Investing In Real Estate

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

ii

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

Praise for Gary Eldred

“Donald Trump and I have created Trump University to offer the

highest quality, success-driven education available. Our one goal is to

help professionals build their careers, businesses, and wealth. That’s

why we selected Gary Eldred to help us develop our first courses in

real estate investing. His books stand out for their knowledge-packed

content and success-driven advice.”

—Michael W. Sexton, CEO

Trump University

“Gary has established himself as a wise and insightful real estate

author. His teachings educate and inspire.”

—Mark Victor Hansen, Coauthor,

Chicken Soup for the Soul

“I just finished reading your book, Investing in Real Estate, Fourth Edi-

tion. This is the best real estate investment book that I have read so far.

Thanks for sharing your knowledge about real estate investment.”

—Gwan Kang

“I really enjoyed your book, Investing in Real Estate. I believe it’s one

of the most well-written books on real estate investing currently on

the market.”

—Josh Lowry

Bellevue, WA

President of Lowry Properties

“I just purchased about $140 worth of books on real estate and yours

is the first one I finished reading because of the high reviews it got.

I certainly wasn’t let down. Your book has shed light on so many

things that I didn’t even consider. Your writing style is excellent.

Thanks again.”

—Rick Reumann

“I am currently enjoying and learning a lot from your book, Investing

in Real Estate. Indeed it’s a powerful book.”

—Douglas M. Mutavi

“Thanks so much for your valuable book. I read it cover to cover.

I’m a tough audience, but you’ve made a fan here. Your writing is

coherent, simple, and clean. You are generous to offer the benefits of

your years of experience to those starting out in this venture.”

—Lara Ewing

i

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

ii

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

INVESTING

in

Sixth Edition

GARY W. ELDRED,PhD

John Wiley & Sons, Inc.

iii

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

Copyright

C

2009 by Gary W. Eldred, PhD. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or

transmitted in any form or by any means, electronic, mechanical, photocopying,

recording, scanning, or otherwise, except as permitted under Section 107 or 108

of the 1976 United States Copyright Act, without either the prior written

permission of the Publisher, or authorization through payment of the

appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood

Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at

www.copyright.com. Requests to the Publisher for permission should be

addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River

Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at

http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have

used their best efforts in preparing this book, they make no representations or

warranties with respect to the accuracy or completeness of the contents of this

book and specifically disclaim any implied warranties of merchantability or

fitness for a particular purpose. No warranty may be created or extended by

sales representatives or written sales materials. The advice and strategies

contained herein may not be suitable for your situation. You should consult

with a professional where appropriate. Neither the publisher nor author shall be

liable for any loss of profit or any other commercial damages, including but not

limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical

support, please contact our Customer Care Department within the United States

at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317)

572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content

that appears in print may not be available in electronic books. For more

information about Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Eldred, Gary W.

Investing in real estate / Gary W. Eldred.—6th ed.

p. cm.

Includes index.

Rev. ed. of: Investing in real estate / Andrew J. McLean and Gary W. Eldred.

5th ed. 2006.

ISBN 978-0-470-49926-9

1. Real estate investment—United States. I. McLean, Andrew James.

Investing in real estate. II. Title.

HD255.M374 2009

332.63

24—dc22

2009023124

Printed in the United States of America.

10987654321

iv

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

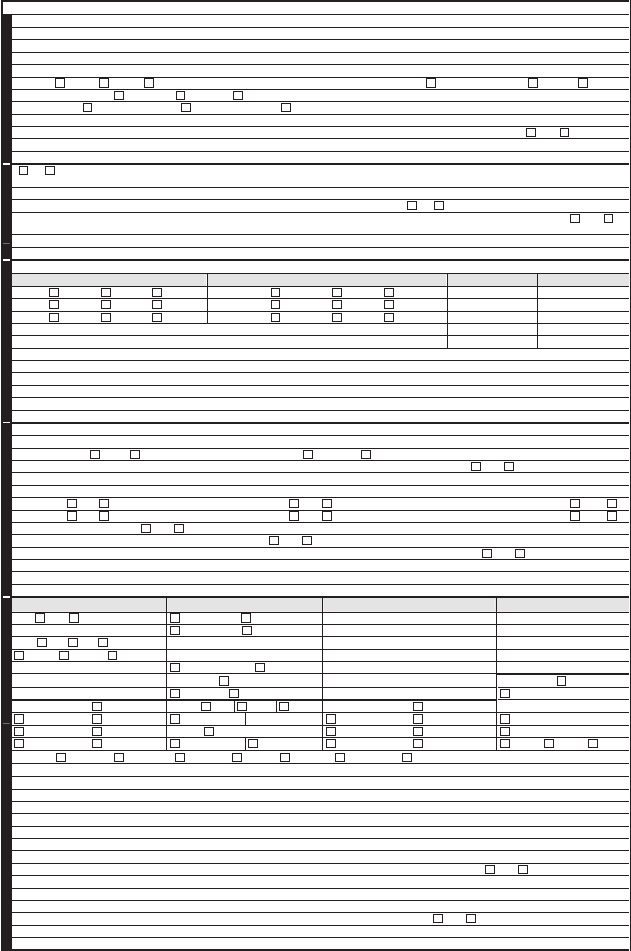

CONTENTS

Prologue:Investin RealEstate Now! xix

Acknowledgments xxvii

1 WHY INVESTING IN REAL ESTATE PROVIDES

YOU THE BEST ROUTE TO A PROSPEROUS

FUTURE 1

22 Sources of Returns from Investment Property 3

Will the Property Experience Price Gains from Appreciation? 4

Will You Gain Price Increases from Inflation? 5

Earn Good Returns from Cash Flows 6

Magnify Your Price Gains with Leverage 6

Magnify Returns from Cash Flows with Leverage 7

Build Wealth through Amortization 7

Over Time, Returns from Rents Go Up 8

Refinance to Increase Cash Flows 9

Refinance to Pocket Cash 10

Buy at a Below-Market Price 10

Sell at an Above-Market-Value Price 10

Create Property Value Through Smarter Management 11

Create Value with a Savvy Market Strategy 11

v

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

vi CONTENTS

Create Value: Improve the Location 12

Convert from Unit Rentals to Unit Ownership 12

Convert from Lower-Value Use to Higher-Value Use 12

Subdivide Your Bundle of Property Rights 13

Subdivide the Physical Property (Space) 14

Create Plottage (or Assemblage) Value 14

Obtain Development/Redevelopment Rights 15

Tax Shelter Your Property Income and Capital Gains 15

Diversify Away from Financial Assets 16

Is Property Always Best? 16

2 FINANCING: BORROW SMART, BUILD WEALTH 18

The Birth of “Nothing Down” 18

Should You Invest with Little or No Cash or Credit? 19

What’s Wrong with “No Cash, No Credit, No Problem”? 20

Leverage: Pros and Cons 22

What Are Your Risk-Return Objectives? 27

Maximize Leverage with Owner-Occupancy Financing 28

Owner-Occupied Buying Strategies 28

Current Homeowners, Too, Can Use This Method 29

Why One Year? 29

Where Can You Find High-LTV Owner-Occupied

Mortgages? 30

What Are the Loan Limits? 30

High Leverage for Investor-Owner Financing 32

High Leverage versus Low (or No) Down Payment 32

Creative Finance Revisited 32

Are High-Leverage Creative-Finance Deals Really Possible? 38

What Underwriting Standards Do Lenders Apply? 39

Collateral 40

Loan-to-Value Ratios 40

Recourse to Other Assets/Income 41

Amount and Source of Down Payment and Reserves 41

Capacity (Monthly Income) 42

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS vii

Credit History (Credibility!) 43

Character and Competency 44

Compensating Factors 45

Automated Underwriting (AUS) 46

3 APPRAISAL: HOW TO DISCOVER GOOD VALUE 47

Make Money When You Buy, Not Just When You Sell 48

What Is Market Value? 48

Sales Price Doesn’t Necessarily Equal Market Value 49

Sound Underwriting Requires Lenders to Loan Only

Against Market Value 50

How to Estimate Market Value 51

Property Description 52

Identify the Subject Property 52

Neighborhood 52

Site (Lot) Characteristics 59

Improvements 60

The Cost Approach 61

Calculate Cost to Build New 61

Deduct Depreciation 61

Lot Value 62

Estimate Market Value (Cost Approach) 63

The Comparable Sales Approach 64

Select Comparable Properties 64

Approximate Value Range—Subject Property 65

Adjust for Differences 65

Explain the Adjustments 66

The Income Approach 67

Income Capitalization 69

Net Operating Income 69

Estimate Capitalization Rates (R) 72

Compare Cap Rates 72

The Paradox of Risk and Appreciation Potential 73

Compare Relative Prices and Values 74

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

viii CONTENTS

Valuation Methods: Summing Up 74

Appraisal Limiting Conditions 75

Valuation versus Investment Analysis 76

4 MAXIMIZE CASH FLOWS AND GROW

YOUR EQUITY 77

Will the Property Yield Good Cash Flows? 77

Arrange Alternative Terms of Financing 79

Decrease (or Increase) Your Down Payment 80

Buy at a Bargain Price 82

Should You Ever Pay More than Market Value for a

Property? 83

The Debt Coverage Ratio 84

Numbers Change, Principles Remain 85

Will the Property Yield Profitable Increases in Price? 85

Low-Involvement versus High-Involvement Investing 86

Compare Relative Prices of Neighborhoods (Cities) 87

Undervalued Neighborhoods and Cities 88

Beverly Hills versus Watts (South Central Los Angeles) 88

Demographics 89

Accessibility (Convenience) 90

Improved (Increased) Transportation Routes 90

Jobs 91

Taxes, Services, and Fiscal Solvency 91

New Construction, Renovation, and Remodeling 91

Land-Use Laws 92

Pride of Place 93

Sales and Rental Trends 93

Summing Up 95

5 HOW TO FIND BARGAIN-PRICED PROPERTIES 96

Why Properties Sell for Less (or More) Than Market Value 96

Owners in Distress 97

The “Grass-Is-Greener” Sellers 97

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS ix

Stage-of-Life Sellers 98

Seller Ignorance 99

Prepare Screening Criteria 100

Bargain Sellers 101

Networking/Get the Word Out 102

Newspapers and Other Publications 102

Cold Call Owners 103

Agent Services 105

Internet Listings 107

Seller Disclosures 107

The Disclosure Revolution 108

Income Properties 108

Summary 109

6 PROFIT WITH FORECLOSURES 110

The Foreclosure Process 110

Lender Tries to Resolve Problem 111

Filing Legal Notice 111

The Foreclosure Sale 112

REOs 112

Buy Preforeclosures from Distressed Owners 112

Approach Owners with Empathy 113

The Difficulties of Dealing Profitably with Owners in

Default 113

Prequalify Homeowners and Properties 115

Finding Homeowners in Default (Prefiling) 117

Networking 117

Mortgage Collections Personnel 117

Drive Neighborhoods 117

Find Homeowners (Postfiling) 118

Cultivate a Relationship with Property Owners 118

Two More Issues 119

Vacant Houses 120

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

x CONTENTS

Satisfy Lenders and Lien Holders 121

All Parties Are Better Off 123

Win by Losing Less 123

Profit from the Foreclosure Auction 124

Why Foreclosures Sell for Less than Market Value 124

Make the Adverse Sales Efforts Work for You 125

How to Arrange Financing 126

The Foreclosure Sale: Summing Up 127

7 PROFIT FROM REOs AND OTHER

BARGAIN SALES 128

Bad News For Sellers/Builders, Good News For You 128

How to Find REOs 129

Follow Up with Lenders after Foreclosure Sales 129

Locate Specialty Realtors 130

HUD Homes and Other HUD Properties 131

Homeowners versus Investors 132

“As-Is” Condition 132

Potential Conflict of Interest 133

Buyer Incentives 133

The Bid Package 134

Department of Veterans Affairs (REOs) 134

Big Advantages for Investors 135

Fannie Mae and Freddie Mac REOs 136

Agent Listings 136

Investors Invited 137

Federal Government Auctions 137

Buy from Foreclosure Speculators 138

Probate and Estate Sales 138

Probate 138

Estate Sales 139

Private Auctions 139

How to Find Auctions 141

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS xi

8 QUICK PROFITS THROUGH FIX AND FLIP 142

Fix, Flip, Profit! 142

Look for “Fixers” 143

The Browns Create Value in a Down Market 144

Research, Research, Research 145

Improvement Possibilities 146

Thoroughly Clean the Property 146

Add Pizzazz with Color Schemes, Decorating Patterns,

and Fixtures 147

Create Usable Space 147

Create a View 148

Capitalize on Owner Nearsightedness 148

Eliminate a Negative View 149

Enhance the Unit’s Natural Light 149

Reduce Noise 150

Required Repairs and Improvements 150

Plumbing 151

Electrical System 151

Heating and Air-Conditioning 151

Windows 152

Appliances 152

Walls and Ceilings 152

Doors and Locks 152

Landscaping 152

Storage Areas 153

Clean Well 153

Safety and Health 153

Roofs 153

Improvements and Alterations 154

You Can Improve Everything about a Property—Including

Its Location 154

The South Beach Example: From Derelicts to Fashion

Models 154

Community Action and Community Spirit Make a

Difference 155

Neighborhoods Offer Potential 156

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xii CONTENTS

What Types of Improvements Pay the Greatest Returns? 157

How Much Should You Budget for Improvements? 157

Beware of Overimprovement 158

Other Benefits 158

No-No Improvements 159

Budgeting for Resale Profits 159

Estimate the Sales Price First 159

Estimate Costs 160

Future Sales Price Less Costs and Profit Equals

Acquisition Price 160

Comply with Laws and Regulations 162

Should You Buy a “Fixer”? 162

Too Little Time? 163

Put Your Creativity to Work 163

9 MORE TECHNIQUES FOR HIGH YIELDS

AND QUICK PROFITS 165

Lease Options 165

Here’s How Lease Options Work 165

Benefits to Tenant-Buyers (An Eager Market) 166

Benefits to Investors 167

The Lease Option Sandwich 168

How to Find Lease Option Buyers and Sellers 169

A Creative Beginning with Lease Options

(for Investors) 170

Lease Purchase Agreements 170

“Seems” More Definite 171

Amount of the Earnest Money Deposit 171

Contingency Clauses 171

Conversions 172

Condominium Conversion 172

Tenants in Common 174

Convert Apartments to Office Space 175

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS xiii

Master Leases 176

Assignments: Flipping Purchase Contracts 178

Summary 179

10 NEGOTIATE A WIN-WIN AGREEMENT 180

Win-Win Principles 181

The Purchase Contract 183

Names of the Parties 184

Site Description 184

Building Description 184

Personal Property 185

Price and Financing 185

Earnest Money Deposit 186

Quality of Title 187

Property Condition 187

Preclosing Property Damage (Casualty Clause) 188

Closing (Settlement) Costs 189

Closing and Possession Dates 189

Leases 190

Contingency Clauses 191

Assignment and Inspection 192

Public Records 193

Systems and Appliances 193

Environmental Hazards 193

No Representations 194

Default Clause 194

Summary 197

11 MANAGE YOUR PROPERTIES TO INCREASE

THEIR VALUE 199

The 10:1 Rule (More or Less) 199

Think First 200

Know Yourself 201

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xiv CONTENTS

Know Your Finances 201

Know Your Capabilities 202

Smart Strategic Decisions 202

Local Markets Require Tailored Strategies 203

Craig Wilson’s Profit-Boosting Market Strategy 203

How Craig Wilson Used Market Information to Enhance

the Profitability of His Property 206

Results 210

Cut Operating Expenses 210

Energy Audits 210

Property Insurance 211

Maintenance and Repair Costs 214

Property Taxes and Income Taxes 214

Increasing Value: Final Words 215

12 DEVELOP THE BEST LEASE 216

The Mythical “Standard” Lease 216

Your Market Strategy 216

Search for Competitive Advantage 218

Craft Your Rental Agreement 219

Names and Signatures 219

Joint and Several Liability 219

Guests 220

Length of Tenancy 220

Holdover Tenants (Mutual Agreement) 220

Holdover Tenants (without Permission) 221

Property Description 221

Inventory and Describe Personal Property 221

Rental Amounts 222

Late Fees and Discounts 222

Multiple Late Payments 222

Bounced Check Fees and Termination 223

Tenant “Improvements” 223

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS xv

Owner Access 223

Quiet Enjoyment 224

Noxious Odors 224

Disturbing External Influences 224

Tenant Insurance 225

Sublet and Assignment 225

Pets 226

Security Deposits 226

Yard Care 228

Parking, Number, and Type of Vehicles 228

Repairs 228

Roaches, Fleas, Ants 229

Neat and Clean 229

Rules and Regulations 229

Wear and Tear 230

Lawful Use of Premises 230

Notice 230

Failure to Deliver 231

Utilities, Property Taxes, Association Fees 231

Liquid-Filled Furniture 231

Abandonment of Property 232

Non-waivers 232

Breach of Lease (or House Rules) 232

No Representations (Full Agreement) 233

Arbitration 233

Attorney Fees (Who Pays?) 234

Written Notice to Remedy 235

Tenants Rights Laws 235

Tenant Selection 235

Property Operations 237

Evictions 237

Landlording: Pros and Cons 238

Possibilities, Not Probabilities 238

Professional Property Managers 238

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xvi CONTENTS

13 CREATE SALES PROMOTIONS THAT

REALLY SELL 240

Design a Winning Value Proposition 240

Yet Generic Prevails 240

USP versus WVP 241

Craft Your Selling Message 243

Use a Grabber Headline/Lead 244

Reinforce and Elaborate 244

Add Hot Buttons 244

Establish Credibility 245

Compare to Substitutes 245

Evoke Emotional Appeal 245

Reduce Perceived Risks 245

Make It Easy for Prospects to Respond 245

Follow Up with Your Prospects 247

Reach Potential Buyers 247

For Sale Signs 247

Flyers/Brochures 248

Networking (Word of Mouth) 249

Web Sites/Links 249

Sales Agents 249

Should You Employ a Realty Agent? 249

Services to Sellers 250

Services to Buyers 251

Co-Op Sales 252

Listing Contracts 252

14 PAY LESS TAX 255

The Risks of Change and Complexity 255

Homeowner Tax Savings 256

Capital Gains without Taxes 256

Rules for Vacation Homes 257

Mortgage Interest Deductions 258

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

CONTENTS xvii

Credit Card Interest 258

Rules for Your Home Office 259

Depreciation Expense 259

Land Value Is Not Depreciable 259

Land Values Vary Widely 260

After-Tax Cash Flows 260

Passive Loss Rules 261

Taxpayers in the Real Property Business (No Passive

Loss Rules) 262

Alternative Minimum Tax 262

Capital Gains 263

A Simplified Example 263

The Installment Sale 264

What’s the Bottom Line for Sellers? 265

Implications for Buyers 265

Tax-Free Exchanges 265

Exchanges Don’t Necessarily Involve Two-Way Trades 266

The Three-Party Exchange 266

Exchanges Are Complex but Easy 266

Are Tax-Free Exchanges Really Tax Free? 268

Section 1031 Exchange Rules 268

Reporting Rental Income and Deductions 269

Tax Credits 271

Complexity, Tax Returns, and Audits 272

Use a Tax Pro 275

Property Taxes 276

Summary 278

15 MORE IDEAS FOR PROFITABLE INVESTING 280

Lower-Priced Areas 281

What about Property Management? 283

Tenant-Assisted Management 283

Property Management Companies 283

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xviii CONTENTS

Emerging Growth Areas 284

The Creative Class 284

Implications for Investing in Real Estate 284

Right Place, Right Time 285

Emerging Retirement/Second-Home Areas 285

Which Cities and Areas? 286

Income Investing 286

Commercial Properties 286

Property Management 287

The Upside and Downside 287

Opportunity for High Reward 287

Commercial Leases Create (or Destroy) Value 289

Triple Net (NNN) 290

Self-Storage 291

Mobile Home Parks 292

Profitable Possibilities with Zoning 294

Tax Liens/Tax Deeds 294

Localities Differ 294

Are Tax Liens/Tax Deeds an Easy Way to Make

Big Profits? 295

Discounted Paper 295

What Is Discounted Paper? 295

Here’s How It Works 296

Broker the Note 296

Do Such Deals Really Occur? 296

Due Diligence Issues 296

Should You Form an LLC? 297

Different Strokes for Different Folks 297

Insufficient Court Rulings 297

One Size Doesn’t Fit All 298

16 AN INCOME FOR LIFE 299

Less Risk 301

Personal Opportunity 301

Index 304

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

Prologue

INVEST IN REAL ESTATE NOW!

N

early everywhere I speak these days, someone from the audience

asks, “Do you feel the real estate market will drop further? Have

we reached bottom yet? When do you think property prices will

fully recover?”

I answer, “I do not know. I really do not care. And neither should

you.”

Why do I give such seemingly flip answers? First, because they are

true. All investment pros encourage you to focus on your wealth-building

goals—not profit maximization per se. Waiting for the bottom merely gives

you an excuse to procrastinate. I’ve seen would-be investors make this

mistake a thousand times.

And second, because the questions are ill-formed. They miss iden-

tifying the multiple ways that you can profit with property. To invest

successfully in real estate, you need not, and should not, focus on pre-

dicting market valleys (or peaks). More productively, think in terms of

possibilities, probabilities, and strategy—not merely the lowest price.

WHAT ARE YOUR POSSIBILITIES?

If you asked financial journalists (or their quotable experts) whether you

should now invest in real estate, you would likely receive a variety of

answers. But nearly all of their answers would focus on one central point:

the expected direction of short-term price movements.

Journalists and their media molls love to play the game of short-

term forecasting. They do it with stocks, gold, commodities, interest rates,

and, for the past 10 years, properties. Are prices climbing? Buy. Are prices

xix

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xx PROLOGUE

falling? Get out and go sit on the sidelines. As a result of their obsession

with short-term price movements, the media have distorted and confused

the idea of investing in real estate.

In contrast to media hype, the most experienced and successful real

estate investors do not weight their deal analysis with any significant

emphasis on short-term price forecasts. Instead, we typically look to an

investing horizon of three to 10 years (or longer). More important, we

realize that in addition to price increases, property provides us with many

possible sources of return. Here are some (but certainly not all) of these

profit possibilities.

♦ Earn price gains from appreciation.

♦ Earn price gains from inflation.

♦ Create unleveraged cash flows.

♦ Use leverage to magnify returns from price gains.

♦ Use leverage (financing) to magnify returns from cash flows.

♦ Grow equity gains through amortization.

♦ Refinance to increase cashflows

♦ Refinance to generate cash (lump sum).

♦ Buy at a below-market-value price.

♦ Sell at an above-market-value price.

♦ Create value through smarter management.

♦ Create value through savvy market strategy.

♦ Create value by improving the location.

♦ Subdivide your bundle of property rights.

♦ Subdivide the physical property.

♦ Create plottage (assemblage) value.

♦ Convert the use (e.g., residential to offices, retail to offices).

♦ Convert type of tenure (e.g., rental to ownership).

♦ Shelter income from taxes.

♦ Shelter capital gains from taxes.

♦ Create and sell development/redevelopment rights.

♦ Diversify away from stocks and bonds.

I explain each of these possible sources of return in Chapter 1 and

then illustrate and elaborate to varying degrees in the chapters that follow.

With this extensive range of possibilities in view, you can always find

profitable ways to invest in real estate.

Unlike investing (or speculating) in stocks, bonds, gold, or commodi-

ties, you can generate returns from properties through research, reasoning,

knowledge, and entrepreneurial talents. In contrast, when you buy stocks,

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

PROLOGUE xxi

you had better pray that the market price goes up, because that’s your only

possibility to receive a reasonable return.

∗

WHAT ARE YOUR PROBABILITIES?

In the correction part of the real estate cycle, fear looms. Cash balances in

banks build up. Investors and savers join in a flight to quality. They will-

ingly accept certificates of deposit (CDs) that pay low-single-digit interest

rates. Investors think, “Who cares about return on capital? I just want to

feel confident that I receive a return of capital.

In his highly regarded book The Intelligent Investor, Benjamin Graham

created the parable of Mr. Market. Mr. Market represents that crowd men-

tality whose moods swing like a pendulum from irrational exuberance

to bewildered fear and confusion. Which market mood provides the best

investment opportunities/possibilities? Which market mood throws in-

vestors the highest amount of actual risk? Which market mood corre-

sponds to the least amount of actual risk?

Booms Increase Actual Risk

You know the answers. During the irrationally exuberant boom times, in-

vestors perceive little risk, but actual risks loom larger and larger as prices

climb higher and higher, income yields fall, and unsustainable amounts of

mortgage debt pile up.

In Las Vegas, so-called investors (actually speculators) believed that

flipping properties paved their way to wealth. Few perceived that their

property risks actually laid down poorer odds than the slots at Harrah’s.

And who but a fool (or Panglossian optimist) would borrow money to

play the slots? Yet Las Vegas property buyers loaded up with excessively

high loan-to-value (LTV) ratios of 90, 95, and 100 percent (or more). They

merely assumed that the future would continue to pay off as they had

experienced in the recent past.

On many of their properties, loan payments (principal, interest, taxes,

and insurance [PITI]) approached $2,000 a month. Potential rents for the

same properties would reach no more than $1,200 a month. When an

alligator is chewing your leg off, you are in a world of danger (and a

world of hurt). As I have written in nearly every one of my books, high

debt, low income yields, and exaggerated hopes for outsized continuing

∗

With property, I have earned per annum returns of 25 percent or more—without

a single dollar of price gain.

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xxii PROLOGUE

increases in price (for either stocks or properties) always trigger a reversal

of fortune. (See especially my Value Investing in Real Estate, John Wiley &

Sons, 2002.)

The speculative buying of Las Vegas houses serves as an outside-

the-norm example. Few other areas experienced such heightened frenzy

among both builders and buyers. Nevertheless, irrational exuberance

infested the moods and minds of property buyers throughout many

of the world’s principal cities (though during the boom of late, not

Dallas, Berlin, or Tokyo—each had suffered its own irrationally exuber-

ant property market 15 to 20 years back, and sat out this most recent

party). In nearly every instance, borrowed money fueled property prices

upward without commensurate growth in rent collections or personal

incomes.

Market Corrections Vanquish Market Risk

Within a few short years, many property markets have shifted from sell-

ers’ markets driven by loose lending and buoyant dreams of fast, easy

money to buyers’ markets sustained by stricter credit standards, record

numbers of foreclosures, a 25-year high in unemployment, and multiple

major banks taking hits for unprecedented amounts of losses. No wonder

fear and confusion have chased many potential property investors out of

the game.

So here is the $64,000 question: How should you interpret these and

other dismal facts from the dismal science? Do lousy economic conditions

diminish your chance to build a prosperous and secure future by investing

in property? Or do they vanquish market risk?

To make this question of risk easier, first address the following 10

issues. When is the best time to acquire investment property:

1. (a) When builders are bringing to market near-record numbers

of new houses, condominiums, and condominium conversions,

or (b) when new housing starts have fallen to the lowest level

since before 1959?

2. (a) When buyers flock to open houses and beg sellers to accept

their above-asking-price bids, or (b) when investors and home

buyers remain relatively scarce?

3. (a) After economic recovery pushes interest rates higher, or

(b) when interest rates sit near the low end of the past 40 years?

4. (a) When inflation seems subdued (as occurred during the

past eight years), or (b) (as today) when massive amounts of

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

PROLOGUE xxiii

government borrowing and huge increases in the money supply

seem sure to push inflation (and interest rates) to higher levels

within the coming decade?

5. (a) When properties sell for prices at a 20 to 50 percent premium

above their replacement costs, or (b) when you can buy properties

at a 20 to 50 percent discount below their replacement costs?

6. (a) When millions of home buyers overleverage to purchase

houses that they cannot afford, or (b) when stricter credit and

high unemployment lead many people to double up (or even

triple up) on their housing?

7. (a) When most sellers can hold out for top dollar, or (b) when

financial distress and more than one million foreclosures/REOs

create millions of desperately motivated sellers?

8. (a) When property prices sit in the clouds well above the level

that rents will support, or (b) when market values fall to the

point where income yields make sense and investors can reason-

ably expect to achieve positive cash flows—either immediately

or within a few years?

9. (a) When hundreds of thousands of new investors overleverage

themselves to buy rental properties that they do not know how

to manage, or (b) when those same starry-eyed investors rudely

awaken to the fact that successful investing requires reserves of

cash and credit, knowledge, thought, and an operating system

and strategy?

10. (a) When economic recovery and increasingly positive news pro-

pel millions of backbenchers into the game, or (b) now?

If you’ve answered (b) to each of these 10 issues, you display the

courage and foresight to become a great investor. You know that market

corrections vanquish risk and multiply your possibilities for profit.

Never Wait for Market Peaks or Bottoms

To invest successfully, never try to time a market bottom—or a market top.

Neither you, I, nor anyone else can develop that skill. Why? Because more

often than not, random events trigger short-term turns in markets. We

can tell when markets are becoming too pricey. We can tell when market

conditions greatly favor investors. But only by extraordinary luck can we

pick the one best time to sell or buy. (Just as importantly, the way you

negotiate a deal can create as much or more opportunity for you than the

market conditions themselves.)

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xxiv PROLOGUE

My Texas Example I owned properties in Texas in the early 1980s. By

mid-1984, I had sold all of them (at substantial gains). The market contin-

ued to go up. Property agents told me that I shouldn’t have sold. Later,

after the crash in 1985, they told me that I had sold too soon. What do you

think?

When do you replace the tires on your car? At the last possible

moment before they blow out? Or when you see the tread wearing down

and the risk of a blowout increasing? If you want to save your life, do not

try to run your tires until the last possible moment.

Likewise with property, when irrational exuberance fuels prices ever

higher and these prices are unsupported by rent levels or personal in-

come growth, risk builds excessively. Prudence sells to save profits. Only

fools hold on to capture the last dollar—or the last 1,000 miles from that

risky, worn tire. And only bigger fools believe that tires or booms will last

forever.

Look for Solid Value—Not Necessarily a Market Bottom or Market Boom

Today’s markets offer multiple low-risk, high-profit possibilities. Over

a time horizon of three to five years—if you follow the principles laid

out in this book—you will enjoy strong profits. I encourage you to get

in the game now. No one can predict the course of prices during the

next year or two. But today, you can certainly find solid values in most

markets.

In my experience, two major mistakes prevent people from profiting

with property: (1) They wait too long to exit an irrationally exuberant

market, and (2) they wait too long to take advantage of the possibilities

that are theirs for the taking.

DEVELOP AND EXECUTE YOUR STRATEGY NOW

As you read through the following pages, you will discover how property

provides at least 22 sources of financial returns. Plus, you will discover

multiple ways to harvest those returns.

Buying, improving, and holding income properties—especially

when you purchase them at bargain prices and finance with smart

leverage—offers the surest, safest, and, yes, even the quickest way to build

wealth. But even long-term investors such as myself will venture along

other avenues when clear opportunities arise.

In addition to the buy, improve, and hold approach, other tech-

niques include discounted paper, real estate investment trusts (REITs),

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

PROLOGUE xxv

condominium conversions, fix and flip, adaptive reuse, tax liens, mobile

home parks, self-storage centers, lease options, triple net leases, and other

possibilities to profit through property.

If you want a secure future—a future free of financial worries, a life

that you can live as you would like to live—property, especially property in

today’s markets, provides a near-certain route to wealth. All that remains

is for you to choose, develop, and execute your own strategy now.

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xxvi

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

ACKNOWLEDGMENTS

M

any people have contributed directly and indirectly to this sixth

edition of Investing in Real Estate. Because of their efforts, this

best-selling classic text on property investing has been made even

better.

Accordingly, I thank Donald Trump and Michael Sexton for inviting

me to work with Trump University to help create some of the best real

estate educational products and services available (e. g., Trump Univer-

sity books—all published by John Wiley & Sons—CDs, seminars, online

courses, webinars, and coaching programs). Working with the Trump team

and Trump University students has broadened and deepened my perspec-

tives on property investing as well as how to simply and effectively convey

that knowledge to property investors at all levels of experience.

I also express my appreciation to Dr. Malcolm Richards, dean of

the School of Business and Management at the American University

of Sharjah (AUS). In recognizing the critical need for real estate educa-

tion in the Middle East—and especially the hyper-growth Sharjah/Dubai

metroplex—Dean Richards carved out a rewarding position for me from

which I have added substantively to my knowledge and analytical abili-

ties as they apply to international property markets. Under Dean Richards,

the School of Business and Management of AUS has established itself as

the premier school for business education in the Middle East—and I am

pleased to have been able to participate in its development. My assistants

at AUS, Mohsen Mofid and Sadaf Ahmad Fasihnia, too, deserve recogni-

tion for their cheerful and competent assistance in all of my writing and

teaching activities. (Alas, both have now graduated and I will miss them

greatly.)

xxvii

P1: OTA/XYZ P2: ABC

fm JWBT174/Eldred September 2, 2009 9:6 Printer Name: Courier Westford, Westford, MA

xxviii ACKNOWLEDGMENTS

My best-selling real estate titles—including Investing in Real Estate—

have been translated into numerous foreign languages such as Russian,

Indonesian, Vietnamese, and Chinese. Thanks go to the skillful translators

of these volumes and to my Asian property adviser, Sit Ming (Laura) Lee.

Last but far from least, I thank my supervising editor, Shannon Vargo;

senior production editor Linda Indig; and the entire staff at John Wiley &

Sons, with whom I always enjoy working. This edition of Investing in

Real Estate marks the 23rd manuscript that I have completed for this 200-

year-old company that represents the finest publishing traditions. I look

forward to completing many more.

Gary W. Eldred

Vancouver, Canada

August 2009

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

1

WHY INVESTING IN REAL ESTATE

PROVIDES YOU THE BEST ROUTE

TO A PROSPEROUS FUTURE

“O

lder workers rush back into the jobs market as downturn

wrecks their retirement portfolios,” so headlined a recent

front-page article in the Financial Times (May 9, 2009). Other

major newspapers such as the Wall Street Journal,theNew York Times,and

Investor’s Business Daily have run similarly disconcerting articles.

The Financial Times article (and others similarly written) depart from

the mainstream media view that dominates. For the past 15 years, most

major media—and especially personal finance magazines such as Money,

Smart Money, and Kiplinger’s—have primarily served up inept mantras for

the masses disguised as financial wisdom. Such widely read magazines

and newspapers have published hundreds (quite likely thousands) of ar-

ticles that promise investors that they can achieve wealth without work,

effort, or thought.

Just keep pouring monthly payments into your IRAs, 403(b)s, and

401(k)s and you will enjoy financial security. “Over the long run stocks

outperform all other investments. Over the long run stocks will protect

you against inflation.”

Indeed, just as I was about to write this chapter, voil

´

a, my local

paper obliged with a perfect example. A reader, Nasir Iqbal, posted

this comment: “I don’t trust stocks. I think I will receive higher re-

turns with property. With property, I will feel financially secure when

I retire.”

1

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

2 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

The journalist, Cleofe Maceda, responded as follows:

Is buying property the right way to secure your retirement?

Experts [sic] say people like Iqbal are better off looking into

other avenues for capital growth—which can reduce the long-

term risk of running out of income in retirement.

Maceda (the journalist writing the article) then quotes one of his

so-called experts,

The challenge with property is that you can only sell it for what

people are willing to pay. [Duh?] It can take two years or longer

to sell a property. There is no liquidity with property.

Continuing a bit further in this article, the journalist again quotes his

expert.

Stock markets offer the best possibility to beat inflation over

periods of five years or more. This is because shares produce

dividend income in addition to the ability to grow in price.

As to volatility—that other big issue that confronts investors—the

mantra persists. No need to worry about 30 to 50 percent drops in the

stock markets...

...that volatility can work for an investor’s advantage because

it allows them to maximize their buying power [i.e., when stock

prices fall, your $1,000a month deposits(or whatever) buy more

shares].

In one short article, Maceda scores six out of six widely popularized,

yet false claims:

1. Stocks outperform all other assets.

2. Liquidity favors stocks.

3. Stocks pay you good income.

4. Stocks protect you against inflation.

5. Stocks reduce the risk of running out of money in retirement.

6. You don’t really lose when your stock portfolio crashes, you gain.

Evidently, Maceda—like a majority of journalists (and investors)—

prefers not to think for himself. He prefers not to look at the actual

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 3

historical recordof stocks.He preferstoremain ignorant of property.Stand-

ing against conventional wisdom, the Financial Times (at least in the article

quoted) has captured the sad reality of stocks. Maceda only perpetuates

the mantra manufactured by Wall Street.

This chapter sets the record straight. It provides you (and Nasir Iqbal)

a more enlightened perspective on property, stocks, and several other asset

classes (bonds, annuities) that investors might turn to as they strive to build

wealth and achieve financial security.

22 SOURCES OF RETURNS FROM

INVESTMENT PROPERTY

When so-called experts compare property with stocks, they rarely get

their comparisons right. More often than not, they assume that property

yields only one source of return that counts: potential gains in price. For

example, in his acclaimed book, Winning the Loser’s Game, Charles Ellis

concludes that:

Owning residential real estate is not a great investment. Over

the past 20 years, home prices have risen less than the consumer

price index and have returned less than Treasury bills.

Leaving aside for a moment how and where Ellis came up with

his long-term house price figures—no statistics I have ever seen re-

port that housing, relative to incomes or consumer prices, has become

cheaper—Ellis (and other finance/economics types) err most egregiously

in how investors should measure the total potential returns that property

offers. Ellis omits at least 20 other sources of financial returns that investors

can earn from their portfolio of properties.

1

To evaluate property, certainly weigh the possibilities for price gains,

but go further. You can earn double-digit rates of return (and sometimes

much more) from your property investments—even without any gain

in price.

It’s up to you to decide which sources of returns best fit your in-

vestment goals—and correspondingly, for each property you evaluate,

which sources of return seem doable. Few properties present a full range

of possibilities. But to fully see potential, apply each test of possibility

1

His two-decade time horizon also fails as a representative period because it in-

cludes the late 1970s and the 1980s—treasuries paid record-high interest rates

during those years.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

4 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

to all properties you consider. Every property presents multiple sources

of returns.

Will the Property Experience Price Gains from Appreciation?

In everyday speech, most people do not differentiate price gains that result

from appreciation and those that result from inflation. Appreciation occurs

when demand grows faster than supply for a specific type of property

and/or location. Inflation tends to push prices up—even if demand and

supply remain in balance.

Homes in Central London, San Francisco’s Pacific Heights, and

Brooklyn’s Williamsburg neighborhood have experienced extraordinar-

ily high rates of appreciation during the past 15 to 20 years. And just since

1990, houses within a mile or so of the University of Florida campus have

tripled in market price—primarily because UF students and faculty alike

now strongly prefer “walk or bike to campus” locations.

Areas Differ in their Rate of Appreciation. Although properties lo-

cated in Pacific Heights and Williamsburg have jumped in value at rates

much greater than the rise in the Consumer Price Index (CPI), some

neighborhoods in Detroit have suffered major declines in value. Appre-

ciation does not occur randomly. You can forecast appreciation potential

using the right place, right time, right price methodology discussed in

Chapter 15.

Likewise, you need not get caught in the severe and long-term down-

drafts that plague cities and neighborhoods that lose their economic base

of jobs. Just as various socioeconomic factors point to right time, right

place, right price, similar indicators can signal wrong place, wrong time,

wrong price.

You Do Not Need Appreciation. Should you always invest in prop-

erties that are located in areas poised for above-average appreciation?

Not necessarily. Throughout the rest of this chapter, I show you many

ways to profit with property. Some investors own rental properties

in deteriorating areas—yet still have built up multimillion-dollar net

worths. My first properties did not gain much from price increases

(appreciation or inflation)—but they consistently cash flowed like a slot

machine payoff.

If you choose a fast money, flip and fix strategy, appreciation doesn’t

count for much either. Also, when you buy at a price 10 to 30 percent below

market value, you earn instant appreciation that is not related to market

temperature. Throw away the urge to believe that you can’t make good

money with property unless its market price appreciates.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 5

Will You Gain Price Increases from Inflation?

In his book, Irrational Exuberance, the oft-quoted Yale economist, Robert

Shiller, concludes that houses perform poorly as investments. According

to his reckoning, since 1948, the real (inflation-adjusted) price growth in

housing has averaged around 1—at best 2—percent a year.

“Even if this $16,000 house sold in 2004,” says the eminent profes-

sor, “at a price of $360,000, it still does not imply great returns on this

investment ... a real (i.e., inflation-adjusted) annual rate of increase of a

little under 2 percent a year.”

Shiller Thinks Like an Economist, Not an Investor. Every investor

wants to protect his wealth from the corrosive power of unexpected infla-

tion. Even if we accept Shiller’s numbers—and I believe them reasonable,

though certainly not beyond critique—the data do show that property

has kept investors ahead of inflation in every decade throughout the past

75 years.

Not true for stocks (or bonds). Consider the most inflationary period

in U.S. history: 1966–1982. In 1966, the median price of a house equaled

$25,000; the Dow Jones Index hit 1,000. During the next 18 years the CPI

jumped from 100 to 300. In 1982, the median price of a house had risen

to $72,000; the DJIA closed the year at 780—below its nominal level of

18 years earlier.

Inflation Risk: Property Protects Better than Stocks. No one knows

what the future holds. Will the CPI once again start climbing at a steeper

pace? At the runaway rate the U.S. government prints money and floats

new debt, the odds point in that direction. During periods of accelerating

inflation, most people would rejoice at just staying even.

Imagine that in the early to mid-1960s you were a true blue “stocks

for retirement” kind of investor—and you were then age 45. In 1982, as

you approach age 65, your inflation-adjusted net worth sits at maybe

30 percent of the amount you had hoped and planned for. What do you

do? Stay on the job another 10 years? Sell the homestead and downsize?

Borrow money from a wealthy friend who invested in real estate?

Property Investors Do Not Buy Indexes and Averages. Economists

calculate in the netherland of aggregates and averages. Investors buy

specific properties according to their personal investment objectives. An

economist’s average does not capture the actual price gains (inflation plus

appreciation) that real investors earn.

No investor who intelligently chooses properties for their wealth-

building potential selects such properties randomly. Investors apply

some variant of right time, right place, right price methodologies (see

page 285). If you want to outperform the average price increases of real

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

6 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

estate—even though the averages themselves look quite good—you cer-

tainly can.

Earn Good Returns from Cash Flows

Unlike the overwhelming majoritystocks, incomeproperty typically yields

(unleveraged) cash flows of 5 to 12 percent.

2

If you own a $1,000,000

property free and clear of financing, you can pocket $50,000 to $120,000 a

year. If you owned a $1,000,000 portfolio of stocks, you might pocket cash

flows (dividend payments) of $15,000 to $30,000 a year.

Historically, the largest source of return for unleveraged properties

has come from cash flow. If you want to grow a passive, inflation-protected

stream of income, own income properties.

Economists and financial planners greatly embarrass themselves

when they sleight or ignore this critical source of return. Before Charles

Ellis, Robert Shiller, and others of their ilk again take up their pens to write

on real estate, they might set aside their misguided claims of expertise on

realty returns and first learn something about the actual practice of invest-

ing in real estate. If they did, they would also learn that nearly all property

investors magnify their returns with leverage.

Magnify Your Price Gains with Leverage

Know-nothing economists, financial analysts, and various media-anointed

experts claim that price gains from property provide real (inflation-

adjusted) returns of one to two percent a year. In doing so, they omit the

return-boosting power of OPM (other people’s money—typically, mort-

gage financing).

Low Rates of Price Gain Create Big Returns. Assume you acquire

a $100,000 property. You borrow $80,000 and place $20,000 down. During

the following five years, the CPI advances by 50 percent. Your property,

though, lagged the CPI. Its price only increased by 25 percent. Your real

wealth fell, right? No, it increased.

You now own a property worth $125,000, but your equity wealth—

your original $20,000 cash equity in the property—has grown to $45,000

(not counting mortgage amortization of principal). You have more than

doubled your money. To have stayed even with the CPI, your equity only

needed to grow to $30,000.

2

Yields in the U.K., Asia, and most of Europe often fall somewhat below those

available throughout the United States.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 7

Acorns into Oak Trees. Real estate investing builds wealth because it

grows acorns (small down payments) into free and clear properties worth

many multiples of the original amount of invested cash. Let’s go back to

that Shiller example.

The homebuyer paid a price of $16,000 in 1948. Did that homebuyer

pay cash? Not likely. Ten to 20 percent down set the norm—say, 20 percent

or $3,600 (.2 × $16,000). At Shiller’s hypothetical 2004 value of $360,000,

the homebuyer multiplied his original investment 100 times over. Even

if we say the 2004 property value comes in at $180,000—the homeowner

enjoyed a 50-fold increase of his $3,600 down payment.

What about stock gains during that period of 1948 to 2004? In 1948 the

DJIA hovered around 200 (by the way, still about 40 percent below its 1929

peak of 360). In 2004, the DJIA stood at about 8,000—a 40-fold gain. Not

bad, but still less than the gains from property (and much, much less when

we bring cash flows into the comparison of returns). [Note: As I write

in mid-2009, the DJIA still sits around 8,000—whereas property prices

(in all but the most distressed areas) are still up from 2004 and way up

from 1998, which is the year that the DJIA first hit 8,000.]

Magnify Returns from Cash Flows with Leverage

Traditionally, investors not only magnify their equity gains from leverage,

they also magnify their rates of return from cash flows. You pay $1,000,000

cash for an apartment building that yields a net income (after all operating

expenses) of 7.5 percent (no financing). Not bad. But if you finance $800,000

of that $1,000,000 purchase price at, say, 30 years, 5.75 percent interest,

you invest just $200,000 in cash. Your net income equals $75,000 (.075 ×

1,000,000) and your annual mortgage payments (debt service) will total

around $56,000. You pocket $19,000 ($75,000 less $56,000). You’ve boosted

your cash flow return (called cash on cash) from 7.5 percent to 9.5 percent

(19,000 ÷ 200,000).

Build Wealth through Amortization

Assume for a moment that your $1,000,000 apartment building throws off

zero cash flows. You apply every dollar of net operating income to paying

down your mortgage balance of $800,000. After 20 years, you own the

property free and clear. This property experienced no gain in price. It’s

still worth $1,000,000.

No price gains from inflation, no price gains from appreciation, and

no money pocketed from cash flows. Quite unrealistic and pessimistic,

right? Yet, over a 20-year period, you grew your equity from $200,000 to

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

8 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

$1,000,000—a five-fold gain, and annual compound growth rate of more

than 8 percent.

Your tenants just bought you a $1,000,000 property. That’s why I tell

my students, “Rent or buy?” asks the wrongquestion. All tenants buy—the

real question is one of ownership. If you rent, you still pay your landlord’s

mortgage. Your landlord reaps the rewards of ownership—while tenants

bear the cost. Seems to me a great deal for property investors.

Over Time, Returns from Rents Go Up

Most property owners raise their rents. Maybe not this year. Maybe not

next year. But over a period of five years or more, increasing rents yields

increasing cash flows. If you’ve selected a right time, right place, right price

location, demand will push rents up as more people want to live in the

neighborhood where your property is located. Or perhaps, as government

floods the economy with paper money, inflationary pressures force rents

up. Either way, you gain. In fact, you can gain even if your rent increases

fail to match the inflationary jumps in your expenses.

Let’s return to our apartmentbuilding example.Grossrentcollections

equal $125,000; net operating income equals $75,000; mortgage payments

equal $56,000; your cash flow equals $19,000.

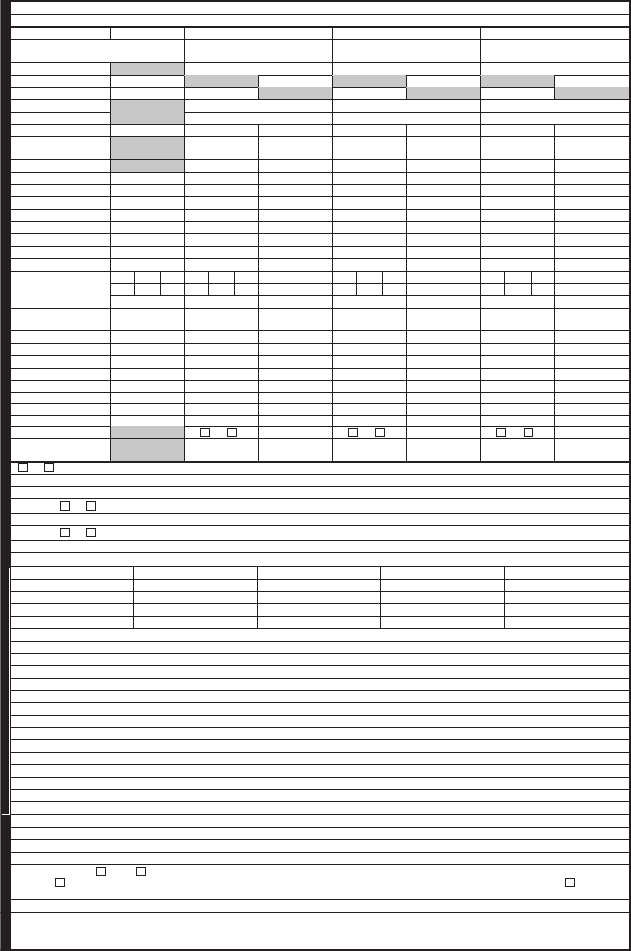

Gross rents $125,000

Vacancy and expenses 50,000

Net operating income 75,000

Annual mortgage payments 56,000

Cash flow 19,000

First, assume your rents and expenses each increase by 8 percent.

Here are the revised amounts:

Gross rents $135,000

Vacancy and expenses 54,000

Net operating income 81,000

Annual mortgage payments 56,000

Cash flow 25,000

An 8 percent increase in rents and expenses boosts your cash flow by

31 percent:

25,000 ÷19,000 = 1.31

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 9

If expenses had increased by 12 percent and rents stepped up mildly

by just 6 percent per annum (p.a.), you would still increase your cash flow:

Gross rents $132,500

Vacancy and expenses 56,000

Net operating income 76,500

Annual mortgage payments 56,000

Cash flow 20,500

20,500 ÷19,000 = 1.08

[Note: You can run multiple scenarios with these numbers and other

numbers presented throughout this chapter. No results are guaranteed.

Through your own market and entrepreneurial analysis, you will both

estimate and create the potential returns for the properties you buy.]

But I do encourage you to realistically envision the return pos-

sibilities that property investing offers. Then as you evaluate markets,

properties, and the economic outlook for your geographic areas of inter-

est, figure the probabilities. Which sources of return look most promis-

ing? Which sources of return seem remote? What risks could upset the

applecart?

Refinance to Increase Cash Flows

You increase your cash flows when you increase your rents (or decrease

your expenses). You also increase your cash flows when you refinance to

lower your annual mortgage payments. Today, a future refinancing at rates

lower than those currently available seems somewhat remote.

But who knows? From 1930 until the early 1950s, interest rates on

long-term mortgages ranged between 4.0 and 5.0 percent. A refi from a

6.5 percent, 30-year loan into a 4.5 percent, 30-year loan would not only

slice your mortgage payments by 20 percent, it would lift your cash flows

by an even greater percentage.

In some future time, we might again confront mortgage interest rates

of 8 to 10 percent. Under those market conditions, a later refinance at lower

interest rates becomes ever more likely.

(Note: Chapter 2 introduces a technique called a wraparound mort-

gage whereby investors can obtain the benefit of a lower-than-market inter-

est rate throughseller financing. Wraparounds give buyers a reduced inter-

est rate and at the same time, from a seller’s perspective, the wraparound

creates another source of return, cf. p. 34.)

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

10 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

Refinance to Pocket Cash

Unless history makes a U-turn, buy a property today and within 10 to

15 years, you can sell it for 50 to 100 percent more than the price you paid.

You gain a big pile of cash. But what if you do not want to sell? Can you

still get your hands on some of that equity that you have built up? Sure.

Just arrange a cash-out refi.

Here’s how this possible source of return works. Say after 10 years

your $1 million property is now worth $1.5 million. You’ve paid down your

loan balance to $650,000. Your equity has grown from $200,000 to $850,000

($1.5 million less $650,000). You obtain a new 80 percent loan-to-value ratio

(LTV) mortgage of $1.2 million. You pocket $550,000 tax free!

But don’t spend that cash. Reinvest it. Buy another income property.

Yes, you now owe higher monthly mortgage payments on your first prop-

erty, and your cash flows from that property will decrease. But with the

additional cash flows from your second property, your total cash flows

will go up. How’s that for having your cake and eating it too?

Buy at a Below-Market Price

When the economists (mis)calculate the returns that property investors re-

ceive, they omit the fact that savvy buyers often acquire greatproperties for

less than their market value. Opportunity (grass-is-greener) sellers, don’t-

wanter sellers, ill-informed sellers, incompetent sellers, unknowledgeable

sellers—and most importantly in today’s markets—financially distressed

sellers all will sell at below-market prices.

And unlike in normal times, the financially stressed and distressed

today not only include individual property owners but also the mortgage

lenders themselves. Financial institutions now own more than a million

foreclosures (called REOs) that they must sell as quickly as they can line

up buyers to take these properties off their books.

How do you find and buy these properties for less than they are

worth? See Chapters 5, 6, and 7.

Sell at an Above-Market-Value Price

How do you sell a property for more than market value? Find a buyer

who is unknowledgeable, incompetent, or pressed by time. Offer seller

financing, a wraparound, or perhaps a lease option. Develop your skills of

promotionand negotiation (see Chapter 13). Match the unique features and

benefits of the property. Sell the property with a below-market-interest-rate

assumable (or subject-to) loan.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 11

Sometimes buyers pay more than market value because they don’t

know (or do not care) what they’re doing. Sometimes they pay more to

obtain a much-desired feature or terms of purchase/financing. Whatever

their reason, if you wish to exploit this possibility, you’ve created another

source of return.

Create Property Value Through Smarter Management

When you manage your properties and your tenants more intelligently,

you increase your rent collections (without necessarily raising your rents);

you reduce tenant turnover; you increase prospect conversions; you spend

less, yet spend more effectively for maintenance, promotion, and capital

replacements. You enjoy peaceful, pleasant, and productive relations with

tenants.

Fortunately for you, most owners of investor-size (as opposed to

institutional-size) rental properties manage their investments poorly. Why

fortunately? Because their mal-management provides opportunities for

you. Upon acquiring a property, you can execute a more effective and

competitive management strategy to increase the property’s cash flows

and, simultaneously, lift its market value.

How can you achieve such performance? Rely on Chapter 11 to

develop your profit-maximizing management and market strategy.

Create Value with a Savvy Market Strategy

Although investors tend to manage their properties poorly, they show

even less skill as savvy marketers. Go to the property web site,

loopnet.com. Click through to a sample of listings. Look at the listing

promotional information provided. Look at the property photographs.

Does the agent tell a persuasive story about the property? Does the sales

message position that property against the tens of thousands of competing

properties that also hunger for attention? Do the photographs of proper-

ties reveal a well-cared-for property—a property that invites tenants to call

it home?

I will give you the answers. No! No! No! The implication? More

opportunities for you to gain competitive advantage. When you com-

bine the management know-how and marketing strategy lessons of

Chapters 11 and 13, you earn higher cash flows; you provide a better

home for your tenants; and when the time to sell arises, your property will

command a higher price.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

12 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

Create Value: Improve the Location

A famous clich

´

e in real estate says, “You can change anything about a

property except its location.” True or false? Absolutely false. As Chapter 8

shows, not only can you improve a location, but doing so also offers one

of your most powerful sources of return.

Think for a moment. What does the concept of location include? What

makes the location where you live desirable or undesirable? Accessibility,

aesthetics, quiet, good public transportation, cleanliness, the people who

live in the neighborhood, schools, parks, shopping, nightlife . . . the list

could go on and on. What’s the best way to improve any or all of these

attributes? Community action. Examples abound throughout the United

States and throughout the world.

Convert from Unit Rentals to Unit Ownership

Buy wholesale, sell retail. A grocer buys a 48-can box of tomato soup and

then sells each can individually along with a retail mark-up. Property

investors can execute a similar wholesale-to-retail strategy.

Buy a 48-unit apartment building; then, after completing legal ap-

provals and documentation, sell each apartment individually. In princi-

ple, you can apply a similar condo-conversion strategy to office buildings,

neighborhood strip centers, self-storage warehouse units, mobile home

parks, hotels, marinas, boat storage facilities, private aircraft hangars, and

other types of rental real estate where potential users might prefer to own

versus rent. In each case, you typically pay less per unit (or per square

foot) for an entire building than retail buyers are willing to pay for the

smaller quantities of space that they require to meet their needs.

Opportunities for conversion profits never remain constant. As prop-

erty markets change, potential profit margins swing between “make an

easy million” to “call the bankruptcy lawyer.”

3

To capitalize on this source of return, monitor the relative per-unit

prices of properties sold as rentals (income property investments) and

comparable space sold in smaller sizes to end users (see pp. 172–175).

Convert from Lower-Value Use to Higher-Value Use

Assume that in your city, single-family residential (SFR) space rents for,

say, $2 per square foot (psf) (due to a severe shortage)—offices rent for

3

In such distressed market conditions, you might profit from reverse conversions.

Buy a fractured condo and operate it as a rental property.

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 13

$1 psf (due to excess supply). Five years from now, single-family space

rents for $1.50 psf (due to excessive overbuilding), and because of strong

economic and job growth, office space rents for $3.00 psf. What might you

do (if zoning permits)? Convert your SFR to offices.

Conversions of use typically require you to renovate (at least to some

degree) the old, lower-value space use to fit the market needs of the higher-

value use. But when relative prices and/or rent levels grow progressively

wider, conversion of use can generate a lucrative source of returns (see

p. 175).

Subdivide Your Bundle of Property Rights

When you own a freehold estate in property, you actually own an extensive

bundle of divisible property rights. Such rights may include (but are not

limited to):

♦ Air

♦ Mineral

♦ Oil and gas

♦ Coal

♦ Access

♦ Subsurface

♦ Development

♦ Water

♦ Leasehold

♦ Grazing

♦ Timber

♦ Solar/sunlight

♦ Easement

When Donald Trump built his United Nations World Tower, several

nearby property owners pocketed several million dollars. Why? Because

Trump paid these owners to transfer a portion of their air rights to him.

After purchasing their air rights, the City of New York permitted Trump

to build 80 stories instead of 40 stories, as the zoning law then specified.

When you are in Hong Kong, notice that high-rise apartments tower

directly above some of the MTR stations. Developers paid the Hong Kong

government for the right to use that airspace—even though the govern-

ment retained ownership and use rights of the land beneath the apartment

buildings.

Nearly everyone understands thatproperty owners can sellleasehold

rights to earn revenues. (Not all governments, though, permit leaseholds

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

14 WHY INVESTING IN REAL ESTATE PROVIDES YOU THE BEST ROUTE

for all properties—and when they do, they may severely limit the terms

and price of the leasehold agreement.) However, in addition to leasehold,

you might sell, lease, or license other rights that derive from a freehold

estate. Transferring one or more of these other rights can generate another

source of return.

Subdivide the Physical Property (Space)

In one sense, condominium conversions represent one form of subdivid-

ing. But usually subdividing refers to selling or leasing land or buildings

in smaller parcels, most commonly, a developer who buys 500 acres and

cuts it up and sells off half-acre lots to homebuilders. For another example,

consider a shut down Kmart store. A still-thriving big box retailer might

pay $10 per square foot to let the entire now-vacant building.

Instead, a property entrepreneur could master lease the property

and subdivide the interior space into a variety of uses such as childcare,

offices, and/or smaller retail merchants. Each small tenant pays a higher

ppsf (price per square foot) rental rate than would the Best Buy or Lowe’s

who might otherwiselease the total building. If the new space users require

lower parking ratios than the old Kmart, the entrepreneur might subdivide

some of the parking lot area for additional retail/restaurant uses.

Thoughtful entrepreneurs steeped in market knowledge and pos-

sibility thinking persistently search for properties to subdivide. In such

cases, the sum of the parts exceeds the value when viewed as a whole.

Create Plottage (or Assemblage) Value

You createplottage or assemblage value when you combine smaller parcels

into a larger parcel of land or space. Say you discover a perfect site to

build a new neighborhood shopping center. Zoning and planners require

a minimum of four acres for such a development. The site equals four acres

but it is owned by eight different persons in one-half acre lots. Individually,

the lots are worth $10,000 apiece—or $80,000 in total.

However, as a four-acre shopping site, the land would sell for

$250,000. You now see how to earn a good profit. Persuade each of the

current owners to sell you his lot at its current market value (or even at

a price that sits somewhat above market value). Perhaps the champion

assembler to create plottage value was the Walt Disney Company. Over a

period of 10 years, Disney secretly accumulated 25 square miles of Central

Florida land at agricultural-valued prices. Oncethey completedthis assem-

blage, the value of the aggregate site probably exceeded cost by a factor of

20 (or more).

P1: OTA/XYZ P2: ABC

c01 JWBT174/Eldred August 26, 2009 20:44 Printer Name: Courier Westford, Westford, MA

22 SOURCES OF RETURNS FROM INVESTMENT PROPERTY 15

Obtain Development/Redevelopment Rights

Return to the four-acre neighborhood shopping center example. You suc-

ceed. You acquire all eight lots at a total price of $130,000 (several of those

owners did not want to sell—so you sweetened your offer). Can you start

building the center? No. You must first secure a long list of government

permits and approvals. So, your $250,000 current site value stands inde-

pendent of a government go-ahead.

With permits in place, the land could command a price of $500,000.

You could sell now and take your profit. Or you could stay in the game.

Spend $50,000 (or so) for lawyers, soil tests, public hearings, environmental

clearance, traffic studies, and whatever else the city powers throw at you.

This permit process requires (with luck—and no unanticipated delays)

6 to 12 months. If all goes as planned, you earn another $200,000.

In real estate, government approvals add to the value of any property

that is ripe for development, redevelopment, renovation, conversion—or

destruction.

4

Obtain those necessary permits and you earn a good-sized

return.

Tax Shelter Your Property Income and Capital Gains

To build wealth, protect your income and capital gains from the greedy