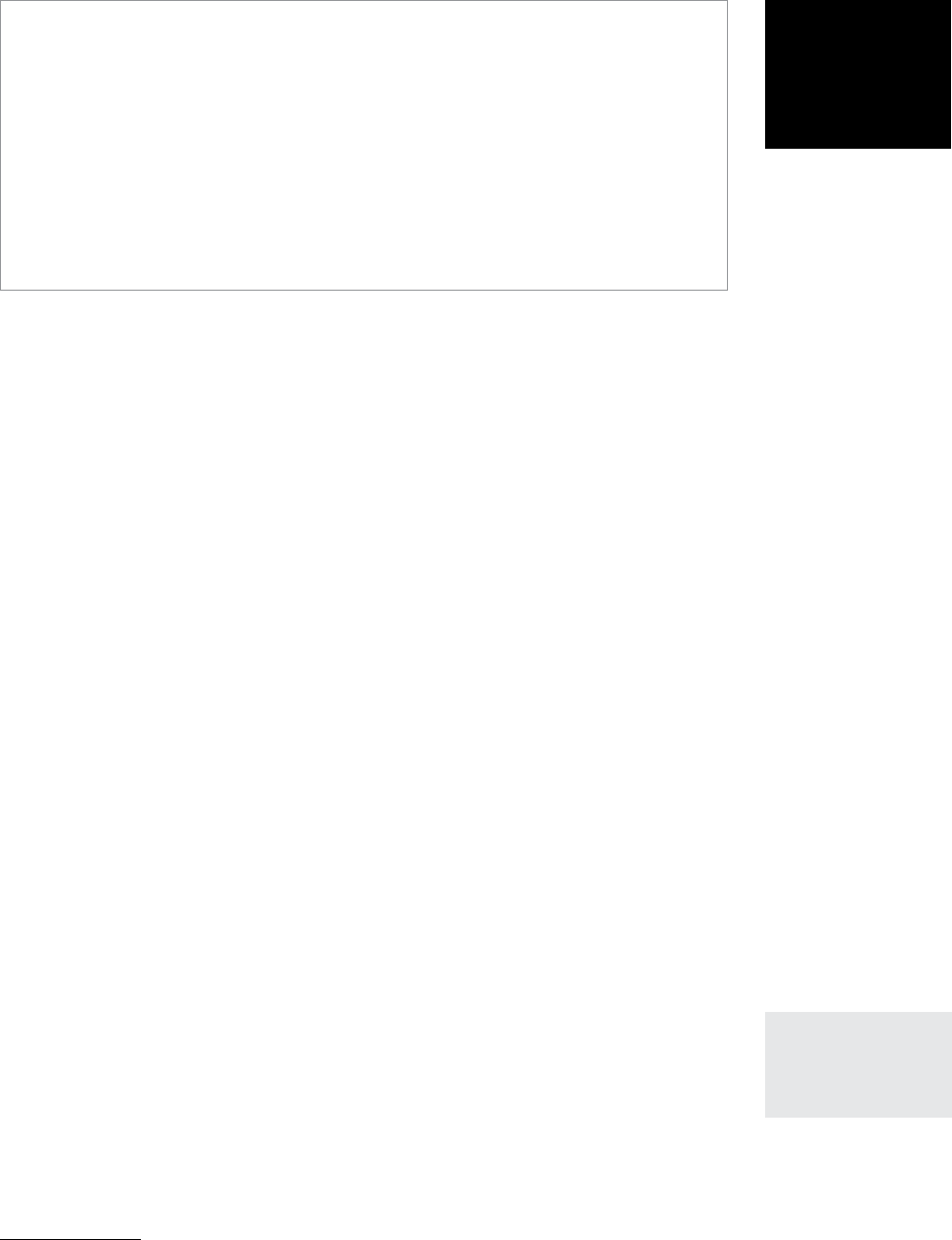

[See Figure 1, Form 552 §2]

Periodic tenancies also last for a specific length of time, such as a week,

month or year. Under a periodic tenancy, the landlord and tenant agree

to automatic successive rental periods of the same length of time, such as

in a month-to-month tenancy, until terminated by notice by either the

landlord or the tenant.

In a tenancy-at-will (also known as an estate at will) the tenant has the

right to possess a property with the consent of the fee owner. Tenancies-at-

will can be terminated at any time by an advance notice from either the

landlord or the tenant or as set by agreement. Tenancies-at-will do not have

a fixed duration, are usually not in writing and a rent obligation generally

does not exist.

A tenancy-at-sufferance occurs when a tenant retains possession of the

rented premises after the tenancy granted terminates. [See Chapter 2]

tenancy-at-will

A leasehold interest

granted to a tenant,

with no fixed duration

or rent owed. A

tenancy-at-will can be

terminated at any time

by an advance notice

from either party.

fixed-term tenancy

A leasehold interest

which lasts for

the specific lease

period set forth in a

lease agreement. A

fixed-term tenancy

automatically

terminates at the end

of the lease period. [See

ft Form 550 and 552]

tenancy-at-sufferance

A leasehold interest

held by a tenant who

retains possession of

the rented premises

after the termination

of the tenancy. [See ft

Form 550 §3.3]

leasehold estate

The right to possess

a parcel of land,

conveyed by a fee

owner (landlord) to a

tenant.

Leasehold

estates held

by tenants

Types of

leaseholds

6 Landlords, Tenants and Property Management, Eighth Edition

In addition to the typical residential and nonresidential leases, you will

find special use leases.

Oil, gas, water and mineral leases convey the right to use mineral deposits

below the earth’s surface.

The purpose of an oil lease is to discover and produce oil or gas. The lease is a

tool used by the fee owner of the property to develop and realize the wealth

of the land. The tenant provides the money and machinery for exploration,

development and operations.

The tenant pays the landlord rent, called a royalty. The tenant then keeps

any profits from the sale of oil or minerals the tenant extracts from beneath

the surface of the parcel.

A ground lease on a parcel of real estate is granted to a tenant in exchange

for the payment of rent. In a ground lease, rent is based on the rental value

of the land in the parcel, whether the parcel is vacant or improved. Fee

owners of vacant, unimproved land use leases to induce others to acquire

an interest in the property and develop it.

Ground leases are common in more densely populated areas. Developers

often need financial assistance from fee owners to avoid massive cash outlays

to acquire unimproved parcels. Also, fee owners of developable property

often refuse to sell, choosing to become landlords for the long-term rental

income they will receive.

An original tenant under a ground lease constructs their own improvements.

Typically, the tenant encumbers their possessory interest in a ground lease

with a trust deed lien to provide security for a construction loan.

Master leases benefit fee owners who want the financial advantages of

renting fully improved property, but do not want the day-to-day obligations

and risks of managing the property.

For instance, the fee owner of a shopping center and a prospective owner-

operator agree to a master lease.

Figure 1

Excerpt from

Form 552

Nonresidential

Lease

Agreement

Commercial,

Industrial Gross

— Single Tenant

ground lease

A leasehold interest

in which rent is based

on the rental value

of the land, whether

the parcel is vacant or

improved.

master lease

A leasehold interest

which grants a master

tenant the right to

sublease a property in

exchange for rent paid

to the fee owner.

Leaseholds

conveying

special uses

Chapter 1: Fee vs. leasehold 7

As the master tenant, the owner-operator will collect rent from the many

subtenants, address their needs and maintain the property. The master tenant

is responsible for the rent due the fee owner under the master lease, even if

the subtenants do not pay their rents to the master tenant.

The master lease is sometimes called a sandwich lease since the master

tenant is “sandwiched” between the fee owner (the landlord on the master

lease) and the many subtenants with their possession under subleases.

The master lease is a regular, nonresidential lease agreement form with

the clauses prohibiting subletting removed. A sublease is also a regular,

nonresidential lease agreement with an additional clause referencing the

attached master lease and declaring the sublease subject to the terms of the

master lease. [See first tuesday Form 552 §2.5]

Another type of special-use lease is the farm lease, sometimes called a

cropping agreement or grazing lease. Here, the tenant operates the farm and

pays the landlord either a flat fee rent, a percentage of the value of the crops

or livestock produced on the land.

Editor’s note — For simplicity, the remainder of the book will treat the

landlord as the fee owner, unless a sublease is specifically referenced. Fee

owners will be referred to as “landlords,” or, if a distinction is required,

simply as “owners.”

The ownership interests a person may hold in real estate are called

estates. Four types of estates exist in real estate:

• fee estates;

• life estates;

• leasehold estates; and

• estates at will.

In practice, estates at will are considered leasehold estates. Leasehold

estates are controlled by landlord/tenant law.

Four types of leasehold interests exist and can be held by tenants:

• fixed-term tenancies;

• periodic tenancies;

• tenancies-at-will; and

• tenancies-at-sufferance.

Chapter 1

Summary

sublease

A leasehold interest

subject to the terms of

a master lease.

8 Landlords, Tenants and Property Management, Eighth Edition

A fixed-term tenancy lasts for a specific length of time as stated in a lease

agreement entered into by a landlord and tenant. On expiration of the

lease term, the tenant’s right of possession automatically terminates

unless it is extended or renewed by another agreement.

Periodic tenancies last for a specific length of time. Under a periodic

tenancy, the landlord and tenant agree to automatic successive rental

periods of the same length of time, such as in a month-to-month

tenancy, until terminated by notice by either the landlord or the tenant.

Under a tenancy-at-will, the tenant has the right to possess a property

with the consent of the fee owner. Tenancies-at-will can be terminated

at any time by an advance notice from either the landlord or the tenant

or as set by agreement. Tenancies-at-will do not have a fixed duration.

A tenancy-at-sufferance occurs when a tenant retains possession of the

rented premises after the tenancy granted terminates.

In addition, several special use leases exist, including ground leases,

master leases and subleases.

estate ....................................................................................................pg. 2

fee estate .............................................................................................pg. 2

fixed-term tenancy ........................................................................... pg. 5

ground lease ....................................................................................... pg. 6

impairment ........................................................................................pg. 4

leasehold estate ................................................................................pg. 5

legal description ...............................................................................pg. 2

life estate ............................................................................................. pg. 4

master lease ........................................................................................pg. 6

parcel....................................................................................................pg. 2

profit a prendre .................................................................................pg. 3

tenancy-at-sufferance .....................................................................pg. 5

tenancy-at-will .................................................................................pg. 5

Chapter 1

Key Terms

Chapter 2: The tenancies in real estate 9

A landlord and tenant enter into a lease agreement. The lease agreement

does not include an option to renew or extend the term of the occupancy on

expiration of the lease.

Several months before the lease expires, they begin negotiations to enter

into a modified or new lease agreement to extend the term of occupancy. The

landlord and tenant do not reach an agreement before the lease expires. On

expiration of the lease, the tenant remains in possession of the property.

The landlord and tenant continue lease negotiations. Meanwhile, the

landlord accepts monthly rent at the same rate the tenant paid under the

expired lease agreement.

The tenancies in

real estate

After reading this chapter, you will be able to:

• differentiate between the four distinct possessory types of

tenancies;

• understand the rights held under each type of tenancy;

• determine how a tenancy is established or changed; and

• serve the proper notice required to terminate a tenancy.

Chapter

2

holdover rent

holdover tenant

lease agreement

rental agreement

reservation agreement

transient occupancy

trespasser

unlawful detainer

Key Terms

Learning

Objectives

Know your

tenancy or

lose time

10 Landlords, Tenants and Property Management, Eighth Edition

Ultimately, they fail to agree on the terms for an extension or a new lease

agreement. The landlord serves a notice on the tenant to either stay and

pay a substantially higher monthly rent, or vacate and forfeit the right of

possession. [See first tuesday Form 571; see Form 569 in Chapter 23]

The tenant does neither. The tenant remains in possession on expiration of

the notice, but does not pay the increased rent.

Can the landlord evict the tenant by filing an unlawful detainer (UD) action

on expiration of the notice?

Yes! The tenant’s right of possession went from an initial fixed-term tenancy

to a tenancy-at-sufferance when the lease expired. When the landlord

accepted rent for the continued occupancy, the tenancy-at-sufferance became

a periodic tenancy. The tenant’s failure to pay the higher rent demanded

in the notice terminated the tenant’s right of possession under the periodic

tenancy on expiration of the notice to pay rent or quit.

Different types of tenancies and properties trigger different termination

procedures for the landlord, and different rights for the tenant. [See Chapters

20, 30 and 35]

Recall from Chapter 1 that leasehold estates, or tenancies, are possessory

interests in real estate. Four types of tenancies exist:

• fixed-term tenancies;

• periodic tenancies;

• tenancies-at-will; and

• tenancies-at-sufferance, also called holdover tenancies.

To initially establish a tenancy, a landlord needs to transfer to the tenant the

right to occupy the real estate. This right is conveyed either orally, in writing

or by the landlord’s conduct, called a grant. If the landlord does not transfer

the right to occupy, the person who takes possession as the occupant is a

trespasser.

Fixed-term tenancies, periodic tenancies and tenancies at will have agreed-

to termination dates, or can be terminated by notice.

A holdover tenancy occurs when a tenant unlawfully continues in

possession of the property after their right to occupy has expired. This

unlawful possession of the property without contractual right is called

unlawful detainer (UD).

A landlord needs to file a UD action in court to evict a holdover tenant. A

tenant’s right of possession under the tenancy is terminated either by service

of the proper notice or expiration of the lease before he can be evicted. Plainly

speaking, the tenant needs to unlawfully detain possession of the property

before the tenant can be evicted for unlawful detainer.

Tenancies

as leasehold

estates

trespasser

A person who occupies

a property without the

landlord’s transfer of

the right to occupy.

unlawful detainer

The unlawful

possession of a

property. [See ft Form

575-578]

Chapter 2: The tenancies in real estate 11

Since the type of notice required to terminate a tenancy depends on the

period of the tenancy, period of the occupancy and location of the property

(e.g., rent control), landlords and property managers needs to understand

how each type of tenancy is created.

1

A fixed-term tenancy, also called a lease or estate for years, is the result of

an agreement between the landlord and the tenant for a fixed rental period.

If the rental period is longer than one year, the lease arrangements need to

be in writing and signed by the landlord and tenant to be enforceable. The

written document which sets the terms of a fixed-term tenancy is called a

lease agreement. A lease agreement has a commencement date and an

expiration date.

2

[See Form 550 in Chapter 35]

During the term of the lease, the tenancy can only be terminated and the

tenant evicted for cause. Even then, service of a three-day notice to cure the

breach or vacate the property is required. [See Form 576 in Chapter 21]

Without an exercise of a renewal or extension option, a fixed-term tenancy

automatically terminates on the expiration date, no notice required.

3

If a renewal or extension option exists, the lease is renewed or extended by

the tenant’s exercise of the option or the landlord’s acceptance of rent called

for in the option.

4

[See Case in point, “Second lease term is not a periodic

tenancy”]

A fixed-term tenancy provides a tenant with several advantages:

• the right to occupy for the fixed term;

• a predetermined rental amount; and

• limitations on termination or modification.

1 Colyear v. Tobriner (1936) 7 C2d 735

2 CC §§761, 1624

3 CCP §1161(1)

4 CC §1945

A landlord and tenant orally agree to a six-month lease, with rent payable monthly. At the

end of six months, the landlord and tenant orally agree to another six-month lease.

At the end of the second term, the tenant refuses to vacate, claiming the landlord nees to

first serve them with a notice to vacate.

Here, the tenant is not entitled to any further notice beyond the agreed-to termination date.

The oral occupancy agreement was not a periodic tenancy, even though it called for monthly

rent payments. Instead, the occupancy agreement created a fixed-term lease with a set

expiration date. Thus, the tenant’s right of possession terminated on expiration of the orally

agreed-to six-month period. The oral lease agreement was enforceable since it was for a

term of less than one year. [Camp v. Matich (1948) 87 CA2d 660]

Case in point

Second lease

term is not a

periodic tenancy

The

fixed-term

tenancy

lease agreement

The written document

which sets the terms of

a fixed-term tenancy.

[See ft Form 550 and

552—552-4]

12 Landlords, Tenants and Property Management, Eighth Edition

However, a fixed-term tenancy also has disadvantages for the fixed-term

tenant:

• the tenant is liable for the total amount of rent due over the entire term

of the lease (less rent paid by any replacement tenant located by the

landlord to mitigate his losses) [See Chapter 19];

and

• the tenant may not vacate prior to expiration of the rental period and

assign or sublet the premises to a new tenant if prohibited by the lease

agreement.

If the landlord finds a fixed-term tenancy too restrictive or inflexible for their

requirements, a periodic tenancy may be more suitable.

A periodic tenancy automatically continues for equal, successive periods

of time, such as a week or a month. The length of each successive period of

time is determined by the interval between scheduled rental payments. A

periodic tenancy is automatically renewed when the landlord accepts rent.

Examples of periodic payment intervals include:

• annual rental payments, indicating a year-to-year tenancy;

• monthly rental payments, indicating a month-to-month tenancy; and

• weekly rental payments, indicating a week-to-week tenancy.

A periodic tenancy is intentionally created by a landlord and tenant entering

into a rental agreement. A rental agreement is the agreement which sets

the terms of a periodic tenancy.

However, the tenancy can also arise due to a defective lease agreement. A

tenant who enters into possession under an unenforceable lease agreement

(e.g., oral, or unsigned) and pays rent in monthly intervals that the landlord

accepts is a month-to-month tenant.

A periodic tenancy continues until terminated by a notice to vacate. This

makes a periodic tenancy flexible, since it allows the landlord and the tenant

to terminate a month-to-month tenancy by giving the appropriate notice to

vacate to the other party.

5

[See Forms 569 in Chapter 23 and 572 in Chapter 17]

To terminate a periodic tenancy, the notice period needs to be at least as long

as the interval between scheduled rental payments, but need not exceed 30

days. An exception exists: a 60-day notice is required to terminate a residential

periodic tenancy if the tenant has occupied the property for more than 12

months.

6

[See Form 569-1 Chapter 23]

On a breach of the rental agreement, a three-day notice to vacate can also be

used to terminate a periodic tenancy. [See Form 577 in Chapter 21]

The characteristics of a tenancy-at-will include:

• possession delivered to the tenant with the landlord’s knowledge and

consent;

5 Kingston v. Colburn (1956) 139 CA2d 623; CC §1946

6 CC §1946.1

periodic tenancy

A leasehold interest

which lasts for

automatic successive

rental periods of the

same length of time,

terminating upon

notice from either

party. [See ft 551 and

552-5]

The periodic

tenancy

rental agreement

The written document

which sets the terms

of a periodic tenancy.

[See ft Form 551 and

552-5]

The tenancy-

at-will:

consent but

no rent

Chapter 2: The tenancies in real estate 13

Consider a property manager who rents an apartment to a tenant under a fixed-term lease.

At the end of the leasing period, the tenant retains possession and continues to pay rent

monthly, which the property manager accepts.

Later, the tenant is served with an appropriate notice to vacate. On the running of the notice

period, the tenant refuses to vacate. The tenant claims the notice to vacate served by the

landlord merely terminated the tenant’s right of possession and made it a tenancy-at-will

on expiration of the notice. As a tenant-at-will, they are entitled to an additional three-day

notice to vacate before they are unlawfully detaining the property.

However, an occupancy agreement for an indefinite term with a monthly rent schedule is a

month-to-month tenancy. Thus, a tenant is only entitled to one notice to vacate which needs

to expire before a UD action may be filed to evict them. [Palmer v. Zeis (1944) 65 CA2d

Supp. 859]

• possession for an indefinite and unspecified period; and

• no provision for the payment of rent.

Situations giving rise to a tenancy-at-will include:

• when a tenant is granted the right to indefinitely occupy the property

in exchange for services rendered [See Form 591 in Chapter 9];

7

• when a tenant takes possession of the property under an unenforceable

lease agreement (e.g., a written lease not signed by either party with

terms orally agreed to) — unless rent is accepted to create a periodic

tenancy;

8

or

• when a tenant is given possession of the property while lease

negotiations regarding the rent amount are still in progress and rent is

not accepted.

9

For a tenancy-at-will, a written notice to pay rent or quit is required to

implement any change in the right to continue to occupy the premises, e.g.,

change it to a different kind of tenancy or terminate the tenancy. However, the

parties can always agree to a shorter or longer notice period to accommodate

the change.

10

[See Case in point, “Periodic tenancy or tenancy-at-will?”]

Consider, an owner-occupant who agrees to sell their office building. The

terms of the purchase agreement allow them to retain the free use and

possession of the property until they can occupy an office building they are

constructing. Thus, a tenancy-at-will is created.

The buyer agrees in the purchase agreement to give the seller a 90-day written

notice to pay rent or vacate the property.

7 Covina Manor Inc. v. Hatch (1955) 133 CA2d Supp. 790

8 Psihozios v. Humberg (1947) 80 CA2d 215

9 Miller v. Smith (1960) 179 CA2d 114

10 CC §§789, 1946

Case in point

Periodic tenancy

or

tenancy-at-will?

Written

notice

required

before any

change in

the right to

occupancy

14 Landlords, Tenants and Property Management, Eighth Edition

The buyer resells the property to a new owner. The new owner serves notice

on the tenant-seller to pay rent or vacate in three days’ time. The new owner

claims they are not subject to the prior owner’s unrecorded agreement to give

a 90-day notice.

However, the new owner acquired the property subject to unrecorded rights

held by the tenant in possession. Thus, the new owner is charged with

constructive knowledge of the unrecorded agreement regarding 90-day

notices to vacate and took title subject to the terms of the agreement.

Until the tenant-at-will receives the appropriate notice to vacate, they are not

unlawfully detaining the property and the owner/landlord cannot proceed

with a UD action to recover possession.

11

However, a tenancy-at-will is automatically terminated if the tenant assigns

or sublets their right to occupy the property to another tenant. The new

tenant becomes a holdover tenant. Either form of possession is an unlawful

detainer and grounds for eviction without notice.

12

Also, a tenancy-at-will terminates on the death of either the landlord or

tenant, unless an agreement to the contrary exists.

13

When a fixed-term or periodic tenancy terminates by prior agreement or

notice, the tenant who remains in possession unlawfully detains the property

from the landlord. Likewise, a tenant-at-will who receives the appropriate

notice to vacate and who remains in the property also unlawfully detains the

property. These scenarios create a tenancy-at-sufferance, commonly referred

to as a holdover tenancy. [See Case in point, “What steps does a landlord take

to serve an unlawful detainer on a holdover tenant?”]

A holdover tenancy also arises on termination of a resident manager when

the resident manager’s compensation includes the right to occupy a unit

rent-free. When the landlord terminates the employment and the resident

manager fails to vacate immediately, the resident manager unlawfully

detains the premises as a holdover tenant.

14

[See Form 591 in Chapter 9]

A holdover tenant retains possession of the premises without any

contractual right to do so. Their tenancy has been terminated. Thus, the

landlord is not required to provide a holdover tenant with any additional

notice prior to commencing eviction proceedings.

15

A holdover tenant no longer owes rent under the expired lease or terminated

rental agreement since they no longer have the right of possession. However,

the rental or lease agreement usually includes a holdover rent provision

which calls for a penalty rate of daily rent owed for each day the tenant holds

over.

11 First & C. Corporation v. Wencke (1967) 253 CA2d 719

12 McLeran v. Benton (1887) 73 C 329

13 Dugand v. Magnus (1930) 107 CA 243

14 Karz v. Mecham (1981) 120 CA3d Supp. 1

15 CCP §1161

The holdover

tenancy

holdover tenant

A tenant who retains

possession of the

rented premises

after their right of

possession has been

terminated.

holdover rent

Rent owed by a

holdover tenant for

the tenant’s unlawful

detainer of the rented

premises. [See ft Form

550 §3.3]

Chapter 2: The tenancies in real estate 15

If the rental or lease agreement does not contain a holdover rent provision,

the tenant owes the landlord the reasonable rental value of the property.

This is a daily rate owed for each day the tenant holds over. [See Case in point,

“Reasonable rental value in a holdover tenancy”; see first tuesday Form

550]

Holdover rent is due after the tenant vacates or is evicted. At that time, the

holdover period is known and the amount owed can be determined, and

demanded. If it is not paid on demand, it can be collected by obtaining a

money judgment.

But a caution to landlords: acceptance of holdover rent prior to a tenant

vacating or being evicted has unintended consequences, as discussed in the

next section.

A landlord, by using an improper notice, can create a different tenancy

relationship from the one they initially conveyed to the tenant. A tenant’s

possessory interest in real estate can shift from one type of tenancy to another

due to:

• a notice;

• expiration of a lease; or

• by conduct.

A classic example involves a change in the type of tenancy which arises

when a holdover tenant becomes a month-to-month (periodic) tenant.

Facts: An apartment landlord filed an unlawful detainer (UD) against a tenant who was

unlawfully holding over. The landlord attempted to personally serve the UD on the tenant at

the apartment address numerous times but the tenant was out of state. The landlord posted

the notice on the property and mailed a copy to the tenant’s last known address, which was

at the apartment. No other address for the tenant was available. The tenant did not receive

or respond to the UD and the landlord took possession of the property.

Claim: The tenant sought to restore their tenancy claiming the landlord’s attempts to serve

the UD were deficient since all the attempts were executed at the apartment address while

the tenant was out of state and no other actions were taken to reach the tenant.

Counter claim: The landlord sought to prevent the tenant from restoring their tenancy,

claiming sufficient actions were taken to notify the tenant of the UD since multiple attempts

to notify the tenant were executed at the apartment address without response before

posting the notice on the premises and no other address for the tenant was available.

Holding: A California Court of Appeals held the tenant may not regain possession since

personal service was attempted and the notice was posted at the apartment address and

no other address for the tenant was available for personal service or mailing. [The Board of

Trustees of the Leland Stanford Junior University v. Ham (2013) 216 CA4th 330]

Editor’s note – A landlord is not required to expend an indeterminate amount of time

and resources to track down an absent tenant in order to serve a UD. If the UD cannot be

personally delivered, the landlord may leave a copy with a competent adult at the property

or post it on the property, then send¬ the documents by mail to the last known address of

the tenant.

Case in point

What steps

mustdoes a

landlord take

to serve an

unlawful detainer

on a holdover

tenant?

Changing

the type of

tenancy

16 Landlords, Tenants and Property Management, Eighth Edition

A landlord who accepts any rent from a holdover tenant under an expired

lease has elected by their conduct to treat the continued occupancy as a

periodic tenancy.

16

Thus, the prerequisite to a UD eviction is the service of a proper notice to

vacate on the holdover tenant who paid rent for the continued occupancy,

rent the landlord accepted to create a periodic tenancy.

17

If a landlord accepts rent from a holdover tenant after a fixed-term tenancy

expires, the expired

lease agreement is renewed on the same terms except for

the period of occupancy, which is now periodic.

18

On expiration of a fixed-term lease, the landlord’s continued acceptance

of rental payments does not renew the tenancy for another term equal to

the term of the original lease. Rather, the tenancy is extended as a periodic

tenancy for consecutive periods equal to the interval between rent payments

— hence, one month if rent is paid monthly.

19

A landlord who wants to terminate a periodic tenancy they created by

accepting rent after expiration of a lease needs to serve the tenant with the

proper notice to vacate and let it expire. On expiration of the notice, the

tenant who remains in possession of the premises is unlawfully detaining

the premises and the landlord may file a UD action to evict them.

A landlord and tenant can establish a shorter or lengthier notice period by

agreement. However, the notice period cannot be less than seven days.

Other specialized rules exist for different types of properties and situations.

For example, in a rent-controlled tenancy, terminating the right of possession

is restricted by local ordinances.

16 Peter Kiewit Sons Co. v. Richmond Redevelopment Agency (1986) 178 CA3d 435

17 Colyear, supra

18 CC §1945

19 CC §1945

Other

rules for

terminating a

tenancy

A tenant with a fixed-term lease holds over after the lease agreement expires. The lease

agreement contains no provisions for the amount of rent due during any holdover period.

On the tenant’s failure to vacate, the landlord serves the tenant a notice to either pay a rent

amount substantially higher than rental market rates, or vacate. The tenant refuses to pay

any rent or vacate.

On expiration of the notice, the landlord files a UD action seeking payment of rent at the

rate stated in the notice, since the tenant did not vacate.

At the UD hearing, the landlord is awarded the reasonable market rental value for the entire

time the tenant held over after the lease expired, not the higher rent demanded in the

notice.

A UD court will only award a reasonable rental value for the time period the tenant held

over. [

Shenson v. Shenson (1954) 124 CA2d 747]

Case in point

Reasonable

rental value in a

holdover tenancy

Chapter 2: The tenancies in real estate 17

In a tenancy-at-will in a mobile home park, the tenant needs to be given a

60-day written notice.

20

Industrial and commercial tenants typically require three months minimum

notice due to the time spent receiving and responding to a notice since it

goes through multiple tiers of corporate management before a decision can

be made.

21

In some instances, an extended 90-day notice is required to terminate

residential tenancies in foreclosed properties. [See Chapter 23]

Another type of occupancy is to be differentiated from the leasehold interests

discussed in this chapter. Transient occupancy is the occupancy of a

vacation property, hotel, motel, inn, boarding house, lodging house, tourist

home or similar sleeping accommodation for a period of 30 days or less. This

type of occupant is classified as a guest, also called a transient occupant.

A transient occupant occupies property known as lodging, accommodation

or unit, not space or premises. The property is not called a rental. The term

“rental” implies a landlord/tenant relationship exists. Further, landlord/

tenant law does not control transient occupancy.

The guest’s occupancy is labeled a stay, not possession. During a guest’s stay

in the lodging, the owner or manager of the property is entitled to enter the

unit at check-out time even though the guest may not yet have departed.

The contract entered into for the lodging is usually called a reservation

agreement, but never a rental agreement or lease agreement. [See first

tuesday Form 593]

Guests pay a daily rate, not a daily or weekly rent. They arrive at a pre-set date

and time for check-in, not for commencement of possession. Likewise, guests

depart at an hour on a date agreed to as the check-out time. Unlike a tenant,

a guest does not vacate the premises; they check out.

When a guest fails to depart at the scheduled check-out hour on the date

agreed, no holdover tenancy is created. Thus, an unlawful detainer does not

exist as with a tenancy conveyed by a rental or lease agreement. A UD action

or court involvement is not required to remove the guest.

22

However, for the owner or manager to avoid the landlord-tenant UD eviction

process, the guest, when checking in, needs to sign a notice stating:

• the unit is needed at check-out time for another guest who has been

promised the unit; and

• if the guest has not departed at check-out time, the owner or manager

may enter, take possession of the guest’s property, re-key the doors and

clean up the unit for the next guest.

23

[See first tuesday Form 593]

20 CC §798.55(b)

21 CC §1946

22 CC §1940(b)

23 CC §1865

Transient

occupants

and their

removal

transient occupancy

The occupancy of a

vacation property,

hotel, motel, inn,

boarding house, lodging

house, tourist home

or similar sleeping

accommodation for a

period of 30 days or less.

[See ft Form 593]

reservation agreement

The written document

which sets the terms of

a transient occupancy.

[See ft Form 593]

18 Landlords, Tenants and Property Management, Eighth Edition

To remove a guest who fails to timely depart the unit and remains in the

unit after a demand has been made to leave, the manager can intervene to

remove the guest, a solution called self-help. If the manager’s intervention

might cause a breach of the peace, the manager may call the police. The

police or the sheriff will assist, without the need for a court order, to remove

the guest and prevent a danger to persons or property during the re-keying,

removal of possessions and clean up for the arrival of the next guest.

24

Transient occupancies include all occupancies that are taxed as such by local

ordinance or could be taxed as such by the city or by the county.

Taxwise, the guest occupancy is considered a personal privilege, not a

tenancy. Time share units when occupied by their owners are not transient

occupancies and are not subject to those ordinances and taxes.

25

Transient units do not include residential hotels since the occupants of

residential hotels treat the dwelling they occupy as their primary residence.

Also, the occupancy of most individuals in residential hotels is for a period of

more than 30 days.

Also, the operator of a residential hotel may not require a resident to change

units or to check out and re-register in order to avoid creating a month-to-

month tenancy which would place the occupancy under landlord/tenant

law. A residential hotel operator violating this rule is liable for a $500 civil

penalty and attorney fees.

26

A broker or any other person who manages “vacation rental” stays for

owners of single family homes, units in a common interest development

(condominium project), units in an apartment complex or any other residence

subject to a local transient occupancy tax, is to maintain accounting records.

Further, the property manager needs to send a monthly accounting statement

to each landlord they represent and make the records available for inspection

and reproduction by the owner. They need to also comply with the transient

occupancy tax regarding collection, payment and record keeping.

27

24 Calif. Penal Code §602(s)

25 Calif. Revenue and Taxation Code §7280

26 CC §1940.1

27 CC §1864

Property

manager’s

self-help

to remove

guests

Chapter 2: The tenancies in real estate 19

A fixed-term tenancy is the result of an agreement between the

landlord and the tenant for a fixed rental period. A periodic tenancy

automatically continues for equal, successive periods of time, such as a

week or a month.

In a tenancy-at-will, possession is delivered to the tenant with the

landlord’s knowledge and consent for an indefinite and unspecified

period, usually without requiring rent. A holdover tenancy is the

result of a tenant retaining possession of a rented premises without any

contractual right to do so.

A tenant’s possessory interest in real estate can shift from one type of

tenancy to another based on conduct of the landlord.

The type of notice required to terminate occupancy depends on the

period of the tenancy or occupancy, the period of the occupancy, the

property type and location.

holdover rent ...................................................................................pg. 14

holdover tenant ..............................................................................pg. 14

lease agreement ..............................................................................pg. 11

periodic tenancy .............................................................................pg. 12

rental agreement ............................................................................pg. 12

reservation agreement ..................................................................pg. 17

transient occupancy ......................................................................pg. 17

trespasser ..........................................................................................pg. 10

unlawful detainer ..........................................................................pg. 10

Chapter 2

Summary

Chapter 2

Key Terms

Notes:

Chapter 3: Landlord’s right to enter 21

Unbeknownst to a residential landlord, a tenant changes the locks on the

door to the rented unit. Several months later, the tenant is arrested by law

enforcement officers as they step out of their apartment. The tenant is hastily

escorted away, leaving lights on and their pet inside, but locking the door.

The landlord becomes aware of the tenant’s dilemma. Fearful the gas stove

was also left on, the landlord attempts, but is unable to enter with their key.

The landlord calls the police to witness their entry and inspection of the

apartment to make sure it is in a safe and secure condition. The landlord then

enters the apartment through a window. The police are let in to observe the

landlord’s conduct.

The police proceed to make a visual inspection of the apartment.

Landlord’s right

to enter

After reading this chapter, you will be able to:

• understand the relationship between a tenant’s right to privacy

and the landlord’s need to access the leased space;

• distinguish the circumstances under which a landlord may enter

a leased premises;

• properly serve a 24-hour notice of entry on a tenant in advance of

the entry; and

• identify resolutions to possessory conflicts arising from the

landlord-tenant relationship.

Chapter

3

Learning

Objectives

business goodwill

forcible entry

notice of entry

punitive damages

restitution

self-help

Key Terms

Conflict with

occupant’s

right to

privacy

22 Landlords, Tenants and Property Management, Eighth Edition

Unfortunately for the tenant, the police find illegal possessions in plain view

casually lying around the kitchen and dining area of the apartment.

Did the landlord have the right to enter the apartment? Did the landlord

have the right to allow the police to enter the apartment?

Yes to both! The landlord had the right to enter since they reasonably believed

the safety of their other tenants and the building may be in jeopardy.

Also, the police were present at the request of the landlord to act as

eyewitnesses so the tenant may not claim the landlord removed any of the

tenant’s possessions.

1

In contrast, consider the landlord who permits the police to enter and search

a tenant’s garage without a warrant.

The police have reason to believe the tenant is manufacturing drugs, an

illegal use of the premises and of concern to the landlord.

May a landlord collaborate with the police at their request and allow them

to enter a tenant’s garage?

No! The landlord has no right of possession when the tenant’s right of

possession has not expired or been terminated. This is true even if the tenant

has vacated and only one day remains under a 30-day notice to vacate.

If the tenant’s right of possession has not expired, the landlord has no

possessory right. Thus, they are prohibited from entering the property or

letting the police enter the property, even if the landlord suspects the tenant

of using the premises to commit a crime. The police need to first obtain a

search warrant to legally authorize them to come onto the premises occupied

by the tenant when the landlord has no right to entry.

2

However, a landlord does have the right to enter and also to allow police

to enter a unit which has been abandoned or vacated by the tenant if the

tenancy has been terminated under state law rules of abandonment or

surrender.

3

[See Chapter 23]

Further, “lock-box” entry by the police in collaboration with a multiple-

listing service (MLS) member to check out a crime is prohibited without a

warrant. The entry violates the purpose of a seller’s broker’s agency and lock-

box authority. The broker may enter only to show the premises to prospective

tenants who accompany them (or other authorized agents).

4

1 People v. Plane (1969) 274 CA2d 1

2 United States v. Warner (9th Cir. 1988) 843 F2d 401

3 United States v. Sledge (9th Cir. 1981) 650 F2d 1075

4 People v. Jaquez (1985) 163 CA3d 918

Landlord may

not interfere

with tenant’s

possessory

right

Chapter 3: Landlord’s right to enter 23

A landlord’s right to enter a residential or nonresidential unit during the

period of the tenant’s right to occupy the premises is severely limited. The

possessory rights to occupy the property have been conveyed to the tenant

and are no longer held by the landlord, until a reversion of possession occurs

on termination of the tenancy.

A residential landlord may enter the tenant’s actual dwelling space during

the term of the rental or lease agreement only in limited circumstances:

• in an emergency;

• to make repairs, alterations, improvements, or supply services that are

either necessary or previously approved by the tenant;

• to complete a pre-expiration inspection for deficiencies which would

result in a deduction from the security deposit [See Chapter 14];

• to show the unit to prospective buyers, prospective tenants, lenders,

repairmen or contractors;

• when the tenant has vacated the premises and their right to occupy

has been terminated by surrender or abandonment; or

• under a court order allowing entry.

5

A property manager’s entry into a tenant’s unit out of concern for the safety

of the property or other tenants constitutes an emergency. The property

manager may properly enter the unit without the tenant’s knowledge and

permission for the limited purpose of dealing with the emergency.

6

Consider a nonresidential lease agreement that prohibits any tenant

violations of government laws and regulations.

The landlord asks the tenant for permission to conduct tests on the property

and investigate whether the leased property contains any contamination

from hazardous waste. The tenant refuses to give the landlord permission

to conduct the investigation, claiming the landlord does not have a right to

determine whether contamination exists until the lease expires.

Here, the landlord, on advance notice to the tenant, has the right to access the

property to determine if contamination has or is occurring on the property.

Hazardous waste contamination is a violation of law and a breach of the

lease provision prohibiting unlawful activities which adversely affect the

value of the property.

7

Before a residential landlord may proceed with any maintenance or services

which require entry into a tenant’s unit, the tenant needs to be given a

written notice of the landlord’s intent to enter. Maintenance includes all

routine or non-emergency repairs, decorations, alterations, improvements,

replacements or services, whether or not agreed to by the tenant.

8

[See Form

567 accompanying this chapter]

5 Calif. Civil Code §1954

6 Plane, supra

7 Sachs v. Exxon Company, U.S.A. (1992) 9 CA4th 1491

8 CC §1954

Notice of

entry for

repairs

Entry to

conduct a

hazardous

waste

investigation

Landlord’s

right to enter

another’s

space

24 Landlords, Tenants and Property Management, Eighth Edition

The written notice gives the tenant a reasonable time period to prepare for

the entry. A 24-hour notice is considered reasonable, unless extenuating

circumstances known to the landlord or their property managers, such as

the tenant’s vacation or business trip, indicate the tenant needs more time to

receive the notice and prepare for the entry.

Service of a 24-hour notice of entry in advance of the entry is accomplished

by any one of the following methods:

• handing a written notice to the tenant personally;

• handing the notice to an occupant of the unit who appears of suitable

age and discretion to relay the notice to the tenant; or

• posting the notice on, near or under the usual entry door so it will be

discovered by the tenant.

Alternatively, the notice may be mailed, but at least six days is to pass after

mailing before the intended entry can be scheduled to occur.

9

A notice is sufficient to request entry during normal business hours,

emergencies excepted. However, to request entry after business hours, the

tenant’s consent needs to be obtained “at the time of entry.”

The notice of entry procedures may not be used to harass a tenant in a

retaliatory or abusive manner.

10

A tenant in a community apartment project or a homeowner in a common

interest development (CID) is to receive at least 15 days but no more than

30 days written notice when the management or association needs the

occupants to vacate the project in order to treat termites. Condominium

projects and planned unit developments are examples of CIDs.

11

9 CC §1954

10 CC §1954

11 CC §1364(d)(2)

Facts: A residential landlord owned several rental properties. The city enacted an ordinance

requiring annual inspections of all residential rental properties to identify substandard

properties. The ordinance required inspectors to obtain consent from landlords and tenants

prior to entering units for inspections. However, the ordinance allowed inspectors to enter

properties without consent if the inspector had reason to believe a dangerous condition of

the property required an immediate inspection for public safety.

Claim: The landlord sought to invalidate the ordinance, claiming the ordinance violated

tenants’ right to privacy since the inspections allowed searches without a warrant.